Binani Cement Limited (BCL) is the flagship subsidiary of Binani Industries Limited (BIL), representing the Braj Binani Group. BCL has a capacity of 8.55 MTPA which includes an integrated cement unit with capacity of 4.85 MTPA and a split grinding unit with capacity of 1.4 MTPA in the State of Rajasthan. BCL has investments in subsidiaries in China and UAE. Total revenue of Binani cement for Mar-17 was ₹1,534.62 crores and a reported loss of ₹347.60 crores for that year. The company went under the insolvency resolution process initiated by its financial creditor in July 2017 with finally a resolution plan accepted in Nov 18 by NCLAT without any haircut to financial and operational creditors.

Corporate Insolvency Resolution Process (CIRP)

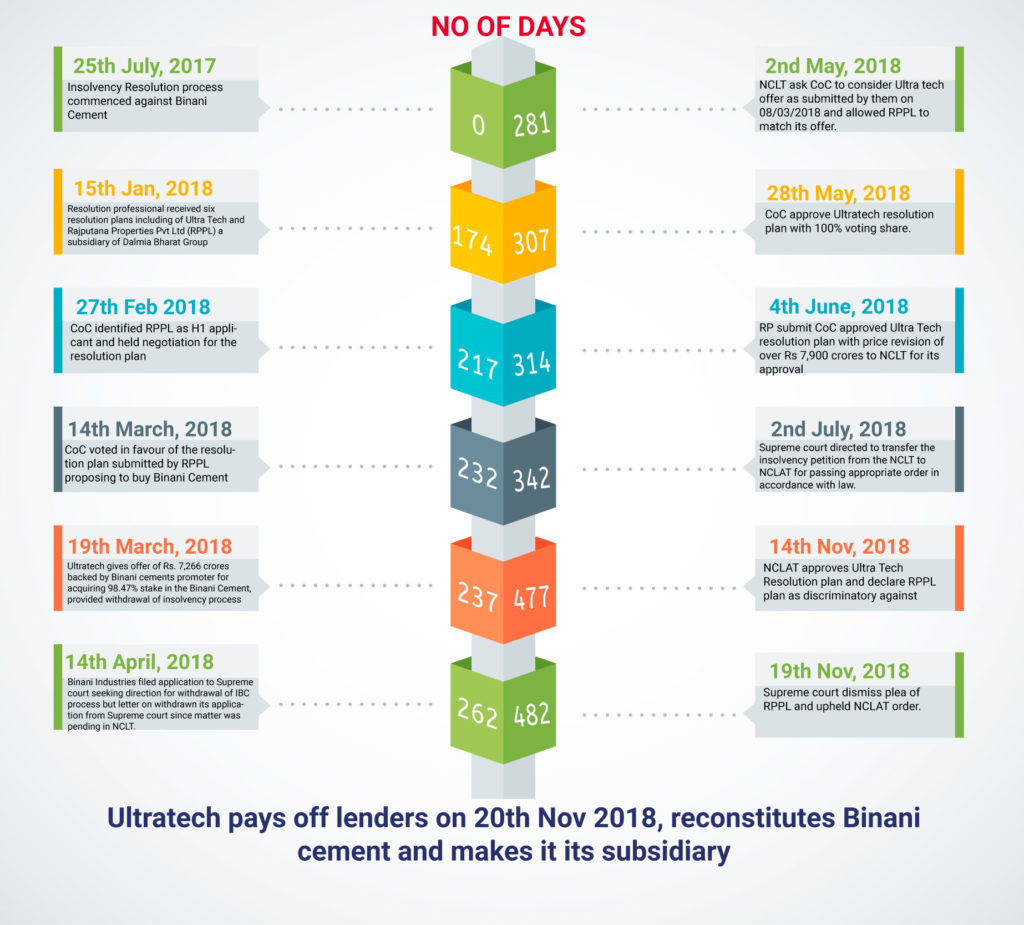

On 25th

CIRP Journey

Resolution plan:

As per Ultra tech resolution plan, all creditors, financial as well as operational creditors (other than related party) are getting 100% of their claims amount, further financial creditors are also paid interest amount accrued during the CIRP process which was never considered before in any other resolution plan.

Comparison between RPPL and Ultra Tech Payment offers to creditors of Binani Cement

Table 1: Claims and Resolutions (All Figs in ₹ Crores)

| Particular | Claim amount | Proposed payment by RPPL | Proposed payment by Ultratech* |

| CIRP cost | 132 | 132 | 134** |

| Financial creditors with direct exposure to corporate debtor | 4,042 | 4,041 | 4,359 |

| Financial creditors to whom corporate debtor was a guarantor | 2,428 | 2,225 | 2,493 |

| Operational creditors (other than workmen) | 676 | 184# | 616# |

| Equity/Working Capital Infusion | – | 350 | 350 |

| Total | 7,283 | 6,932 | 7,951 |

*include interest on financial creditors debt till 30/04/2018

**includes claims not approved by CoC

#Related parties dues are paid Nil.

What was not right in RPPL resolution plan

- RPPL in its resolution plan has given preferential treatment to different creditors within same class of creditors by paying lesser amount to few creditors in comparison with others which was objected before adjudicating authority and went against them.

- Further Exim Bank submitted before Adjudication Authority that they were forced to vote favour of the ‘Resolution Plan’ as the ‘Resolution Applicant’ (‘RPPL’) in its plan made it clear that those who will not vote in favour of its ‘Resolution Plan’ will be paid liquidation value which is almost Nil.

- Payment to operational creditors are also not on same parameters like trade creditors with Outstanding (O/s) less than Rs 1 crore are paid 100% of verified claims, trade creditors with O/s 1-5 crores are paid 40% or 1 crore whichever is higher and trade creditors with O/s 5-10 crore are paid 25% or 2 crore whichever is higher, such preferential treatment is not there in IBC.

Table 2: Financial & Operational Creditors

| Category | Proposed Amount(Rs. In Crores) | Percentage payment wrt to claims | |

| Financial Creditors to whom corporate debtor was a guarantor | |||

| State Bank of India (Hong Kong) | 3.7 | 10% | |

| Export-Import Bank of India | 450 | 72.59% | |

| All other banks (Except EXIM Bank & SBI-Hong Kong branch) | 1,771 | 100% | |

| Operational Creditors (Other than workmen) | |||

| Unrelated Parties | 151 | 35% | |

| Statutory Liabilities | 33.10 | 19.3% | |

Valuation of Binani Cement:

Liquidation value as ascertained during

Ultratech’s interests in Acquisition

- Ready to use assets which are currently operating at 50% capacity utilization

- Location benefit since Binani cement unit is in Rajasthan which will help Ultratech realignment of its existing market for Rajasthan and Gujarat.

- Ultra tech cement sells more than 2.5 MT per month in North + West markets and with Volume addition by 5-6% on existing base, will meet the growing demand and make them one of the strongest in Northern Indian market.

- Alignment of Binani cement dealer networks with Ultratech’s market strategy

- Acquisition provides access to large limestone reserves enough for another 5MTPA capacity addition with combined reserve life of 35-40 yrs.

- Access to Thermal power plan of 70MW of Binani cement

Table 3: Past Acquisitions by Ultratech Cement

| Target | Year | Capacity (MTPA) | Value (EV) (Rs in crores) | EV /MTPA |

| Star Cement | 2011 | 3 | 1,754 | 584.67 |

| Gujarat Unit of Jaypee Group | 2013 | 4.8 | 3,800 | 791.67 |

| Jaiprakash Associates Limited | 2016 | 21.2 | 16,189 | 763.63 |

| Century Textile (Cement Business) | 2018 | 13.4 | 8,138 | 607.31 |

| Binani Cement – current cement capacity | 2018 | 8.55 | 7,951 | 929.98 |

| With likely brownfield expansion of 5 MTPA | 13.55 | 9,547 | 704.54 |

RPPL Interests in Binani cement

Dalmia Bharat, holding company of RPPL has significant presence in southern & eastern market and acquisition of Binani cement would have given them Northern India market along with a running plant.

Resolution plans from other stakeholders point of view:

- For Creditors: Financial and operational creditors are getting 100% of their claim value and further financial creditors are also getting interest during CIRP period.

- For Binani cement shareholders: They loose control of the company and not received any penny from the plan.

Conclusion

Binani Cement clearly was having problems, squeezed for working capital and unable to generate free cash flow. Furthermore, cement industry is seeing consolidation from the past years which makes it difficult to standalone and create and maintain its brand to generate profits in the future. Submission of the company into Insolvency Process, was a God-sent opportunity for Ultratech to strengthen its presence in the North-Western market.

Ultratech got assets at competitive rate while repaying outstanding credits of all stakeholders including suppliers customers and employees, only party affected and lost is non-promotor shareholders. Although subjective, resolution plan should provide some compensation to non-promotor shareholders, more so in this case.

Binani cement Insolvency resolution case is considered as one landmark achievement of Insolvency & Bankruptcy Code as assets will be quickly put to use to generate returns for all concerned and generate tax revenues for the government.

Add comment