Mergers and acquisitions (M&A) have got a leg up, thanks to rising cases filed under the Insolvency and Bankruptcy Code (IBC). Till the last count, M&A deals in distressed asset sales worth around $14.3 billion were done since the code became functional in December 2016, according to data from Kroll and Mergermarket.

Such sales will rise as more and more companies line up to face the new bankruptcy law. Data from Insolvency and Bankruptcy Board of India show that more than $26 billion in distressed steel assets are coming on block, while banks are unwilling to take more haircuts and more companies will be put under the IBC and make their way through the NCLT process. In fact, opportunities for investors and acquirers have grown as quality assets at attractive valuations come to market.

Distress M&As account for 12% of the total M&A value this year, led by deals involving Bhushan Steel ($7.4 billion). In terms of actual deals, distressed M&As has accounted for about 3% of the total M&A volume in the Indian market and 21 out of a total 623 deals completed since 2017. Companies in steel, power, real estate and infrastructure are in the top of the list to be referred to National Company Law Tribunal (NCLT). Similarly, over leveraged companies in manufacturing, textiles, consumer and metals are also likely to face the chopping block. In other words, it is a buyer’s market in the M&A scenario. Some of the notable distress M&A deals were Bhushan Steel, Reliance Communications and Fortis Healthcare.

About two-thirds of the distress M&A deals were direct, where the asset itself was distressed, while the remaining one-third were indirect transactions, which resulted in a sale because the parent organization was in distress. Interestingly, the IBC has also given a legal face to buying distressed assets, as in the past promoters would be very cautious of buying distressed assets.

Till now, the buyers of distressed assets were mostly domestic promoters those with a big strategic play. Data from Kroll show that Indian investors account for 90% of distressed deal value and 81% of deal volume. A few foreign promoters have also shown interest in the assets on the block. Also, financial players such as private equity firms and pension funds are showing interest to put money in distressed assets.

With banks pushing for change in management of loan defaulting companies, corporate assets are available for acquisition at a throw-away price. Swift, time-bound resolution or liquidation of stressed assets will be critical for de-clogging bank balance sheets and for efficient reallocation of capital. Stressed assets are in multiple sectors, so M&As are expected to happen in multiple sectors.

IBC: A work in progress

The basic objective of IBC is a comprehensive code to consolidate laws relating to reorganisation and insolvency resolutions of companies. The schemes implemented in the past including Strategic Debt Restructuring, sustainable structuring of stressed assets, SARFAESI Act etc did not prove to be beneficial for the banking system in realising their claims. The purpose of the code is to put the firm on a viable track in order to improve its performance and enable it to service its debt in the future.

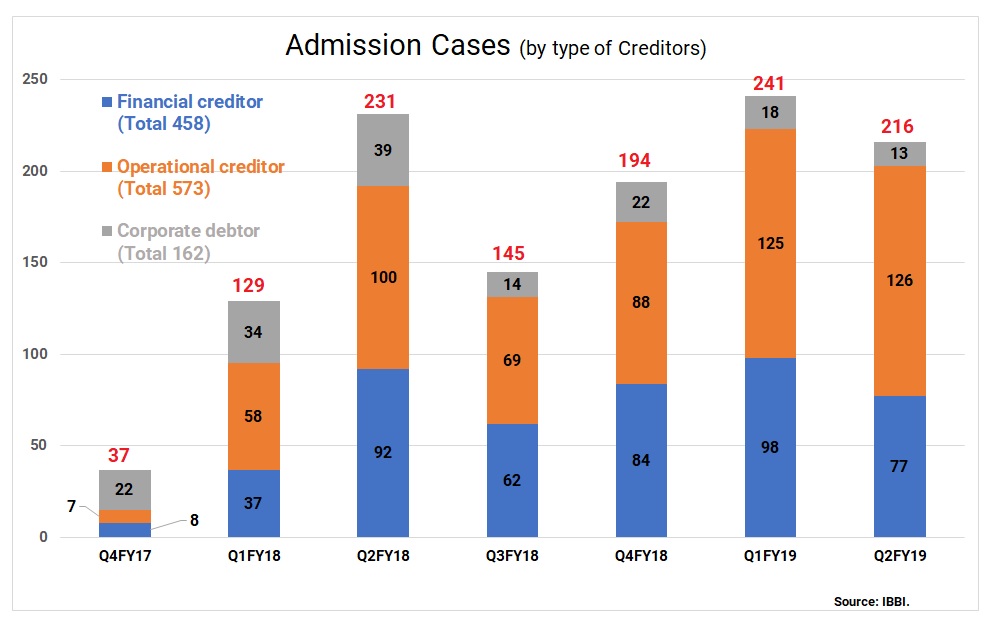

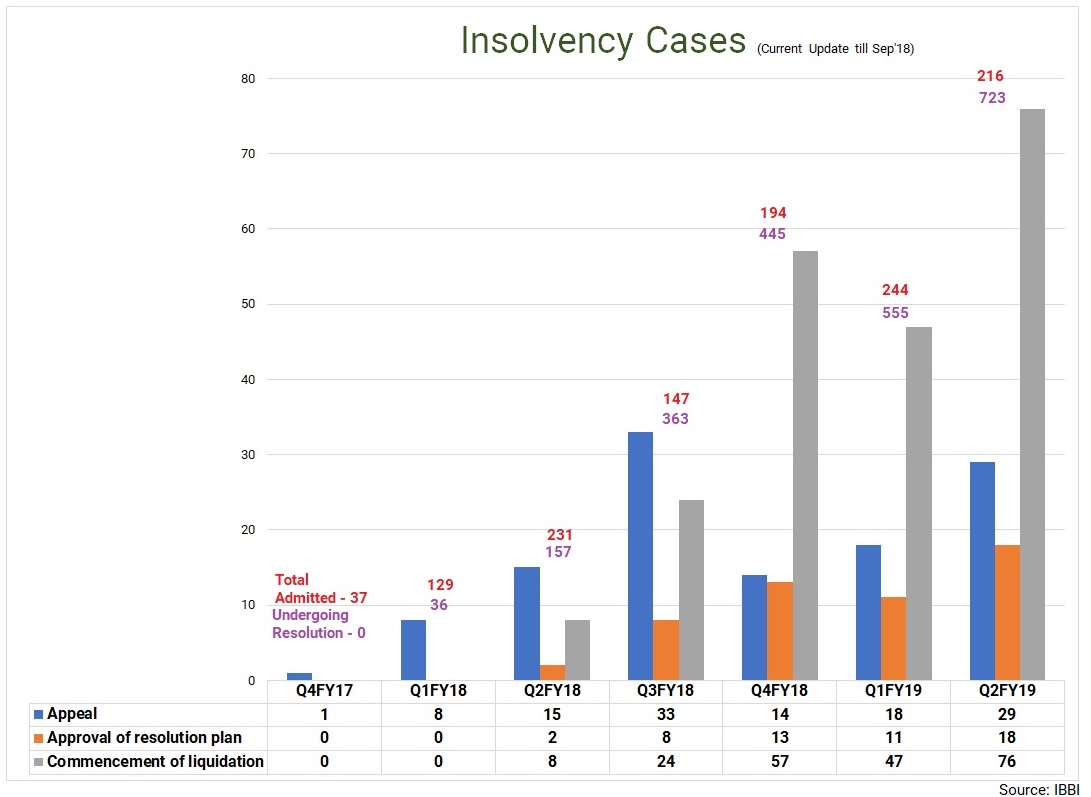

If a company defaults, a financial creditor, or an operational creditor or even an individual can initiate the insolvency resolution process. The corporate insolvency resolution process starts with filing an application before the NCLT. Since May 2016, over 1,200 companies have been referred to the NCLT and the list of companies going through the IBC restructuring and insolvency process continues to grow. Over half of all closed cases were through liquidation of the corporate debtor while 34% cases were resolved with an average haircut of 45% on admitted claims.

The code has instilled a sense of urgency among all stakeholders to resolve bad loans. However, the code is at a nascent stage and has been amended few times to plug loopholes and fine tune it to be more effective. The government modified the IBC to filter down the genuine bidders from those promoters or related party entities trying to get a backdoor entry into the distressed company.

As the IBC is a time-bound process to resolve cases, about 180 days which can be extended to another 90 days, the code has not only helped to intensify M&A activities but also helped India leapfrog 23 places to rank 77 in the World Bank’s Ease of Doing Business for 2019. The IBC will help in solving the twin balance sheet problem of companies and improve credit growth of banks. Defaulting promoters will have to find ways to bring in more capital, else, they will face bankruptcy. Also, loan restructuring guidelines of the RBI have been overhauled to encourage lenders of distressed companies to force a change of control.

The IBC is a good way to clean up the system and to instill some discipline. There are several reasons for the success of IBC. Firstly, it has the support of the government and the judiciary, the two most important institutions for any speedy resolution of bankruptcy-related cases. Secondly, IBC started with resolutions of big companies, which were tricky given the large quantum of money at stake. The process helped all stakeholders to chart new ways and come to an amicable solution.

Steel sector takes the lead

Stressed steel sector has taken the lead in distress sale of assets. Through three acquisitions – the largest one being Bhushan Steel – around $7.8 billion in assets have changed hands since 2017. They account for more than half of the distressed asset values and 14% of distressed asset volumes. In addition to Bhushan Steel, asset sales have included the acquisition of Electrosteel Steels by Vedanta valued at $274 million and Jindal Stainless for $132 million. Essar Steel and Electrosteel Steels are the other big metal companies undergoing the bankruptcy process. In this case since plan approved in May 2018, till date not only lenders recover their substantial dues but it created value for shareholders increasing market capital from Rs 200 crores to Rs 8000 as on date including for shares allotted to new promoters. Essar Steel is facing claims of Rs 49,000 crore from financial creditors and is among the 12 large companies that the Reserve Bank of India had directed banks to refer to bankruptcy court in June last year.

It is reported in the media that Arcelor Mittal will acquire the debt-ladden Essar Steel after Competition Commission gave its approval for the deal in September this year. There going M&A deals through distress sale is a clear indication of consolidation taking place in the steel sector. In fact, given the macro growth potential of India, the potential to buy steel assets looks attractive. India is going to be the second largest steel producer in the world. Steel is the basic material for building the nation’s infrastructure. Companies, locally and globally (like ArcelorMittal and Vedanta), operating in steel will look at India very seriously and expand base. So, consolidation will remain the key to growth in the Indian steel market.

Similarly, the pharma sector can see a lot of distress M&As and deals could sprout in the sector. Even the real estate sector is one which is very much in focus because of cash crunch, slowdown in sales and builders defaulting on giving procession of flats to buyers.

Risks in buying distressed assets

In general, the risks for investing in distressed assets are same as any other M&As. As long as there is an effective strategy in executing any M&A, things will move in the right direction. The same holds true even for buying distress assets. If there is a right strategy in place, distress assets can be valuable pursuits. Promoters must first analyse the reasons for the distress like over-leverage, missing linkages in terms of raw material suppliers or distribution and marketing, optimal size, government policy and environment clearance and the gap between demand and supply. At times, the asset may not be bad, but due to some unforeseen circumstances, it may have turned bad. In such cases, a proper due diligence and an effective strategy will help the asset to turn around operations.

The entities under the IBC provides a conducive environment for the financially healthy entities to look for inorganic growth opportunities. Financially sound companies can acquire competitors at attractive valuations and grow in the business. However, the road to recovery will not be easy and promoters bidding for distress assets will have to ensure that valuations are ring-fenced and liabilities are bare minimum.

Add comment