Binani Industries Limited (BIL), a group that has business interests in cement, zinc, glass fiber, energy, and industrial infrastructure, Binani Metals Merger Binani Industries (BML) with itself.

ABOUT BINANI GROUP

The Braj Binani Group made a humble beginning in the metals business in 1872. The group now known as the Braj Binani Group was restructured between 1996 and 2004, and Binani Industries Limited was founded to serve as the holding company of the group. New businesses have been added and today Binani Industries Ltd. comprises 5 key businesses areas – Cement, Zinc, Fiberglass, Infrastructure Construction, and Energy production.

ABOUT BIL

Binani Industries Limited is a flagship company of the group and is a fast growing, multidimensional business conglomerate and is engaged in the business of manufacturing and marketing of cement, Glass fiber, zinc and execution of EPC contracts spread in Asia, Europe, Middle East and North America. BIL has granted the rights to use the brand, logo, and Trade Mark etc. to its subsidiaries.

The equity shares of BIL are listed on the BSE Limited, NSE, and Calcutta Stock Exchange.

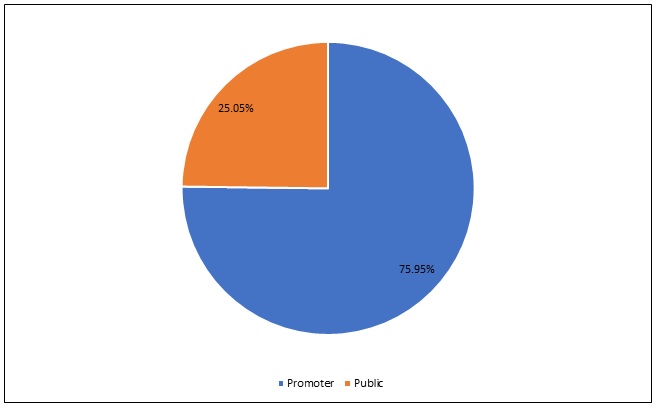

Shareholding Pattern and segment wise break up

Source:- Company Data, hu research Source:- Company Data, hu research*:- EBIT & Capital Employed figures are in crore.

ABOUT BML

BML, incorporated in 1941, is currently engaged in the business of providing logistic solutions, media, and publications, trading of shares and securities.

The equity shares of BML are listed on the Calcutta Stock Exchange.

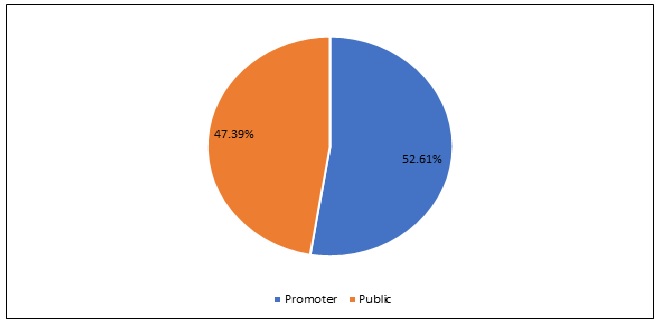

Shareholding Pattern

Source:- Company Data

THE TRANSACTION

BML will get merge with BIL.

Consideration

Equity Shareholder

BIL will issue 50 fully paid up equity shares of face value of INR 10 each for every 1 fully paid up equity share of face value of INR 1000 each of BML.

Preference Shareholder

BIL will issue 10 fully paid up 0.01% Non- cumulative Redeemable Preference shares of INR 100 each for every 1 8% Non-cumulative Redeemable Preference share of INR 1000 held by preference shareholders in BML.

Post-Restructuring Shareholding Pattern

Source: Company Data.

As a result of a merger, Promoters shareholding will get increased by 1.33% making it to 52.61%. The transaction will consolidate group activities and simplify its structure.

Further, consolidation will result in a saving of administrative and operative cost, a logistic cost which will help in achieving operational and management efficiency.

FINANCIAL

INR in Crore

| Particulars | BIL(Consolidated) | BML | BIL-BML |

| Net- worth | -1023 | 16.64 | 1006.36 |

| Revenue | 4331.19 | 483 | 4814.19 |

| >PAT | -649.18 | 1.5 | -647.65 |

| EPS* | -219.34 | 430 | -206.46 |

| Fixed Assets | 4902 | 10.76 | 4912.76 |

*:- Excluding extra-ordinary items.

CONCLUSION

| Particulars | Amount |

| No. of shares issued in course of merger | 17,71,600 |

| Share price of BIL as on 01.09.2015 | ~72 |

| Total consideration | 12,75,55,200 |

BML is valued about 20% less than its actual net worth as on 31.03.2015. As BML’s activities are too small hence it has almost no impact on BIL except increased net worth. This is a mere consolidation of group activities. However, as all the businesses are run through its subsidiaries, we didn’t get the reason of merging BML into BIL instead of acquiring shares of BIL and then running the same as its 100% subsidiary.