Cipla Limited (Cipla) a public limited company and its equity shares are listed on NSE (National Stock Exchange) and BSE (Bombay Stock Exchange); and its Global Depository Receipts (GDR) listed on Luxembourg Stock Exchange. It is engaged in the business of manufacturing and sale pharmaceutical products.

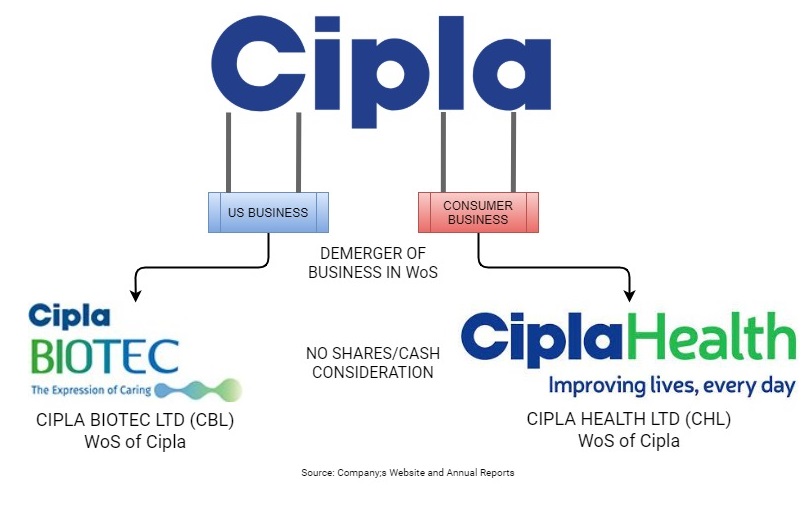

Cipla Biotec Limited (CBL) is engaged in the business of research and development and manufacture of pharmaceutical products including biopharmaceuticals and providing numerous services in contract research, contract manufacturing etc. CBL is a wholly-owned subsidiary of Cipla.

Cipla Health Limited (CHL) is engaged in the business of development, manufacture, and marketing of Nicotex and Nicogum, Cofsils, Unobiotics, MamaXpert, Prolyte and Ciphands and other brands. CHL is a wholly-owned subsidiary (WoS) of Cipla.

The Transaction:

In simple terms, Cipla Limited demerged its US Business and Consumers Business into CBL and CHL, respectively.

“Appointed Date” for the transaction is opening of business hours of April 1, 2021.

Rationale of the scheme:

As per Scheme:

- Simplification of group structure

- Enables the business to run the operations in a more cohesive manner including better management of product development, manufacturing & quality, and supply chain within the existing group structure.

Why Scheme under The Companies Act 2013?

For transfer of Business Undertaking to its subsidiaries, options available are Under Sec 180:

- board approval in certain cases or

- Approval of shareholders by a special resolution if value of assets and/or income exceeds criteria given under the section.

According to section 180 of Companies Act, 2013 Board of directors of a company sell, lease, or otherwise dispose of the whole or the whole of the undertaking of the company without the consent of company by special resolution if:

- investment in undertaking less than twenty percent of its net worth of the company as per last audited balance sheet or

- an undertaking which generates less than twenty percent of the total income of the company during preceding financial year.

So, in this case, as both businesses meet with the above criteria hence the board could have transferred those businesses by approval at the board meeting. Section 180 of the Companies Act, 2013 deals with the situation where there is a sale or disposing of the undertaking of the Company. As per section 4(1) of the Sale of Goods Act, 1930 sale of goods is a contract where the seller transfers the property in goods to the buyer for a price. The Sale cannot be contemplated unless and until the price is being paid by the buyer to the seller.

In case the property is being transferred from the company to another company at zero consideration, it can be considered as a “Compromise” with the shareholders. Pursuant to section 230 of the Companies Act, 2013 if the compromise is proposed between the company and its members, approval of the National Company Law Tribunal is required. One other reason to go by Sec 230 route is to have single-window clearance for the transfer of various licenses, employees, and tax benefits.

Taxation

Section 2(19AA) of Income Tax provides some conditions in case of demerger transaction if all the conditions specified in section 2(19AA) satisfied then the transaction is not regarded as transfer as per section 47(vi b) (i.e., exempted transfer). One and foremost condition specified in section 2(19AA) is the consideration is issued by the resulting company to the shareholders of demerged company.

Section 2(41A) of the ITA (Income Tax Act) defines a resulting company, inter alia, to include a company and its wholly-owned subsidiaries, to which the undertaking of the demerged company is transferred on the demerger, and as consideration, the Resulting Company issues shares to the shareholders of the demerged company.

On a conjoint reading of the above, it becomes apparent that the resulting company is not only the company to which the undertaking of the demerged company is demerged but also its 100% holding company which may issue shares to the shareholders of the demerged company, since the definition of the resulting company includes a company and its wholly-owned subsidiaries.

In the present case, Cipla Ltd is demerged company also the holding company of resulting companies, hence also resulting company also by definition under Sec 2(41A) of the Act. As Cipla Ltd is both demerged company and resulting company based on the above-expanded definition, there is no need to issue any additional shares to its own shareholders.

Based on above, the said demergers can be considered as compliant demergers qualifying for tax-neutral treatment to all the parties to the transaction.

Financials

Table 1: Financial Statements of resulting companies CHL and CBL (All Figs in INR Crores)

| Particulars | 2019-20 | |

| CHL | CBL | |

| Income from Operation | 203.02 | 14.1 |

| Turnover of Demerged Undertaking | 326.53 | 2460.1 |

| Total | 529.55 | 2474.2 |

As per the above financial details, we can see that Consumer Business, there is consolidation as even CHL already have substantial business, while in case of US Business, the subsidiary CBL has insignificant operations before the demerger.

Accounting Treatment:

In the books of demerged company (Cipla):

The difference between the carrying amounts of assets and carrying amounts of liabilities of the Demerged Undertakings shall be added to the carrying value of the investment in Resulting Companies in the books of the Demerged Company.

One needs to ponder Whether increase in cost of investment can be considered a cost of improvement in investments (being capital asset) under Sec 55(b) of The Income Tax Act,1961.

In the books of resulting companies (CHL and CBL):

Resulting companies (CHL and CBL) records assets and liabilities as per ‘pooling of interest method’ specified in Ind AS 103.

Conclusion

Recently, Cipla closed its WoS in UK and exited from 30 countries. Now Cipla, through the scheme which is demerger under the Companies Act and other administrative laws, proposes to create focus business entities by transferring two business incubated and nurtured in the main company to its WoS subsidiaries. Both the business needs strategic and/or financial partners to fuel their respective growth without diluting at HOLD Co level which is already low (—%) and without burdening prospective partners with listed entity.

In the process, it may be able to /wants to encash partially or fully its investments in those businesses which cash flow can be used to acquire further businesses. Cipla recently in fact acquired stake in Pharmarack Technologies Private Limited through newly formed LLP DigiHealth Technologies LLP (DigiHealth) which Wholly Owned entity of its Indian investee entity IndoHealth Services LLP. Further, it also acquires 66.02% ownership stake in AIOCD Pharmasofttech Awacs Private Limited.

Add comment