The Piramal Group has received the approval from Reserve Bank of India (RBI) to acquire Dewan Housing Finance Corporation Ltd (DHFL) under bankruptcy law. DHFL was the first finance company to be referred to NCLT by the RBI using special powers under Section 227 of the IBC (Insolvency and Bankruptcy Code). Before that, the company’s board was superseded and R Subramaniakumar was appointed as the administrator. He is also the resolution professional under the Insolvency and Bankruptcy Code (IBC). The central bank has, however, declined to transfer DHFL’s deposit-taking license to Piramal Group as part of the takeover.

The saga of the DHFL resolution has been a long drawn one. There were multiple bidders on the fray, but it came close for two– Oaktree Capital and Piramal. The chronology of events and the bidding and revised bidding process talk about the intense process.

On November 29, 2019, DHFL was admitted for resolution under the Insolvency and Bankruptcy Code. Then on February 17, 2020, the company received an expression of interest from over two dozen companies. and a month later, Oaktree Capital submits bids for the entire loan book. Similarly, Piramal Group, Adani Group, and SL Lowy bid for distinct parts of the loan book.

In October 2020, all the bidders sweeten their offers after financial creditors say they are not happy with what was offered. Subsequently, only three out of four bidders submit fresh bids On November 15, Adani Group proposed to change its offer materially by offering to bring the entire loan portfolio as compared with previous offer to buy just the wholesale portfolio. In November last year, Piramal Group protested Adani Group’s change in bids and challenged to seek legal resolution to the issue. However, in December last year, the financial creditors voted to write fresh bids for all bidders, and they removed credit limits on assets where bidders could bid for. Creditors also sought clarification from the three bidders which include valuation of insurance venture and treatment of additional interest income. After the three bidders — Piramal Group, Adani Group and Oaktree — submitted their bids, the lenders began a discussion in December last year on the commercial aspect of the bids.

Then on December 24, Oaktree increased its bid by Rs 1,700 crore. as additional interest income to financial creditors. With this offer, Oaktree Capital total bid for DHFL was at Rs 38,400 crore. The increase in the offer came after rival bidder Piramal Capital and Housing Finance offered to increase the interest income by a similar amount. Desperate to win the bid, Oaktree writes to lenders again in December end that its bid was misrepresented and warns of legal consequence if it is not allowed to change its bid. To that, Piramal Group wrote to financial creditors warning them against accepting Oaktree’s amended offer. Finally, Piramal’s offer was accepted.

To be sure, Piramal Enterprise and Oaktree were engaged in an intense bidding war to take control of DHFL, which was referred to a bankruptcy court in December 2019 after it was seized by RBI. The lenders have had to redo the voting process six times as new bidders emerged, and existing bidders changed offers.

The Committee of Creditors (CoC) voted in Favour of the resolution plan submitted by Piramal Capital and Housing Finance, overlooking rival and American asset management company Oaktree Capital. The Rs 34,250-crore Piramal plan that was approved included an upfront cash component of Rs 14,700 crore.

On January 15, 2021, creditors to DHFL voted in Favour of Piramal Capital and Housing Finance Ltd (PCHFL), a subsidiary of Piramal Enterprises, for the resolution plan, garnering more than 94% of the votes. The PCHFL is the non-bank lending unit of group flagship Piramal Enterprises Ltd. As per the resolution plan, Piramal Group would pay a total of Rs 36,250 crore, including upfront cash of Rs 12,700 crore, Rs 4,000 crore of interest income on DHFL’s book and Rs 19,550 crore of non-convertible debentures to be repaid in 10 years. Thus, the estimated recovery for creditors is around 43%. Piramal’s upfront payment to creditors and the equity infusion offer into DHFL are much higher than Oaktree. Moreover, Piramal’s offer for an outright buyout of the insurance business also helped. After the RBI’s approval, now Piramal Enterprise will have to wait for the final approval from National Company Law Tribunal Mumbai Bench and other regulatory authorities under applicable laws.

Cases against DHFL

DHFL, once one of India’s top NBFCs, owes its creditors — which include mutual funds, banks, pension funds, insurance firms and retail investors — around Rs 91,000 crore. In October 2019, a forensic audit conducted by KPMG on behalf of the lenders of DHFL found a diversion of over Rs 19,000 crore of bank loans to the NBFC’s related entities.

Investigations were launched against the Wadhawan’s on various charges relating to financial irregularities and unholy nexus with the underworld in relation to certain real estate transactions. Subsequently, DHFL was pushed to the National Company Law Tribunal (NCLT) court in December 2019. In September last year, the RBI-appointed administrator of DHFL filed a case of fraud worth Rs 12,705 crore against the company’s promoters Kapil and Dheeraj Wadhawan, who are currently behind bars. Apart from the country’s largest lender, SBI (State Bank of India), which has an exposure of around Rs 10,000 crore, other banks having exposure to DHFL include Bank of Baroda, Bank of India, Canara Bank, Union Bank of India, Syndicate Bank and National Housing Bank.

The Central Bureau of Investigation has also filed a case against DHFL and its promoters for siphoning off several thousand crore rupees from Pradhan Mantri Awas Yojana (PMAY) for creating fake home loan accounts and claiming interest subsidy. The company claimed in December 2018 that it had processed 88,600 cases under PMAY for which it had received an interest subsidy of around Rs 1,350 crore.

The takeover of DHFL will so help lenders such as State Bank of India, Bank of India, Canara Bank, Union Bank and Yes Bank will be benefited. The SBI has the highest exposure of Rs 10,200 crore followed by BOI (Bank of India) at Rs 4,100 crore and Canara Bank Rs 3,800 crore. However, DHFL shareholders might not benefit much as the stock will is valued at zero Over 50,000 retail and institutional investors hold around 5,500 crores in fixed deposits in DHFL, which had collapsed under the weight of a severe liquidity crunch after Infrastructure Leasing and Financial Services Ltd, then India’s largest non-bank financier defaulted on payment obligations in late 2018. enter

Way ahead for Piramal

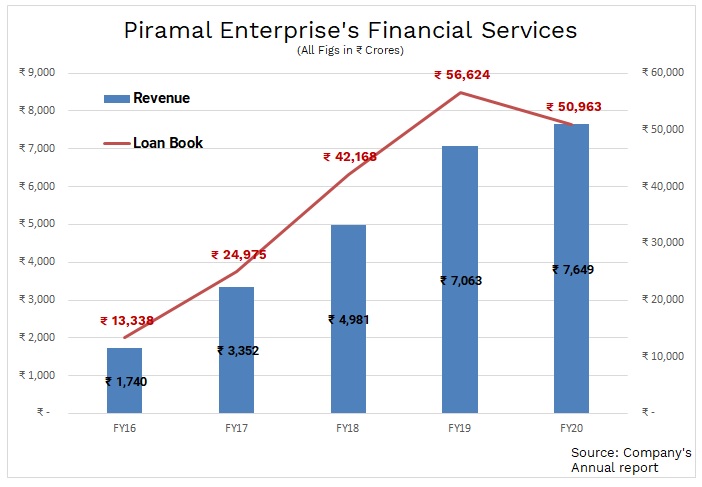

The takeover of DHFL, if it happens finally, will help Piramal Enterprises to diversify its portfolio, lead to effective use of capital and even improve the credit rating. It will also help in lowering the cost of funds. For Piramal, the merger with DHFL makes sense as it would give it a stable cash flow from retail customers at a time when its own corporate loan portfolio is facing tough times due to the real estate sector slowdown. Piramal Enterprise’s financial services business offers a wide range of financial products and services to cater to the diverse needs of its clients. The financial services business had a strong portfolio with loans, alternative assets under management and investments of Rs 66,500 crore as on March 31, 2020.

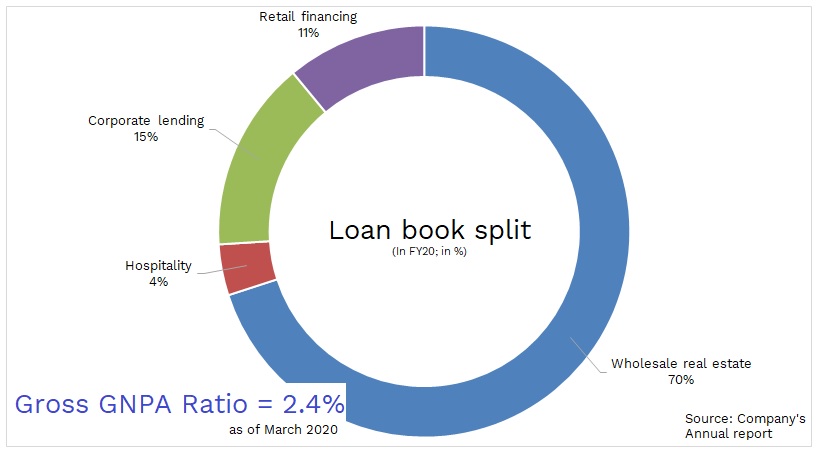

For Piramal Capital and Housing Finance, the takeover will help in its strategic portfolio diversification intent towards 50:50 wholesale to retail mix and will reduce the dominance of wholesale portfolio, which will in turn help ease the borrowing cost. The multi-asset retail digital lending can get a further fillip from the existing DHFL franchise of 182 branches and 99 micro branches. Also, a better-than-anticipated revival in real estate sentiment after the Covid-19 pandemic lockdown and expected scale-up of retail lending will provide an advantage of diversification to Piramal. The most important benefit for Piramal will be that the borrowing cost will reduce because of lesser reliance on wholesale portfolio in the overall mix. If the Piramal merges DHFL with Piramal housing finance, an AA rated entity, it will have access to over Rs. 10,000 crores of equity immediately and provides clarity on quality and secondary market valuation of NCDs.

Conclusion

The key to successful Acquisition is integration and realignment of loans resulting in reduced borrowing cost and ramping up of the business. Equally important is recoveries of present outstanding loan efficiently not resulting into any further surprises ad requirements for provisions and write off. Piramal has no experience with retail borrowers a hence either it must depend on the present infrastructure of DHFL or appoint a new team. In the case of NBFC business, if Net interest margin is n to improved quickly, the acquisition may lead to value destruction instead of value creation. Considering Piramal’s capability to do successful M&A, they will be successfully integrating and create value for all its stakeholders.

Add comment