Did you know, in 2020, India and the USA dominated the inbound & outbound M&A segment, with cross-border transactions totalling about 15 billion USD?

Furthermore, IFLR reports also state that in 2020, the M&A deal flow in India itself crossed 82 billion USD in aggregate deal value, which is a 22.9% increase from 2019. This is an impressive growth despite the stark market uncertainties and the country’s complex financial and market structure. Moreover, such whooping transactions also establishes why formulating a proper merger and acquisition plan has become important for foreign organizations which are planning to invest in the Indian industrial sectors.

However, India’s diverse culture, complicated legal procedures, and intricate business structure act as a significant challenge for foreign organizations trying to execute transactions or gain partnership in India. That is why it has become imperative for foreign companies to consult reliable mergers and acquisitions consulting firms in India that can ensure fair deals and suitable business opportunities in the country.

What Is M&A And How M&A Consulting Firms Can Help?

- Merger & Acquisition: A brief understanding

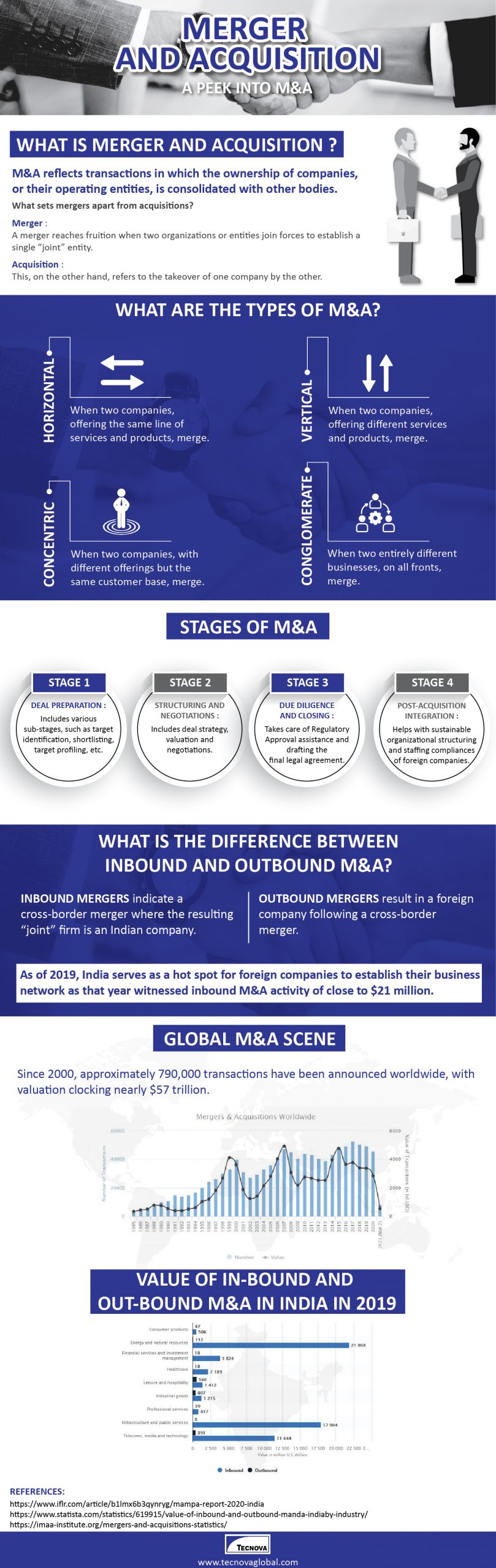

Merger and acquisition is an act of consolidating companies through various types of financial transactions. This practice is undertaken with an aim to stimulate growth, increase market share and gain a competitive edge in the business. However, though “merger” and “acquisition” are used as synonymous terms, both are considerably different and need to be understood first to formulate correct business plans.

Merger: Merger refers to a business transaction in which two companies come together to combine forces and form a new, joint entity under the banner of a new corporate name.

Acquisition: Acquisition, on the other hand, refers to a business and financial transaction in which an organization comes to acquire all the market shares and assets of another company such that it gains complete control over that respective firm.

Now that you have learned about the difference between the two, let’s have a look at the types of mergers and acquisitions.

The Four Main Types of Mergers and Acquisitions

- Conglomerate

When two companies belonging to completely different industries and having distinct supply chains combine their forces, it is known as conglomerate M&A. This approach helps to reduce costs and also reduce investment risks as it allows operating in a range of industries.

- Concentric

Concentric M&A refers to the collaboration of two companies that share the same customer base but trade in different products and services. This helps organizations to diversify the offerings, and therefore, earn higher returns in the long run.

- Horizontal

Horizontal M&A is the coming together of two business organizations that trade on similar products and services. This allows the collaborating firms to expand the supply chain range and increase market share, thereby reducing competition in a similar marketplace.

- Vertical

Vertical M&A is a business transaction in which two companies belonging to the same industry but trading on different products and services combine their forces. This helps them become more vertically integrated and improve logistics, supply chains, consolidate a considerable number of staff for smooth business operations, etc.

To decide which type of merger and acquisition plan will work best for you, it is important to focus on the goals you want to achieve while investing in the Indian playground. Further, detailed consultation from mergers and acquisitions consulting firms in India will also help foreign organizations to decide the right course of action.

Stages Of Merger And Acquisition

For an adequate execution of the merger and acquisition plan, foreign organizations must duly focus on the four main stages that are explained below.

- Deal preparation

This is the primary step that you must focus on while executing an M&A business plan. This involves identifying the motivation and potential targets, deciding upon the type of M&A you want to proceed with, and the amount of capital you are willing to spend.

- Structuring and Negotiation

Next, you must focus on deal strategy, negotiation, and deal valuation. You must use the products of your valuation of a target company to create an initial deal and carry forward with the negotiation. In this phase, both parties have to agree on equal terms.

- Performing Due Diligence

Next, you must perform due diligence. This involves creating financial modeling and operational analysis of the target firm with an objective to ensure there are no discrepancies in terms of information shared by the target firm and based on which the deal was finalized.

- Post-Acquisition Integration

The last step involves signing the deal and getting involved in combining the forces and integrating the firms with thorough planning on the financial and organizational structure.

However, drafting an elaborate plan for this stage and ensuring proper merger and acquisition transactions require professional help. Therefore, it is essential that you avail assistance from a reliable merger and acquisition consulting firm, like Tecnova. With extensive experience and understanding of the intricate business structure in India, Tecnova offers end-to-end assistance in structuring and executing M&A plans for foreign clients to ensure sustainable growth.

From identifying targets, structuring deals, closing the transaction, and 100% post-deal integration, Tecnova covers it all with the help of highly experienced merger and acquisition professionals. It is one of the leading mergers and acquisitions consulting firms in India. The company has over 35 years of experience in the field and has over 1400 clients worldwide. It is also an exclusive Indian member of the “Pandion Partners,” which is a leading international network of banking boutiques and corporate advisory firms.

With 100% FDI and other attractive government schemes, India is certainly emerging as a lucrative ground for foreign investors. However, without an adequately formulated merger and acquisition plan gaining a strong foothold in Indian industries (where about 90% of the businesses are family-owned) is highly inconvenient. Therefore, it is essential for foreign organizations to actively collaborate with merger and acquisition consultant firms.

Reference

https://www.investopedia.com/ask/answers/040815/how-does-merger-affect-shareholders.asp

https://www.ibef.org/news/ma-deal-activity-in-2020-jumps-33-pc-to-us-369-bn

https://www.wallstreetmojo.com/ma-process/

Add comment