BACKGROUND

The COVID-19 crisis is unprecedented and we professionals have never in our lifetime seen instances of governments of every major economy shutting businesses, foregoing exports and FDI and effectively closing down the economy so quickly and suddenly for the purpose of maintaining the health of the country. The implications and challenges to valuations of business are also unique.

VALUATION IMPACT

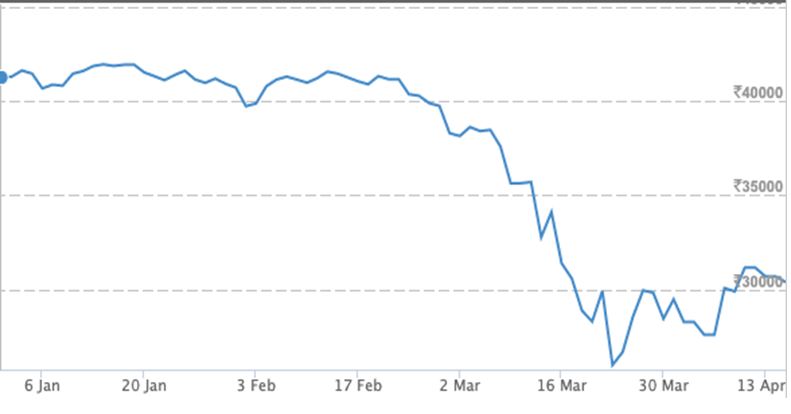

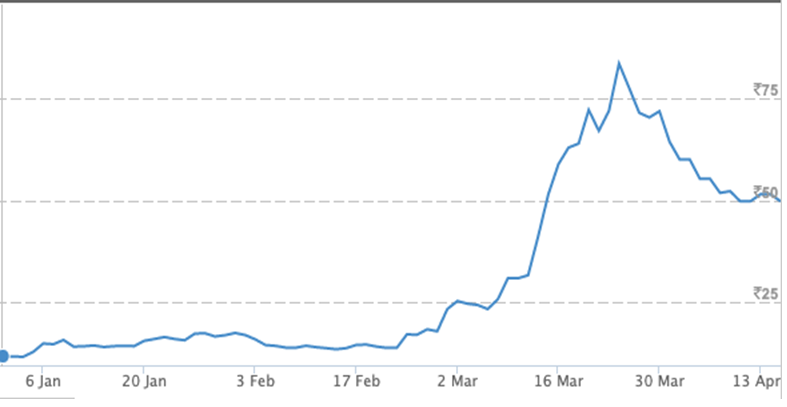

An illustration of the steep negative impact on the stock market, which gives validated market-related information for valuation is shown below both from a return perspective and a risk perspective.

Return Perspective

A summary of the movement of the BSE Sensex from pre-crisis taken as December 31, 2019 to the current date, taken as April 15, 2020 is shown below. The Sensex has fallen from 41,253 to 30,380 during this period, a decline of over 25%. The steepest decline was on March 23, 2020 at 25,981, a decline of 37%.

Risk Perspective

Risk for the Sensex has been derived or implied by the movement in the India Volatility Index for the same period of December 31, 2019 to April 15, 2020. From a low of 11.76, the VIX has risen to 49.74, an increase of 323%. The VIX peaked on March 24, 2020 at 83.61 showing an increase of 611% from the pre-crisis date.2

VALUATION IMPACT

Let us attempt to understand the impact of the ongoing crisis on corporate finance situations such as business valuations for M&A, fund-raising, pricing and exercise of convertibles, warrants and options, dispute resolutions, earn-out clauses.

FAIR VALUE

Both the IND-AS-13 and the IFRS-13 define Fair Value to mean:

“The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date”

The Insolvency & Bankruptcy Board of India and the Reserve Bank of India have maintained that for Fair Value to be acceptable, it should be determined by a Certified Valuation Professional using “Internationally Acceptable” valuation methodologies.

In India, the most practical, common and acceptable valuation methodologies used by Certified Valuation Professionals are:

- Income Approach – Discounted Cash Flow (‘DCF’)

- Market Approach

- Trading Multiples Methodology

- Transaction Multiples Methodology

Challenges that these methodologies are facing are shared below.

DISCOUNTED CASH FLOW METHODOLOGY

The key variables used in a DCF are as follows:

- Forecasted cash flows

- Risk Free Rate

- Market Rate of Return

- Beta

- Cost of Debt

- Perpetuity Growth Rate

One of the biggest challenges in a DCF will be determining realistic forecasted free cash flows due to the number of factors involved. Any or all of the factors below can change and, given the unique nature of the current crisis, no one can be sure of the severity or swing of the change.

Factors amongst others include the period of lockdown, domestically as well as in other countries (for companies with significant imports or exports), the extent of impact on economic activity, de-linking of globalization by countries to protect domestic economies, fiscal stimulus packages for the short to medium term and tightening of fiscal and monetary policies to rebalance the economy that will be taken by countries in the medium to long term.

For other variables, a comparison of values pre (December 31, 2019) and during the crisis (April 15, 2020) is shown below:

| DEC 31, 2019 | APR 15, 2020 | |

| Risk Free Rate (GOI 10 Year Bond Yield) | 6.43% | 6.52% |

| Market Rate of Return (BSE Sensex 10 Yr Return) | 9.10% | 5.73% |

| Beta (measure of risk)(substituted by measuring the volatility using the VIX India index) | 11.67 | 49.74 |

Let’s use the volatility index to measure risk. Whilst not a perfect science, to translate this into a risk premium, we assumed these higher levels of volatility have a short-term impact on the cost of equity.

Cost of Debt, assuming not influenced by Government Stimuli, should also increase as risk increases.

Perpetuity Growth Rate in my view will remain normal for most industries given that it is based on a long-term outlook and the global economy has bounced back from previous disruptions such as the economic downturn of 2002 and the housing bubble led the collapse of 2007. However, the COVID-19 crisis may impact some industries structurally for example, restaurants negatively or something like e-commerce or telehealth positively and these need to be assessed on a case by case basis.

Hence the key challenges in the current environment would be on determination of future cash flows and of estimating the level of risk that exists today.

MARKET MULTIPLES BASED METHODOLOGY

Another widely accepted methodology is multiples-based methodologies. These include the most common Price-Earnings Ratio, Enterprise Value to Revenue Multiple, Enterprise Value to EBITDA Multiple, Price to Book Value, etc.

The current fall in the stock market has significantly affected these multiples. Using the PE ratio as an example, results are shown below of PE ratios across the Sensex and other sectoral indices based on current prices, prices pre-crisis and their 5-year average PE ratios.

| PE Ratio | 15-Apr-20 CM | 31-Dec-19 HM | 5 Yr Avg NM | Fall in CM vsHM | Fall in CM vsNM |

| S&P BSE SENSEX | 18.37 | 26.01 | 22.95 | -29% | -20% |

| S&P BSE Auto | 18.67 | na | 25.80 | na | -28% |

| S&P BSE BANKEX | 17.45 | 34.23 | 29.53 | -49% | -41% |

| S&P BSE Capital Goods | 16.70 | 22.84 | 38.15 | -27% | -56% |

| S&P BSE Consumer Discretionary | 24.49 | 28.23 | 35.98 | -13% | -32% |

| S&P BSE Consumer Durables | 34.51 | 46.01 | 45.47 | -25% | -24% |

| S&P BSE FMCG | 30.16 | 31.99 | 42.43 | -6% | -29% |

| S&P BSE Healthcare | 31.95 | 26.54 | 31.94 | 20% | 0% |

| S&P BSE Industrials | 28.32 | na | 33.06 | na | -14% |

| S&P BSE Information Technology | 14.94 | 19.24 | 18.84 | -22% | -21% |

| S&P BSE Oil & Gas | 8.13 | 11.31 | 12.51 | -28% | -35% |

| S&P BSE Power | 8.51 | 11.97 | 22.47 | -29% | -62% |

| S&P Realty | 17.53 | 28.26 | 34.19 | -38% | -49% |

* Data from www.bseindia,com

** 5 Yr Avg is a simple average of the PE ratios for the last 5 years adjusted for abnormalities

*** CM – Current Multiple | HM – Historical Multiple | NM – Normal Multiple

The father of value investing, Benjamin Graham famously said,

“in the short run, the market is a voting machine but in the long run, it is a weighing machine.”

It, therefore, makes sense that multiples tend to decrease rapidly in the short term during a crisis then increases slowly as investors start to see more clarity as the crisis abates.

Using current multiples will be the most accepted but the challenges that one will have to address include:

- Using FY20 EBITDA as the multiplier will overstate fair valuation as the effect of Covid-19 was still to set in;

- Using FY21 EBITDA is likely to understate valuations as profit & loss statements are likely to be skewed;

In addition, while transaction multiples could be used this will result in overvaluation as on today as they did not consider a period of stress and low growth for the medium term.

CONCLUSION

There is no doubt that COVID-19 does and will continue to pose significant problems for the valuation of assets, businesses and equities in the short to medium term.

The traditional approaches to valuation need to be carefully reconsidered in the current environment. Valuers will need to conduct a more rigorous due diligence on the quality of financial forecasts provided to them and what normative adjustments, if any, should be made to earnings, multiples or discount rates.

- Valuations using DCF will be given more weightage in the current scenario as this can capture a limited downside period more accurately, albeit with a lot more diligence on business projections;

- Transaction Multiples could gain more traction but in the current scenario will still need to be adjusted downwards; degree of this adjustment will need to be assessed on a case to case basis depending upon the industry, level of stress, etc;

- In a situation where the Trading Multiple based methodologies are still being used, normative, normalized or adjusted numbers will become more visible:

- Multiple year average multiples rather than current multiples;

- Skewed P&L statements i.e. 10 months of revenues and 12 months of costs, being normalized;

- COVID-19 adjustments related to one-time costs of restarting or stabilizing operations,

- Innovative deal structures based on convertibles, options and warrants will become more

Those issues must be resolved on a case-by-case basis – there is unlikely to be a ‘catch-all’ approach which can be applied across businesses in all industries. It is exactly at these times that valuations done by a random application of a multiple to a number will be deemed irrelevant and much deeper professional expertise will be needed. Given the variability, closing deals and negotiating valuations in the midst of COVID-19 will remain an enigma.

About the author – Vikram Bihani is a Senior Partner with Aurum Equity Partners LLP (www.aurumequity.com) and is based out of Bangalore. He is a graduate of the Indian Institute of Management, Bangalore and has 22 years of experience in Investment Banking.

The article was published first here.

Add comment