Recently Dalmia Group announced yet another restructuring of one of its group companies Dalmia Bharat Refractories Limited. After selling its core business last year to RHI Magnesita, Dalmia Bharat Refractories Limited was trying to evaluate various opportunities.

Dalmia Bharat Sugar and Industries Limited is incorporated in 1951 under the provisions of the Indian Companies Act, 1913, having its registered office at Dalmiapuram, District Tiruchirappalli, Tamil Nadu (“DBSIL” or “Demerged Company”). The equity shares of DBSIL are listed on BSE Limited and National Stock Exchange of India Limited.

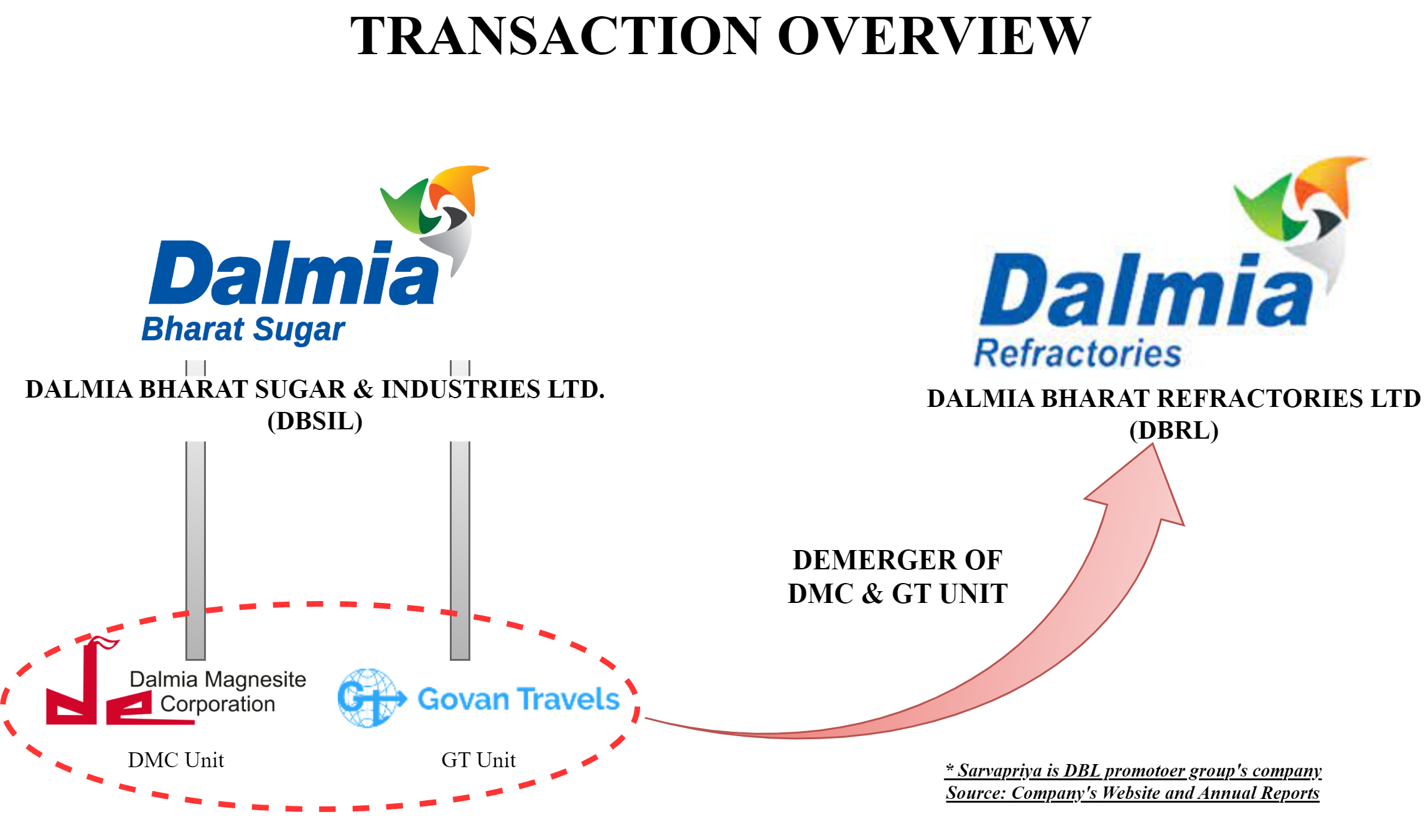

DBSIL is engaged in the manufacturing of sugar, generation of power and the manufacturing of industrial alcohol. DBSIL has a refractory unit i.e. Dalmia Magnesite Corporation (“DMC Unit”) which is engaged in the business of manufacturing of refractories. DBSIL also has a separate business unit named as Govan Travels (“GT Unit”), which is engaged in the business of providing tour and travel services.

Dalmia Bharat Refractories Limited is incorporated in 2006 under the provisions of the Companies Act, 1956, having its registered office at Dalmiapuram, District Tiruchirappalli, Tamil Nadu (“DBRL” or “Resulting Company”). The equity shares of DBRL are listed on Calcutta Stock Exchange Limited and Metropolitan Stock Exchange of India Limited.

In 2023, DBRL sold its refractory business through a slump sale to RHI Magnesita Limited for a consideration equivalent to 14.38% equity stake in RHI Magnesita Limited. Currently, the key assets of DBRL are:

- 14.38% stake in RHI Magnesita,

- ~0.85% Stake in Dalmia Bharat Limited

- Other investments such as Birla Tyres Limited, Veeda Clinical Research Limited, Hippostores Technologies Private Limited etc.

- Immovable properties

Announcement of the Scheme in 2023 & other activities:

Interestingly in June 2023, the Board of Directors of DBRL & DBSIL announced the same transaction (Demerger of DMC & GT unit into DBRL). The Appointed Date for the demerger was proposed to be 1st April 2023. However, immediately in August 2023, the board accorded their approval for postponement of the scheme. The reason cited was that DBRL is considering some other corporate actions to expand its business horizon, which may have an impact on the discerned share exchange ratio.

The ratio proposed under the previous scheme was 1 equity share of DBRL of INR 10 each fully paid up for every 39 equity shares of DBSIL of INR 2 each fully paid up.

Soon thereafter, DBRL was declared as the successful resolution applicant for Birla Tyres Limited under the corporate insolvency resolution process. DBRL joined hands with Himadri Speciality Chemical Limited as a strategic partner for Birla Tyres Limited.

Meanwhile, effective from October 1, 2023, DBRL started operations at the DMC unit owned by DBSIL as per the leave and license agreement entered into by DBRL with DBSIL.

The Proposed Transaction:

Demerger of Dalmia Magnesite Corporation (DMC) & Govan Travels (GT), demerged undertaking, of DBSIL, on a “going concern” premise into DBRL, resulting company, pursuant to a scheme of arrangement under section 230-232 of the Companies Act, 2013, and other applicable provisions of the Companies Act, 2013, read with Section 2(19AA) and other applicable provisions of the Income Tax Act, 1961.

Dalmia Magnesite Corporation (DMC) means refractory business of DBSIL while Goval Travel (GT) business includes the tours and travels business of DBSIL.

As per the disclosures given by the companies, the cumulative turnover of the demerged undertakings for Financial Year 2023 was circa INR 29.43 crore. Both DMC & GT are more few decades old businesses of DBSIL and classified “Others” segment. The net revenue from the “others” segment in Financial Year 2014 was circa INR 102 crore.

Rationale for the transaction as envisaged under the proposed scheme:

For DBSIL:

- Separation from non-core activities

- Efficient & focused management for DMC & Govan Travel business

For DBRL:

Focus on DMC & GT business.

The Appointed Date for the transaction is 1st July 2023 or such other date as may be approved by the Hon’ble NCLT. The Appointed Date has been changed from 1st April 2023 (as envisaged under the previous scheme). The reason for shifting the appointed date is not clear to us. However, there could be regulatory or tax angel for changing the appointed date.

Swap Ratio

The fair Share Exchange Ratio for the proposed Scheme of Arrangement of DMC Unit and GT Unit with DBRL is 1 equity shares of DBRL of INR 10 each fully paid up for every 48.18 equity shares of DBSIL of INR 2 each fully paid up.

| Particulars | DBSIL (Pre & post) | DBRL (Pre) | DBRL (post) |

| Paid-up number of equity shares | 8,09,39,303 | 4,42,00,107 | 4,58,80,042 |

| Face Value | 2 | 10 | 10 |

| Promoters stake | 74.91% | 74.99% | 74.99% |

Had it been the earlier proposed scheme, the total paid-up number of equity shares of DBRL (post demerger) would have been 4,62,75,474 with promoters holding remaining as 74.99%. Pursuant to the postponement of the scheme, DBRL now has to issue 3,95,432 less equity shares.

Post-demerger, the shares issued pursuant to the demerger shall be listed on the bourses where existing shares of DBRL are listed (regional stock exchange). Interestingly, equity shares of DBSIL are listed on nationwide bourses vis-à-vis the shares allotted will be listed on regional bourses. It will be interesting to see if SEBI & Exchanges ask the company to list the shares on nationwide bourses. Further, as per clause 14.3 of the proposed scheme, the promoter shall comply with minimum 25% public shareholding within such timeline as may be prescribed by the regulations. However, as per the pre & post shareholding pattern shared by the company, the promoter’s shareholding will remain below 75%.

Accounting Treatment:

As envisaged under clause 15 of the Scheme, the Demerged Company and the Resulting Company shall account for the proposed transaction in their respective books/financial statements in accordance with applicable Indian Accounting Standards (Ind-AS) notified under the Companies (Indian Accounting Standards) Rules, 2015, and generally accepted accounting principles in India as amended from time to time.

The demerged company shall derecognize the carrying value of assets and liabilities pertaining to the Demerged Undertakings, transferred to and vested in the Resulting Company from the carrying value of assets and liabilities as appearing in its books. The excess/deficit of net assets transferred shall be adjusted against the retained earnings.

The Resulting Company shall record all assets & liabilities pertaining to the Demerged Undertakings, transferred to and vested in it at their respective fair market value as on the Appointed Date. The equity shares issued will be recorded at fair value (premium being credited to securities premium account) and any difference shall be adjusted in Goodwill/Capital Reserve.

Basically, the transaction will be accounted as per guidelines for recording transaction between unrelate parties/ having no common control. Major promoter shareholder of DBRL is Sarvapriya Healthcare Solutions Private Limited (holds 42.36% of equity shares) which is classified as “promoter group” of DBSIL. One may find it as a transaction between entities having common control however, statutory auditor of DBRL has given certificate stating the accounting treatment mentioned in the scheme is in accordance with accounting principles.

Valuation

As per the valuation report provided by the companies, the significant assets of the DMC are land & building (INR 124 crore) along with Mining rights having value INR 24 crore (which is non-operational since last 5 years on account of various regulatory clearances). The valuer has also adjusted contingent liabilities worth circa INR 120 crore on account of operations & mine closure. The total valuation assigned to DMC undertaking is circa INR 97 crore.

For GT business, again the significant asset includes commercial property having assigned value of INR 13 crore. The total value assigned to GT undertaking is around circa 17 crores. Thus, for both undertakings getting transferred, most of the value comes through immovable properties.

Conclusion

As per DBRL website & Annual Report for FY 2023, the company now wants to focus on Magnesia Carbon business under its brand DMC along with investment in startups and group’s umbrella company Dalmia Bharat Limited (DBRL is continuously buying shares of Dalmia Bharat Limited from market in various tranches) however, the mining rights which are getting transferred as part of DMC undertaking are till 31st March 2030 and which shall take at least a year to be operational. Further, the other key benefit arising from the transaction seems to be the consolidation of non-core immovable properties under DBRL.

As DBRL is becoming an investment company, consolidation/starting some business activity seems to be a step to avoid classification as core investment company.

For DBSIL, the demerger seems to be more value creative as it will get rid of multi-decade-old non-core business. Though, its public shareholders will get shares listed on the regional stock exchange which may not be as liquid as shares listed on the nationwide stock exchange. It seems DBRL is in the process of delisting in time to come being group investment company.