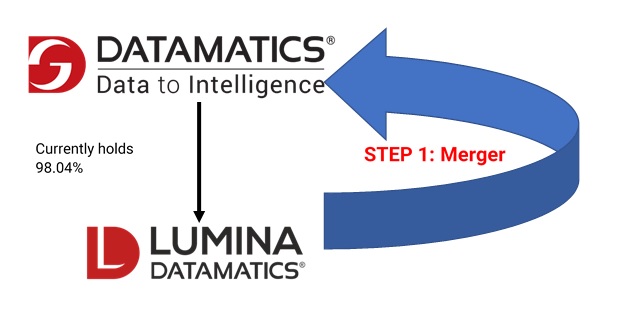

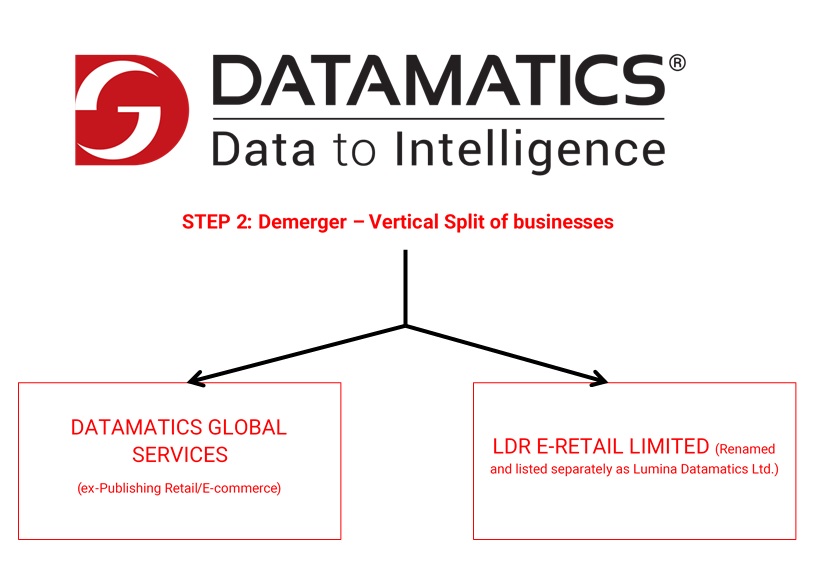

In a move to list E-Retail & Digital Publishing segment, the Board of Directors of Datamatics Global Services Limited has decided to demerge its E-Retail & Digital Publishing business carried by its subsidiary Lumina Datamatics Limited after merging it.

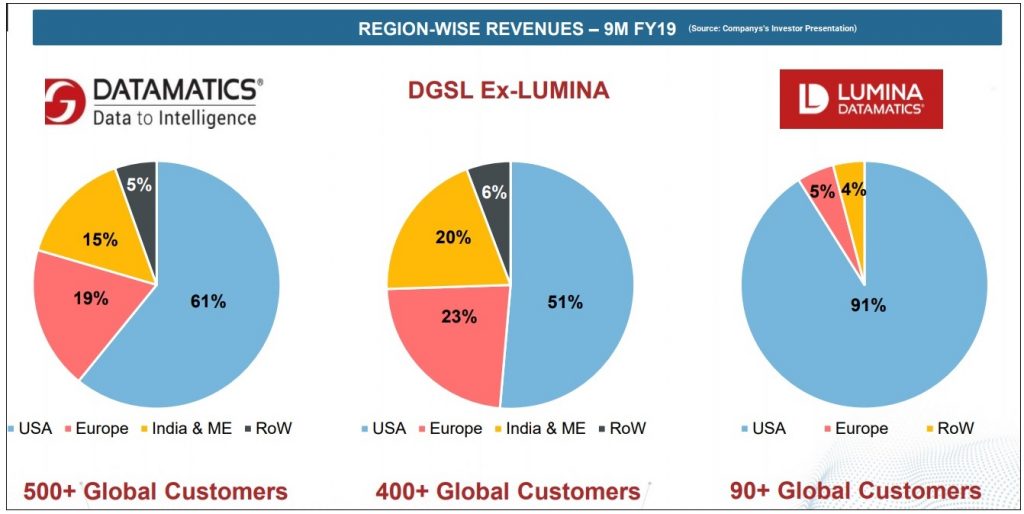

Datamatics Global Services Limited (DGSL) builds intelligent solutions for data-driven businesses to improve their productivity and customer experience. The Company portfolio spans across Information Technology Services, Business Process Management, Engineering Services and Big Data & Analytics, which are powered by Artificial Intelligence. The Company also has established products in Robotics Process Automation, Advanced Analytics, Business Intelligence and Automated Fare Collection. Equity Shares of DGSL are listed on BSE & NSE.

Lumina Datamatics Limited (LDL) is engaged in the business of providing e-retail and digital publishing services in content transformation, e-books and new media, rights and permission, QA Services and Project Management etc. DGSL holds 98.04% stake in LDL and rest stake is held by Mr. Vidur Bhogilal (Vice-Chairman of LDL).

LDR ERetail Limited is a wholly owned subsidiary of LDL.

Current Transaction

The Board of Directors of the DGSL has announced demerger of “ERetail & Digital Publishing Services Undertaking” after merging LDL with the company.

“ERetail & Digital Publishing Services Undertaking” means the business of providing e-retail and digital publishing services in content transformation, e-books and new media, rights and permission, QA Services and Project Management etc. Currently, this business is carried by DGSL through its subsidiary, LDL.

The appointed date for the transaction is 1st April 2019. Upon the scheme becoming effective, the name of the LDR will get changed to Lumina Datamatics Limited. Post-Demerger, the equity shares of the LDR will get listed on the bourses.

Consideration

For the merger of LDL with DGSL

DGSL will issue 187 equity shares for every 100 equity shares held in LDL.

For the demerger of “ERetail & Digital Publishing Services Undertaking”

2,00,00,000 equity shares will be issued by the LDR to the equity shareholders of DGSL on a proportionate basis to their holding in DGSL.

Shareholding Pattern

As a result of the merger, DGSL holding in LDL will get cancelled & Mr. Vidur Bhogilal will receive the equity shares of DGSL. It is not clear why equity shares held by Mr. Vidur Bhogilal in LDL is classified as public shareholding in the shareholding pattern submitted to the exchange. Post-Transaction, he will become a promoter of the DGSL. As a result of this, the promoters holding in the DGSL will get increased fractionally. Post-demerger, promoters of DGSL will hold 73.62% stake in LDR.

DGSL also holds 9% Redeemable Preference Shares of LDL. As a result of the merger of LDL with DGSL, these preference shares will get cancelled. There is no significant change in the shareholding pattern of promoters and public in DGSL.

Prior Major Transactions

2013

During the year, Datamatics eRetail and Publishing Limited acquired a controlling interest in Lexicon Publishing Services Private Limited (now known as LDL) on September 5, 2013. Thereafter, the Hon’ble High Court, Madras has passed an order sanctioning the Scheme of Arrangement/Amalgamation of Premedia Global Private Limited (wholly owned subsidiary of LDL) and Datamatics eRetail and Publishing Limited (wholly owned subsidiary of the DGSL) with and into LDL. After acquisition/merger. Post-Restructuring, DGSL holding in LDL was 73.12%.

2016

During the year, JM Financial Trustee Co.Pvt. Ltd & NEA Indo-US Venture Capital LLC exercised their put option on all the outstanding compulsorily convertible preference shares which resulted in DGSL to buy out all of them.

2016-17

During the year, DGSL acquired 11.61% equity stake from JM Financial Trustee Co.Pvt. Ltd & 5.75% equity stake from NEA Indo-US Venture Capital LLC making LDL its wholly owned subsidiary. Further, LDL converted its compulsorily convertible preference shares into 9% Redeemable Preference Shares.

2018

In April 2018, to streamline promoter’s holding in DGSL, the promoters of the company announced the merger of Delta Infosolutions Private Limited into the company. Before merging Delta Infosolutions Private Limited with the company, promoters de-merged other assets of the Delta Infosolutions Private Limited into Datamatics Infotech Services Private Limited.

In the same year, LDL issued 200,000 equity shares to Mr. Vidur Bhogilal for the consideration of INR 2.90 crores.

Financials

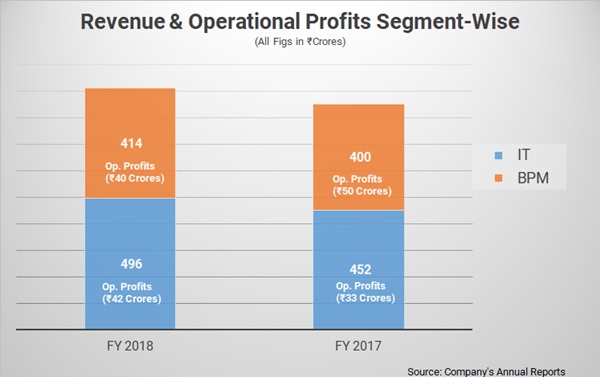

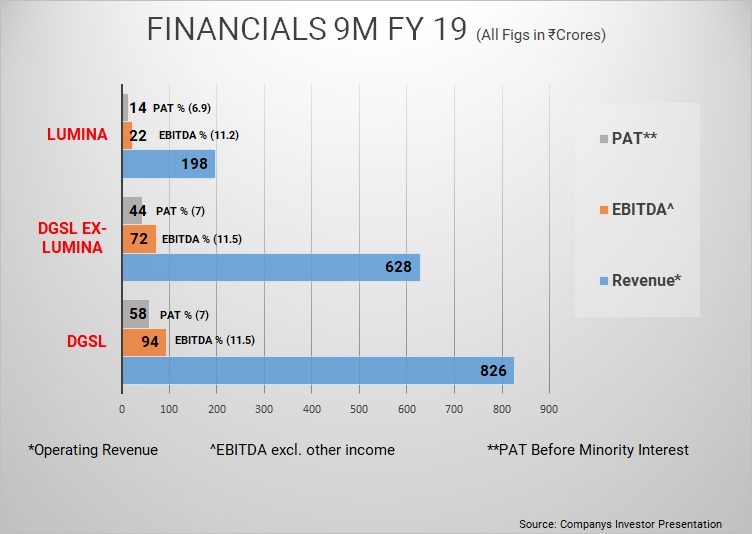

Currently, DGSL has two main segments, one is IT Services & Other is Business Process Management (BPM) Segment. Publishing & E-Retail business of LDL contributes more than 50%+ to DGSL’s BPM Revenue Segment.

Valuation

As per the valuation report, the total value assigned to the LDL is INR ~216 crores. Last year, the LDL issued 2,00,000 shares at a valuation of circa INR ~150 crores. Current valuation is around 1x of FY 18 Revenues of LDL.

Further, it is not clear why valuer has considered “Underlying Net Asset Approach Method” for the valuation of DGSL as the method does not consider the earning capacity of the business and the value under Underlying Net Asset Approach Method is significantly lower than the value under “Market Price Method”.

Conclusion

To become one of the world’s leading publishing BPO company, DGSL acquired LDL in 2012. Thereafter, they took several steps to streamline the shareholding of the company. Last year they allotted Equity shares to the vice-Chairman, Mr. Vidur Bhogilal. Promoters also streamline their holding in DGSL by merging Delta Infosolutions Private Limited with DGSL.

The structure of the transaction is designed in such a way to list the LDL on the bourses without any control/stake of DGSL in LDL post-transaction. There can be some assets of LDL which may remain with DGSL. However, the company is likely to end up paying double stamp duty. Post-listing, there is a possibility of strategic investment in ERetail & Digital Publishing business.

Add comment