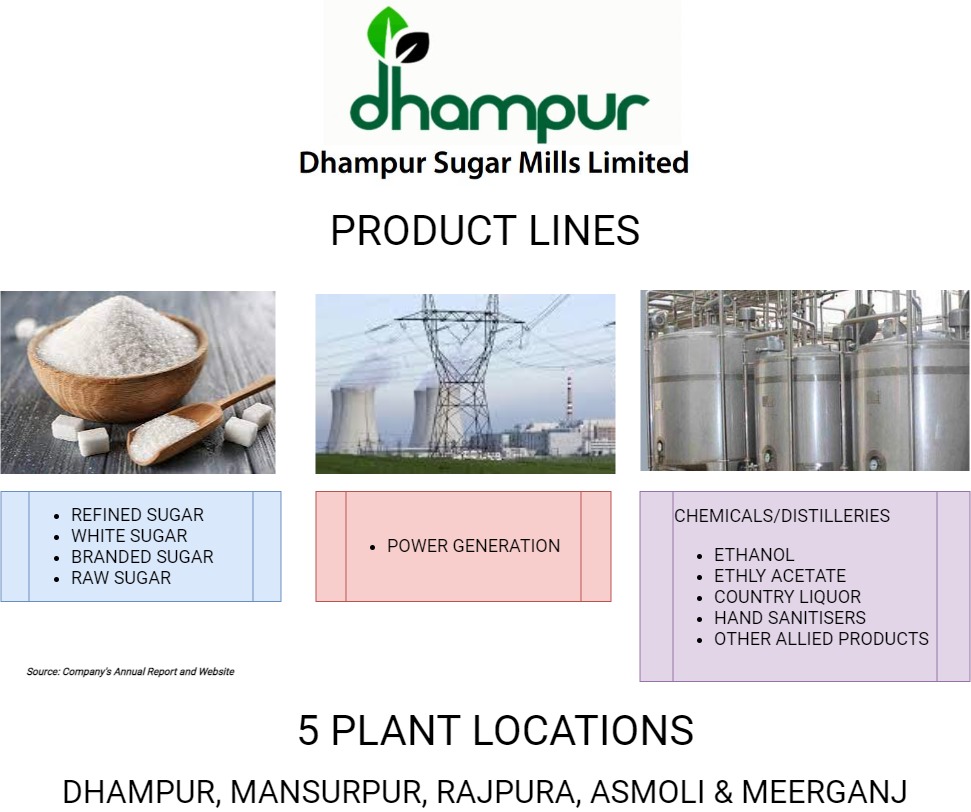

Dhampur Sugar Mills Limited (DSML) is one of the leading sugar manufacturers in India with nearly nine decades of experience. Its operations are integrated, encompassing crushing of cane, refining of raw sugar, ethanol production and power generation.

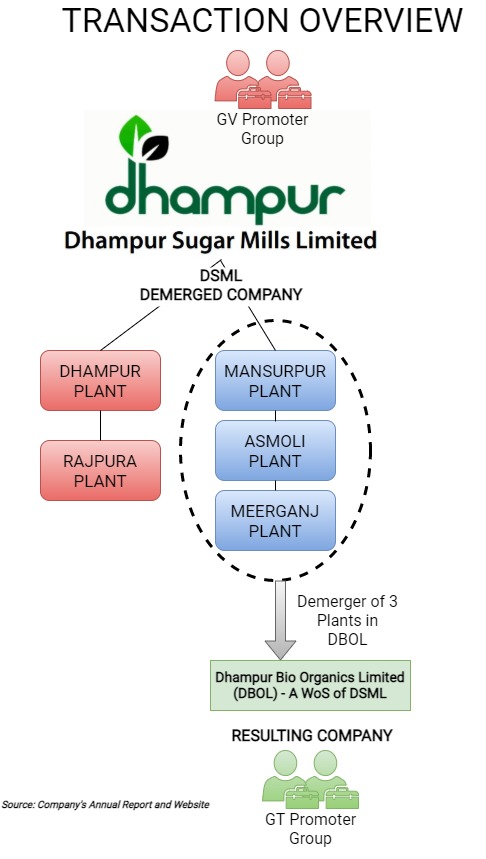

Recently, the company announced separation of the company through demerger into equal parts. As for many family-owned business, succession planning is quite crucial for the longevity of the company. In what might be the first step towards this, Goel family has decided to demerge its company, based on plant locations whilst keeping all the different business running, between family members.

Dhampur Sugar Mills Limited (DSML) is a public company. The equity share of DSML is listed on BSE and NSE. At present, the Demerged Company has five manufacturing units situated all in the State of Uttar Pradesh, having manufacturing facilities of sugar, power, industrial alcohol, ethanol, chemicals and potable alcohol with different capacities.

Dhampur Bio Organics Limited (DBOL) is a Wholly Owned Subsidiary (WoS) of DSML. The objects of the Company are to carry out the dealing in and manufacturing of sugar, power and industrial alcohol, ethanol, chemicals, and potable alcohol. Currently, DBOL is not carrying any business.

The Transaction

Currently, the business of DSML is carried by two brothers. Mr. Vijay Goel is chairman of the Board & Mr. Ashok Goel is Vice Chairman. Their respective sons, Gautam Goel & Gaurav Goel, both are Managing Directors of the Company.

As part of Succession Planning, the families have agreed to separate the operations of DSML. It is decided that GV Promoter group will look after Dhampur and Rajpura units and GT Group will look after Manusurpur, Ashmoli and Meerganj units. To achieve this, DSML will demerge Manusurpur, Ashmoli and Meerganj units into DBOL.

“GV Promoter Group” means Mr. Ashok Kumar Goel, Mrs. Vinita Goel, Mr. Gaurav Goel, Ms. lshira Goel, Goel Investments Limited, Saraswati Properties Limited, and Ujjwal Rural Services Limited.

“GT Promoter Group” means Mr. Vijay Kumar Goel, Mrs. Deepa Goel, Mr. Gautam Goel Mrs. Bindu Vashist Goel, Shudh Edible Products Private Limited and Sonitron Limited.

GV Promotor Group and GT Promotor Group cumulatively hold 48.96% equity shares of DSML in equal portion (i.e. 24.48% by each group).

Appointed date for the transaction is opening business hours of April 1, 2021 or such other date as the NCLT may direct/allow.

Valuation & Swap Ratio

In present case, the Resulting Company is a wholly-owned subsidiary of Demerged Company & upon demerger, shareholding pattern of the resulting company will be mirror image of shareholding pattern of demerged company.

The Scheme is executed mainly to separate the business equally between family, thus commercially, companies have agreed to issue 1 share of Resulting Company for every 1 share of Demerged Company. Effectively, shareholder holding 100 shares of Demerged company will additionally receive 100 shares of the Resulting Company as bonus.

Post-issuance of new shares, the shares of DBOL will be listed on nationwide bourses.

Share Swapping between Promoters

To achieve separation between promoter group, Scheme provides for inter-se exchange of equity shares amongst group. Post arrangement, GV group will retain Control & ownership of DSML & GT group will retain control & ownership over DBOL. The Scheme provides two options for share swapping/transfer in scheme. Selection of either Option 1 or Option 2 will be any time prior to the dispatch of notices to the shareholders of the DSML in respect of the shareholders’ meeting convened to approve this Scheme, and the Option that they have not chosen shall automatically become ineffective and stand severed from the Scheme.

Option One is simple swap of entire stake i.e., 24.48% of respective companies between promoter group. Second option is swap with optionality. Under option 2, Initially, the promoter group will swap such no. of shares so that post swap, minimum stake of promotor group in respective companies will reach to 30%. In addition, there will be call/put option (but not an obligation) available for 11.17% stake which is exercisable at any time after the expiry of one year from the date of listing of equity shares of resulting company and not beyond four years from the date of listing. Call/Put option effectively provides additional safety to the promoter group. In Option 2, even after exercising put/call option, GV & GT group will hold circa 7.79% equity stake in other entities i.e., GV group will hold in DBOL & GT group will hold in DSML. GV Promoter Group will reclassify their status as public shareholders in DBOL and GT Promoter Group will reclassify their status as public shareholders in DSML. This will be integral part of the scheme. If option 2 is selected and at any future date they want to exchange balance7.79% stake, then they will not be entitled to exemption from SEBI takeover code hence they have to exchange over a period of at least two years exchange of less than 5% per year. No doubt they will have to comply with all LODR regulations and SEBI takeover regulations as may be applicable

Exemption from SEBI takeover code

Regulation 10(1)(a)(ii) of the SEBI takeover code provides for the general exemption from the obligation to make an open offer when the shares are getting acquired through the transfer of shares amongst promoters. Furthermore, Regulation10(d)(ii) of SEBI takeover code provides for the exemption of change in promotors because of the scheme approved by the NCLT. The Scheme provides for exemption of “Open Offer” requirement for swapping of shares amongst promoter group hence compliance of Regulation 3 of the SEBI (Substantial and Acquisition of Shares and takeover regulations) (Takeover Code) will not be required.

Structure of the transaction

Whether swap between the promotor group will be cash or non-cash transaction is not clearly specified. How the difference in price in shares of both the companies at the time of exchange will be settled between the group is also not clear. Based on the structure of the transaction and difference in the prices may have capital gain tax implications

Taxation

The Scheme provides for –

Sharing of Minimum Alternative Tax (MAT) Credit

As provided in para 7 of scheme the MAT available with the DSML on the Appointed date shall be apportioned to DBOL in the proportion of book profit under section 115JB of the Income Tax Act, 1961 of the Demerged Undertaking and book profit of the Demerged Company for the respective tax assessment years which shall, without any further act or deed, vest with and be available for set-off under section 115JAA of the Income Tax Act, 1961 to the Resulting Company on the same terms and conditions on and from the previous year commencing from the Appointment Date.

As in the case of MAT credit, there is no explicit provision in income tax regarding carried forward of MAT credit to the resulting company like provide in sections 35AB(3), 35D(5A), 35DDA(3), 72A(4) etc. However, ITAT Ahmedabad in the case of Adani Gas Ltd, relying upon Supreme Court decision in Marshall Sons & Company India Ltd, allowed the transfer of MAT Credit to the resulting company.

Sharing of Re-Structuring Expenses

Para 36 provides cost and charges borne by the demerged company and the resulting company equally. Cost and charges include any taxes and duties, registration charges, etc. incurred due implementation of scheme. However, stamp duty will be pay by transferee company how one can it segregates equally. Para 7.10 of the Scheme provides for claiming deduction of restructuring expenses under Section 35DD of the Income Tax Act, 1961 over a period of 5 years beginning with the previous year in which this Scheme becomes effective. However, in section 35DD provided that a deduction of an amount equal to one-fifth of restructuring expenditure for each of the five successive previous years beginning with the previous year in which the amalgamation or demerger takes place. Thus, five years beginning with the previous year is taken from appointed date or effective date. The restructuring transaction take effects from effective date, but effect is given from appointed date.

Re-transfer of assets

There is a para 29 in scheme “Wrong pockets assets” which provides no part of the Demerged Undertaking/Remaining Undertaking shall be retained by the Demerged Company/Resulting Company after the Effective Date. If any part of the Demerged Undertaking/Remaining Undertaking is inadvertently retained by the Demerged Company/Resulting Company or realizes any amounts after the Effective Date that form part of the Demerged Undertaking/Remaining Undertaking, the Demerged Company/Resulting Company shall transfer such part to the Resulting Company/Demerged Company for no consideration. The Resulting Company/Demerged shall bear all costs and expenses as may be required to be incurred by the Demerged Company/Resulting Company, subject to the prior written consent of the Resulting Company/Demerged Company. Implications of transfer of Wrong pockets assets post Effective Date and that to without consideration may be severe in terms of compliances including going back to NCLT again for revision or clarification in the sanction order and taxes to be paid.

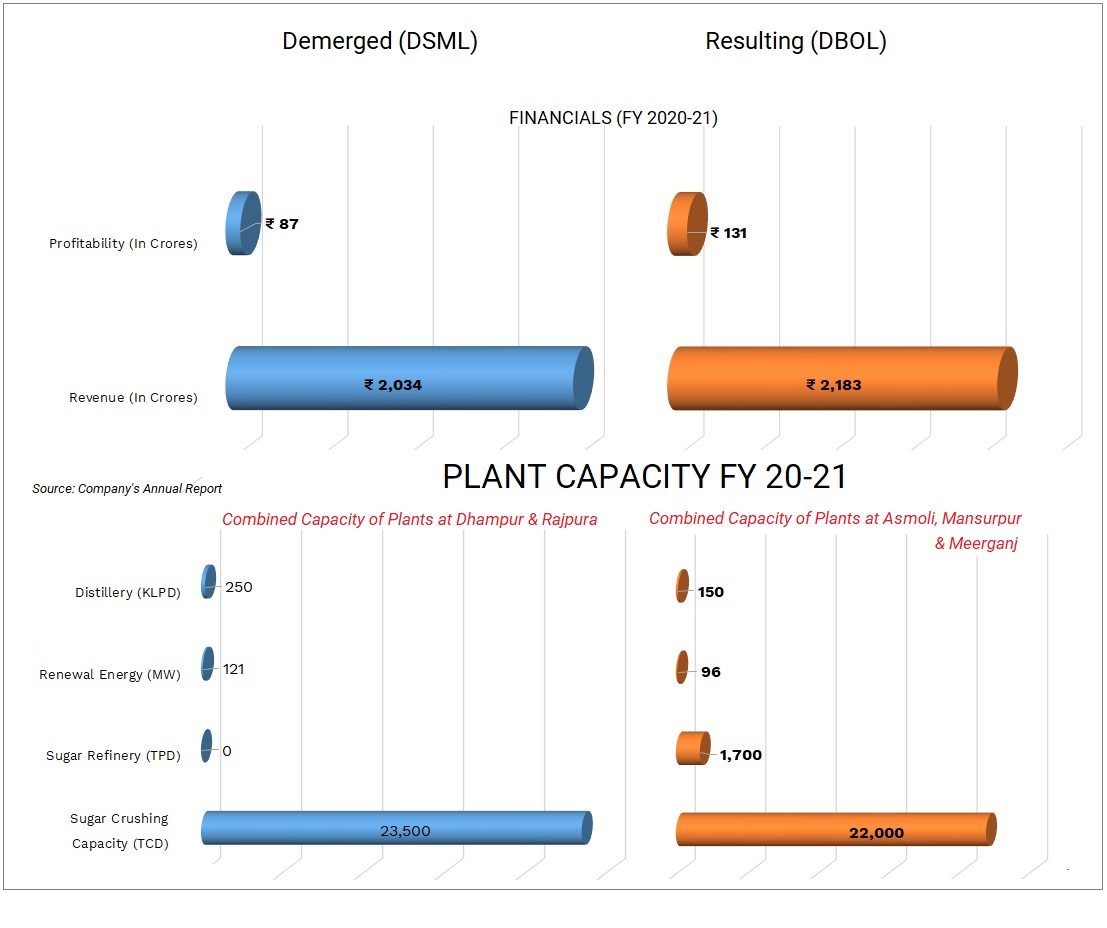

Financials

Table below shows financial of demerged business and remaining business separately:

Table 1:– Net worth of Companies Pre and Post Transaction (All Figs in ₹ Crores)

| Companies | Pre-Transaction | Post Transaction |

| DSML | 1,559.98 | 779.03 |

| DBOL | – | 780.94 |

The above figures show substantial reduction in borrowings and increase in revenue but with reduced PAT.

Succession Planning

Under the scheme, the capacity has been divided based on plants. The Sugar Cane Crushing capacity, Power & Distillery capacity will be divided between promoter group. GT group will be compensated on account of difference in Sugar Cane Crushing Capacity & Renewable Energy by transfer of Sugar Refinery. Net Worth post demerger is also equal between two groups and may be, to have equal net worth even common assets etc are getting transferred to Resulting Company

Scheme clearly provided that the Company logo and other intellectual property rights as specified in scheme will be transferred to the resulting company. Further the scheme provides that the DSML and DBOL shall be entitled to continue to use the word 'Dhampur' whether as part of the corporate names (including in respect of any subsidiaries, associate companies, joint ventures, etc.), logos, brand names, trademarks, products, programmes or services, present or future and both the Companies may enter into appropriate arrangements in respect of the Intellectual Property which is transferred to the DBOL under the Scheme or vice versa for such transition period or on a long term basis as the Boards may deem fit for use or license, for no charge.

Scheme in Schedule I additionally provides that 50% right in undivided assets will be transfer to the resulting company. Only provided for transfer of rights not the ownership thus, the ownership will remain with the demerged company.

If both the companies post scheme are going to use/own assets and trademarks and other intellectual rights even post-demerger, than transferring as part of the scheme increases compliances, reregistration, and taxes. It increases regulatory risks also if those common assets are not considered as part of the demerged undertaking

Conclusion

The main objective of the scheme is the segregation of business between promotors group and succession planning for future generation. Before structuring the succession planning, one needs to consider various aspects like bifurcation of Assets & liabilities, key Management Person including directors, employees, sharing of common/surplus assets, Intangibles like brand, distribution network, Trademark etc. In the present case, overall, the assets sharing amongst promoter group has been structured with due care.

Add comment