The Indian Aerospace Industry is growing significantly with the rising activities from both the defence and civil aviation sector. According to IBEF, the Indian aerospace & defence (A&D) market is projected to reach ~US$ 70 billion by 2030. Further, the government is taking several measures to boost domestic manufacturing. Companies, which are already in aerospace segment need to create appropriate structure to capture huge opportunity in the sector, where it can invite technical, strategic and financial partners and also compliance with the stringent regulatory requirements. In pursuance of this, recently Lakshmi Machine Works Limited, a company pioneer in manufacturing textile machinery announced separation of a tiny unit engaged in making structural, sheet metal parts, and engine components and sub-assemblies for leading Original Equipment Manufacturers in the aerospace business in India and abroad.

Overview of the companies:

Lakshmi Machine Works Limited (LMW) is a listed company engaged in the business of Textile Machinery Division, Machine Tool Division, Foundry Division and Advanced Technology Centre (ATC).

LMW Aerospace Industries Limited (LMWASIL) is a public limited company and is wholly-owned subsidiary of the LMW. LMWASIL is yet to commence operations in the intended Aerospace business vertical. It is incorporated in March 2021.

The Transaction:

LMW filed a scheme for transfer of Advanced Technology Centre (ATC) business undertaking as Slump Sale and going concern basis to its wholly-owned subsidiary LMWASIL. The turnover of transferred undertaking is ₹ 28.88 Crores in FY 2020-21 and net worth is Rs 17.08 crores which is minuscule as compared to turnover and net worth of LMW.

Rationale of the scheme:

The board, audit committee and independent directors meeting while approving the transaction has identified the following rationale.

As on date, the Company operates various business verticals /undertaking/divisions viz. Textile Machinery Division, Machine Tool Division, Foundry Division and Advanced Technology Centre (ATC).

The ATC business undertaking of the Company has different capital, operating and regulatory requirements from the rest of the business verticals. Further, the Company is also desirous of scaling up the business operations within aerospace industry. All other divisions have similar operating requirements hence it will lead to inefficient operations and increased compliances if put in separate legal entities. So, for regulatory reasons and to create focused organisation, the transaction in the present form is proposed.

Why Slump Sale through scheme:

The revenue and assets of the transfer business undertaking is miniscule compared to the entire company’s revenue and assets. Slump Sale through execution of Business Transfer Agreement would have been easy in terms of compliances and time however, LMW decided to execute a slump sale through the NCLT route.

Probable reasons of doing so may be:

- The ATC business undertaking has some licences, registrations and approvals which may not get transfer if it is not done through the legal process of approval of NCLT. Annexure A to the scheme provides a list of such licenses must run the transferred business which are going to be transferred on Effective Date without any action on the part of The Transferee company.

- Appointed date for the transaction is 1st April 2022. The reason for keeping prospective appointed date could be to have enough time available to get approvals from various government agencies by making representations as may be required by both companies. Clause 6 and 17.1 of the scheme specifically authorises the transferee company to start the process of obtaining licences and approvals as may be required even before The Appointed Date.

- The Scheme is single window clearance from all the stakeholders including government authorities, employees, suppliers, lenders and customers.

Why Slump Sale Not Demerger?

- In case of a demerger of ATC business, ATC business would have been listed on exchanges which considering the miniscule size may not be feasible.

- Inviting a strategic partner in an unlisted company is far easy than in a listed entity, particularly when public shareholding is circa 70%.

Financial:

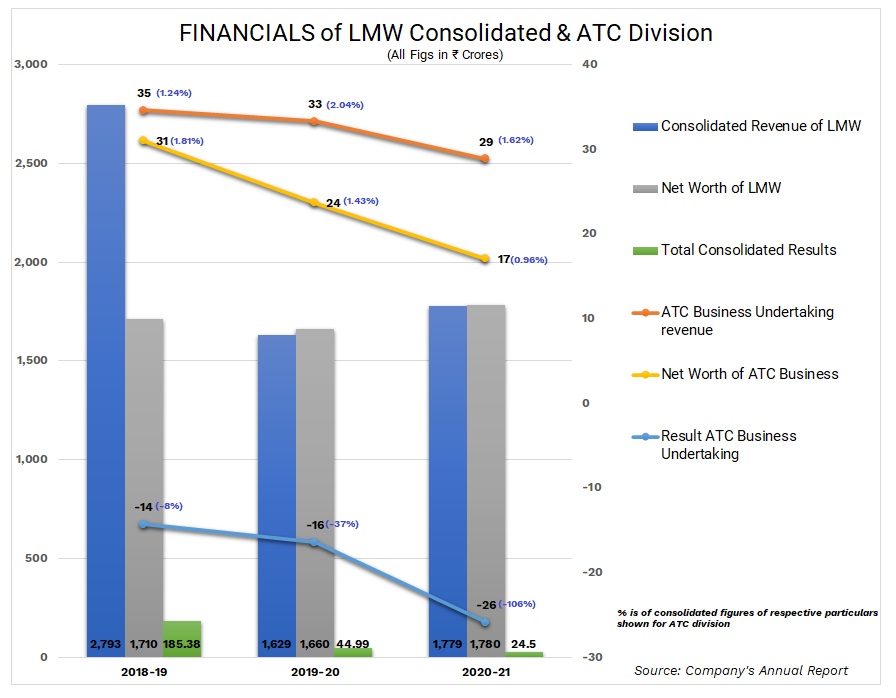

We give below financials for last three years.

From the above table it is obvious that ATC business is not only minuscule but also struggling to grow and as a result continuously growing losses as a percentage of Revenue. Further also note that it is incurring expenses more than its revenue. Even Q1 of FY 22 also had similar results. Under the circumstances, it is commercially and strategically difficult to have a listed entity with the above financials and level of operations. Promotors of LMW has only 31% stakes so it is not feasible to dilute further by inviting partners. It will not create any value for stakeholders and the cost of raising funds and other costs also will be higher. It is neither feasible for promotors of LMW or partner to take stake in LMW directly hence Wholly owned subsidiary (WoS) is being created as special purpose vehicle (SPV) to invite strategic and/or financial partner who has interest in this business. It will also enable LMW to have substantial stake in the business even after dilution hence participate in the growth in this business. So, the structure is a win-win for all concerned.

Accounting treatment:

Both Transferor and Transferee company will account as per Appendix C ‘Business combinations of entities under common control’ of Ind AS – 103 ‘Business Combinations. i.e., record assets and liabilities at their book value and difference between CCD issued and net assets shall adjust against the capital reserve. As a result of the transaction, capital reserve of ₹73.80 crores will get created.

In this structure, LMW has one incidental benefit of not reducing its net worth. In fact, capital reserve will be created. Though, it is transferred at book value by creating CCD of higher value as compared to net worth amounts to transfer at fair value without routing the difference through profit and loss account. However, in LMWASIL the balance of capital reserve will be negative.

Consideration:

The consideration for the Scheme shall be a lump sum consideration of INR 90,88,00,000 / – (Rupees Ninety Crore Eighty-Eight Lakhs Only), determined as on the Valuation Date i.e., 31st December 2020 (arrived based on valuation report obtained from registered valuer) and adjusted by the increase/(decrease) in the Net Asset Value of the ATC business from the Valuation Date till the Appointed Date (‘Purchase Consideration’). Thus, adjustment will be based on the change in net worth and will not get adjusted for change in valuation of any assets as compared to its value on the valuation date. LMWASIL will discharge the consideration by issue and allotment of Compulsorily Convertible Debentures (‘CCDs’) to the Company on the terms and conditions as set out in the Scheme. The number and amount of CCD will be arrived at after considering change in net worth as mentioned. Conversion will be at the end of 10 years and on conversion, equity shares will be issued at par.

Taxation implication:

Transfer for the purposes of capital gain under the income tax Act,1961 will be on Appointed Date I.e., 1st April 2022. LMW will not be liable to pay capital gain tax till LMWASIL continues to remain its WoS. Change in ownership of CCD will not change the relations between two companies.

Shareholding pattern of LMW and LMWASIL:

There is no change in number of shares of both the companies, as no shares are getting issued.

Conclusion:

No doubt LMW has already done the groundwork for the last couple of years for creating undertaking in the business vertical having huge potential. The Indian aerospace & defence (A&D) market is projected to reach ~USD 70 billion by 2030, driven by the burgeoning demand for advanced infrastructure and government thrust. To capture the full potential of the opportunity, it needs partners for sure. Still, The business has not reached a size that can attract strategic and financial partners. The structure gives flexibility to LMW in terms of time, strategy, and financial structuring as desired by incoming partners to create value for its stakeholders.

Add comment