India has second largest market for TV after China. As per estimate there are around 284 million household as on March 2016, out of which around 181 million has TV sets which are served through Cable TV around 102 million, Private Direct to Home(DTH) around 58.53 million active subscribers, Internet Television Protocol Service (IPTV) around 0.5 million and others (including government-owned DD direct) around 19.97 million. There are around 899 permitted satellite TV channels in India till Dec 2016 and 7 DTH/satellite operators.

Indian broadcasting industry grew to Rs 54,200 crores in 2015-16, registering the growth rate of around 14.10%. Major share comes from subscription revenue which accounts to Rs 36,100 crores and remaining from the advertisements.

Dish TV India Limited (Dish TV)

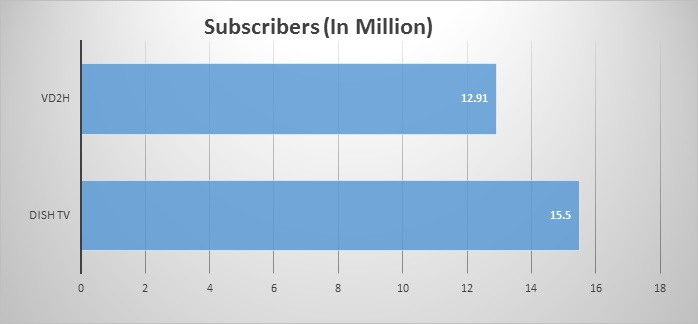

- Dish TV is world’s third largest and India’s number one DTH service provided with a subscriber base of 15.5 million as on March 2017

- DTH service contribute almost 63% of total revenue whereas Infra support service contributes around 36% of revenue amounting to Rs 1,125.54 crores (gross basis including inter segment revenue) as on March 2017.

- Having pan-India presence.

- As on March 2016, Dish TV is having almost 25% share of Private DTH market.

- Listed on BSE and NSE having a market capitalisation of around Rs 8,996 crores.

Videocon D2H Limited (VD2H)

- Videocon d2h is India’s fastest growing DTH company.

- Since its launch of DTH service in Year 2009, company went pan-India by 2010 and as on March 2017, it has 12.91 million subscribers.

- It is also the First India Media company to be listed on NASDAQ.

- Company having a market cap of USD 1.208 billion (Rs 7,852 Crs approx. @Rs 65/$) as on March 2017.

- VD2H is having a market share of around 20%.

Scheme of Amalgamation

Scheme of amalgamation between Videocon D2H Ltd (Transferor Company) with Dish TV India Ltd (Transferee Company) with appointed date which is effective date (i.e. date on which filing of order with ROC) with exchange ratio is fixed at 2.02 equity shares of Rupee 1 each in Dish TV for every 1 Share of Rs 10 each in VD2H.

Please Note:

- Any fractional shares, if 0.5 or more, then 1 share of Dish TV is to be given else no shares.

- ADR holders of VD2H are provided with 2 options to be opted prior to effective date

- Shares of Dish TV as per exchange ratio for number of transferor company shares represented by Such ADRs Or

- GDRs of Dish TV

- Exchange ratio will change subject to following scenarios:

Shares are to be issued to VD2H shareholders by Dish TV, exchange ratio will be subject to change based on the scenario mentioned below.

Table 1: Share Exchange Ratio Scenarios

| Scenario’s | |||

| Particular | I | II | III |

| Shares Outstanding as on 30 Sept 2016 | 42,00,64,600 | 42,00,64,600 | 42,00,64,600 |

| Less: Shares held in employee trust to be cancelled as per the scheme | 4,66,647 | Nil | Nil |

| Add: Shares to be issued pursuant to contribution agreement* | Nil | 53,99,984 | 53,99,984 |

| Add: Shares to be issued on occurrence of subsequent performance hurdle* | Nil | Nil | 2,87,59,984 |

| Total equity shares as per the scenario | 41,95,97,953 | 42,49,97,937 | 45,37,57,921 |

| Exchange Ratio for 1 Equity share of VD2H | 2.04 | 2.02 | 1.89 |

*Subject to receipt of regulatory approval prior to the effective date.

The exchange ratio will be adjusted such that it shall be equal to 85,77,85,766 shares divided by total number of transferor shares considering the effect of above mentioned events.

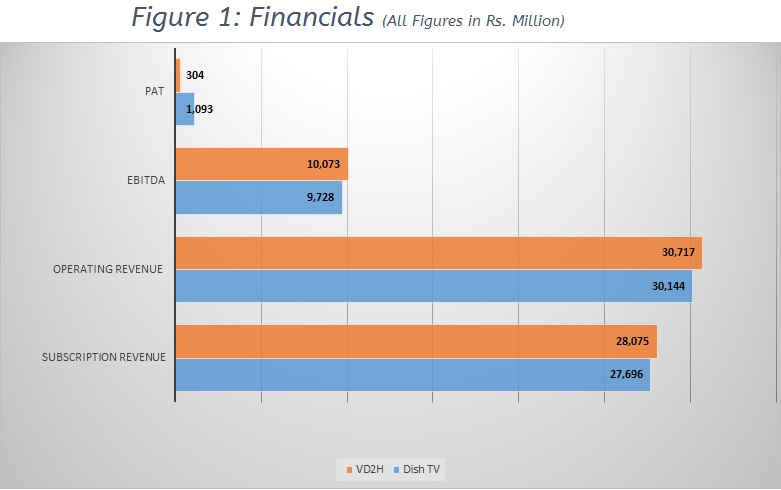

Financial Overview

Table 2: Dish TV & Videocon Financials (All Figures in Rs. Million)

| Particulars | Dish TV (Consolidated) | VD2H |

| Shareholders’ Funds | 4,906 | 7,809 |

| Non-Current Liabilities | 7,064 | 2,721 |

| Current Liabilities | 30,639 | 32,852 |

| Total | 42,609 | 43,382 |

| Non-Current Assets: | ||

| Fixed Assets | 27,071 | 26,103 |

| Other Non-Current Assets | 8,616 | 11,603 |

| Current Assets: | 6,922 | 5,676 |

| Total | 42,609 | 43,382 |

Accounting Treatment

- All assets and liabilities of the transferor company pursuant to this scheme shall be recorded in the books of transferee company at fair values as determined by the board of directors of the Transferee.

- Any excess of the fair value equity shares, over the value of net assets of the transferor company will be adjusted as goodwill arising on amalgamation. If fair value of equity shares issued as consideration for amalgamation is lower than the value of net asset acquired, the difference shall be credited to “capital reserve account”.

- Fair value of equity shares issued as consideration is excess of face value of equity shares shall be recorded as “share premium account” in the books of transferee company.

Post-Merger Scenario

- Dish TV Videocon Ltd will be the name.

- Both brand will co-exist, i.e. Dish TV and Videocon D2H

- Dish TV will be continued to be listed on BSE & NSE in India and GDRs of the company will be listed on Luxembourg Stock exchange.

- Combined market shares will be around 43% of the Private DTH market.

Shareholding Pattern

Table 3: Pre Transaction Shareholding

| Shareholders | Dish TV | VD2H |

| Promoter and Group | 64.44% | 63.17% |

| Public | 35.56% | 36.83%* |

| Total | 100% | 100% |

Table 4: PostTransaction Shareholding

| Entity | % Holding |

| Dish TV Promoters | 36% |

| Videocon D2H | 28% |

| Public (all categories) | 36% |

| Total | 100% |

Board Power

- Videocon Promoter will have 2 director seat on board, Vice-chairman and deputy MD

- Whereas Dish TV promoter has no limitation on number of directors.

- Dish TV current CMD Mr. Jawahar Lal Goel will be the MD of Dish TV Videocon Ltd

- Mr. Saurabh Dhoot, who is Executive Chairman of the D2H company will hold the position as Deputy MD of the company.

Benefit from the Merger

- Dish TV Videocon Ltd will become world’s 2nd largest DTH company in terms of subscribers with a base of 28.07 million (as on 31st Dec 2016) net subscribers.

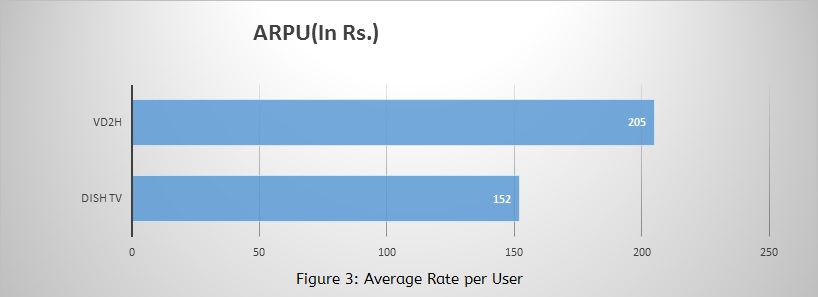

- Dish TV has more subscribers in rural India whereas VD2H has more reach in Urban cities, merger will give boost to their pan India reach of subscribers.

- Net worth before the merger is Rs 109.78 Crores of Dish TV (Standalone basis) and Negative Rs 115.38 crores of Videocon, after the merger it will climb to Rs7,611.11 crores.

Conclusion

- Merger will create market leader in form of Dish TV Videocon.

- Currently, around 56% market is held by cable TV, it will be interesting to see how new subscribers will be added to DTH platform in coming years.

- Management will be dominated by Dish TV as Videocon have just 2 seats on board and no limit is mentioned for Dish TV directors.

- Closest competitors TATA Sky and Airtel are having around 18% market shares each which will leave a wider gap between first and second position, they may have to think of merger to stand in the competition.

- New entrant Reliance JIO is also planning to enter the DTH market which will challenge the price and pull the new subscribers and will create a pressure on profits of existing players.

- Small players such as Reliance Big TV and Sun Direct have to fight for their survival or evaluate other options including exit.