The Board of Directors of Fairchem Speciality Limited announced the separation of its “Oleo Chemical & Nutraceutical Business” through a demerger. To take the company to the next level, the famous Fairfax group acquired a significant stake in the company & thereafter immediately the company acquired “Aroma Business” from Privi Organics Limited. As a result of the acquisition by Fairfax & demerger, the erstwhile promoters stake got changed from 62% to 4%. Interestingly, only after less than three years, the promoters have decided to part away. What made them think of separation of the business? What will be the impact on minority shareholder and the largest promoter shareholder Fairfax Group?

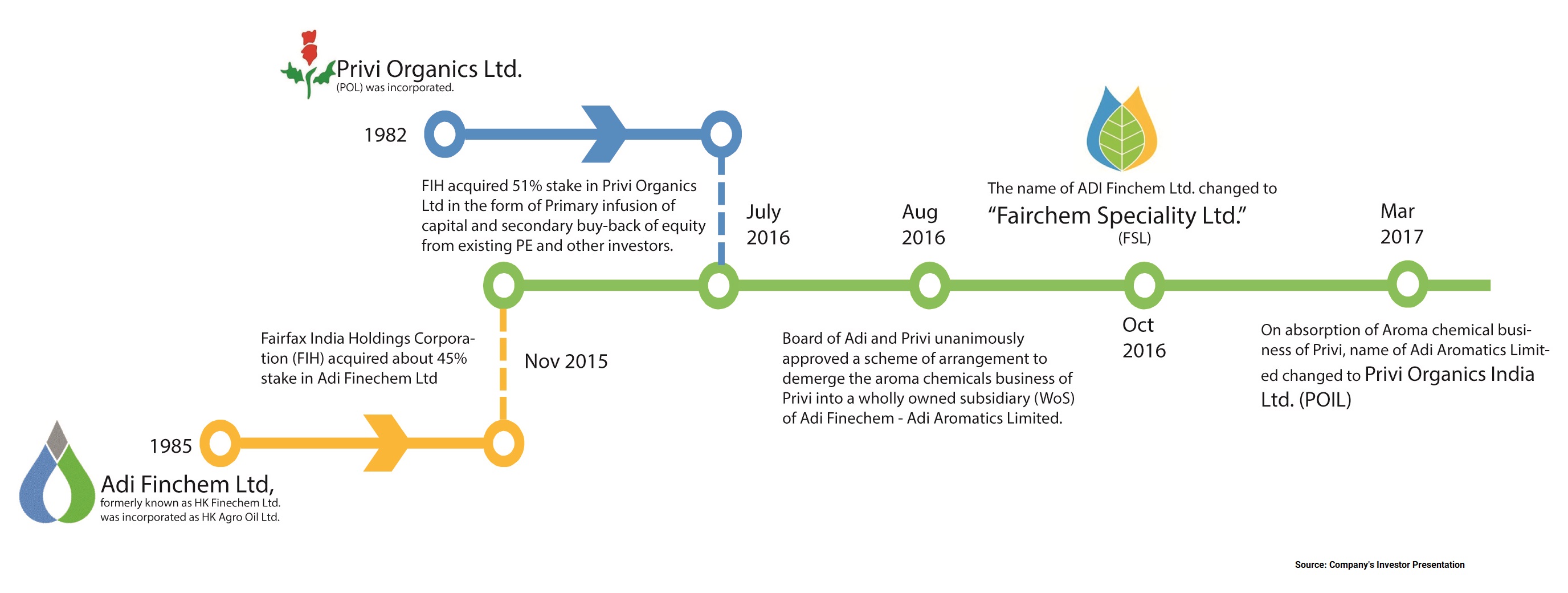

Formation of FAIRCHEM SPECIALTY LTD.

Till 2015-16, the company was operated as Adi Fairchem Limited (AFL) having a business of speciality oleo chemical & nutraceuticals. In late 2015, Canada based Fairfax Group (FIH) entered into a Share Purchase Agreement with existing Promoters (Adi Promoters) to acquire 44.66% equity stake in the company at a price of Rs 212 per equity share. As a result of this, Adi Promoters received circa Rs 131 crores.

FIH also came with an open offer, however, it got a poor response from the public shareholder and only 847 equity shares were accepted by the FIH. With an introduction of Fairfax, the name of the company got changed to its current name.

Previous Demerger Transaction and Changes in Shareholding.

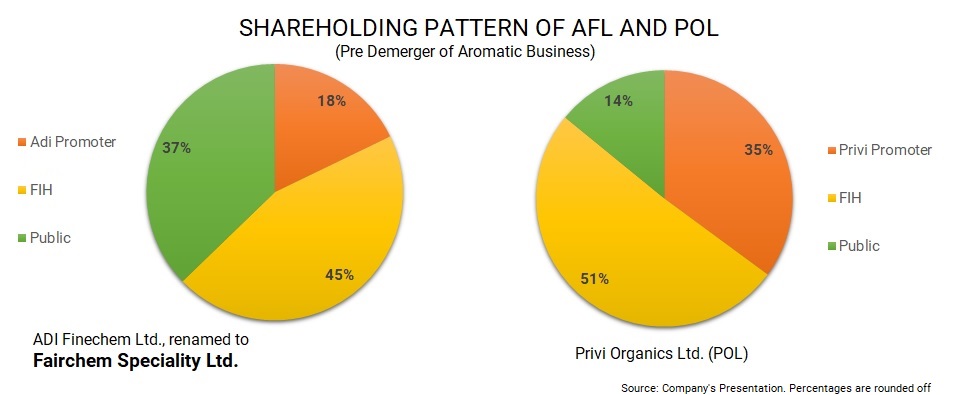

As in the figure above, Fairfax (FIH) enters the promoters group of AFL in 2015 and of Privi Organics Ltd. (POL) in 2016.

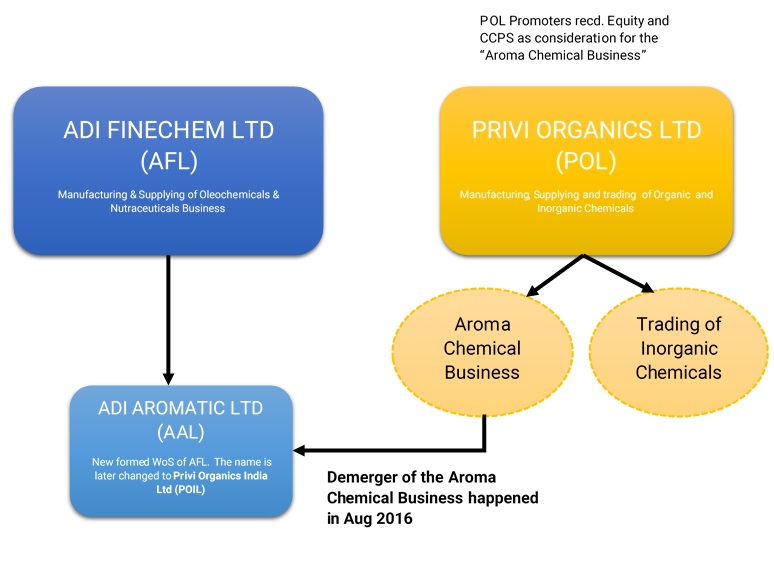

In 2016, FSL announced acquisition of “Aroma Chemical Business” of Privi Organics Limited(“POL”) (then unrelated company) through demerger into a wholly-owned subsidiary of ADI Finechem – ADI Aromatics Ltd. For considerations, shareholders of POL, Privi Promoter Block (Babani & Rao family) and others were issued equity shares and compulsory convertible preference shares (CCPS). These CCPS were converted into equity shares in subsequent year 2017 and 2018.

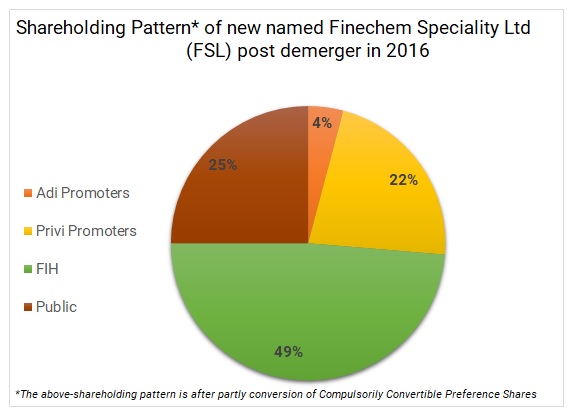

After de-merger, few of the existing promoter shareholders were classified as a public shareholder hence Adi Promotor Block shareholding came down to 4.12%. With the de-merger of “Aroma Chemical Business”, both Mr. Babani & Mr. Rao joined the board of directors of the company, with Mr. Babani in the role of Managing Director. Further, the composition of the board got changed significantly after the de-merger.

ADI Aromatic Ltd was later renamed to Privi Organics India Ltd (POIL). Also FIH exited from the POL post demerger by selling the share back the Privi Promoters. Currently, there is marginal business of trading inorganic chemicals present in POL.

Current Transaction

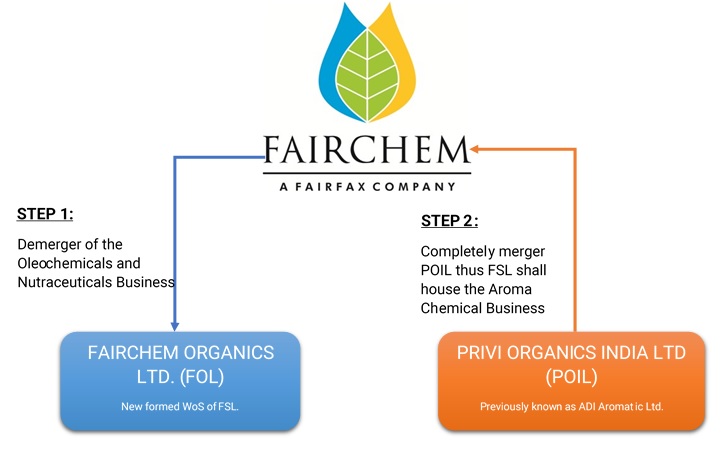

Fairchem Speciality Limited (FSL) is engaged in the business of manufacturing, supplying and exporting of speciality oleochemical and nutraceuticals made from the by-product generated from the processing of crude vegetable oil refineries. The equity shares of FSL are listed on nationwide bourses.

Fairchem Organics Limited (FOL) is a wholly-owned subsidiary of FSL. This company has been newly incorporated for the purpose of executing this transaction.

Privi Organics India Limited (POIL) is in a business of development, manufacture and processing of Aroma Chemicals and to supply and export aroma chemicals. Privi is a wholly-owned subsidiary of FSL.

Step1: FSL will demerge its speciality oleo chemical and nutraceuticals business into FOL.

Step2: POIL will get merge with its holding company. As a result of the merger, FSL will house the Aroma Business.

The Appointed date 1 i.e. Appointed date for demerger of “Demerged Undertaking“ the is closing of the business hours of 31st March 2019. The Appointed Date 2 i.e. Appointed Date for the merger of POIL is the opening of business hours of 1st April 2019.

“Demerged Undertaking” means the business of manufacturing, supplying and exporting of speciality oleochemical and nutraceuticals.

Swap Ratio

As a result of demerger of speciality oleochemical and nutraceuticals business into FOL, one equity share of FOL will be issued for every Three equity shares of FSL.

Inter-se Transfer Agreement:

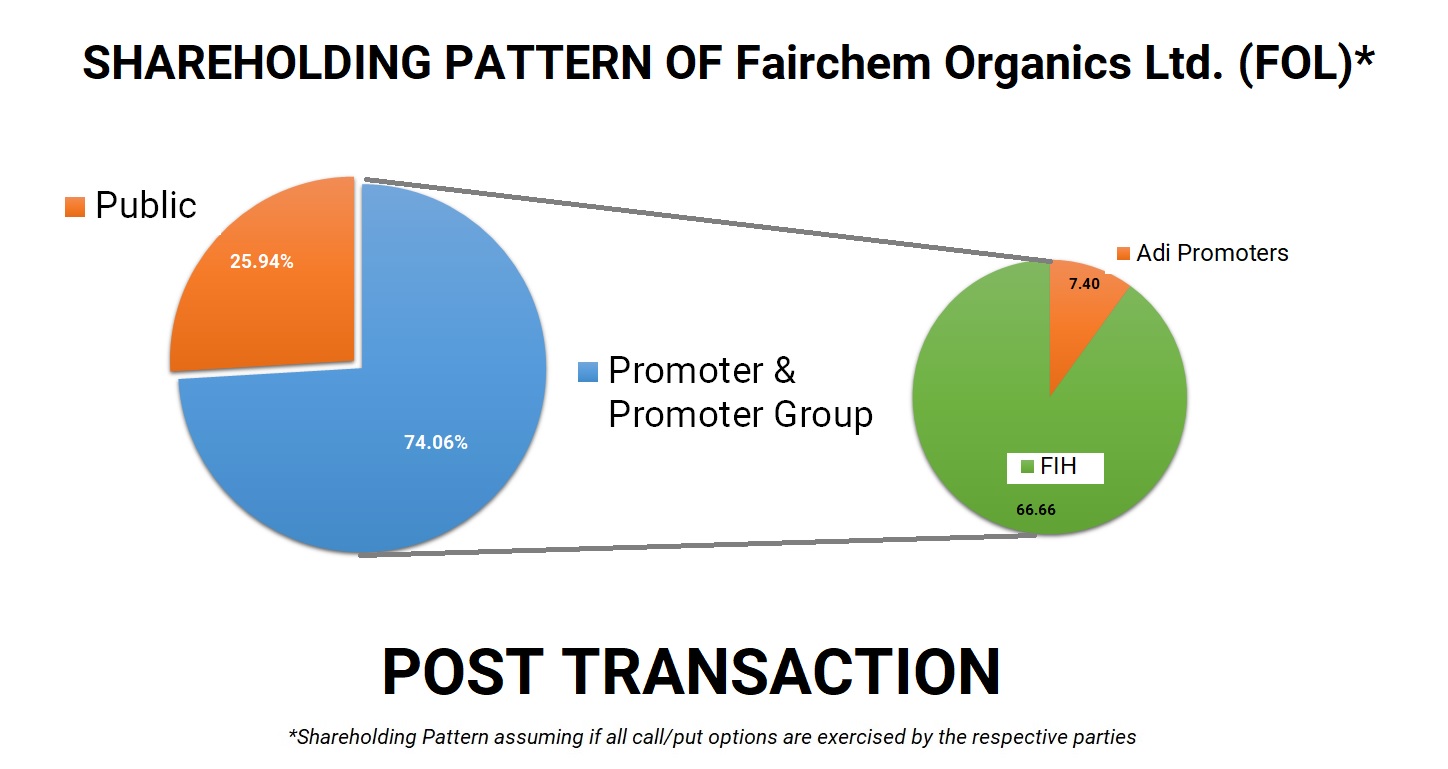

The promoters have entered into an option agreement amongst themselves for inter-se transfer of equity shares but there is no mention of such agreement in the scheme. In the agreement, FIH proposes to grant a call option to the Privi Promoter Block in relation to 38,41,908 equity shares of FSL (equivalent to 9.84% of the share capital of the FSL) currently held by FIH, post the Scheme coming into effect. Further, Privi Promoter Block has proposed to grant a put option to the Adi Promoter Block and the Adi Promoter Block proposes to grant a call option to the Privi Promoter Block in relation to 10,25,000 equity shares of FSL (equivalent to 2.62% of the share capital) currently held by the Adi Promoter Block, post the Scheme coming into effect.

FIH has also proposed to acquire 23,30,758 equity shares of the FOL – Post restructuring (equivalent to 17.9% of the share capital of the FOL) currently held by the Privi Promoter Block, post the Scheme coming into effect. Further, Adi Promoter Block proposes to acquire 6,21,833 equity shares of the FOL (equivalent to 4.78% of the share capital of the FOL) held by the Privi Promoter Block, post the Scheme coming into effect.

It is likely that Adi Promoter Block will take exit from the Aroma Business vis-à-vis Privi Promoter Block will take an exit from speciality oleochemical and nutraceuticals. FIH will increase its stake in speciality oleochemical and nutraceuticals business at a cost of reduced stake in Aroma Business.

Shareholding Pattern (Current and Post Transaction)

The promoter’s shareholding is divided into three parts. One is Babani & Rao Family (together known as “Privi Promoter Block”), second being Shah, Nahoosh Tradelink LLP and Jariwala Tradelink LLP (together known as “Adi Promoter Block”) and third being FIH Mauritius Investment Limited (FIH). Out of total promoter holdings, each group owns 22.7%, 2.6% and 48.8% respectively. Last year, Adi Promoter Block sold some of the equity shares to the public.

The pricing for the inter-se transfer has not yet disclosed by the promoters. As inter-se transfer is happening post-restructuring through a separate agreement having no mentioned in the scheme, it seems difficult that the promoters will get an exemption from the requirement of the Open offer.

These inter-se transfer will not have any impact on the minority shareholding pattern.

Other Clauses

Post-Restructuring, the name of the FSL will get changed to Privi Speciality Chemical Limited. Further, all the cost, charges, levies and expense to be borne by the resulting company & the Transferor Company in the ratio of 1:2. Further, any difference between excess of book value of assets over the book value of liabilities pertaining to the Demerged Undertaking shall be adjusted to the “Other Equity” i.e. share premium or general reserve.

Financials

Table 1: Standalone (Oleo & Nutraceuticals) & Consolidated Financials of FSL- FY19 and FY 18

| Particulars | 2019 | 2018 | ||

| Standalone | Consolidated | Standalone | Consolidated | |

| Revenue (Rs. Crores) | 250 | 1341 | 243 | 1039 |

| EBITDA % | 14.56% | 15.81% | 13.91% | 12.51% |

| EBIT % | 12.38% | 12.32% | 11.88% | 8.34% |

| PAT % | 7.40% | 6.11% | 7.16% | 3.95% |

| Fixed Assets (Rs. Crores) | 115 | 582 | 104 | 479 |

| Capital Employed (Rs. Crores) | 161 | 1135 | 156.12 | 854 |

| RoCE | 19.2% | 14.6% | 18.5% | 10.1% |

| RoE | 18.1% | 14.3% | 20.0% | 8.4% |

Source: BSE Fillings

The business of manufacturing, supplying and exporting of speciality oleochemical and nutraceuticals is housed under standalone basis & “Aroma Chemical” business is housed under subsidiary i.e. consolidated basis.

Table 2: Financials of “Aroma Business” of POL

| Particulars | 2019 |

| Revenue | 1091 |

| EBITDA % | 16.10% |

| EBIT % | 12.31% |

| PAT | 5.82% |

| Borrowings | 501 |

| Fixed Assets | 467 |

| Capital Employed | 974 |

| RoCE | 13.8% |

*: The above figures are approximate & ignoring inter-segment transactions, if any.

Table 3: Pre-Transaction Financials of POL (All figs in Rs. Crores)

| Particular | 2015-16 | 2014-15 | 2013-14 |

| Net-worth | 204 | 184 | 171 |

| Loans | 312 | 308 | 235 |

| Income from Operations | 621 | 549 | 514 |

| PBT | 30 | 24 | 18 |

Source: BSE Fillings

These financials are including minuscule Trading business of “POL” which was not demerged into FSL.

Valuation

At a time of demerger, the enterprise value of the “Aroma Chemical Business” was worked out at Circa INR 880 crores.

Table 4: Valuation of POL Consolidated (All Figs in Rs. Crores)

| Particulars | Amount |

| Current Market Cap | 2,100 |

| Borrowings | 560 |

| Enterprise Value | 2,660 |

| EBIT | 165 |

| EV/EBIT | 16 |

Table 5: Valuation of Standalone Business of POL (All Figs in Rs. Crores)

| Particulars | Aroma Division | Other |

| Total Debt | 501 | 59 |

| EBIT | 134 | 31 |

| EV/EBIT Valuation | 16.1 | 16.1 |

| Enterprise Value | 2,162 | 498 |

| Equity Value | 1,661 | 439 |

| Per Share | 425 | 337 |

*: The above calculation is approximate & we have considered the all Cash & Cash equivalent to be used in business.

Value Creation for original Minority Shareholders

| Particulars | Amount |

| Valuation given by FIH during acquisition of FSL | 292 |

| Minority Shareholders Stake | 37.5% |

| Value of Minority Shareholders | 110 |

| Current Stake of those Minority Shareholders | 13.2% |

| Current Value | 278 |

Conclusion

Strategy and reasons to separate the businesses which was just merged three years back is not spelt out. The reason for what looked like great synergy three years back has changed now, the reasons being unclear. Fairfax acquired a stake in FSL (then ADI Fairchem) in late 2015 and a stake in POL in mid-2016.

It seems that the acquisition of a stake in POL was some strategic move by FIH before combining the operations of FSL & POL. No doubt original promotors of AFL existed completely having a minuscule stake of around 2%, though post-demerger again they will manage their original business as in the past. The original listed business is getting demerged probably for two reasons; bringing capital in line with its size of business i.e. almost same as it was in FY 2015 before any transaction of investments or restructuring and it may have savings in transaction costs in terms stamp duty etc.

Private agreement to transfer shares among shareholders post demerger as mentioned above may have a hurdle in terms of valuation under the income tax act and compliances required under SEBI takeover code.

Add comment