A consortium of 26 bankers led by the State Bank of India (SBI) have finally decided to take the grounded Jet Airways to bankruptcy court after failing to revive the company and find buyers. Insolvency proceedings have been initiated against debt-ridden Jet Airways, which stopped flying on April 17. Before the bank consortium filed the bankruptcy proceedings for Jet Airways, two operational creditors – Shaman Wheels and Gaggar Enterprises – had already taken the airlines to National Company Law Tribunal (NCLT) as the airline owes Rs 8.74 crore and Rs 53 lakh to the two companies, respectively. After the airline stopped flying, most of its domestic and international slots have been given away to other airlines by the government.

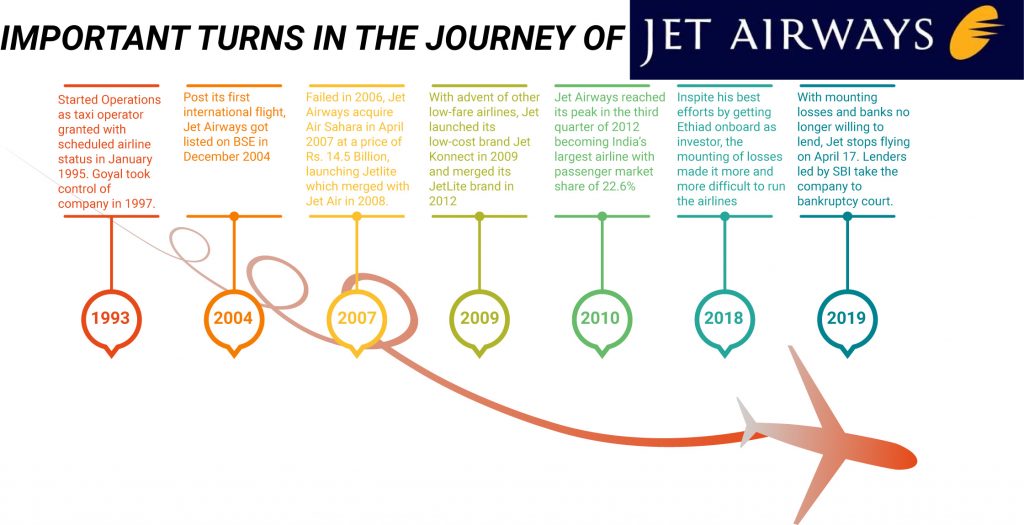

Jet Airways will be the first airline’s company in the country to go into bankruptcy, as it owes over Rs 8,000 crore to banks and thousands of crores to vendors, lessors and employees. Jet Airways was started by airline-ticketing-agent-turned-entrepreneur Naresh Goyal about 25 years ago. It was the country’s oldest private sector carrier and remained a dominant player in the Indian skies. At its peak, it had 120 aircraft flying to almost 1000 destinations in the country and abroad. The two potential buyers Etihad and the Hinduja Group wanted 85% haircut on the Jet Airways bank loans which was unacceptable to lenders. The lenders led by SBI have been trying to sell the airline for the past six months but failed due to many reasons.

Trouble for long time

The airline has been making losses for a long time and has accumulated a loss of over Rs 13,000 crore, has total debt and dues of Rs 36,500 crore and has negligible assets to recover. Despite Abu Dhabi’s Etihad Airways taking 24% stake in the airline in 2013, Jet Airways had been slipping deeper into negative equity for seven years.

The company had only 16 aircraft on its book valued at Rs 5,000 crore and the rest of its 123 fleets were on lease and most of them have been de-registered or taken away by the foreign lessors. As the airline ran out of money, promoter Naresh Goyal had to give up control on March 25 and the banks in principal had agreed to infuse Rs 1,500 crore to meet the daily operating expenses.

The real problem with promoter Naresh Goyal was that he gambled away a well-oiled but unprofitable airline by not infusing equity himself, or worse, not stepping aside in time and allowing a professional team to manage this show. He kept the management under his control, which did not enthuse airline to buy it. A timely merger with a profitable domestic airline would have saved the carrier from being declared bankrupt. Also, had all the banks insisted on a timely capital infusion by Goyal and had they threatened to dilute his controlling stake of 51%, Jet Airways would have had a new owner.

Jet Airways’ trouble began in the mid-2000s as a slew of budget carriers started flooding the market offering no-frills cheap tickets. Full-service carriers too had to lower ticket prices but could not cut expenditures. As a result, the airlines lost money in all but two of the past 11 years. The airline defaulted on loans that were due last year. Jet Airways has held talks with Etihad and Tata Group, to raise money, but all such efforts failed. The struggling Abu Dhabi-based Etihad Group has cut down on routes and has also halted its expansion plan after almost $3.5 billion in loss. In 2012, when Indian aviation was opened up to foreign direct investment, Goyal again used his networking skills to rope in

Etihad Airways as an investor. After negotiating many roadblocks, the deal went through in 2013, and the Abu Dhabi-based airline-owned a 24% stake in Jet.

Acquiring Air Sahara: The trouble monger

Jet’s troubles goes to the legacy issues as Goyal’s 2007 Air Sahara deal, which was meant to salvage Jet’s market share from the threat of an aggressive Kingfisher Airlines, actually boomeranged. Jet Airways acquired loss-making Air Sahara in 2007 for Rs 2,050 crore and the latter was renamed JetLite as a budget brand. In fact, the first takeover attempt was made by Jet Airways on January 19, 2006, when Jet offered US$500 million in cash for acquiring Air Sahara. In spite of getting a go ahead from the Indian Civil Aviation Ministry, the deal fell apart due to disagreement on the price. Lawsuits were filed by both the companies seeking damages from each other. Jet finally acquired in 2007 after offering a higher price. This merger marked the beginning of consolidation in the Indian aviation sector.

In fact, in 2005, when the now-defunct Kingfisher Airlines, led by now fugitive liquor baron Vijay Mallya, entered the Indian aviation market, Goyal tried to buy Air Sahara. The deal was hanging fire for many months and was even called off initially in 2006. But a persistent Goyal revived his attempt in 2007 and managed to bring the Sahara India Pariwar-owned airline into Jet Airways’ fold, consolidating the market leadership it enjoyed at the time.

The deal began all the trouble for Goyal as he paid a huge premium for a loss-making airline and did not do enough due diligence. At that point, Air Sahara was struggling and Jet was an established player. So, probably, the understanding was that Jet could leverage that network and make the deal work to turn profitable. Moreover, JetLite was not managed properly and did not put a check on the cost. When there are two different airlines it is very difficult to do cost control or optimisation in operations as the two companies had completely different operating structures.

So, in 2012, JetLite was merged with Jet’s low-frills brand JetKonnect and the latter dissolved. In fact, Goel’s plan to merge JetLite with Jet Airways was rejected by the aviation ministry. The weight of deal of the bad business decision haunted Jet Airways throughout and ultimately led to bankruptcy. The merger of Jet and Sahara gave Jet Airways access to the entire leased fleet of 27 aircraft of Air Sahara along with its infrastructure and logistics and in routes where Jet Airways had no presence.

While Jet was operating on long haul routes such as US and Europe, Air Sahara operated to neighbouring countries such as Sri Lanka, Nepal and Thailand. At the time of the deal, Jet Airways had about 62 aircrafts and operated 320 flights to 44 domestic destinations and 6 foreign destinations at the time of the deal. One major gain for Jet in the deal was that it could gain access to Sahara’s parking slots in London’s Heathrow airport as well as in Delhi and Mumbai. At that time, Jet Airways was also looking at capturing more market share post the deal. It used to have a 40% market share which fell down to 27% at the time of the deal. The major reason was Jet’s intention of becoming the king of Indian skies by becoming the number one private airlines in the industry.

The idea for acquiring Air Sahara was low-cost carriers were starting to dominate the Indian skies and by acquiring the airline, Jet Airways would also have entered the low-cost business. Passengers preferred low-cost carriers such as Indigo for low prices and on-time arrival and departure. But the fact was Air Sahara was not a low-cost carrier and the airline ran the same business model as Jet Airways. So, Jet Airways paid a lot of money to acquire Air Sahara for additional aircraft, routes and parking slots.

Internal trouble also brewed in Jet Airways. In 2009, hundreds of Jet Airways flights had got affected following strikes called by its pilots. The company also fired 1900 employees to cut costs. But after protests on the street, Goyal re-hired the workers. The pilots going on strike just added to the difficulties of the airlines. However, after a lot of route rationalization, efficiency improved in the airline and the company reduced a lot of overheads. In 2009, Jet Airways launched one more subsidiary called Jet Konnect. These moves seemed to work for few years as the airline started getting some traction. However, three years later in 2012, Jet Airways merged the two low-cost subsidiaries and Jet Konnect as a brand stopped existing.

Conclusion

Airline business is a difficult business, because of its assets heavy model. VERY FEW AIRLINES MAKE profit world over. to be successful, Airlines should be able to control its interest/leasing cost by having high utilization level i.e. squeezing the assets by having a very quick turnaround time. Its debt equity ratio, even after considering off balance sheet financing, should be less than one. As far as operating cost is concerned, its cost other than fuel should be optimum. Now, as the bankruptcy court chalks its course of action for Jet Airways and banks stare at a huge haircut, the failed policies of the airline can be good lesson for corporate India. For one, a merger without proper synergy can be no good, especially if one is looking at increasing market share to stay ahead of the curve.

After Jet Airways stopped flying, other airlines are making the most of the situation. All of them are vying for Jet’s prime slot, expanding their fleets and adding new routes. The directorate general of civil aviation had allotted 130 airport slots to Jet, including 68 prime slots in Mumbai. Now, the lessors of aircraft have taken most of the fleet and the slots of Jet have been allocated to other domestic airlines. So, it looks very unlikely that Jet Airways will ever be able to fly again.

Add comment