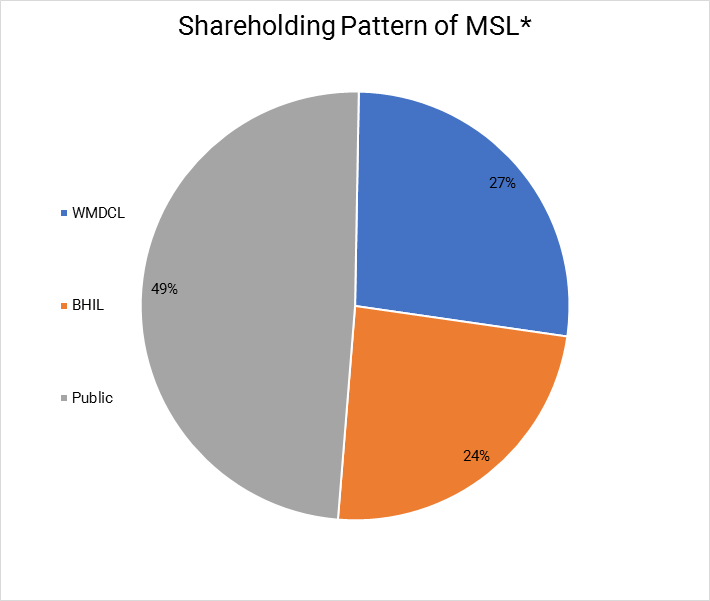

In a long-standing battle between Western Maharashtra Development Corporation Limited (WMDCL), a Government of Maharashtra undertaking, and Bajaj Holding & Investment Limited (BHIL) over pricing of equity shares of Maharashtra Scooters Limited (MSL) has finally settled, and on June 17, 2019 MSL has become a subsidiary of BHIL. Upon the acquisition of 27% stake of MSL from WMDC, BHIL’s holding has increased to 51% in MSL.

In 1975, Maharashtra Scooters Limited was incorporated jointly by Bajaj Auto Limited (BAL) now Bajaj Holding and Investments Ltd post demerger in 2007 and Western Maharashtra Development Corporation Limited to manufacture geared scooters. With a gradual shift in consumer preferences from geared scooters to motorcycle, the company discontinued production of geared scooters in 2006. Currently, the company is engaged in two businesses — manufacturing of die casting dies, fixtures and die casting components, primarily meant for the automobiles industry and other being treasury operations involving management of surplus funds invested by the company. MSL holds a significant investment in Bajaj group companies.

*: Before Transfer

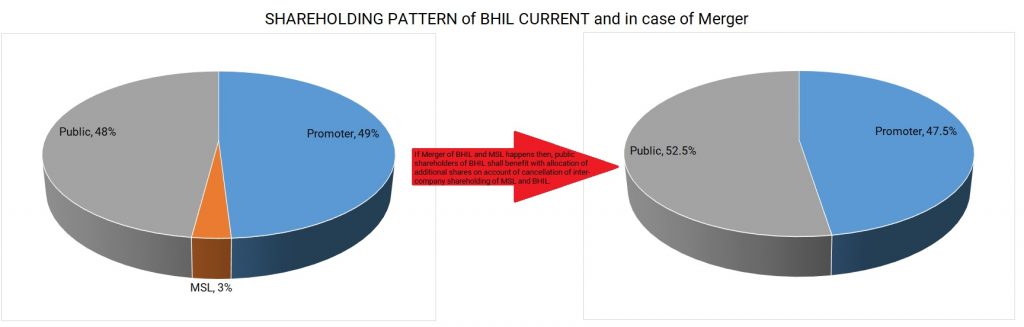

Bajaj Holding & Investment Limited is Bajaj group’s listed holding company. Currently, promoters own 49% & rest is owned by the public shareholder. Out of 51% of the public shareholding, MSL owns 3% of BHIL.

Background

In 2003, WMDCL had offered to sell its 27% shareholding in MSL to BHIL. Since there was disagreement in price between both parties, both parties referred to a sole arbitrator with an understanding that the award would be binding on both. In 2006, the arbitrator awarded with a price of INR 153.6 per equity share. The said pricing/award was then challenged by the WMDCL in Bombay High Court.

In 2015, the Division Bench of the Bombay High Court had pronounced its judgment in the matter.

Also Read: “Hamara Bajaj” or “Promoter’s Bajaj”?

Special Leave Petition (SLP) was then filed by WMDC in the Supreme Court against the above Order. After hearing both the parties, the Supreme Court has passed an order dated January 9, 2019, dismissing the SLP filed by WMDCL, subject to the following conditions:

- BHIL shall pay to WMDCL an amount of Rs. 232 per Share in place of Rs.151.63, along with interest @ 18% p.a. from the date of the award (i.e. January 14, 2006).

- No sooner the afore-said payments due are made, the shares shall be transferred to BHIL.

On June 17, 2019, BHIL purchased the 27% stake from WMDCL making MSL its subsidiary.

Gain/Loss to both parties

BHIL acquired 27% stake with WMDCL for an amount of INR 232 per share plus 18% p.a. interest from January 14, 2006. Assuming the compounded interest for calculation, the value per share comes to circa Rs 2000 per share plus dividend of Rs 228 per share during the disputed period. The total consideration given by BHIL would be ~Rs 670 crores to WMDCL.

Price per equity share of the MSL was Rs 4640 (as on BSE dates 17th June 2019). Though the above may look like a gain to BHIL, considering the delay in consolidation, time and cost spent on the litigation might have destroyed more value for them.

Financials

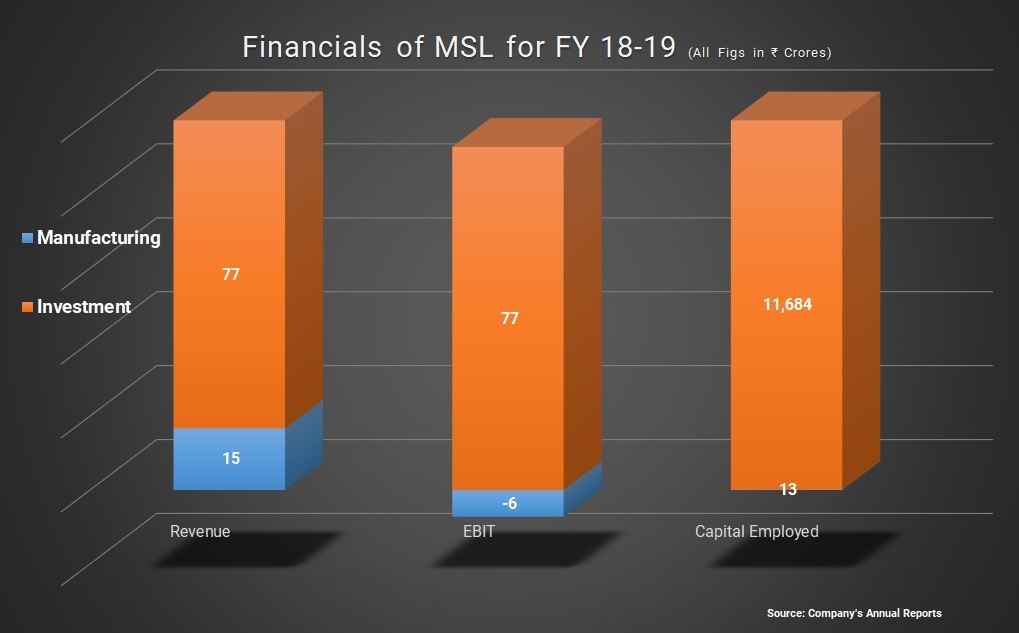

Table 1: Financials of MSL as on 31.3.2019 (All Figs in INR Crores)

| Particulars | Amount |

| Revenue | 95 |

| PAT | 73 |

| Net-worth | 11,323 |

| Fixed Assets | 15 |

| Investment | 11,679 |

Currently, the market cap of the company is circa Rs. 5200 crores. Most of the value of the MSL comes through its investment in group companies.

MSL’s manufacture of die casting dies, fixtures and die casting components business is too small. Even, the business is making operating losses. MSL’s most of the income comes from the dividend from the investments in group companies.

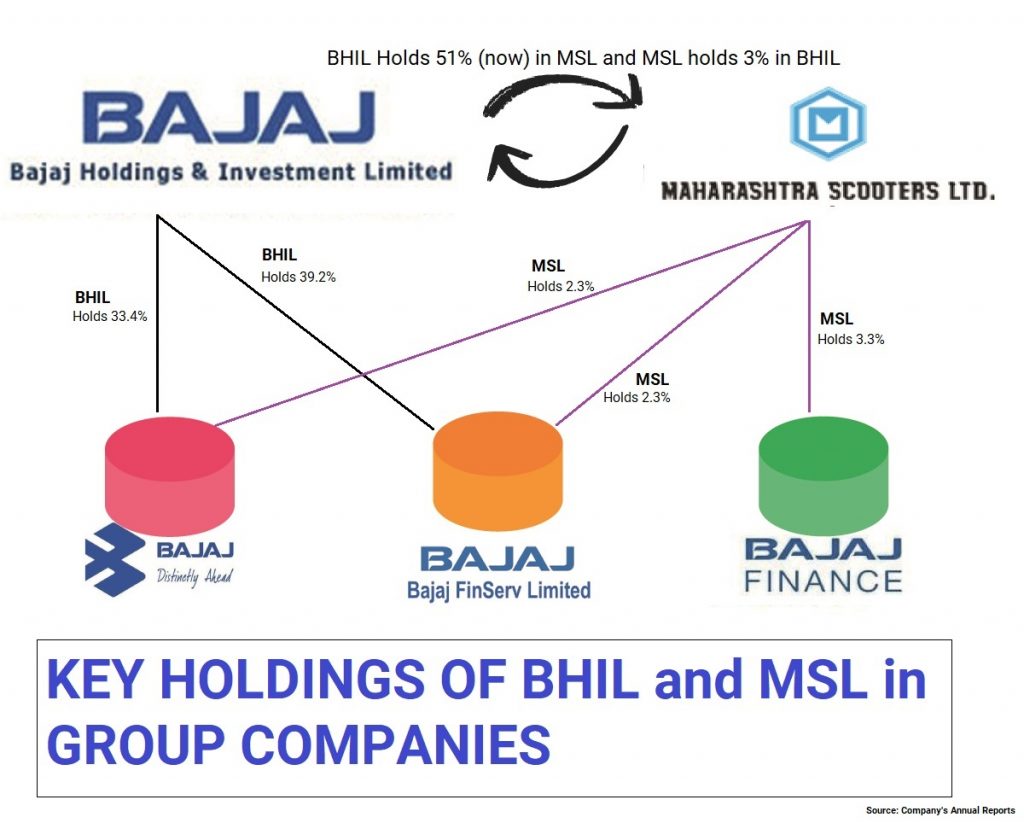

Table 2: MSL investments in Group Companies

| Particulars | Stake | Value* (Rs. Crores) |

| Bajaj Auto Limited | 2.3% | 1,943 |

| Bajaj Finance Limited | 3.3% | 7,026 |

| Bajaj Finserve Limited | 2.3% | 3,137 |

| BHIL | 3.0% | 1,248 |

| *The value is as on 02.07.2019 | ||

Apart from above, MSL also holds an investment in debentures issued by Bajaj Finance Limited, various certificate of deposits, Commercial Papers and Mutual Funds worth circa Rs.189 crores.

Also Read:“Hamara Bajaj” or “Promoter’s Bajaj”?

What next for MSL?

MSL, even though operational in manufacturing of auto components has become more of an investment company as evident from its earnings during past years. So, going ahead it would make sense for BHIL to merge MSL into itself.

Please note: Apart from the above, Bajaj Auto Holding Ltd. is WoS of BHIL and there are other subsidiaries of other group companies not mentioned here.

Post-exit of WMDCL, the merger of MSL & BHIL should happen as there is no commercial rationale to have two holding companies in the group. Based on the current market prices and assuming not much change in it, if the merger of MSL with BHIL happens, the following will be the shareholding pattern for the BHIL post-consolidation:

In the consolidation process promoters stake in BHIL will come down, however, there will be a consolidation of Bajaj group holding companies

Conclusion

Long-battle over ownership of MSL has finally ended on June 17, 2019 with the transfer of 27% stake of WMDCL to BHIL. This should have happened much earlier because the purpose of JV between WMDCL and Bajaj group was to promote industries in Western Maharashtra. As soon as the purpose of business in which any state financial institution has invested fulfilled, it should exit (ideally in 2003) and use the proceeds to support a further new industry coming up. Even though it couldn’t exist earlier due to price of exit, it should have resolved it in 2006 when the MSL discontinued its core scooter manufacturing business.

Value creation in MSL was because of investments and not because of the profit generated from the undertaking supported by WMDCL. The manufacturing of die casting dies, fixtures and die casting components business is minuscule for Bajaj group. In the coming period, Bajaj Group is likely to divest MSL’s manufacturing business to some of its suppliers and may consolidate the investment operation with its holding company.

Better late than never for WMDCL, it can use the funds received towards its main objects. Similarly, for Bajaj group if it wants to retain the same level of holding post-consolidation in the merged entity, it has options of buyback of shares from minority shareholders or purchase from the market or even during the merger of MSL it can offer redeemable preference shares to minority shareholders.

Add comment