Future Group is continuously trying to redefine the consumer space in India. Recently, Future Consumer Limited also came up with a new vision “FMCG 2.0” based on key pillars like Data Science, Multiple Categories, Integrated Value Chain and Digital Distribution Network.

In a move to enhance its product portfolio, Future Consumer Limited is set to acquire the “Identified Undertaking” of Mumbai based Athena Life Sciences Private Limited.

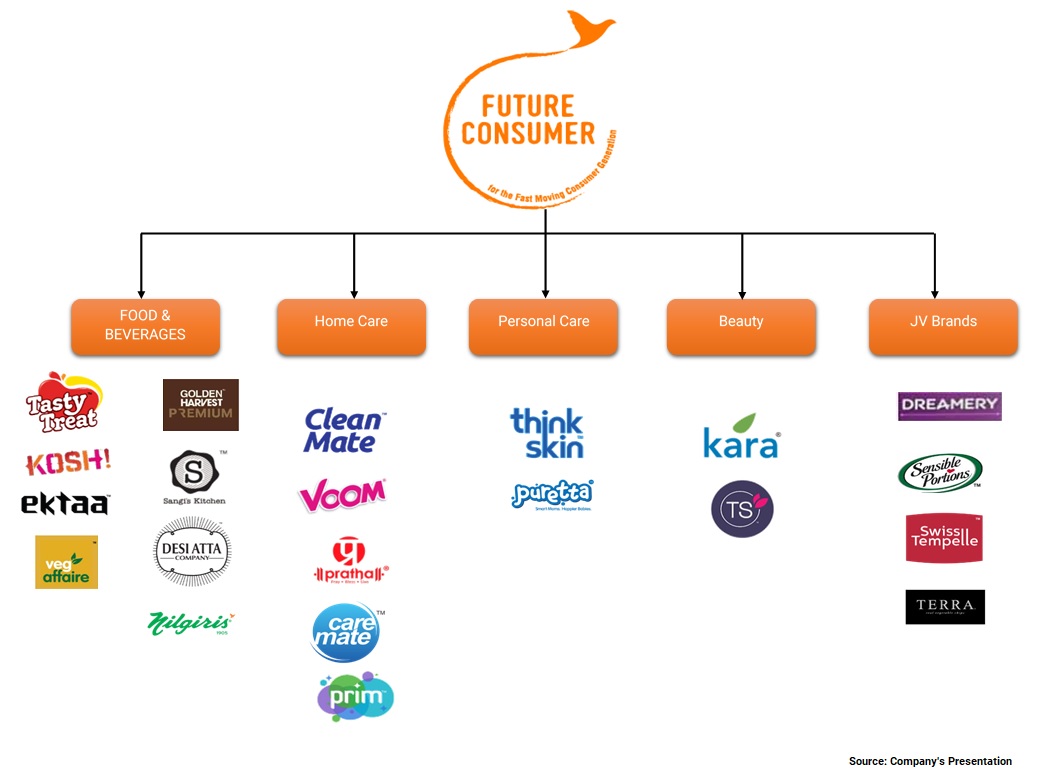

Future Consumer Limited (“FCL”) is an integrated food and FMCG company that markets brands such as Tasty Treat, Golden Harvest, Sunkist, Sangi‘s Kitchen, Desi Atta Company, Kara, Swiss Tempelle, CareMate, Clean Mate, Think Skin, Fresh & Pure, among others. These are backed by a nation-wide network of sourcing centres for agricultural produce and state-of-the-art manufacturing facilities at India Food Park, Tumkur and other locations across India and Sri Lanka. The Company ‘s products include processed and frozen food, dairy and bakery items, juices, snacks, biscuits and basic food items such as rice, wheat, spices, pulses, oats and sugar etc.

Incorporated in 2014, Athena Life Science Private Limited (“ALSPL”) is inter alia engaged in the business of marketing, selling and distribution of fast-moving consumer goods and services in the cosmeceutical and healthcare space., Some of its brands include ’Iraya’, ’D ‘Free ‘, ‘Hair for Sure ‘, ‘Safe and Sure ‘, ‘Just for Moms ‘, ‘Fab Fit’ etc.

Transaction:

With the appointed date as 1st April 2019, FCL will acquire “Identified Business” undertaking of ALSPL. The “Identified Business” undertaking includes marketing, selling and distribution business of the brands like ‘Iraya’, ‘D’Free’, “Hair for Sure’, and ‘Safe & Sure Q”

Detailed description of the Identified Undertaking:

D’Free: D’Free is a unique, leave on lotion that is superior and different from the current approaches of treating Dandruff, viz – shampoos.

Hair for Sure: Hair for Sure 15 clinically proven Hair Tonic that helps to treating consumers in early stages of Androgenic Alopecia.

Safe & Sure: Safe and Sure is a brand under development to enter the fast-growing female hygiene segment including products like Sanitary Napkins, etc.

lraya: Iraya operates in the fast-growing space of Premium Ayurvedic products. With a portfolio of over 240 products in both retail and professional salon segments, Iraya’s unique approach to formulations and focus on quality, makes it a leading name in Premium Ayurvedic Cosmetics.

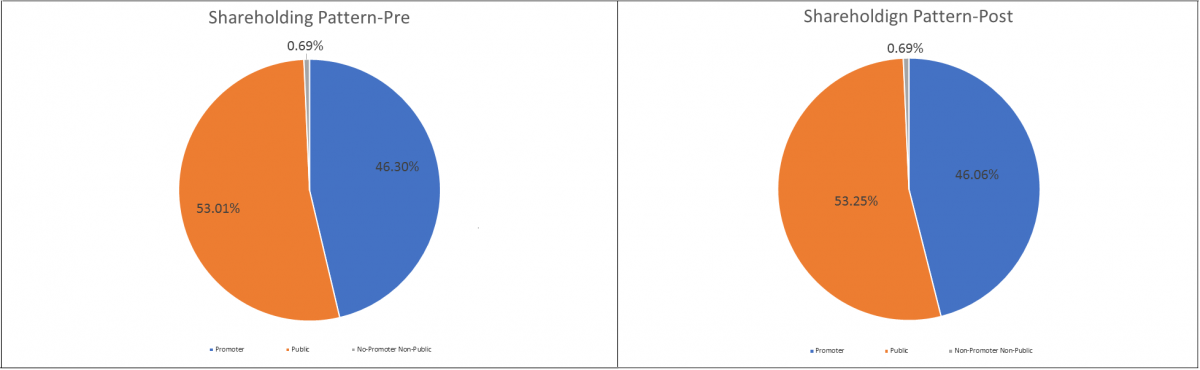

Shareholding Pattern

Future Consumer Limited

Athena Life Science Private Limited

Almost all the shares of Athena Life Science Private Limited are held by the High Net worth Investors. Post-demerger, they will get the equity shares in FCL.

Swap Ratio:

13 (Thirteen) fully paid-up equity shares of face value INR 6 each of FCL will be issued for every 83 (Eighty-Three) equity shares of ALSPL

As a result of the demerger, around one crore shares will get issued to the existing shareholders of ALSPL which is meagre in front of total equity share capital of FCL. Post-demerger, ALSPL’s shareholder will hold circa 0.5% stake in FCL.

Changes in Shareholding pattern of ALSPL:

In FY 2015-16, Enam group entered company by subscribing to the equity shares of the company. At the end of FY 2016, Athena Family Trust (“Promoters of Athena”) was holding ~67% stake & ~20% stake was held by Enam Group in the Company. In 2017, additional shares got issued to financial partners and promoters. Further, maybe as a part of marketing strategy, warrants & 100 equity shares got issued to Bennett Coleman and Company Limited.

In FY2019, Athena Family Trust sold its entire stake (except for 100 shares) to financials partners. The company issued 10,67,571 equity shares in tranches at INR 46.52 per share & 1,97,00,000 equity shares at INR 10 each. Further, the Company also converted warrants into equity shares and sold by Bennett Coleman and Company Limited. In the same year, the Company shifted its register office from Ahmedabad to Mumbai.

Product Portfolio

FCL current product portfolio

Currently, FCL has a rage of diversified products in its portfolio. Some of its key products has been acquired inorganically. In past, they have successfully able to scale the operations using their distribution network & through cross-selling it in their group. Acquisition of the identified business of ALSPL will give an opportunity to FCL to diversify its product base in beauty & personal care and enter into Ayurveda range.

Consolidation in Retail Industry

Over the last two decades, the Indian retail industry has seen significant changes, evolving rapidly from traditional shops to large multi-format stores offering a global experience. The rapidly changing dynamics resulted in unprecedented growth in overall consumption with numbers suggesting that consumer expenditure in India is expected to almost double to $3,600 billion by 2020 from $1,824 billion in 2017.

Kishore Biyani led Future Group has gone through a lot of restructuring in the past. It started with the demerger of the retail business in 2015 and further separating the home retail business in 2017 and focusing on the consumer retail business.

Financials

Turnover of the identified Undertaking:

Table 1: Turnover of the Identified Undertaking (All Figs in INR Crores)

| Particular | Amount |

| FY 2017-18 | 4 crores |

| FY 2016-17 | 16.62 crores |

| FY 2015-16 | 18 crores |

Over the last couple of years, the turnover of the identified business has down to quarter which further came down to less than 10% in FY 2019. The major problem for the company seems to be a lack of expansion of its operations on account of limited distribution channel. As mentioned in the press release, the operation of the company is limited to India. Further, the promoters are now holding minuscule stake in the company and the Company is being managed by the financial investor.

Table 2: ALSPL Financials (All Figs in INR Crores)

| Particulars | 2019 | 2018 | 2017 |

| Net worth | 11.72 | -6.14 | -7.19 |

| Income from Operations | 1.21 | 4 | 17.34 |

| Other Income | 1.05 | 0.84 | 0.66 |

| PAT | 2.99 | -15.59 | -45.80 |

| Carry-Forward Losses | 52.08 | -54.05 | -38.60 |

Comparing the revenue of FY 2018 from the identified business with total operational revenue, it looks most of the revenue of ALSPL belongs to the identified business. From this, we can assume that most of the carry-forward loss may belongs to the “Identified Business” which can be carry-forwarded to FCL.

Valuation

| Particular | Amount |

| Total No. of Shares (ALSPL) | 6,38,06,363 |

| Exchange Ratio (13 shares for every 83 shares) |

0.157 |

| Per Share Price of ALSPL | 7.05 |

| Per Share Price of FCL | 45.02 |

| ALSPL’s Identified Undertaking Valuation | 44,98,34,859 |

| FCL derived Valuation | 86,45,92,29,854 |

ALSPL’s identified business has been valued at INR 45 crores. On revenue of a little more than 1 crore, the valuation looks expensive. However, FCL must have considered the synergy & huge carry-forward losses available with ALSPL.

Conclusion:

The move to acquire the Identified Undertaking of ALSPL is a step towards bolstering its product portfolio. This acquisition is likely to strengthen FCL’s portfolio in personal care. In past, FCL has acquired businesses which they were able to integrate well with their existing portfolios. Going forward, FCL can use its pan-India distribution channel which is currently a hurdle for ALSPL to scale up the business. If they can capture synergies between its distribution strength and its present customer base with the quality of products which ALSPL brings, FCL can create value for all the stakeholders.

Post demerger, ALSPL will be left with products /brands having minuscule sales. In fact, even distribution infrastructure is also getting transferred, hence in future, ALSPL will be left with little option but to sale those remaining brands. Currently, financial investors hold almost entire stake of ALSPL. The proposed demerger will result in multiple benefits to financial investors. First, they will get a strategic partner who can scale the business very well and second, liquidity to take exit whenever they want. In all it looks like, the deal has been arranged by the financial partner which is likely to be a win-win for all.

Add comment