Incorporated in June 2007, Equitas Holdings Ltd is a Chennai-based company founded by Mr. P.N. Vasudevan who holds a mere 2.5% equity stake as a promoter of the company. The company is a financial services provider focused on individuals, micro and small enterprises offering services to low-income groups and economically weaker individuals operating small businesses with limited access to formal financing channels.

Equitas Holdings Ltd is a holding company and operates through its three subsidiaries — Equitas Microfinance is engaged in microfinance lending, Equitas Housing Finance is in affordable housing finance and Equitas Finance is engaged in vehicle and MSME lending and operates in four segments — microfinance, used vehicle finance, micro and small enterprises (MSE) finance and housing finance spread across 12 states and has 549 branches across India as on March 2016.

Equitas is one of the 10 companies which has been granted in-principal approval by RBI to convert its subsidiaries into a Small Finance Bank (SFB).

Management

Managing Director: Mr. P.N Vasudevan

Chairman: N. Rangachary

Financials

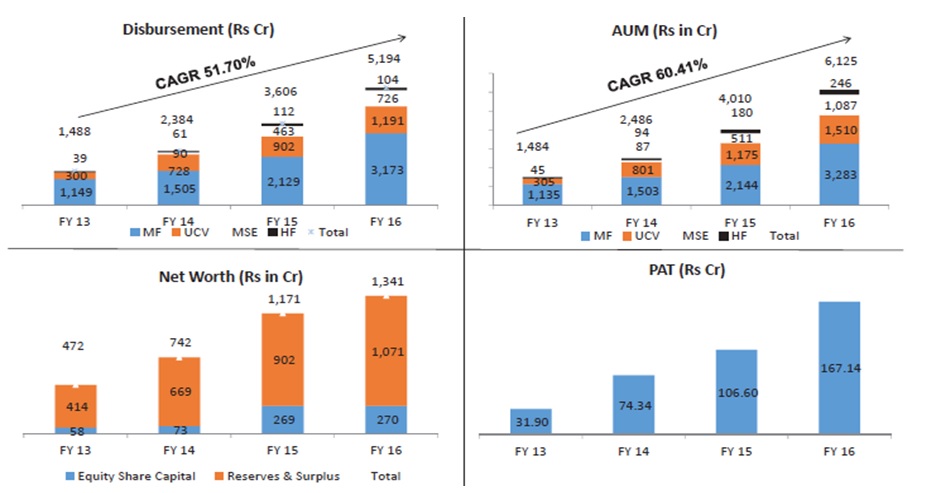

Consolidated Figures (in Rs crore) of Equitas Holding Ltd.

Equitas consolidated revenue increased to Rs 1110.93 crore for the year ended March 2016 from Rs.755.06 crore in the previous year.

The company’s long-term borrowings stood at Rs. 2608.75 crores in FY 16 vis-à-vis Rs 1457 crore in FY 15 on a consolidated basis. There are no long-term borrowings on a standalone basis.

Segmental Performance

- Microfinance Business

This segment earned revenue of Rs. 603.09 crore, an increase of 38.5% from the previous year with a profit before tax of Rs. 118.49 crore in the FY16 against revenue of Rs 435.21 crore and profit before tax of Rs. 104.13 crore in FY15

- Other Finance (includes Vehicle Finance, MSE Finance, and Housing Finance)

The three business segments earned revenue of Rs 512.03 crore, an increase of 59% and a profit before tax of Rs 146.58 crore in FY 16 against revenue of Rs 322 crore and profit before tax of Rs 63.63 crore.

EQUITAS IPO

Equitas Holding’s Rs 2,177crore IPO, one of the biggest IPO since December 2012, got over-subscribed at an issue price fixed at Rs 110. The company received total bids for 239.57 crore shares compared with 13.91 crore shares on the block. This was 17.21 times the total issue size.

| Particulars | No. of equity shares (in crore) |

| Fresh Issue | 0.67 |

| Offer for sale | 13.24 |

The company was able to raise Rs 652 crore by allotting 5.93 crore shares to Anchor Investors which included mutual funds and domestic institutional investors.

Equitas Holding made a strong debut on April 21, 2016, which got listed at Rs. 144, a premium of 30.9% over its issue price of Rs 110 per share without seeing any participation from the foreign shareholders.

Utilisation of IPO proceeds:

- OFS proceeds to the selling shareholder: Rs 1,450 crore

- Investment in subsidiaries for future growth: Rs 616 crore

- General corporate purpose: Rs 104 crore

Out of the IPO proceeds of Rs 720 crore, the company has till date invested Rs 616 crore in the subsidiaries in the line with the prospectus.

Shareholding pattern:

| PRE-IPO | POST – IPO (As of April 2016) | |

| Mr. Vasudevan (Promoter) | 3.17% | 2.50% |

| Foreign Investors | 92.80% | 44.2% |

| Others | 4.03% | 53.3% |

Pre -IPO

Equitas had a well-spread-out shareholding pattern as no investor held more than 15%. IFC was the biggest shareholder with 14.27%.

There were 17 foreign investors which had invested in this company which cumulatively held 92.8% in the company.

Post-IPO

The guidelines for SFBs limit foreign shareholding to 49%. At all times, at least 26% of the paid-up capital will have to be held by residents or domestic investors.

Hence, FIIs were not allowed to buy shares in the IPO as their holdings already exceed the limit stipulated by RBI for SFBs.

As part of the IPO, 6 foreign investors fully exited their holdings. They are Sequoia Capital India Investments III, Aavishkaar Goodwell India Microfinance Development Co. Ltd, Aquarius Investment Advisors, MVH SpA, Lumen Investment Holdings Ltd and WestBridge Ventures II Llc and other foreign investors sold part of their shares.

Capital Structure:

As on June 22, 2007, the company had a share capital of Rs 1,00,000 consisting of 10,000 equity shares of face value of Rs 10 each.

Over the years, the company has raised capital from foreign investors and institutional investors through preferential allotment by issuing compulsory convertible preference shares. The total fund raised by the company was around Rs 852 crore at an average share premium of Rs 77.05 per share.

As on June 2014, 14.74 crore bonus equity shares were issued to investors in the ratio of 2:1.

The company has allotted equity shares under the ESOP scheme to the employees.

The company’s total share capital was Rs. 269.34 crore of 26.93 crores of equity shares at a face value of Rs 10 each as on August 7, 2015.

Reasons for IPO

The company started with the process of an IPO once they received a RBI license to operate as an SFB. With effect of the SFB guidelines below were the mandatory reasons for the company to come out with an IPO:

- The promoter of an SFB is required to be owned and controlled by Indian residents in order to qualify as an ‘eligible promoter’ and hence providing an exit to the foreign investors through offer for sale route was a way to as a win-win situation for the investors and the company to adhere to the SFB guidelines.

- The SFB guidelines require that an SFB is required to be listed within a period of three years once it has a net worth of Rs 500 crore. Hence as the combined net worth of EMFL, EFL and EHFL taken together was more than Rs 500 crore and it had to take the listing route.

In order to satisfy the criteria for commencing operations as a Small Finance Bank pursuant to the SFB Guidelines, Equity holding shall merge its subsidiaries into a single entity and has already filed the scheme of amalgamation of the merger of its three subsidiaries while the approval is awaited.

The Future Looks Bright

Equitas was the biggest IPO seen in 2016 having a first mover advantage in the SFB space to enter the primary market.

The microfinance business and the other finance business segment has shown a great jump in the revenues generated in FY16 and earning a 27% and 19.8% returns on the capital employed respectively; showing huge potential in the business in the coming years.

Equitas has also received the GVC level 2 rating for the company from CRISIL-credit rating agency, which indicates high corporate governance and value creation capability for all the stakeholders.

On April 28, 2016; Equitas submitted an application to RBI for grant of banking license after the successful IPO, the merger scheme filed which only reaffirms the commitment of the company towards opening a bank in the future.

Interestingly, Equitas is a professionally managed company by an unidentifiable promoter who has built Equitas into a prudent organization. Mr. PN Vasudevan as a promoter not only holds a very small stake in the company; he has also done a capping on his salary.

He believes that no promoter should hold more than 15% stake in the company which would only tilt towards selfish interests over the period of time.

Equitas’ rapid growth has driven by investments in technology, commitment to governance and transparency, and a set of unique social policies, which distinguishes itself from the other IPOs in the financial inclusion sector.