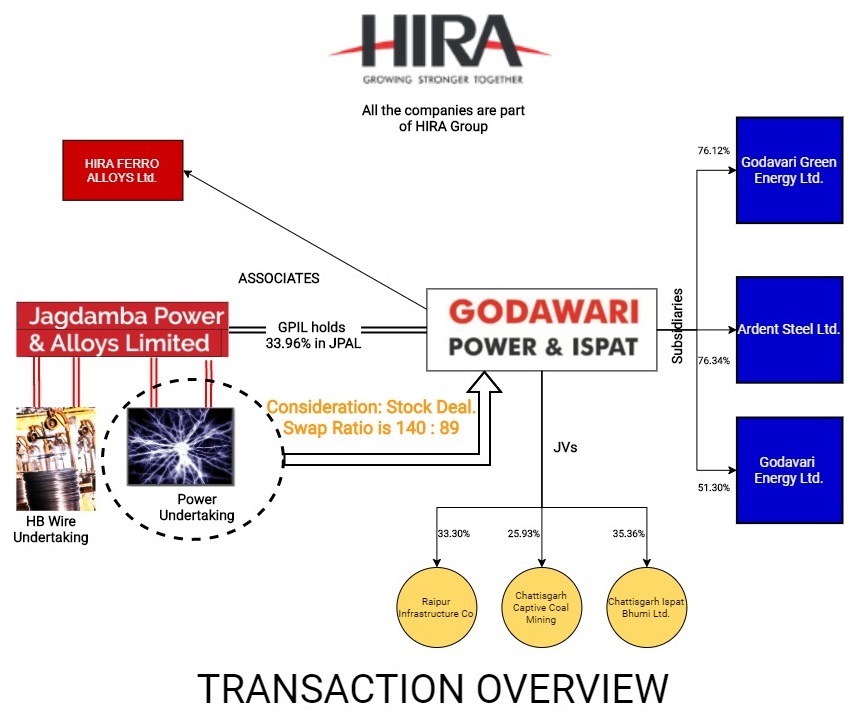

Godawari Power & Ispat Ltd. (GPIL), a listed company, is going to acquire the power undertaking of its unlisted associate company, Jagdamba Power and Alloys Ltd. (JPAL). It is going to be an all stock deal. Earlier in 2018, the companies had tried to amalgamate JPAL into GPIL but the shareholders of JPAL had rejected the scheme. Now in a renewed effort, GPIL has again knocked the doors of JPAL to meet its power needs.

Godawari Power & Ispat Ltd. (GPIL), formerly Ispat Godawari Ltd (IGL), a listed company, is a flagship company of the Raipur based HIRA Group of Industries. Founded in 1999 by Mr. Bajrang Lal Agrawal, company operates in mainly two business segments of Steel and Electricity. The major driver of revenue and profit is the sale of steel and related products. Today GPIL is an end-to-end manufacturer of mild steel wires and in the process also manufactures sponge iron, billets, alloys, captive power, wires rods, steel wires, Oxygen gas, fly ash brick and iron ore pellets. It also generates power for captive consumption.

GPIL mainly functions out of 2 states: Chhattisgarh and Rajasthan. While most of its business is based in Chhattisgarh, it has one 50MW solar power plant in Rajasthan. It has 3 subsidiaries: Godawari Green Energy Ltd. (GPEL), Ardent steel Ltd. (ASL) and Godawari Energy Ltd. (GEL) None of them are wholly owned. It also has a step-down subsidiary called Hira Energy Ltd. (subsidiary of ASL). From its AR – 2019 GPIL says that only GPEL and ASL are functional while GEL’s projects never commenced and have been abandoned. Also, revenue from Hira Energy is insignificant.

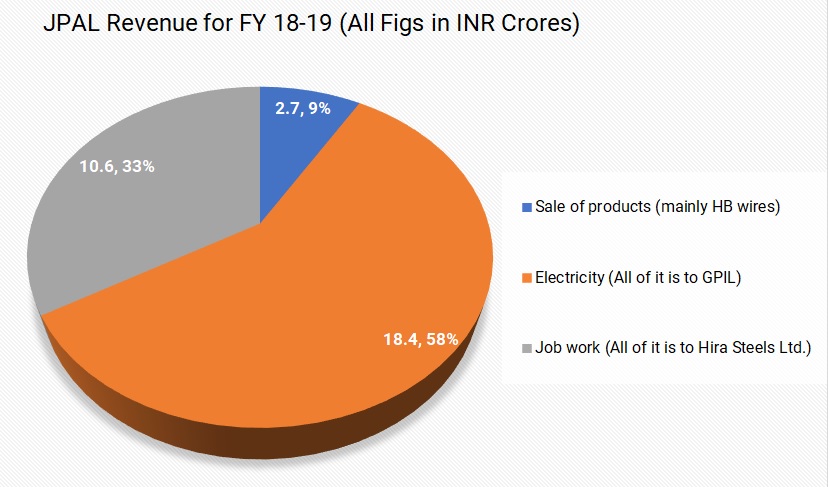

Jagdamba Power and Alloys Ltd. (JPAL) is an unlisted company. It was incorporated in 1999. The company operates in 2 segments: Steel and Electricity. Over 58% of its revenue in 2018-19 came from sale of electricity, which was sold exclusively to GPIL under a short term “Power Purchase Agreement” (PPA). Besides, JPAL also manufactures HB wires (mesh wires of steel) and provides Job work services. The Power Plant became operational in FY 19 only and is a captive power supplier to GPIL.

JPAL is based in Siltara, Raipur, Chhattisgarh and it has no subsidiaries. The company is promoted by Mr. Alok Agrawal.

The Transaction

- Appointed date for the transaction is 1 April 2019.

- GPIL is going to acquire the power undertaking of JPAL in all-stock deal. The swap ratio arrived at is 140: 89 i.e. for every 140 shares held, 89 shares of GPIL will be issued.

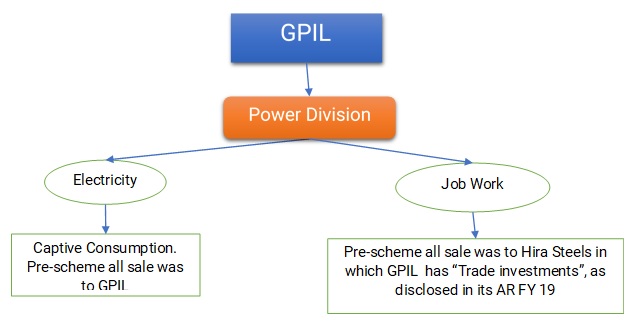

- The Power Division of JPAL includes the Electricity and Job Work Services Business. The Non-Power division is the HB Wire Manufacturing Division.

- The scheme provides for a tentative deadline of 31st March 2021 for the scheme to take effect. Beyond this date, the scheme shall stand revoked and cancelled.

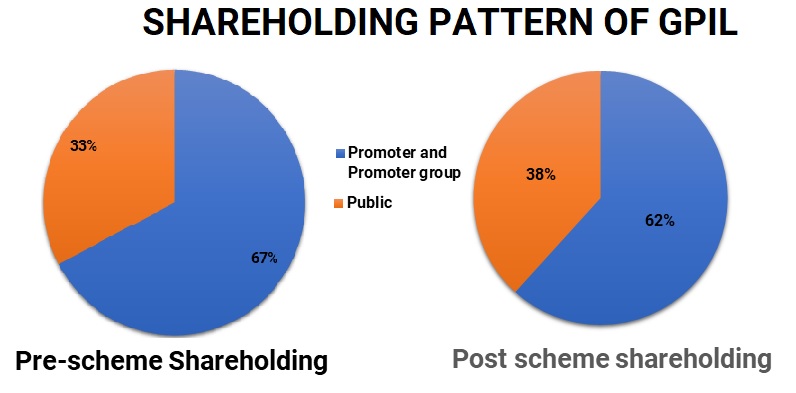

GPIL Pre and post scheme Shareholding Pattern

As can be seen, the promoter holding will be diluted by around 5%, but in the process the promoters will also get to hold shares in power business directly.

JPAL shareholding pattern (as on 31st March 2019)

The Major shareholders are Alok Agrawal (30.4%), GPIL (33.97%), Amit Agrawal (23.36%), Sagar Energy and Steels Ltd. (12.26%) and other minor shareholders (3 in number) who together hold less than 1%.

In the financials of JPAL, as well as in the copy of the Board resolution on this scheme, only Alok Agrawal is classified under “Promoter and Promoter Group”. But in the document showing Pre and Post Scheme Shareholding pattern of JPAL all shareholders except GPIL are classified under “Promoter and Promoter Group”. So more clarity is needed to determine as to who is part of the Promoter Group. Nevertheless, in the alternative, the collective promoter holding in JPAL is 66.03% as opposed to Alok Agrawal’s 30% holding.

Rationale as per the Scheme

- With the complete integration of the Demerged Undertaking with GPIL, the captive power generation capacity of the GPIL will stand enhanced from 73MW to 98 MW. The availability of much needed additional 25MW of power capacity, to meet the shortfall of electricity, will assure uninterrupted power supply to the steel plant.

- The Demerged Company currently has business interests in diverse businesses. Post demerger it will achieve greater management focus in other business activities.

- The scheme will help achieve cost efficiency and help achieve economies of scale, reduction in overheads and improvement in various other operating parameters.

Valuation

Table 1: Valuation of GPIL and JPAL

| Particulars | Value |

| Total no. of shares that are going to be issued | 32,19,702 |

| Value per share of GPIL as per valuation report | Rs. 233.44 |

| Value of Power Undertaking of JPAL | Rs. 75.16 Crore |

| Market cap of Godawari (as on 14 Feb 2020) | Rs. 727.63 Crore |

*Excluding GPIL’s stake of 34%

So, the value of power undertaking (excluding GPIL’s share of 34%) of JPAL comes to about 10.3% of the market cap of GPIL.

Note: In the Financials released by JPAL, which show the allocation of Assets and Liabilities, they have adjusted an amount of 30 Crore by deducting it from the “Other Equity” of Non-Power division and adding it to the “Other Equity” of Power Division and named it as a transfer for “Branch/Division Account”. If we consider this naming, the transfer could either be an adjustment of the general reserve or could be recognition of an amount receivable from the Power Division, maybe a “Loan”. If it is the latter, the Fair value of Net Assets of the Power Division will be reduced to almost Nil and the whole transaction would be payment towards Goodwill and Fair value of long-term assets like Land.

What are the industry standards for valuing a Coal Power Plant?

- In 2012, CERC came up with calculations for “benchmark capitals costs” for Coal and Thermal Power Plants. Those calculations were done for plants with capacities 500MW and above, with costs starting from Rs. 5Cr/MW and reducing as capacity increases. This scheme is of a comparatively miniscule 25MW Plant and hence the costs per MW of setting up a new plant in 2019-20 would be much higher. Besides, setting up any new coal plant has been banned in the region due to environmental restrictions. So, this acquisition would not only be beneficial valuation wise but is also necessary for GPIL.

- Recently JSW acquired GMR Kamalanga Electricity Ltd. (GKEL) for cash consideration of Rs. 5321 Cr. Comparison of this with the GPIL-JPAL arrangement is given in the following Table.

Table 2: Recent Transaction Comparison in Power Sector

| Particulars | JSW – GKEL | GPIL – JPAL |

| Valuation (INR Crore) | 5321 | 113.6* |

| Capacity (MW) | 1050 | 25 |

| Value per MW (Crore/MW) | 5.06 | 4.54 |

| Revenue FY 19 | 2195 | 31.72 |

| Revenue multiple (Value/revenue) | 2.4 | 3.6 |

*Including GPIL’s share

Accounting treatment in books of GPIL

- All the assets and liabilities will be taken over at fair values in the Financial Statements of GPIL, after following the “Acquisition Method” as per Ind AS 103: Business Combination.

- The Goodwill will have to be recognized as the difference between the consideration and the Fair Value of the Net Assets taken over. It will be a significant amount of about 40 Crores. (Refer working and note below Table 4.2)

- The Share capital will increase by Rs. 3,21,97,020 and the balance consideration of approx. Rs. 71.95 Crores will be recorded as a Securities premium.

Taxation

- The Power division is a business undertaking and has a loss of Rs. 2.23 Crore which will be passed on to GPIL u/s 72A (4), ITA, 1961.

- The Power division also has Deferred Tax Liability of Rs. 1.14 Crore allocated to it.

Analysis

- GPIL’s steel plant generates captive electricity and has a capacity of 73 MW. Steel manufacturing requires a huge amount of uninterrupted power supply. The acquisition of a 25 MW power plant of JPAL helps GPIL ensure its power needs are met.

- The coal thermal power plant of JPAL is in Siltara, Raipur, which is the same industrial area where GPIL’s steel plant is located. No new coal power generation facility can be set up in the area because of environmental restrictions and hence existing power plants in the area are crucial for big steel plants like GPIL. Thus, acquisitions like these are important for steel manufacturers.

- JPAL and GPIL already have a short term PPA between them where JPAL exclusively supplies all its power to GPIL but this acquisition of the Power undertaking will decrease the GST and other compliances.

- GPIL claims that this additional power supply will specifically help it to increase its billet production.

Note: “Billets” are long steel rods used as raw materials or feedstock in extrusion, forging, rolling and other metal-processing operations. Post scheme JPAL’s operations will be reduced to only HB wire manufacturing which accounted for only 9% of its revenue in 2018-19.

Table 3: Segment-Wise Financials of JPAL (All Figs in INR Crores)

| Particulars | Power division (Electricity + Job Work) | Non-Power Division (HB Wires) | Total |

| Assets | 44.75 | 45.2* | 89.95 |

| Liabilities | 14.77 | 3.86 | 18.63 |

| Net Assets | 29.98 | 41.34 | 71.32 |

| Revenue | 29.21 | 5.97 | 35.18 |

*35 crores are loans and advances given to body corps.

Source: JAPL financials : Annexure to Scheme- (retrieved from GPIL website)

Table 4: Book Value of Assets of Power Undertaking of JPAL (All figs in INR Crores as on 31.03.2019)

| Particulars | Value | Whether the asset will be beneficial in future? |

| Land & Building | 2.48 | Maybe the Fair value of this land is high today. |

| Plant and Machinery | 13.98 | Depreciable. No incremental value in future. |

| Inventories | 14.31 | Current asset |

| Advance to vendors | 5.17 | Blocked capital. No appreciation in value. |

| Balance with Govt. authorities | 5.55 | Blocked capital. No appreciation in value. |

| Total | 41.2 | |

Note: This table describes 90% of the assets being acquired by GPIL and most of them have no appreciable value. Considering the valuation given to Power undertaking the Value of Goodwill will be extremely high when it gets accounted for. Net Assets Fair Value should be around 35 Crores. The value of Power undertaking (excluding GPIL’s share) is about 75 Crores.

So, the GPIL is acquiring the Power division has about 50% of the Assets allocated to it but brings in more than 91% of the revenue of JPAL. 58% of this revenue is from GPIL itself. All the Job Work services are provided to Hira Steels Ltd., a company in which GPIL has Trade investment. Following flow chart explains this acquisition.

Important Metrics of GPIL

Capacity Utilization

| Asset | Steel Billet production | Power* |

| Capacity | 0.4 mt (metric tonnes) | 98MW |

| Utilization | 75% | 70% |

*Including supply from JPAL

The company states that one of the reasons for the acquisition is to help augment its billet production. Considering the data above, FPIL has scope for improving capacity utilization. And in fact, in its AR – FY 2019, GPIL claims that because of the power supply from JPAL under the existing PPA signed between them, it was able to increase its steel billet production by 51% in 2019 over its 2018 production levels.

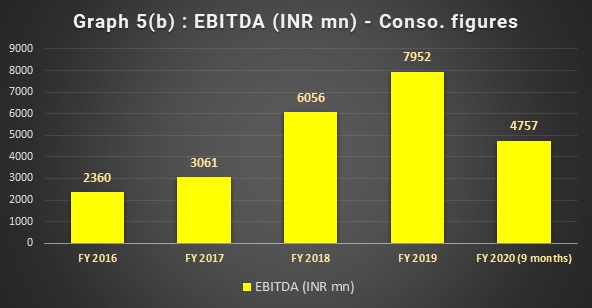

Trend of EBITDA over the years of GPIL:

Note: The EBITDA had an impressive jump in 2017-18. This was mainly because of increase in demand, production volume and market prices across all product lines of the company.

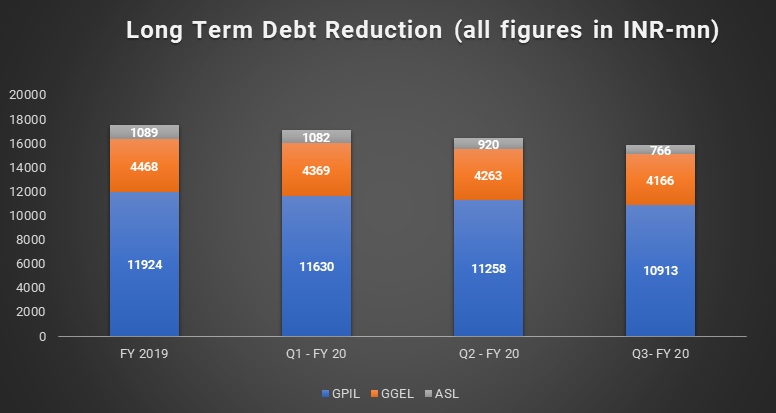

Long term debt reduction in this year till now

GPIL Consolidated – Historical Profit & Loss

Table 5: Profit & Loss of GPIL for last 4 Years

| Particulars | FY 19 | FY 18 | FY 17 | FY 16 |

| Net Sales (INR Millions) | 33,216 | 25,274 | 19,941 | 22,037 |

| EBITDA Margin | 24% | 23% | 15% | 11% |

| PAT Margin | 8% | 8.5% | -3.7% | -4.5% |

As can be seen, the trends in all the figures is an increasing trend which is a positive sign.

Financial ratios of GPIL (Consolidated)

Table 6: Financials Ratios for GPIL

| Particulars | FY 19 | FY 18 | FY 17 | FY 16 | Trend |

| ROCE | 21.71% | 15.72% | 6.51% | 3.8 % | Dramatic Increase. This increase, especially in 2017-18, is because of the reasons as mentioned above. Refer note below Graph 5 (b). |

| Asset Turnover | 1.24 | 1.00 | 0.8 | 0.83 | Mostly Increasing |

| Debt/Equity ratio | 1.61 | 2.3 | 3.18 | 2.52 | Mostly decreasing |

| Interest Coverage ratio | 2.62 | 1.78 | 0.72 | 0.43 | Increasing |

About the earlier attempt to amalgamate JPAL which failed:

Earlier in February 2019, the companies had filed a scheme for the amalgamation of JPAL into GPIL. The Rationale of the scheme was same at that time too. The swap ratio on that deal was 100: 45 i.e. for every 100 shares held, 45 shares of GPIL were to be issued. But in the subsequent months, till the scheme got the necessary approvals, GPIL’s share price took a beating in the market and the shareholders thought they were getting a raw deal. As a result, the shareholders rejected the scheme at that time.

Subsequently, GPIL entered into a short-term power purchase agreement (PPA) with JPAL for consistent power supply from their 25MW plant. Now, the Boards of both companies have approved this new scheme with a new swap ratio of 140: 89. This is an increase of approx. 20% over the previous ratio.

It still remains to be seen if the deciding shareholders of JPAL (apart from GPIL and Alok Agrawal) who are Amit Agrawal, Sagar energy and Steels Ltd. and the other minor shareholders will approve the scheme or not, especially since the market value of shares of GPIL as of February 2020 (hovering around Rs. 200) is lower than the value as per valuation report (Rs. 233.44).

Conclusion:

The scheme does have some operational synergies as claimed by the management, but the real effect is the simplification of group structure, avoidance of multiple level of compliances and taxes post GST. The increase in the assets of the company without any cash outflow and only dilute the promoter holding by 5%. In addition, Shareholders of GPIL will have direct interest in both the businesses. Shareholders of JPAL will now have an interest in steel as well as other businesses, thereby reducing their risks and giving them liquidity of shares of the listed entity.

Add comment