In a move to become conglomerate with holding company having stakes in different businesses, the tech giant ‘GOOGLE’ announced that it would rebrand itself as Alphabet – the holding company and push all its operating businesses including Google into separate subsidiaries.

Google reshuffled its corporate structure. All its businesses will be housed under Alphabet whose largest wholly owned subsidiary will be Google.

ABOUT GOOGLE

Everyone knows what Google do. However, apart from its search engine business it has a few other businesses in its portfolio.

Google, incorporated in California in 1988, as a company that offered Internet search engine as something that “understands exactly what you mean and gives you back exactly what you want”. Every month a hundred billion searches run through Google – a repository of the world’s curiosity, hopes, dreams, and fears. Google founders Larry Page and Sergey Binn named the search engine they built “Google,” a play on the word “googol,” the mathematical term for a 1 followed by 100 zeros.

On 1st April 2004, Google launched Gmail which is the leader in email services. In August same year, Google got listed on Wall Street. In 2006, Google acquired online video sharing site YouTube. In 2007, Google launched its famous Android system.

Over time, it has broadened into various areas as such as

- YouTube, the video service

- Android, the company’s mobile operating system

- Calico, an anti-aging biotech company

- Sidewalk, a company focused on smart cities

- Nest, a maker of Internet-connected devices for the home

- Fiber, high-speed Internet service in a number of American cities

- Investment arms, such as Google Ventures and Google Capital

- Incubator projects, such as Google X, which is developing self-driving cars, delivery drones, and project loons

All these businesses are supported and nurtured through cash flow of Google’s core business.

According to Forbes, Google has a brand value of $66 billion, the third most valuable behind Apple and Microsoft.

Revenue

Source : Company Data, HU ResearchGoogle’s main revenue is from Advertisement. For the CY 14, out of its total advertisement revenue, 76% is from Google website and rest 24% is from Google Network member’s website. Its other revenues share has got doubled in last 3 years. In CY 2012, other revenues share in total revenue was 5.1% only. The increase was primarily due to the growth of its digital content products, such as apps, music, and movies.

ABOUT ALPHABET

Alphabet means a collection of letters that represent language, one of the humanity’s most important innovations. It means alphabet (Alpha is investment return above benchmark). Like its meaning, ‘Alphabet will be the collection of companies. The largest of which, of course, is Google.The new parent company, Alphabet, will be run by Google founders Larry Page as CEO and Sergey Brin as President. So nowAlphabet Inc. will replace Google Inc. as the publicly-traded entity and all shares of Google will automatically convert into the same number and class of shares of Alphabet with the same rights.Two classes of shares will continue to trade on NASDAQ as GOOGL and GOOG.

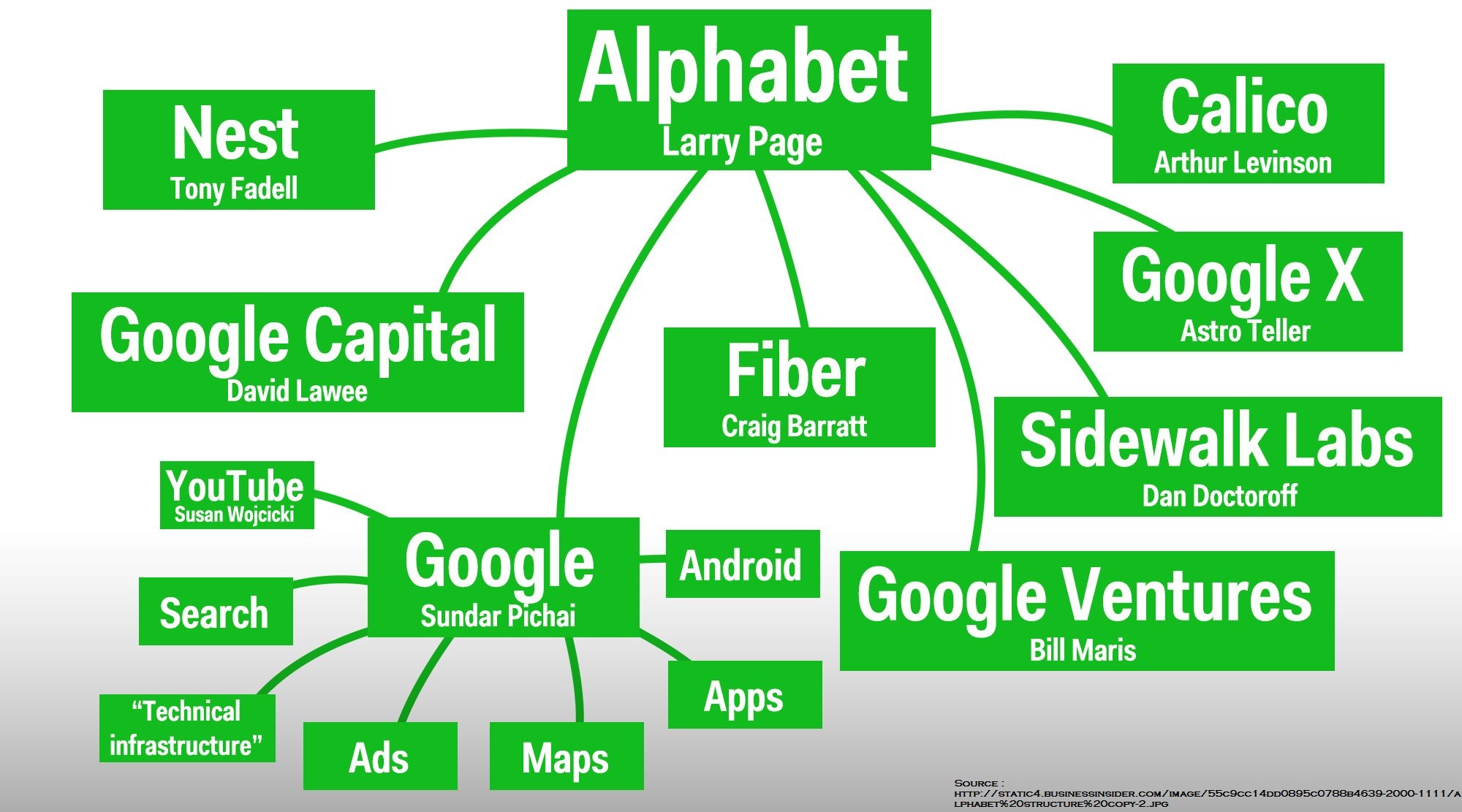

All the businesses will be housed as a wholly owned subsidiary as given below.

Source: – Company data, hu researchSenior vice president of Android, Chrome, and Apps Sunder Pichai will be the new CEO of Google and similarly all other subsidiaries will be headed by respective COO.

WHY RESTRUCTURING

($ in millions)

| Particulars | 2010 | 2012 | 2014 |

| Revenues | 29,321 | 46,039 | 66,001 |

| EBIT | 10,381 | 13,834 | 16,496 |

| EBIT Margins | 35.40% | 30.05% | 24.99% |

| Net Income | 8505 | 10,737 | 14,444 |

| Net Margins | 29.01% | 23.32% | 21.88% |

| EPS | 13.35 | 16.41 | 21.37 |

| Shareholders Fund | 46,241 | 71,715 | 104,500 |

| R&D Expenses | 3,762 | 6,077 | 9,834 |

| Capital Expenditure | 2,218* | 3,273 | 11,000 |

| Cash & Cash Equivalent | 34,975 | 48,088 | 64,395 |

*Excluding capital expenditure for purchase of New York office.

Over the last five years, Google’s EBIT margins have declined almost by 25%. The main reason for this is an increase in research & development expenses and cost incurred for other businesses. Its businesses other than search engine do not contribute so much to its top line but the company is relentlessly incurring expenditure on developing these businesses. The increase in capital expenditures is mainly on account of production equipment, data centres, real estate purchases and higher spend related to acquisitions.

Mainly cash is generated by its search engine business. However, now a days, its search engine business is facing intense competition from many of the social networking sites. The restructuring will provide Google’s management to utilise its cash for its core businesses first and then transfer excessive cash for development other businesses.

All the businesses done by google are characterised by rapid change as well as new and disruptive technologies. It faces formidable competition in every aspect of its business, particularly from companies that seek to connect people with online information and provide them with relevant advertising. In the new structure Alphabet’s subsidiaries will each have their own chief executive, reporting to Page. This will provide focused management for each set of its business. Each of these different businesses has to compete with each other to raise funds for holding company ‘Alphabet’. Better allocation of capital among its various businesses will improve the overall profitability of the group.

This new structure will allow Google to keep its focus on the extraordinary opportunities inside of Google. Google always looks for smaller bets in areas that might seem very speculative or even strange when compared to its current businesses.

Google has come under pressure as its founders have used the enormous success of its search engine to fuel riskier bets on autonomous cars, smart household devices, internet-delivering balloons and cutting-edge medical research. The major restructuring will give investors greater insight into how the money is being spent. A move towards getting more transparent. It will also help Alphabet to invite strategic partner for each of the businesses without losing operating and management control it now holds 100% in all the businesses.

CONCLUSION

Conglomerates can be managed in two ways, either by demerging each of the businesses or by forming an ultimate holding company. Google is continuously investing in new businesses, products, services, and technologies. Such endeavours may involve significant risks and uncertainties, including distraction of management from current operations, insufficient revenues from such investments to offset liabilities assumed and expenses associated with these new investments, inadequate return of capital. Because these new ventures are inherently risky, no assurance can be given that such strategies and offerings will be successful and will not adversely affect our reputation, financial condition, and operating results. With the help of holding-subsidiary structure, each of its business will be managed by dedicated focus management team however capital is allocated by holding company on performance basis. In future, it will give flexibility of selling its less-profitable businesses to others or to make alliance in particular business by diluting its stake in such business to the extent of maintaining controlling stake in it.

A similar structure has been formed by Bajaj group a few years back. Bajaj group separated its automobiles, insurance, and financial arms into different subsidiaries by creating ultimate holding company ‘Bajaj Holdings And Investment Ltd’. In the process, there is increase in the stake for the group and ability to raise finance for each of the operating company based on its own balance sheet. This strategy paved the way for Bajaj group in becoming a niche player in each of the respective categories.