In order to create large-size state-owned banks, the government has decided to merge 10 public sector banks into four. The mergers will help drive credit growth, lift the slowing economy of the country and boost the government’s target of a $5-trillion economy by 2024. After the merger, India will have 12 public sector banks from 27 in 2017. The mergers are expected to enhance risk appetite, create stronger balance sheets and rationalise branches as many state-owned banks were sub-par in size. Supplementing the merger decision is the government’s move to infuse capital into many state-owned banks, which will boost lending.

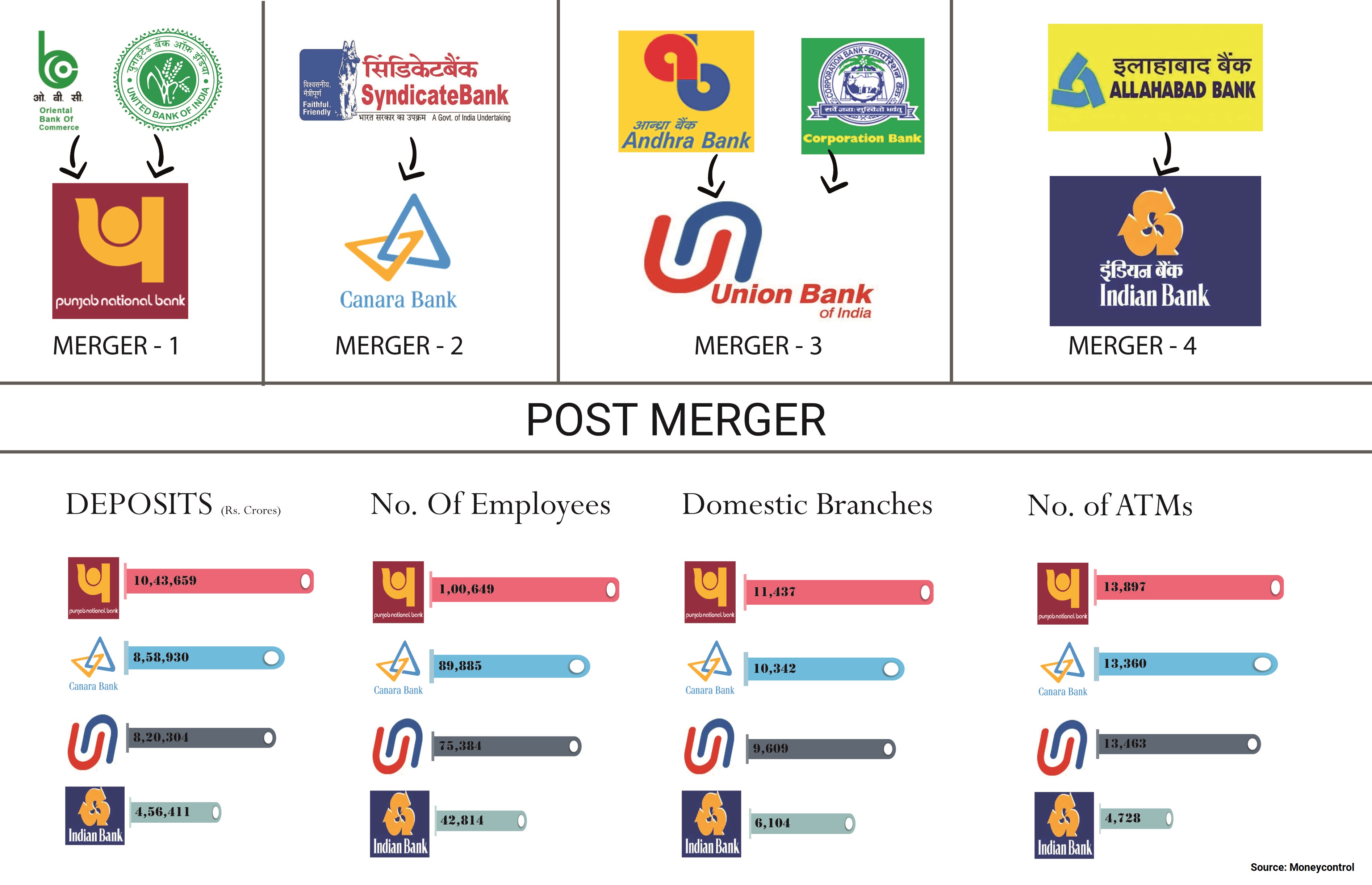

Punjab National Bank, Oriental Bank of Commerce and United Bank of India will be merged to form one bank which will become the country’s second-largest lender after State Bank of India, with a total business of close to Rs 18 lakh crore and 11,437 branches. The second merger will be Canara Bank and Syndicate, which will create the fourth largest state-owned bank with Rs 15.2-lakh crore business and branch network of 10,324 branches. The third will be merger of Union Bank of India with Andhra Bank and Corporation Bank, which will create the fifth-largest public sector bank with Rs 14.59-lakh crore business and 9,000 branches. The fourth merger will be Indian Bank with Allahabad Bank, which will make it the seventh-largest state-owned bank in the country with Rs 8-lakh crore business. After the merger, the boards can appoint chief risk officer at market-linked compensation and the risk management committee will be empowered to veto management decisions.

Table 1: PSU Banks Business (post-merger) with data as on March’19

| Bank | Business (Rs lakh crore) | Market share (%) |

| State Bank of India | 52.1 | 22.5 |

| PNB+ OBC+ United | 17.9 | 7.7 |

| Bank of Baroda | 16.1 | 7 |

| Canara + Syndicate | 15.2 | 6.6 |

| Union + Andhra + Corporation | 14.6 | 6.3 |

| Indian + Allahabad | 8.1 | 3.5 |

These banks were chosen for merger on the basis of ensuring that there was no disruption in banking services and that these banks will also benefit from higher current and savings accounts. It is expected that the newly merged entities will control two-thirds of India’s banking in terms of lending and deposits. Earlier, the government had merged five associate banks of SBI and then merged Bharatiya Mahila Bank with SBI. Last year, the government also merged Dena Bank and Vijaya Bank with Bank of Baroda, which came into effect from April 1, 2019. The merger created the third-largest bank by loans in the country. After the merger, there will six banks which will remain independent – Indian Overseas Bank, UCO Bank, Bank of Maharashtra, Punjab and Sindh Bank, Bank of India and Central Bank of India. These banks have a strong regional focus.

Why mergers of PSU banks?

The merger of 10 PSU banks into four was required because of the growing non-performing assets of state-owned banks. The steep rise in bad loans or non-performing assets (NPAs) of state-run banks has weighed on the economic development of the country as these banks hold more than two-thirds of deposits and advances in India’s banking industry. With losses mounting because of dodgy loan, the government wants to consolidate and improve their performance. Also, since it is not feasible to reduce the government’s share to below 51% in public sector banks (PSBs), consolidation is the only answer to create strong banks. Moreover, these banks are in dire need for more funds to meet the new capital adequacy norms under the global Basel III norms.

As a part of managing large NPAs, a consolidation of state-owned banks or mergers of banks can make them more capable and strong in managing challenges ahead. A large bank will be adequately capitalized, will have deeper expertise to handle large credits and large NPAs and can ride off troughs with relative ease. Cost rationalization will be a key to make mergers a success.

In 1991, the Narasimham Committee Report had recommended a three-tier banking structure: establishment of three large banks with international presence, eight to 10 national banks and a large number of regional and local banks. The basic idea of merger of government-owned banks is that bigger banks or mergers of weak ones with bigger banks will enable Indian banks to catch up with global peers. In fact, the country’s largest lender State Bank of India does not feature in the top 50 banks in the global ranking. In contrast, four Chinese banks were listed among the top 25 lenders in the world based on the profits and asset size. Consolidation will also increase capital efficiency and large banks can finance bigger infrastructure projects as it will have more legroom to raise capital. Also, a larger bank may be less risky than a smaller bank as the former will have a more diversified portfolio which will result in less volatility in its earnings. Also, a large bank will command higher credit rating than a smaller bank.

Differentiation in terms of products will be a key to success of the merged banking entities. For instance, in the private sector banks like Kotak Bank or HDFC Bank have been able to create a niche for themselves in the retail banking space. Even cost rationalisation will be the key to make the mergers successful. This would result in reducing inefficient branches, especially in urban areas, where there are quite a lot of branches of various banks. Shared infrastructure will give customers a wider us of ATM network, charges on cross-bank ATM usage will reduce and customers of smaller banks will get access to wider use of financial instruments like insurance and mutual funds.

Financial parameters of PSU Banks

Table 2: Gross Non Performing Assets

| Month | Amount (INR Lakh Crores) |

| March 2018 | 8.96 |

| June 2018 | 8.76 |

| Sept 2018 | 8.69 |

| Dec 2018 | 8.65 |

| March 2019 | 7.9 |

Table 3: Recovery Amount

| Year | Amount (INR Crores) |

| FY17 | 61930 |

| FY18 | 77,563 |

| FY19 | 1,21,076 |

Source: RBI

How will the new mergers work?

The merger move by the government to create large size banks, a move that comes 50 years after bank nationalisation, will help to create the bandwidth for better management. The consolidated banks will see an improvement in economies of scale and efficiency of operations over the medium to long-term. Also, by merging small public sector banks, the government has managed to rationalise the demand on government finances for capital infusion. Bigger banks have the ability to absorb shocks, reap economies of scale as well as the capacity to raise resources without depending on the exchequer.

The merger will require harmonisation of asset quality and provisioning among the banks. The government’s move to merge these banks will hinge on a stronger and more independent central bank and supervision. Post-merger, integration will remain a challenge for few years. The most crucial part of any success of a merger is the integration of technology, people and culture. On these fronts, the state-owned banks have a similar process, which means that integration will not be a challenge. The focus of synergies should be properly identified which must investigate broader gambit of compatibility of business, treasury, IT, HR, and other issues. The expert panel must seek suggestions from all stakeholders to make the merger process work and make it a win-win situation for all. The interest of all stakeholders like the government, depositors, borrowers, employees must be well balanced. Ideally, the process of mergers should evolve based on profitability of the bank with whom it is merging and taking support of the officers and staff.

Table 4: Recapitalisation of PSU Banks

| Bank | Amount (INR Crores) |

| Punjab National Bank | 16,000 |

| Union Bank of India | 11,700 |

| Bank of Baroda | 7,000 |

| Canara Bank | 6500 |

| Indian Overseas Bank | 3,800 |

| Central Bank of India | 3,300 |

| UCO Bank | 2,100 |

| United Bank of India | 1,600 |

| Punjab & Sindh Bank | 750 |

Larger banks will benefit more in terms of capital adequacy than the smaller lenders. The government will also infuse capital in state-owned banks. In FY19, the government had infused over Rs 1 lakh crore in state-owned banks with the last round of Rs 48,000 crore in February this year, which allowed six banks to exit the Reserve Bank of India’s prompt corrective action (PCA) framework. In fact, since FY14, the Centre and Life Insurance Corporation of India have infused about Rs 3 lakh crore in state-owned banks. Given the sizeable capital announced for merging banks, all the merged banks are likely to be well placed on capital.

After merger, the top seven state-owned banks will account for 58% of the Indian banking sector advances and the residual five state-owned banks (excluding IDBI Bank) will account for only 5.7% of the banking sector advances, leading to a significant consolidation among state-owned banks. Among the merged banks, PNB will continue to have a higher share of current account and savings account.

The government should look at a comprehensive approach to restructure weak banks that can have a lasting effect on the cost, earnings, profits and assets. The government should recapitalize the banks and set aside capital for one-time write-off of the bad loans, which will enable banks to clean up their books and start afresh. Moreover, the government should work to strengthen the bad loan recovery process at the banks.

Conclusion

The mega merger exercise will lead to better supervision of a few large state-owned banks, which will improve their corporate governance, bring in discipline and spur competition. The merger will help in improving the banks’ profitability and not remain dependent on the government for capital each year. After the board approval of the merging banks, it will take around 18 to 24 months to complete the full amalgamation as previous mergers have shown that it is time consuming. Merger of weak state-owned banks will be useful if the strategic vision is driven by synergy and create value for both the banks.

Add comment