Hindustan Media Ventures Limited (HMVL) is one of India’s leading print media companies with its distribution spread across Delhi-NCR, Uttar Pradesh, Uttarakhand, Bihar and Jharkhand. Incorporated in July 9, 1918 under the Indian Companies Act, 1913, the company is engaged in the printing and publishing of the flagship Hindi newspaper ‘Hindustan’, which is the second largest daily of India, based on total readership. It holds the leading position in Uttarakhand, Bihar and Jharkhand and ranks second in UP and Delhi. HMVL also publishes two Hindi magazines ‘Nandan’ and ‘Kadambini’. The equity shares of the company are listed on BSE and NSE, the market capitalization of the company on BSE is Rs 1,659 Crores.

India Education Services Private Limited (IESPL) incorporated in October 2011 is engaged in the business of providing all types of academic and non-academic services including providing all kinds of academic, technical, administrative, infrastructure and management support to students, corporate, universities, educational institutions and colleges.

Brief business details of both the Companies:

| Hindustan Media Ventures Limited (HMVL) | India Education Services Private Limited (IESPL) |

| Presently HMVL offer 4 brands they are:

1.Hindustan: It covers news across the entire spectrum of international, national and local news relating to politics, business, entertainment, sports and other general interests. 2.LiveHindustan.com: LiveHindustan.com is the recently launched Hindi News website, which promises far more than what Language sites are typically credited for. 3.Nandan: Nandan, HT Media’s monthly Children Magazine is more than 47 years old brand and it is extremely popular among children and their families in India and abroad. 4.Kadambini: A magazine for thought leaders giving them a fresh perspective on a variety of topics- literature, art, culture, health, technology, fashion, travel, beauty etc. |

There are 2 distinct business lines:

1.Business to Consumer Segment (B2C):

2.Business to Business Segment (B2B):

|

Note: As per the financials as on 31st March 2016 of IESPL, the revenue from B2B business was 88% and B2C business was 12%

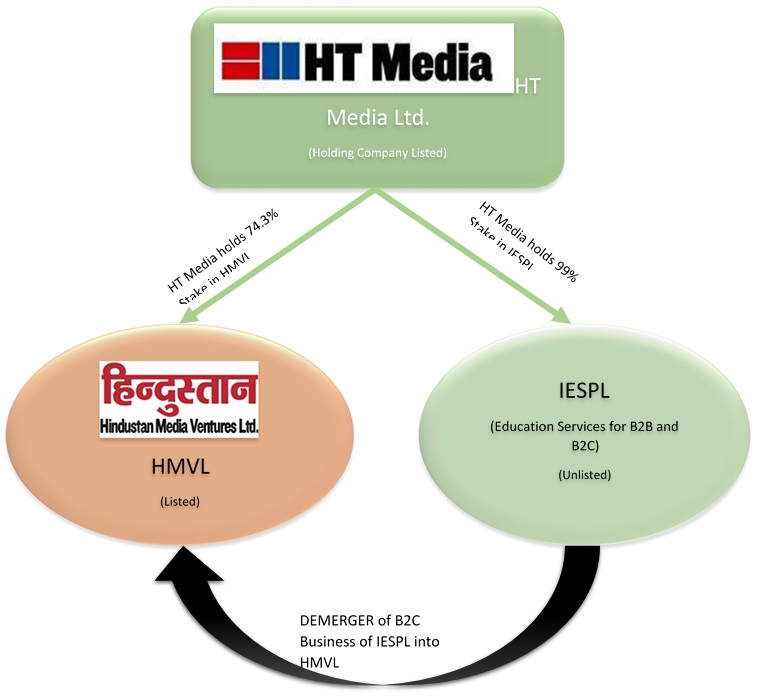

What is getting demerged to HMVL from IESPL? And why?

- Over the period, IESPL has not been able to scale its B2C business and unleash its full potential for growth and profitability.

- On the other hand, the HMVL has a deep presence in Tier II and Tier III cities of North India, which offers a large customer base with favourable demographics for the growth of the business of the B2C business of the Demerged Company.

- Therefore, HMVL has proposed to acquire the B2C business of IESPL through demerger, to utilize its expertise and wide-spread reach of in North India to turnaround the B2C business of IESPL.

Structure

Valuation

Appointed Date is 1st October 2017

Table 1: Valuation of HMVL and B2C Business of IESPL

| Valuation Approach | HMVL | Demerged Undertaking of IESPL | ||

| Value per share(INR) | Weight | Value per share(INR) | Weight | |

| Underlying Asset* | 166.04 | 0 | -34.64 | 0 |

| Income | 317.95 | 1 | 41.67 | 1 |

| Market | 270.97 | 1 | 40.25 | 1 |

| Relative Value per share | 294.46 | 40.96 | ||

| Entitlement Ratio (Rounded off) | 7.2 | |||

Shareholding Pattern

In consideration for this demerger HMVL will issue 10 Equity Shares of Rs 10 for every 72 Equity Shares of Rs 10 held in IESPL.

Hindustan Media Ventures Limited

Table 2: Shareholding Pattern Pre & Post Arrangement

| Pre-Scheme of Arrangement | Post scheme of Arrangement | ||||

| Particulars | Nos of Shares | % Holding | Consideration: HMVL to issue 10 Equity Shares of Rs 10 for every 72 Equity Shares of Rs 10 held in IESPL. | Nos of Shares | % Holding |

| HT Media Limited | 54,533,458 | 74.30% | 274,999 | 54,808,457 | 74.40% |

| Public | 18,498,110 | 25.20% | 2,779 | 18,500,889 | 25.11% |

| Shares held by employee trusts | 362,202 | 0.49% | 0 | 362,202 | 0.49% |

| Total | 73,393,770 | 100% | 277,778 | 73,671,548 | 100% |

Observations

- In July 2017, HT Media Limited acquired 49% stake of IESPL from Apollo Global Singapore Holdings Pte Limited for Rs 58 Crores.

- The said transaction price has been considered under Price of Recent Transaction method, after adjusting for the net assets of remaining business of IESPL, to arrive at value of the Demerged Undertaking under market approach.

- The value arrived under income approach is calculated based on outstanding number of equity shares of HMVL and Demerged undertaking of IESPL (post the proposed capital reduction).

- The value of the demerged undertaking will be as follows:

| Particulars | Amount |

| Number of shares post capital reduction of IESPL | 20,00,000 Shares |

| Fair value as per valuation report | 40.96 |

| Value of the B2C undertaking | 8,19,20,000 |

- India Education Services Private Limited (IESPL), was operating as a 50:50 Joint Venture between the Company and Apollo Global Singapore Holdings Pte. Ltd. (Apollo Global).

- In 2017, in view of differences in the strategy of the JV Partners for future operations of IESPL, HT Media Ltd has acquired 49% equity share capital of IESPL, held by Apollo Global; and thus, the JV agreement stood terminated.

- Accordingly, IESPL is a subsidiary of HT Media Ltd.It is interesting to note that HT Media Ltd decided to demerge the B2C business into HMVL instead of merging the whole IESPL into HMVL.

Tax Implication

The proposed demerger is in compliance of Section 2(19AA) of the Income Tax Act 1961 Therefore it will be tax neutral in the hands of the involved companies and their shareholders. It is interesting to note that HT Media Ltd decided to demerge the B2C business into HMVL instead of merging the whole IESPL into HMVL possibly because of the following reasons:

- IESPL has carry forward losses of Rs. 124.62 Crores as on 30th September 2017, the conditions of Section 72A are not applicable to the merger of IESPL and HMVL, hence HMVL would not have been able to carry forward the losses of IESPL.

- Hence HMVL opted for demerger instead of merger.

- HMVL has lots of Foreign Portfolio Investors and Institutional Investors who might not be interested in loss making and capital intensive B2C business of IESPL.

Accounting Treatment

| In the books of Demerged Company | In the Books of Resulting Company |

| All the assets and liabilities of the demerged company being transferred shall be reduced at their book value as on appointed date (after taking into account the impact of capital reduction as proposed under “Scheme of share capital between the Demerged Company and its Shareholders) | The Resulting Company shall, record the assets and liabilities of the Demerged Undertaking vested in it pursuant to this Scheme at the respective carrying amounts appearing in the books of the Demerged Company. |

| The difference between the book value of assets and liabilities of the Demerged Undertaking as on Appointed Date shall be transferred to retained earnings | The Resulting Company shall credit its share capital account with the aggregate face value of the new equity shares issued by it to the equity shareholders of the Demerged Company pursuant to issue of shares on consideration. |

| The difference between the carrying amount of the assets and liabilities and the share capital credited with aggregate face value of the new equity shares as issued, shall be recorded as capital reserve. |

Rights Issue

Following is the Rights Issue details of IESPL:

| Particulars | 2015 | 2016 |

| HT Media Ltd | 12,64,50,000 | 10,92,50,000 |

| Apollo | 12,64,50,000 | 10,92,50,000 |

| Total Amount | 25,29,00,000 | 21,85,00,000 |

IESPL used the rights issue money to run the operating expenses of the company, as it can be seen from its cash flow statements.

Conclusion

HMVL is a cash rich company and having free cash flow. HT MEDIA Ltd financed the exit of JV partner and now the responsibility is cast on HMVL to fund the B2C business. Though it is stated that for HMVL it is strategic fit and create value for its stakeholders, but considering its business how it will create value, for its stakeholders is not clear except may be better returns on surplus cash with the company. The promoters of HMVL have managed to increase their stake without spending a penny for a completely unrelated business, which also doesn’t seem to be strategically important for the company.

No Doubt HMVL will save tax on accumulated loss and further loss incurred till B2C business become profitable. As B2C business has become division of listed company, the company will not be able to invite partner in B2C business unless it demerges the said business in the new company. The purpose of keeping B2B education business as part of other group company and B2C as part of HMVL also is not clear. Instead of buying B2C business had HMVL invested in other securities its opportunity cost would be higher than the returns on B2C business. Hence this is a poor move done by HMVL.