About the companies

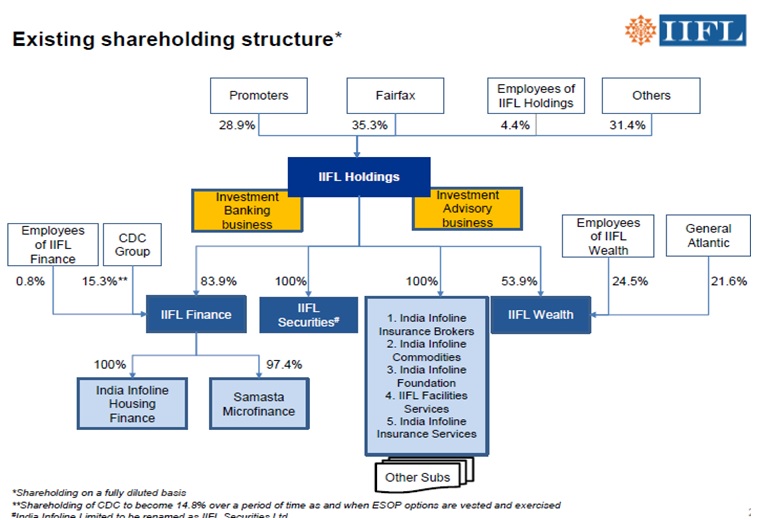

The Boards of Directors of IIFL Holdings and its subsidiary companies, at their respective meetings, held on January 31, 2018, have decided to reorganize the corporate structure. Over the last 23 years, IIFL has expanded into multiple financial services activities. Today, the group’s business comprises three distinct business lines:

- Loans and Mortgages;

- Wealth and Asset Management; and

- Capital Markets

The reorganization will result in three listed entities, one for each of the above businesses.

IIFL Holdings Ltd (IHL) was founded in 1995 and is a diversified financial services company. It provides financial services including investment banking, institutional equities, advisory services, financing, asset & wealth management, financial advisory, broking and financial product distribution by itself and through its various subsidiaries. IHL is listed on the BSE Limited and National Stock Exchange of India Limited.

India Infoline Media & Research Services Ltd (IIFL M&R) is a wholly-owned subsidiary )WoS) of IHL. IIMR generates revenue from media related corporate advisory services, advertising, other related streams such as lead generation for real estate sector clients, online distribution of media contents etc.

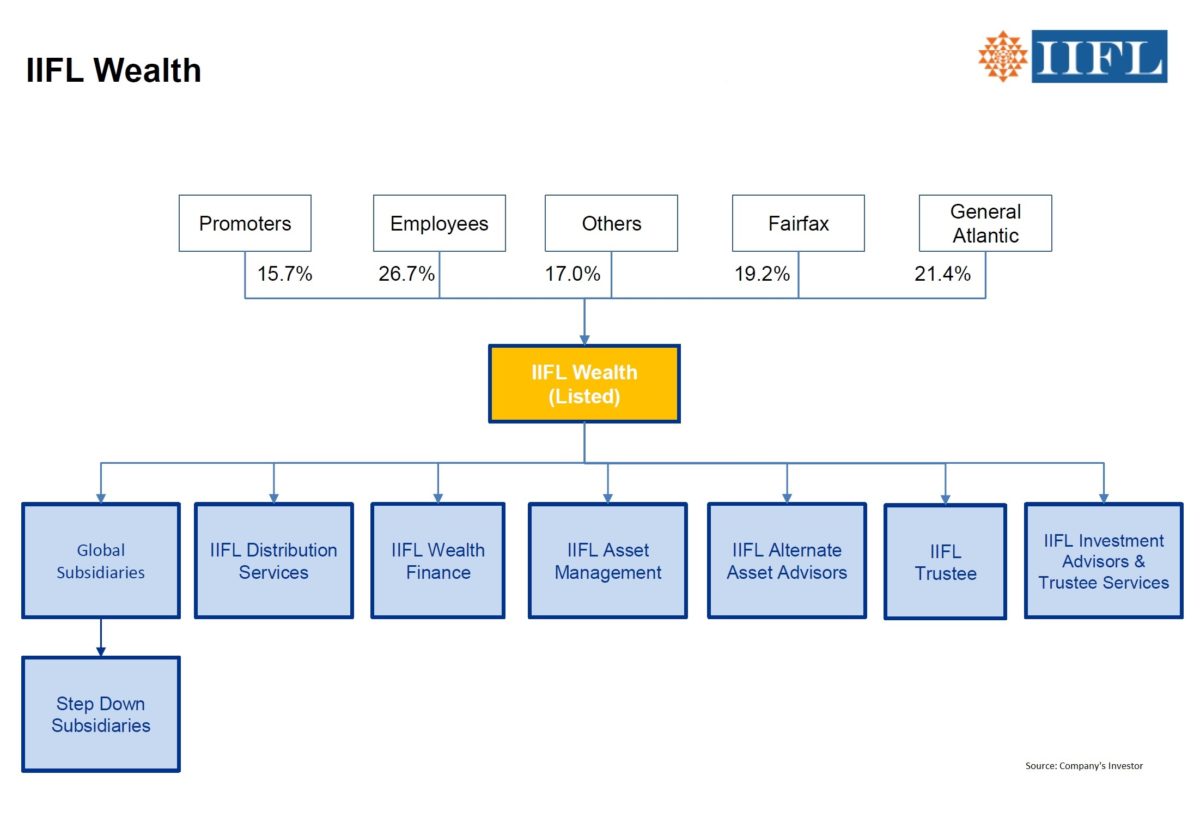

IIFL Wealth Management Ltd (IIFL Wealth) subsidiary of IHL, along with its subsidiaries provides a range of services such as wealth management, asset management, investment advisory and treasury solutions by itself and through its various subsidiaries. It also acts as a broker, depository participant and portfolio manager.

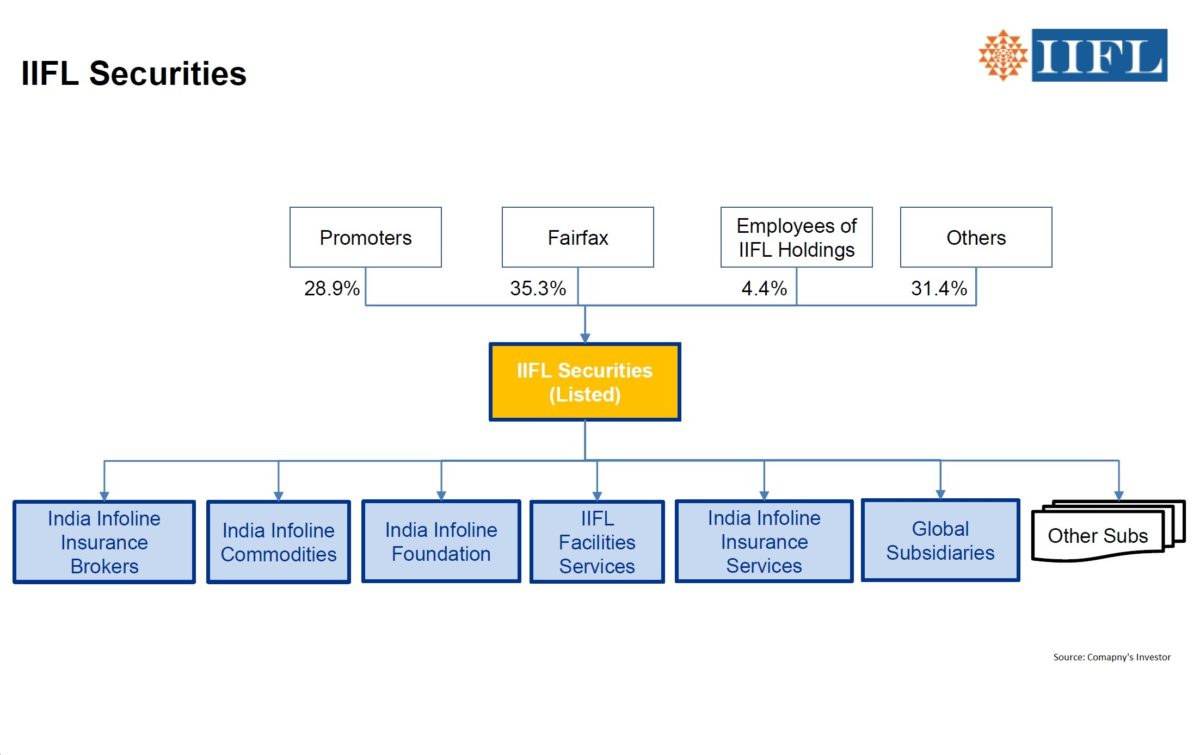

IIFL Securities Ltd (IIFL Securities), a WoS of IHL, is one of the leading players in the financial services sector offering equity and currency broking, depository participant, portfolio management, distribution of mutual funds, bonds and other saving products. It is a member of BSE, NSE and MSEI. It is also registered with NSDL and CDSL as a depository participant, providing a one-stop solution for clients trading in equities market. Last year, IIFL Securities raised equity funds by way of right issue for an amount Rs 150 crore.

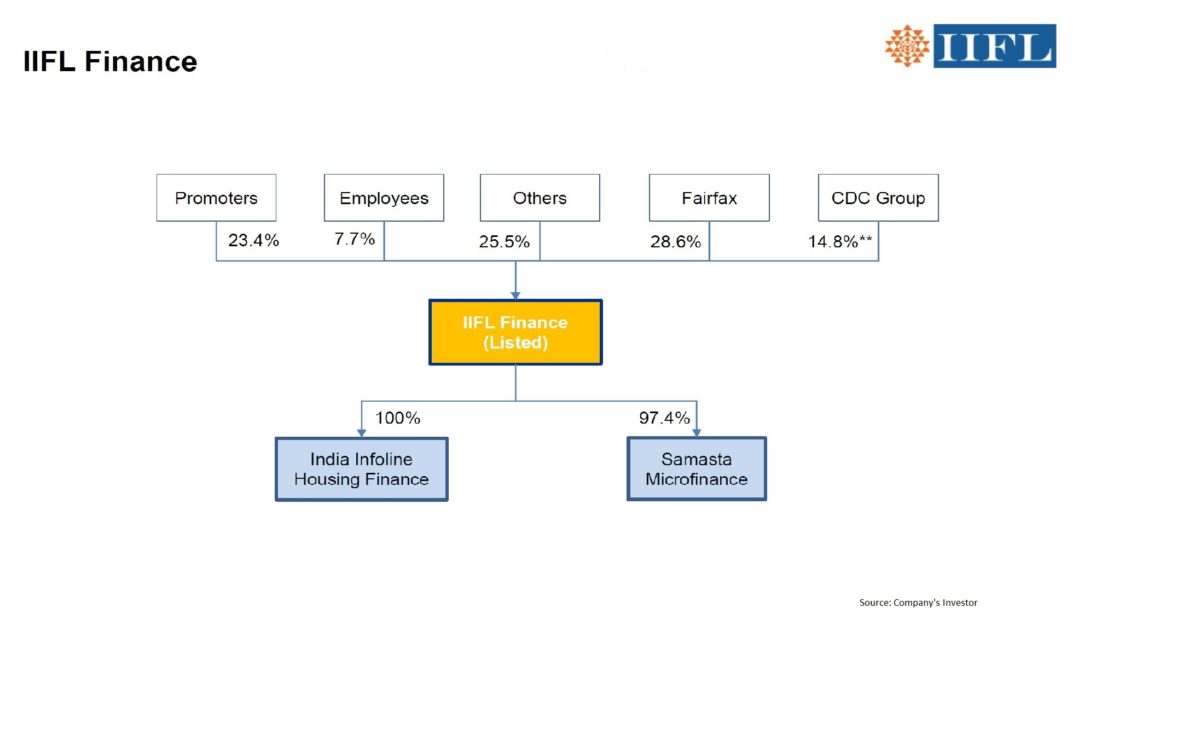

India Infoline Finance Ltd (IIFL Finance) is a subsidiary of IHL, operates as a non-banking finance company. IIFL provides a wide range of products such as home loan, loan against property, commercial vehicle loan, gold loan, SME loan, healthcare finance and capital market finance to small and medium enterprises by itself and through its various subsidiaries.

IIFL Distribution Services Ltd (IIFL Distribution) is a WoS of IIFL Wealth. It is engaged in the business of distribution of mutual funds and in providing manpower services to its associate companies.

The Transaction

IIFL group will re-structure its group entities in such way that the restructuring will result in three different listed entities for each finance, wealth and securities business.

- IIFL Finance Limited (currently IIFL Holdings Limited) will be having the lending business.

- IIFL Securities Limited will be having all the securities business.

- IIFL Wealth Management Limited will be having all the wealth business.

“The security business undertaking” is comprising of all the securities & investment banking business.

“The wealth business undertaking” comprises of investment advisory and media & research business.

“Broking and Depository Participant Business Undertaking” comprising all the retail and institutional broking, research and equities trading business and depository participant business.

Finance Business which is carried through its unlisted company, India Infoline Finance Limited which offers a plethora of products including home loans, loan against property, gold loans, commercial vehicle loans etc.

The transaction will be done in the following stride: –

Step 1: – Amalgamation of the IIFL M&R with the IHL.

Step 2: – Transfer and the vesting of the Security Business Undertaking from the IHL into the IIFL Securities.

Step 3: – Transfer and vesting of the Wealth Business Undertaking from the IHL into the IIFL Wealth

Step 4: – Amalgamation of the IIFL Finance with the IHL.

Step 5: – Transfer of Broking & Depository Participant Business undertaking from the IIFL Wealth to the IIFL distribution.

Appointed dates: –

- The Amalgamation of IIFL M&R with the IHL from April 1,

- All other transaction will be having appointed date of 1 April 2018.

The denouement of the transactions, the group will be segregated into 3 listed companies:-

IIFL Finance

IIFL Wealth

IIFL Wealth IIFL Securities

IIFL Securities

Rationale

- Over the course of time, the demerged entity has grown into a diversified financial conglomerate with interests in loan & mortgages, wealth management services, distribution of financial products and capital market services. Each of the core businesses has acquired critical mass, requiring flexibility and independence to grow faster.

- All three businesses have clearly distinct set of customers. In IIFL wealth, they cater to HNI’s investment requirement, even their financing requirement will be fulfilled through a subsidiary of IIFL Wealth which has started 2 years ago. IIFL Finance and IIFL Securities caters to retail customers. Each of the businesses have different way of working, culture and different critical success factors.

- A clean corporate structure with no cross holdings will ensure transparency, accountability, highest standards of corporate governance and compliances.

- The de-merger will unlock the value for shareholders. Further, it will also provide an ability to attract investors who are interested in specific businesses which best suit their investment strategies and risk profiles

- Each listed company can separately attract and motivate its key people with stock options such that their rewards are strongly correlated with their own business’s performance.

Earlier Corporate Actions

Open Offer

Fairfax Group along with its group companies announced an open offer in the year 2015 for an acquisition of ~26% of the post-offer equity share capital. The offer was successfully completed with a response of 21.85% of the paid-up share capital of the company, which enabled Fairfax group to increase their stake in the company. Post-open offer aggregate shareholding of Fairfax went to 35.7%.

Investment by private equities

During 2015, General Atlantic made a strategic investment of Rs 904 crore in IIFL Wealth through fresh issue of shares and additionally Rs 159 crore through the acquisition of shares from IIFL Wealth employees for 21.61% equity stake.

During 2016, CDC group invested around Rs 10 billion in IIFL Finance for 15.45% equity stake on a fully diluted basis.

De-merger of 5paisa

Last year IIFL Holdings de-merged its “5paisa digital undertaking” means the entire business of IHL relating to the set-up of 5paisa digital business which provides an online technology platform through internet terminal and mobile app for trading to 5paisa Capital Limited.

The de-merger pawed the way for the listing of 5paisa Capital Limited on the bourses.

Valuation

Swap Ratio:

Owner of Seven shares of IIFL Holdings’ (the listed company) to own post-reorganization

- a) Seven shares of IIFL Finance (IIFL Holding);

- b) Seven shares of IIFL Securities; and

- c) One share of IIFL Wealth

Amalgamation of IIFL Finance into IHL

For Equity Shareholders:

IHL shall issue 135 Fully paid up equity shares of Rs 2 each for every 100 Fully paid up equity shares of Rs 10 each held in IIFL Finance.

For Preference Shareholders:

IHL shall issue 135 Fully paid up equity shares of Rs 2 each for every 100 fully paid up compulsory convertible preference shares of Rs 10 each held in IIFL Finance.

Slump sale of Broking, Research and Depository Participant Business Undertaking

The transfer of the Broking and Depository participant business undertaking of IIFL Wealth to IIFL Distribution for a cash consideration of Rs 165.80 million.

Financials

Table 1: Standalone Financials as on 31.12.2017 (All Figs in INR Crores)

| Particulars | IDSL | ISL | IIWL | IIFL | IMAR | IIFL HOLDING |

| Networth | 5 | 484 | 1,330 | 3,489 | 23 | 1,478 |

| Borrowings | – | 298 | 403 | 10,791 | – | – |

| Total Assets | 7 | 1,974 | 1,994 | 17,242 | 26 | – |

| For 9 months ended on 31.12.2017 | ||||||

| Revenue | 15 | 454 | 522 | 1,861 | 15 | 111 |

| EBIT | 0 | 164 | 167 | 1,292 | 13 | 101 |

| PAT | 0 | 93 | 78 | 256 | 11 | 72 |

Table 2: Incomes from Different Business Verticals (All Figs in INR Crores)

| Particulars | Loan | Wealth | Capital Market | |||

| 9MFY18 | FY17 | 9MFY18 | FY17 | 9MFY18 | FY17 | |

| Total Income | 2,819 | 3,165 | 1,307 | 1,082 | 615 | 677 |

| PBT | 600 | 649 | 370 | 363 | 248 | 212 |

| PAT | 394 | 423 | 282 | 250 | 168 | 148 |

| Networth | 3,861 | 3,545 | 1,786 | 1,524 | 575 | 575 |

| AUM | 27,288 | – | – | – | – | – |

| Wealth Assets | – | – | 1,28,175 | – | – | – |

| Customers | – | – | 10,000 | – | 40,00,000 | – |

Table 3: Peer Comparison.

| Particulars | L&T Finance | ICICI Sec. |

| Total Income | 7,561 | 1,344 |

| PBT | 1,180 | 612 |

| PAT | 1,055 | 399 |

| Networth | 10,369 | 675 |

| AUM | 75,963 | – |

| Market Cap(as on 26.04.2018) | 33,000 | 13,700 |

Please note that the above-mentioned figures are on the consolidated basis unless otherwise mentioned.

Conclusion

The scheme of arrangement is a decisive step towards unlocking the potential value of IIFL group companies. Further, it will simplify the corporate structure providing shareholders of IHL direct shareholding in the respective operating companies. Thus, Post-restructuring, shareholders will be having the flexibility to sell out or stay put, based on the performance of the companies.

IIFL group is continuously allotting ESOP’s in various group companies, especially in wealth business. For instance, Karan Bhagat MD of IIFL Wealth has an equity interest in IIFL Wealth 6.17% in March 2017 compared to 3.5% in March 2016. The restructuring will give the flexibility to allot the ESOP to the employees of their interested business.

The other intention for the restructuring can be to provide private equity players a route for an exit. This can be affirmed by the management statement during the con-call about the term between the respective company and private equity player for providing them with an exit in seven years. In the process, it can also improve the worth of their holdings by eliminating the holding company discount and facilitate the listing of security & wealth business.