S Chand and Company Ltd (S Chand) is a listed public limited company, engaged in the business of publishing educational books with products ranging from school books, higher academic books, competition and references books, technical and professional books and children books. The market cap of the company is Rs 1,273 crore.

Blackie and Son (Calcutta) Pvt Ltd (Blackie) is a private company and is a WoS of S Chand. Till year ended March 31, 2016, the company was primarily engaged in sale of its own books to S Chand Group. However, from FY 2015-16, the company is earning income by way of royalty.

Nirja Publishers and Printers Pvt Ltd (Nirja) is a private company, engaged in the business of manufacturing paper and paper products, publishing, printing and reproduction of recorded media and is a WoS of S Chand.

DS Digital Private Ltd (DS Digital) is a private company, engaged in business of providing digital education services and is a subsidiary of S Chand.

Safari Digital Education Initiatives Pvt Ltd (Safari) is a private company, engaged in the business of rendering digital education. S Chand and Nirja are holding 60% and 40% of share capital of Safari and accordingly, Safari is an indirect WoS of S Chand.

Table 1: Product Portfolio of S. Chand & Co. (Source: Annual Report)

| Brand | K12 | Higher Education | Early Learning |

| S Chand | ✔ | ✔ | |

| Vikas | ✔ | ||

| Madhubun | ✔ | ||

| Saraswati | ✔ | ||

| Blackie | ✔ | ||

| Chhaya | ✔ | ||

| IPP | ✔ | ||

| Brands specializing in e-content and services | |||

| Destination Success | ✔ | ||

| Mylestone | ✔ | ||

| mystudygear | ✔ | ||

| Ignitor* | ✔ | ✔ | |

| Testbook* | ✔ | ||

| Online Tyari* | ✔ | ||

| BPI* | ✔ | ||

| Smartivity* | ✔ | ||

| Risekids | ✔ | ||

| Flipclass* | ✔ | ||

*Investees Company

S Chand’s higher education segment is the second largest segment by consolidated revenue, and comprises two components: (1) test preparation and (2) college and university/technical and professional.

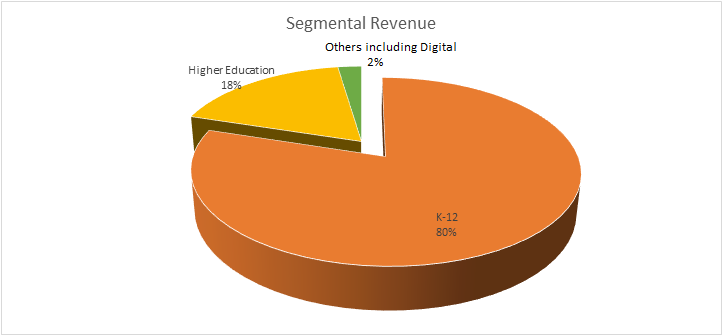

Revenue Details (Based on Consolidated Financials as on 31st March 2017)

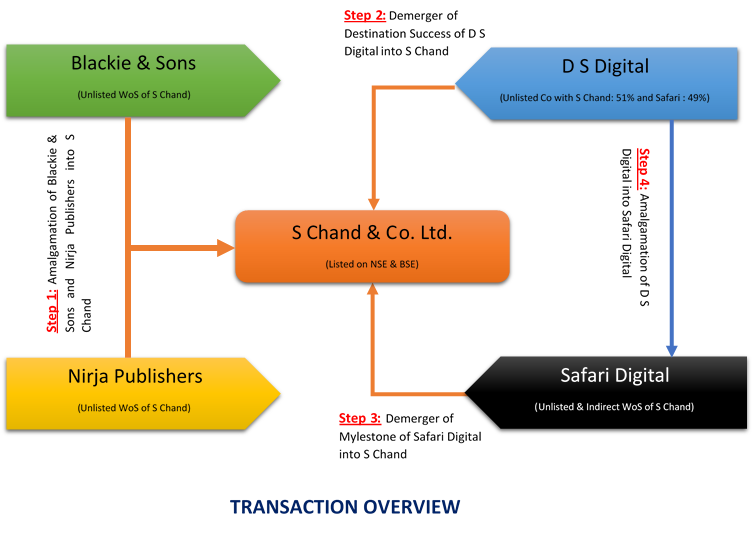

Transaction Overview

- Post- Scheme only S Chand and its WoS Safari will remain.

- Blackie and Nirja comprises of content business, whereas DS Digital and Safari consists of digital content services business. Therefore, this is a complete consolidation of the non-digital content and digital content business of S Chand Group into S Chand.

- Post restructuring, Safari will house Rise Kids business, which is one of the consumer facing brands of S Chand and minority investments in Edtech companies, which means education & technology companies.

- Appointed Date is April 1, 2017.

Shareholding Pattern

- On Amalgamation and Demerger there is no change in Shareholding pattern of S Chand and Company Ltd on amalgamation and demerger.

- As a consequence of amalgamation of Blackie and Nirja into S Chand, Safari will become a direct WoS of S Chand and also substantial equity shares and all preference shares of DS Digital are held by S Chand and Safari, therefore S Chand shall not issue any shares neither to itself nor to Safari.

- Share capital of Safari will be increased from 4.44 crores of shares to 4.65 crores of shares post scheme.

Also Read: S Chand raises Rs219 crore from anchor investors ahead of IPO

Accounting Treatments

Amalgamation of Blackie and Nirja into S Chand

| Element | Treatment |

| Assets and Liabilities | S Chand shall record all assets/liabilities at existing carrying amounts. |

| Inter-company Balances | Inter-company balances and investments amongst Blackie, Nirja and S Chand, if any shall stand cancelled. |

Pooling of Interest Method prescribed under Ind AS 103 Business Combinations

Demerger of Destination Success Business of DS Digital into S Chand and Mylestone Business of Safari into S Chand

| Element | Treatment |

| Assets and Liabilities | The value of all assets, liabilities, profits or reserves pertaining to the Demerged Undertakings of the Demerged Companies along with the liabilities which are directly relatable to the Demerged Undertaking, as appearing in the books of accounts of the Demerged Companies and are to be transferred to the Resulting Company, shall be reduced from the book value of assets and liabilities of the Demerged Companies |

| Inter-company Balances | Inter-company balances and investments, if any, between Demerged Companies and Resulting Company pertaining to the Demerged Undertakings shall stand cancelled. |

| Surplus/Deficit adjustment | Any surplus of deficit arising in the books of the Demerged Companies, shall be adjusted against the reserves appearing in the books of the Demerged Companies and if the difference still remains, the same shall be adjusted against the share capital of the Demerged Companies. The share capital of the Demerged Companies shall stand reduced and cancelled. |

Pooling of Interest Method prescribed under Ind AS 103 Business Combinations in the books of D S Digital and Safari

In the books of S Chand

| Element | Treatment |

| Assets and Liabilites | S Chand shall record the assets/liabilities of the Demerged Undertakings vested in it at book value at the close of the day immediately preceeding the Appointed Date. |

| Inter-se transaction of sale/purchase between the DS Digital, Safari and S Chand | The effect of any inter-se transaction of sale/purchase between the DS Digital, Safari and S Chand shall stand nullified and would be given effect to in the books of the respective companies, in order to give full effect to demerger. |

| Surplus/Deficit adjustment | Any surplus/excess in the value of assets over the value of liabilities of the Demerged Undertakings as transferred to the Resulting Company over the face value of the New Equity Shares-I allotted by the resulting Company shall be adjusted in accordance with the applicable accounting principles. |

Amalgamation of DS Digital into Safari

| Element | Treatment |

| Assets and Liabilities | Safari shall record all assets/liabilities at existing carrying amounts. |

| Inter Company Balances | Intercompany balances shall stand cancelled. |

| Consideration | The difference between the amount recorded as share capital issued along with any additional consideration in the form of cash or the other assets and the amount of share capital of DS Digital and Safari shall be transferred to capital reserve. |

Pooling of Interest Method prescribed under Ind AS 103 Business Combinations in the Books of Safari

Valuation

Following is the Valuation as per DCF Method provided in valuation report as on March 31, 2017

| Sr Nos | Companies | Face value per share | Fair value per share | Nos of Shares | Amount (Rs in Crores) |

| 1 | S Chand And Company Ltd | 5 | 650 | 3,49,50,061 | 2,271.75 |

| 2 | Blackie & Son (Calcutta) Private Ltd | 1000 | 3,84,680 | 149 | 5.73 |

| 3 | Nirja Publishers and Printers Pvt Ltd | 10 | 77,048 | 12,000 | 92.46 |

| 4 | DS Digital Private Ltd -Education Business | 10 | 11 | 3,47,28,920 | 38.69 |

| 5 | DS Digital Private Ltd -Full Business | 10 | 12 | 3,47,28,920 | 41.61 |

| 6 | Safari Digital Education Initiatives Pvt Ltd- Education Business | 10 | 8 | 4,43,69,268 | 36.74 |

| 7 | Safari Digital Education Initiatives Pvt Ltd- Full Business | 10 | 15 | 4,43,69,268 | 68.33 |

| S Chand and Company | Value per share (Rs) | Weight | Amount |

| Value as per DCF Method taking 14% as Cost of equity | 794 | 3 | 2,382 |

| Value as per NAV Method | 217 | 1 | 217 |

| Total | 4 | 2,599 | |

| Value per share | 650 |

Please note: Fair value per share of S Chand is Rs 650/- share and currently S Chand is trading at Rs 387.05/- per share (Market price on BSE dated 28th May 2018)

Financial Performance of S Chand and Company Ltd

Based on Consolidated Financials. Rs in Crores

| Particulars | Mar-18 | Mar-17 | Mar-16 |

| Revenue | 807 | 685 | 541 |

| EBIT | 186 | 144 | 102 |

| Total Assets | 1,516 | 1,333 | 993 |

| Current Liabilities | 477 | 624 | 317 |

| Total Assets-Current Liabilities | 1,039 | 708 | 676 |

| Return on Capital Employed | 18% | 20% | 15% |

Rationale

General purpose

- The amalgamation of Blackie and Son (Calcutta) Private Ltd and Nirja Publishers and Printers Pvt Ltd into S Chand and Company Ltd, will result is simplification of the group structure, thus enabling focus on core competencies.

- The proposed scheme is in line with the current global industry practice to achieve size, scalability, integration, greater financial strength and flexibility thereby maximizing shareholder value and to achieve higher long-term financial returns. On Amalgamation and Demerger there is no change in Shareholding pattern of S Chand and Company Ltd on amalgamation and demerger.

Resultant outcome of restructuring

- As a result, the structure is framed in such a way that preschool business will be managed by a WoS and K-12, Higher education and other digital business will be housed by S Chand.

- The said restructuring will increase S Chand’s Networth from Rs 509 Crores as on 31st March 2017 to Rs 564 Crores as on 1st April 2017.

Strategy

- Moving further S Chand wants to focus more on K-12 segment, and the company is capturing markets all over India, example being one such acquisition of Chhaya Prakashani Pvt Ltd in Dec 2016, it also acquired well-known brands Madhubun and Vikas in Fiscal 2013, pursuant to the acquisition of Vikas Publishing House, bolstering its Hindi language titles. In Fiscal 2015, the Company acquired New Saraswati House for their strength in the languages and arts & crafts titles.

- These acquisitions are a part of the Company’s strategy to increase its share of content used by CBSE/ICSE schools.

Acquisition done in recent past:

- In December 2016, S Chand acquired 74% stake of Chhaya Prakashani Private Limited for an enterprise value of Rs 220 Crores, which helped the company gain increased access to the West Bengal market, being the first acquisition of the company in the state board content market.

- With the consolidation of Chhaya, the company has covered around 40,000 institutions, catering to more than 25 million students.

Fundraising and utilization of IPO proceeds

| Particulars | Amount in Crores | Utilized upto 31st March 2018 | Unutilized amount as at 31st March, 2018 |

| Gross proceeds from IPO: Fresh issue | 325 | – | – |

| Objects | |||

| Repayment of loan availed by S Chand utilized towards funding acquisition of Chhaya | 100 | 100 | |

| Repayment of loan availed by Eurasia Publishing House Private Limited (Wholly Owned Subsidiary of S Chand) utilized towards funding acquisition of Chhaya. | 50 | 50 | |

| Repayment of loans availed by S Chand | 55 | 55 | |

| Repayment of loans availed by subsidiaries of S Chand | 50 | 50 | |

| General Corporate purposes | 49 | 37 | |

| Share issue expenses | 21 | 21 | |

| Total | 325 | 313 | Rs 12 crore unutilized temporarily parked in fixed deposit with Banks. |

The trading of equity shares commenced on May 9, 2017

Details of IPO:

Issue Size: 10,873,982 Equity Shares of Rs 5 aggregating up to Rs 728.56 Cr

Fresh Issue of 4,850,746 Equity Shares of Rs 5 aggregating up to Rs 325.00 Cr

Offer for Sale of 6,023,236 Equity Shares of Rs 5 aggregating up to Rs 403.56 Cr

Conclusion

The company made IPO just to repay loans taken for Acquisition of Chhaya Prakashani Private Ltd and other loans. So it seems till date the company is not able to capture the value out of the acquisition and, ROCE before IPO was 20% and after IPO it is 18%. So, post IPO, funds are not getting utilized to increase the business of the company. Moving forward, this restructuring is nothing but simplification of the group structure, and only future acquisitions and expansions in various regions will improve their spread in the business because regional timings are different depending on which region they acquire, which will stabilize the company’s growth track.