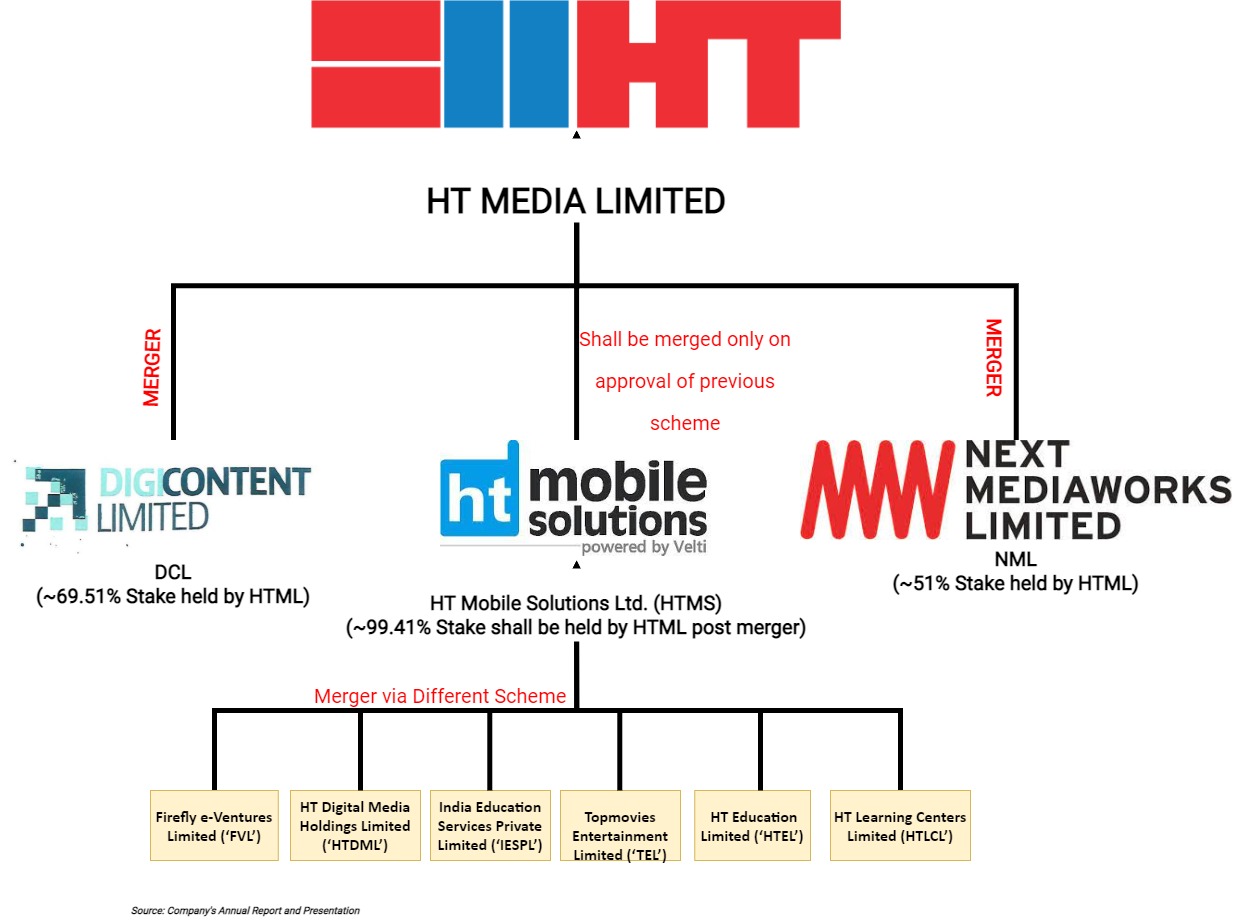

HT Media Limited (HTML) is a public listed company. HTML publishes ‘Hindustan Times,’ an English daily, and ‘Mint,’ a business paper and undertakes commercial printing jobs. HTML is also engaged in the business of providing entertainment, radio broadcast and all other related activities through its Radio Stations operating under the brand name ‘Fever 104’, ‘Fever’ and ‘Radio Nasha’. The digital business of HTML comprises of various online platforms such as ‘shine.com,’ ‘VCCircle,’ etc.

Digicontent Limited (DCL) is a public listed company engaged in the business of Entertainment & Digital Innovation Business. DCL is also a fellow subsidiary of HTML. The Hindustan Times Limited, holding company of HTML owns 69.51% stake in DCL.

Next Mediaworks Limited (NML) is a public listed company engaged in the business of FM broadcasting and presently has the “Radio One” FM brand in 7 cities of the country being Delhi, Mumbai, Chennai, Kolkata, Bengaluru, Pune, and Ahmedabad. The company operates under frequency 94.3MHz in all its cities except for the city of Ahmedabad where it operates under the frequency 95 MHz HTML owns ~51% equity stake in NML.

HT Mobile Solutions Limited (HTMS) is an unlisted public limited company engaged in the business of investment through HT Digital Media Holdings Limited to carry out mobile marketing, social media marketing, advertising, mobile CRM and loyalty campaigns, mobile music content, ring tones and integrates with other media campaigns and strategies. “HTMS has filed a scheme of amalgamation with the National Company Law Tribunal, New Delhi Bench for merger of Firefly e-Ventures Limited (‘FVL’), HT Digital Media Holdings Limited (‘HTDML’), HT Education Limited (‘HTEL’), HT Learning Centers Limited (HTLCL’), India Education Services Private Limited (‘IESPL’), Top movies Entertainment Limited (‘TEL’) with itself, which is pending for final approval” (HTMS Scheme). Post-implementation of the HTMS Scheme, HTML will hold ~99.41% equity interest in HTMS.

Appointed date is 1st April 2020 (for both the scheme)

Effectiveness and effective date of scheme:

Effectiveness of merger of HTMS with HTML depends on the effectiveness of HTMS Scheme (Part D of Scheme). Further also note that the effectiveness of each part of the scheme are severable and can be made effective independently.

The effective date is last date of filing of orders of the NCLT (National Company Law Tribunal) with the Registrar of Companies.

The Transaction

This the simple transaction of merger of three companies with HTML. However, it has two parts:

- Merger of HTMS with HTML which is dependent on approval of merger of other entities with HTMS.

- Merger of DCL and NML with HTML.

Both parts are independently implemented.

Rationale of the Scheme

As per Scheme

- Simplification of holding structure

- Elimination of inter-company transaction

- Savings in operational and other costs

Some Past Transactions

2016

HTML transfer its Multimedia Content Management Undertaking to HT Digital Streams Limited (HTDSL) via slump exchange. 42.83% stake of HTDSL is acquired by DCL on 28th December 2017 at ~₹77 crores.

2018

HTML demerged its Entertainment & Digital Innovation Business along with 57.17% stake in HTDSL into Digicontent Limited (formerly known as HT Digital Ventures Limited) got listed on 18th June 2019 and the appointed date for the transaction is 31st March 2018.

In 2018, HTML and Next Radio Limited (NRL) filed a scheme for demerger of its FM Radio Broadcasting Division into NML, an article we covered in our Oct 2018 issue, and, merger of HT Music and Entertainment Company limited with NML. This scheme was withdrawn on 20th December 2018 because a similar scheme is filed by NRL for demerger of its FM Radio Business into Syngience Broadcast Ahmedabad Limited (SBAL) but not get approval from the Ministry of Information & Broadcasting. Thereafter, on 15th April 2019, HTML through open offer acquired 51% stake of NWL. Further, on 15th November 2019 HTML acquires 48.6% stake of NRL.

Swap Ratio

- 4 equity shares of HTML of ₹ 2 each fully paid up for every 13 equity shares of DCL of ₹ 2 each fully paid up.

- 1 equity share of HTML of ₹ 2 each fully paid up for every 14 equity shares of NMW of ₹ 10 each fully paid up.

- 1 equity share of HTML of ₹ 2 each fully paid up for every 12 equity shares of HTMS of ₹ 10 each fully paid up.

Shareholding pattern

HTML Pre and Post shareholding pattern based on December 2020 Data.

| Particulars | PRE-TRANSACTION SHAREHOLDING (%) | POST-TRANSACTION SHAREHOLDING (%) |

| Promotors | ||

| THE HINDUSTAN TIMES LTD | 69.51% | 68.86% |

| Others (Classify as Public after implementation of Scheme) | 0.00% | 0.45% |

| Total Promotors | 69.51% | 69.32% |

| Public | 29.56% | 29.80% |

| Employee Trust | 0.94% | 0.88% |

| Total | 100% | 100% |

Shares to be issued to the shareholders of HTMS is not considered as after implementation of HTMS Scheme the HTML holds 99.41% shares of HTMS.

Promotor others will classify as public on implementation of scheme.

Related Party transaction

In FY 2020 DCL pay Rent and Maintenance of ₹ 16.15 crores to its holding company, ‘The Hindustan Times Limited’ and ‘DCL’ also given a security deposit of ₹ 15.56 crores to its holding co.

Taxation

At the end of FY 2019-20 HTML has MAT Credit balance of ₹ 105.74 crore (Consolidated) while other companies are paying tax at normal rate, merger will accelerate the process of setoff of its MAT Credit on merger of other companies. Further note that NML and DCL have accumulated losses of ~₹ 166 crores and ~₹ 5 crores as on FY 2019-20 respectively.

Conclusion

HTML wanted to demerge its FM Radio business but had to withdraw the scheme of demerger of FM Radio business because NRL WoS of NML failed to get approval from the Ministry of Information & Broadcasting. In fact, recently Network 18 group also had to withdraw its scheme as it failed to obtain approval from SEBI (Securities and Exchange Board of India) even after more than 12 months. So, in cases of businesses where approvals of other regulatory authorities are required or other ministries are involved, one should have a proper strategy to get approval under those regulations even before going to honorable NCLT or the shareholders. The present scheme seems to be internal restructuring exercise arising out of cash flow compulsion, regulatory requirements and in the process get some tax benefits.

Add comment