On May 27, 2017, the Board of Directors of Igarashi Motors India Ltd at their meeting approved the amalgamation of Agile Electric Sub Assembly Private Limited with the company and pursuant to the scheme, the company will issue bonus shares only to the public shareholders of the company and ensure compliance of minimum public shareholding after the merger.

Igarashi Motors India Ltd. (IMIL) was incorporated on January 10, 1992, as a public limited company. Presently, the shares of the company are listed on BSE and NSE. The company is in the business of manufacturing of permanent magnet DC motors for automotive sector specifically for passenger car. It has technical collaborations with Igarashi Electric Works (IEW), Japan, and International Components Corporation (ICC), US for technology transfer and sourcing of all critical plant and equipment. IMIL has market cap of Rs 2,967.18 crore on BSE.

Agile Electric Sub-Assembly Pvt Ltd. (AESPL) was founded in 2005, the company is based in Chennai. Agile Electric Sub Assembly Private Limited manufactures and markets DC motors and brush cards in India. Agile has five manufacturing units in MEPZ-SEZ, Tambaram and two units at Maraimalai Nagar, Kancheepuram Dist. Agile Electric Sub Assembly Private Limited and operates as a subsidiary of Igarashi Electric Works, Ltd.

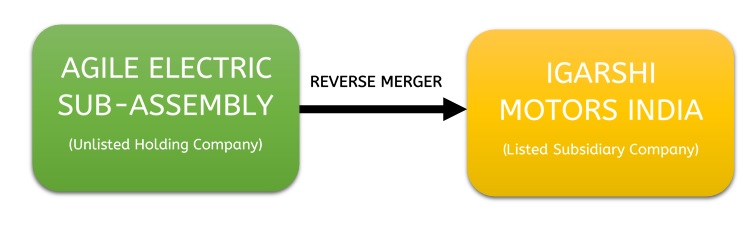

Structure

Valuation

The exchange ratio is decided as 35 equity shares of IMIL (of Rs 10 each fully paid up) for every 128 equity shares of AESPL of Rs 10 each fully paid up. And the appointed date is April 1, 2017.

Shareholding Pattern

Table 1: Pre & Post Restructuring & Bonus Shareholding Pattern

| Pre-Arrangement | Pre-Arrangement (% Holding) | Post-Arrangement but Before Bonus Issue (% Holding) | Post-Arrangement After Bonus Issue (% Holding) |

| Promoters | 75.00% | 76.31% | 74.59% |

| Public | 25.00% | 23.69% | 25.41% |

| Total | 100.00% | 100.00% | 100.00% |

Financials

Table 2: Standalone Financials (All Figs in INR Crores)

| Particulars | IMIL Mar-17 | AESPL Mar-17 | Combined position post-arrangement and after bonus issue |

| Total Revenue | 522.56 | 362.66 | 885.22 |

| EBT | 111.31 | 48.92 | 160.23 |

| PAT | 73.77 | 35.44 | 109.21 |

| Net worth | 370.35 | 231.92 | 521.87 |

| EPS | 24.10 | 6.51 | 33.06 |

| Fixed Assets | 160.51 | 188.17 | 348.68 |

| Secured Loans | 21.9 | 110.7 | 132.6 |

| Market Price | 841.55* | – | 973.6# |

*Rs 841.55 is the market price just before the date of announcement i.e. 26th May 2017.

# Rs 973.6 is the market price as on 15th September 2017.

The EPS for post amalgamation period is calculated by dividing Profit after Tax of Rs 109.21 crore with 3.30 equity shares post arrangement and after taking into consideration the impact of bonus shares. Due to higher interest cost in AESPL the combined EBT margin is reduced to 18%.

Table 3: Consideration

| Details | Crores |

| New shares issued to AESPL | 1.45 Shares |

| Shares already held by AESPL in IMIL to be cancelled on merger | 1.28 Shares |

| Balance shares for AESPL | 0.17 Shares |

| Market price of IMIL share when the scheme was announced | Rs 841.55 per share |

| Total Value | Rs 141.88 |

| PAT of AESPL | Rs 35.44 |

| Valuation amount | Rs 4.00 |

Accounting Treatment

The amalgamation of AESPL with IMIL shall be accounted by IMIL as per the pooling of interest method in accordance with Appendix C ‘Business Combinations of entities under common control’ of Ind AS 103 for Business Combination prescribed under Section 133 of Companies Act 2013.

Tax Implications

The amalgamation in this scheme is carried out as per Sec 2(1B) and the said transactions are covered under Section 47(vi), hence thereunder no tax liability will arise.

Why this amalgamation?

- Business Strategy Consolidation

The company would be able to diversify into new application areas and serve existing and new customers. AESPL manufactures customer designed products and IMIL develops and manufactures own designed and patented products. The customer designed products would require short product launch time. Combination of both the companies will clearly provide diversification, expansion and risk mitigation of market/customers/applications.

- Technology Aggregation

The aggregation of specific technologies in each of the companies will help in seamless engineering across the value stream for expansion into new products, applications and technologies.

- Business Chain Integration

The Amalgamation creates a Full-Service Supplier play by the Company, i.e. from Product Development, Process Development to Manufacturing in Tier-2, Tier-3 & Tier-4 as both companies have specialized focus at different Tiers.

- Shareholder Value

This amalgamation will result in improved shareholder value for the Companies by way of improved financial structure and cash flows, increased asset base and stronger consolidated revenue and profitability.

- Expansion & Scalability

The amalgamation will allow flexibility in utilization of manufacturing capacities in all operation Tiers enabling quicker launches in the manufacturing cycle and improved utilization of infrastructure and capacities. This will eventually make the company meet its customer/market demands in a timely and efficient manner.

Conclusion

It is a reverse merger of Holding Company AESPL into subsidiary IMIL. AESPL also has its own business over above the investment in IMIL. For the proposed merger, AESPL’s business is valued at 1*book value and PEX4 and based on that its shareholders will get 17 lakh additional shares. Post amalgamation IMIL will issue bonus shares to its public shareholders only, this creates a win-win situation for public shareholders. This is a good business strategy carried out by promoters in which we can see that the combined revenue is Rs 900 crore and with possibility of Rs 1,000 crore companies with improved profitability due to synergy in years to come. Further no doubt the whole scheme is fair to public shareholders and no negative impact on any other stakeholders also.