Signaling consolidation in the private banking space, IndusInd Bank and Bharat Financial Inclusion Ltd (BFIL), formerly known as SKS Microfinance, are in the final stage of merger talks. The two companies have signed an exclusivity agreement to hammer out a deal before the end of this financial year.

The merger comes at a time when Bharat Financial is facing stiff competition from banks. The deal will enable IndusInd Bank to expand its retail loan portfolio and also fulfill BFIL’s long-standing ambition to offer banking services. The proposed transaction, through share swap, would create an organization with assets worth Rs 1.26 lakh crore and a customer base of about 1.7 crore, according to June 2017 data.

Synergies in the merger

For IndusInd Bank, the merger will open up an opportunity to tap the rural market for mopping up deposits and give loans. Also, for IndusInd, the merger will give priority sector benefits, lower cost of funds and boost liquidity side of the business of the bank. It will also enable the bank to cross-sell products and reach the bottom-of-the-pyramid customers efficiently.

The strategic rationale for a merger for IndusInd would likely be access to a high-yield lending book at a time when the industry loan demand is weak. The merger will help IndusInd expand its microfinance loan book about three times, a target the Hinduja-owned lender was looking to achieve in the next three years. Moreover, IndusInd can use the excess priority sector loans (PSL) portfolio to earn fees through the sale of PSL certificates, which the Reserve Bank of India has now permitted. In fact, there is a good market for PSL certificates as they are sold to those banks that fall short of priority sector lending targets.

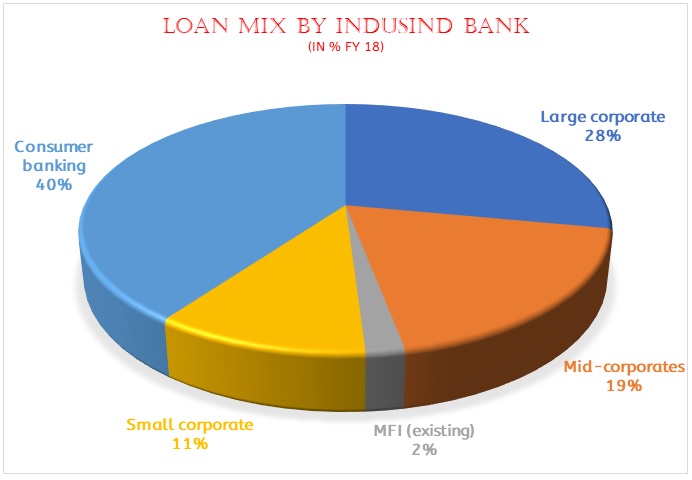

If the merger fructifies, it will be the third major deal for IndusInd Bank after acquisition of Deutsche Bank’s credit card portfolio in 2011 and RBS diamond financing book in 2015. IndusInd Bank has set strategic goal of achieving retail and corporate loan mix of 50:50 from 40:60 ratio at present. Also, within retail the banks aims to raise the share of non-vehicle loans to 50% from 26% now. This merger is expected to add non-vehicle retail loans of 6.6% to IndusInd’s existing loans and 5.3% to the combined balance sheet.

For BFIL, the merger will save them from various regulatory vagaries and reliance on banks for capital. It will have operational efficiency as a bank and gain from lower cost of funds. Since BFIL missed out on getting a banking licence, the merger will give the company’s shareholders access to banking business and a diversified loan book.

IndusInd Bank-Bharat Financial merger to be effective from July 4

If the merger takes place, BFIL’s accounts will be subject to more stringent accounting norms as a bank, though it follows a more conservative 60-days overdue non-performing loans recognition norm as compared to 90-days overdue for most banks.

The merger will allow the customers of BFIL to access savings accounts, small deposit products and the stickiness of customers will increase. Post merger, the cost of funds for BFIL will drop by 200 basis points which will help the microfinance lender as it has seen a large amount of loan write-off and higher provisioning on account of the impact of demonetization. With small finance banks able to access low-cost public deposits, BFIL would have struggled to be competitive on loan pricing.

Key financial parameters

Table 1: Financials of FY 18 Estimate (All Figs in Rs. Billion)

| IndusInd Bank | Bharat Financial | Merged | |

| Market cap | 768 | 114 | 882 |

| Total assets | 2151 | 138 | 2289 |

| Total loans | 1383 | 87 | 1470 |

| Net worth | 228 | 35 | 263 |

| Net profits | 36.8 | 7.7 | 44.3 |

| Tier 1 (%) | 13.2 | 28.3 | 14.3 |

| PE (FY18) x | 21 | 14.8 | 20.6 |

Source: Company data

Private banks buying MFIs

In the past, private banks have acquired microfinance institutions. As private banks are saddled with non-performing corporate loans, they are now looking at retail lending to shore up profits and microfinance institutions fit them well because of the rural reach and low default of repayments. The added benefit is that such acquisitions also enable banks to quickly meet their priority sector lending targets.

In fact, IDFC Bank was the first one to do so when it acquired Tamil Nadu-based microfinance institution called Grama Vidiyal in August last year. After that IDFC Bank along with its parent IDFC Ltd has announced merger plans with Shriram Group entities, bringing into play a blend of retail and corporate lending. Also, Kotak Mahindra Bank has announced acquisition of BSS Microfinance Ltd to leverage on the strong high-margin asset book of the company. With technology making branch-based models redundant, the microfinance institutions with last mile reach and technology have become a good hunting ground for banks for acquisition.

Regulatory issues and challenges

The first challenge is for both the companies to get together and agree on the common terms which will move the deal further. One advantage is that BFIL has business correspondent partnership with IndusInd Bank for quite some time. Both the companies know each other well and that synergy should work well, going forward. The potential transaction will also be subject to due diligence, agreement on the appropriate transaction structure and definitive documentation.

Both the organizations are working on a definitive agreement and will take few months for the processes as they have to go their boards, the regulator and shareholders. As both are independent board-run, management issues should not be a hurdle. Reserve Bank of India’s norms allow banks to buy a stake of up to 10% in a microfinance company or fully acquire it.

About Bharat Financial Inclusion Ltd

A widely held company, BFIL has 1,408 branches in 17 states and employs 15,300 people. Founded by Vikram Akula in 1997 as SKS Microfinance, it is the country’s second largest micro-financer. It also became the country’s first publicly-listed microfinance company in 2010. In the past, SKS had a tumultuous time as it faced a repayment crisis in its largest market of Andhra Pradesh and a corporate battle over leadership that ended with the exit of founder Vikram Akula.

Presently, the company has a customer base of 6.8 million and a loan book of around Rs 11,000 crore. It has reported a gross bad loan ratio of 6% at the end of June quarter compared to 0.1% a year earlier, as borrowers failed to repay loans after the demonetization of high value currency in November and December last year. In the three months to June quarter, the company wrote off Rs 176 crore worth of loans and posted a loss of Rs 37 crore compared to a profit of Rs 236 crore a year ago. With such a loss and write off, there were hardly any options left for Bharat Financial apart from a merger.

Since it is a microfinance company, it gives small loans to the unbanked poor, self employed, low income earners. Being a microlender, it has a disadvantage because the interest charges and spreads are capped and a single borrower cannot take loans from more than two institutions.

About IndusInd Bank

Conceived by Srichand P Hinduja, a leading NRI businessman and head of Hinduja Group, the bank started operations in 1994. The bank’s name was derived from the Indus Valley civilization. The bank’s total deposits and advances amounted to Rs 1,33,673 crore and 1,16,407 crore, respectively. The bank has a network of 1,200 branches and over 2000 ATMs.

Conclusion

While the potential merger appears synergistic and will boost earnings growth, IndusInd’s trading multiples may not necessarily benefit as concerns on periodic credit slippage in the segment may raise risk perception on the stock. However, given the fact that share of microfinance in IndusInd will be less than 10% of loan book, it appears manageable.