Strides Shasun Ltd (Stride), is a vertically integrated global pharmaceutical company headquartered in Bangalore. Stride has four business verticals, viz., regulated markets, merging markets, institutional business and active pharmaceutical ingredients. Stride has a global foot print spread across 85 countries. Shares of the company is listed on BSE and on NSE. Currently, the company has a market cap of Rs 9,100 crore (approx.)

Sequent Scientific Ltd (Sequent) is an integrated pharmaceutical company with a global footprint, operating in the domains of animal health active pharmaceuticals ingredients and formulation, human active pharmaceuticals ingredients, and analytics services. The equity shares of Sequent are listed on BSE and on NSE. Currently, it has a market cap of Rs 2,985.77 crore (approx.)

Solara Active Pharma Sciences Ltd (Solara) is a public limited company incorporated on February 23, 2017, with the objective of undertaking the business of manufacturing, production, processing, formulating, sale, import, export, merchandising, distributing, trading of and dealing in active pharmaceuticals ingredients. The entire issued and paid-up share capital of Solara is held by Strides and its nominees.

Transaction Overview

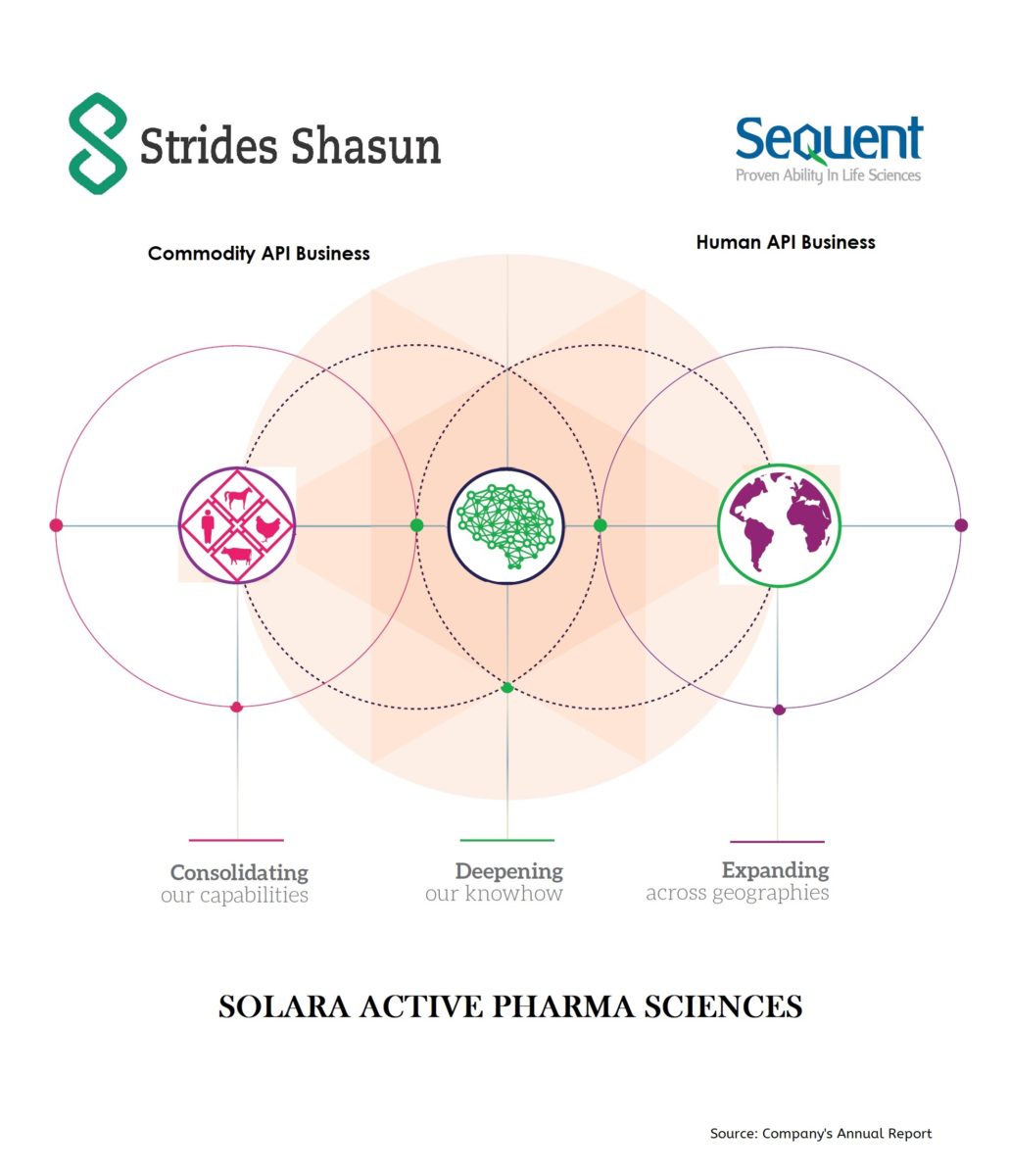

The scheme provides by way of a demerger of the Commodity API business of Stride and the Human API Business of Sequent both business being B2B requires separate strategy from the other business undertaking is the major rationale behind the scheme. The appointed date is October 1, 2017, or such other date as may be decided by the NCLT

Swap Ratio

Stride’s Equity Shareholders: 1 share of Rs 10 each in Solara for every 6 shares of Rs 10 each held in Stride.

Sequent’s Equity Shareholders: 1 shares of Rs 10 each in Solara for every 25 shares of Rs 2 each held in Sequent.

Note:

- ESOP Holders, Employees vested with Stock options of Stride & sequent will be provided with the options of Solara.

- CCI and Stock exchange approval received and currently the scheme is filed with NCLT

Accounting Treatment

In the books of Stride & Sequent (Demerged Companies)

Transfer of Assets & Liabilities at book value. Investment in Solara by Stride will be cancelled, the excess of book value of assets over liabilities as on appointed date will be reduced from Securities Premium. Difference between fair value of net asset transferred and adjustment in Securities Premium, shall be charged to surplus/deficit accumulated in Retained earnings.

In the books of Solara (Resultant Company)

Table 1: Accounting Treatment

| Treatment in the books of resultant company (with respect to demerger business of each company) | ||

| Particulars | For Stride Business | For Sequent Business |

| Recording of Assets & Liabilities | At Book Value | At Book Value |

| Securities Premium Creation | Difference between Book Value of net assets transferred and face value of equity share capital issued to be adjusted in Securities Premium Account | Equity Share issued will be recorded at premium with fair valuation arrived |

| Cancellation of Share capital of Stride | Shares held by Stride in Solara is to be cancelled and adjusted in capital Reserve | Not Applicable |

| Adjustment in Capital Reserve/ Goodwill | Not Applicable | Difference between deficit of book value of net assets over fair value of shares allotted will be recorded as goodwill and if any excess shall be recorded as other comprehensive income and included in capital reserve |

| Income tax Compliance | Though as per Ind-AS asset is to be recorded at fair value, for Income tax return purpose same is to be considered at Book value | |

Shareholding Pattern

Table 2: Pre & Post Restructuring Shareholding Pattern

| Particular | Pre-Merger | Post- Merger | ||||

| Stride | Sequent | Solara | Stride | Sequent | Solara | |

| Authorised Capital (in Rs) | 176,75,00,000 (of Rs 10each) | 50,00,00,000 (Of Rs. 2 each) | 100,000 (of Rs 10 each) | 176,75,00,000 | 50,00,00,000 | 30,00,00,000 (of Rs10each) |

| Issued & paid up capital | 89,42,30,006 | 48,74,72,390 | 100,000 | 89,42,30,006 | 48,74,72,390 | 24,65,32,820 |

| Promoters Stake | 31.09% | 57.24% | 100%* | 31.09% | 57.24% | 35.93%** |

| Public Stake (incl. ESOP trust) | 68.91% | 42.76% | NIL | 68.91% | 42.76% | 64.07% |

*100% stake is owned by Stride and its nominees.

** Some of the Promoters of Stride and Sequent has been classified under Public shareholding as a part of demerger other total promoters holding in Solara would have been 41.43%

Installed Facilities of Human API of Sequent

- Mangalore: 123.5 KL reactor capacity with six clean rooms TGA-GMP certified, WHO pre-qualified, USFDA inspected

- Mahad: 78.5 KL reactor capacity with two clean room EDQM approved and Cofepris Mexico certified

- Mysore: 67.3 KL reactor capacity with one clean room

Valuations

As per the valuation carried out, value of Stride’s – Commodity API business is Rs 859 crore (60.9%) and Sequent- Human API business is at Rs 552.50 crore (39.1%) which will merger into Solara. For valuation, Income Approach and Market approach is followed and weight assigned to them in ratio of 20:80 respectively for both the companies.

Conclusion

Since Animal Health API is now turning in profit and which also needs access to resources, management bandwidth and capabilities to enter the next phase of growth. As per management disclosure, currently, Animal health is heavy leverage from a balance sheet perspective, but they foresee some reduction in the overall leverage. However, they do anticipate more allocation of capital to the business so that the critical gaps in the animal health vertical gets filled. So they might have investors for future growth and keep leverage in control.

Whereas the new proposed entity ‘SolaraLife Sciences Limited’ which also gets the commodity API business of Strides Shasun Limited with Human API of Sequent which will achieve the critical size and scale to become one of the leading API companies from India. Since there is a tremendous opportunity for the API players to bring value to the formulators but they find it risky to partner with companies that also have an interest in the finished dosage business. Therefore, with this demerger they will be able to capture the said market.