On April 24, 2017, Reliance Communications (RCOM) received 99.99% of their shareholder’s approval for Scheme of Arrangement for demerger of the wireless division of the company and Reliance Telecom Limited (RTL), a wholly-owned subsidiary of the company, into Aircel Limited (AL) and Dishnet Wireless Limited. The company had already received approval from the Securities and Exchange Board of India, BSE, National Stock Exchange of India Limited and Competition Commission of India for the proposed Scheme of Arrangement.

This was a total noncash deal in which AL would issue and allot 15,950,000,000 fully paid up equity shares of AL in consideration for the demerged undertaking to Reliance Communications Ltd due to which RCOM was to become a 50% shareholder of AL. The deadline to complete the merger as per FMA was September 30, 2017.

What was RCOM’s blueprint to revive its fortunes?

| Particulars | Mar-17 (Rs In crore) |

| Total RCOM Debt on consolidated basis | 44,345 |

| On December 2016, RCOM signed binding agreements with Brookfield Infrastructure and its institutional partners for sale of its towers business. Due to which RCOM was to receive upfront cash payment of Rs 11,000 crore for a 51% stake in Reliance Infratel Ltd, this being one of the largest foreign direct investments in India. | 11,000 |

| Transfer of debt of Reliance Communications Ltd to Aircel under the scheme of arrangement | 14,000 |

| Balance debt left with RCOM shows a whopping 44% reduction in the debt | 19,345 |

Similarly, Sistema Shyam Teleservices Ltd’s (SSTL) merger with RCOM in which RCOM will get validity of its spectrum across eight circles — Delhi, Gujarat, Kolkata, Karnataka, Tamil Nadu and Kerala — extended till financial year 2033. The SSTL’s 850 MHz spectrum in eight circles is valued at Rs7,500 crore. This is an all stock deal where SSTL post-amalgamation will be allotted 10% equity stake subject to condition in RCOM and there is no cash outflow incurred by RCOM. As per scheme of arrangement with Aircel, the spectrum assets and liabilities of SSTL transferred to RCOM related to wireless telecom business will also be demerged to Aircel.

Reasons for collapse of the merger with Aircel

- DoT in its affidavit before the NCLT, has stated that the Supreme Court had restrained Aircel from selling and trading 2G spectrum allotted to it in 2006. The Supreme Court had also said that it may cancel Aircel’s use of the 2G licences if owners of the Maxis Group continued to avoid appearing before Indian courts in a case connected with irregularities in grant of 2G spectrum licenses. Maxis Group has a 74 percent stake in Aircel.

- The Department of Telecommunications (DoT) has submitted before the National Company Law Tribunal (NCLT) that Reliance Communication’s (RCOM) merger with Aircel would need a no-objection or clearance from the Supreme Court.

- As on date, the SSTL merger with RCOM did not received DoT’s No Objection Certificate. This scheme of merger was announced in November 2015 and the process was delayed by nine months from Feb 2016 to Oct 2016 in Bombay High Court by one shareholder holding <10 shares of RCOM. This possibly can be cited as intervention of vested interests to derail the deal.

- NCLT has admitted Ericsson India Pvt Ltd’s Insolvency proceedings application against Reliance Communications Ltd, Reliance Infratel Ltd and Reliance Telecom Ltd for total unpaid dues of Rs 1,150 crore and its hearing was due on October 6. 2017.

- During the quarter ended 31st March 2017, RCOM saw a decline of about 3 million subscribers and 9,00,000 subscribers of Aircel were lost between Dec and July, this was the period when merger was announced. It appears that both these companies didn’t participate in unlimited voice calling-a prepaid business voice segment.

How Lenders were unhappy with the deal

There are 14 major creditors of Aircel Limited who had filed together an objection petition with NCLT against this RCOM-Aircel merger. The details of which are as follows:

- Out of 14 creditors (objectors) of Aircel Limited, Chennai Network Infrastructure Ltd., Bharti Airtel Ltd., Indus Tower Ltd., Ericson India Pvt Ltd., requested NCLT to reject the scheme on the grounds that it was prejudicial to the rights and interests of the creditors.

- CNIL is an unsecured creditor holding debt of Rs 1,532.34 crore as on March 31, 2017, in Aircel Limited. And it raised a contention that it was not sent a notice of shareholders’ meeting being held for approval of the said merger scheme, meaning CNIL was not put in loop when shareholders were to give their approval for merger. And like CNIL Ericsson has also raised objections.

- NCLT in its decision have rejected the objections raised by the above creditors and now the merger is pending subject to Supreme Court’s No Objection Certificate. This can possibly be cited as legal and regulatory uncertainties.

Impact

- RCOM’s Debt Restructuring plan is in trouble.

- The Tower Sale deal of RCOM with PE firm Brookfield may be renegotiated and it will pay less than originally agreed for 51% stake in Reliance.

- If RCOM doesn’t provide the confidence as to how they plan to reduce their debt before December 2017, then lenders may convert debt to equity.

- Aircel will find it difficult to continue operations.

Changes in shareholding of RCOM since the merger announcement

| Particulars | Jun-17 | % holding | Particulars | Sep-16 | % holding | Difference in number of shares |

| Promoters | 1,46,46,96,844 | 59.00% | Promoters | 1,46,46,96,844 | 59.09% | 0 |

| Public | 99,67,54,247 | 40.15% | Public | 99,26,48,654 | 40.05% | 41,05,593 |

| Shares held by Employee Trust | 2,12,79,000 | 0.86% | Shares held by Employee Trust | 2,12,79,000 | 0.86% | 0 |

| Total | 2,48,27,30,091 | 100.00% | Total | 2,47,86,24,498 | 100.00% | 41,05,593 |

| Promoters Pledge holding % | 96,48,79,001 | 38.77 | Promoters Pledge holding % | 54,28,79,001 | 21.81 | 42,20,00,000 |

Exit done by major public shareholders as on June 2017 since the announcement of merger in September 2016

| Public Shareholders | Exit by nos of Shares | Exit by % stake |

| Mutual Funds/ | 74,14,711 | 0.30% |

| Europacific Growth Fund | 5,61,98,451 | 2.27% |

| Smallcap World Fund | 4,31,71,315 | 1.74% |

| Total | 10,67,84,477 | 4.31% |

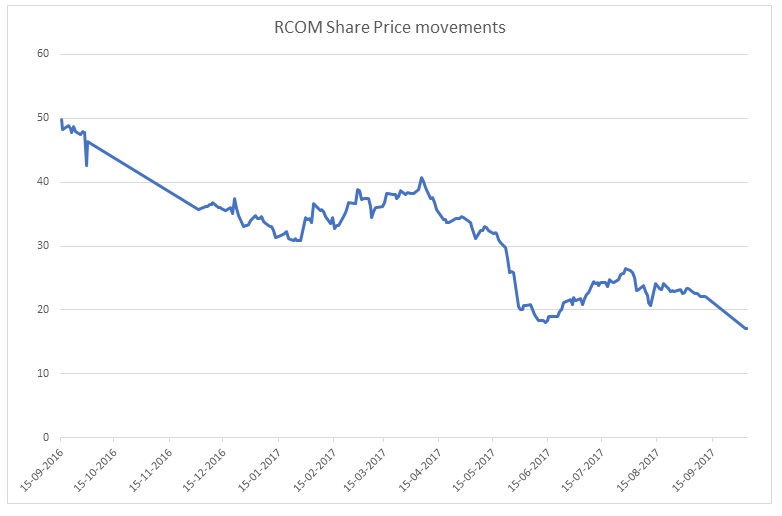

Share price movements

The share price was Rs 49.8 when the scheme was announced on September 15, 2016, till December it was declining until the binding agreements were signed with Brookfield Asset Management for sale of its Tower Business, since December the share price remained Rs 35.75 to Rs 34.5 up till April 2017. Since April the share price declined till date by 100% i.e. from Rs 34.5 to Rs 17.20 due to legal hurdles faced in the merger scheme.

Financial performance of RCOM

Consolidated Quarterly Financials Rs in crore

| Particulars | Mar-17 | Dec-16 | Mar-16 |

| Revenue | 4,524 | 4,922 | 5,980 |

| EBITDA | 1,084 | 1,206 | 2,003 |

| Depreciation | 1,393 | 1,165 | 1,372 |

| EBIT | -310 | 41 | 631 |

| Interest | 983 | 958 | 791 |

| EBT | -1,292 | -917 | -160 |

| PAT | -948 | -489 | 79 |

| Market Cap | 9,533 | 8,475 | 12,445 |

| EBITDA Margin | 24% | 24% | 33% |

| EBT Margin | -29% | -19% | -3% |

| Interest Coverage Ratio | -0.31 | 0.04 | 0.80 |

Details of increase in net debt on quarter on quarter basis Rs in crore

| Particulars | Mar-17 | Dec-16 | Mar-16 |

| Net Worth | 25,021 | 28,655 | 31,263 |

| Total Equity excluding minority Interest | 1,244 | 1,244 | 1,244 |

| Minority Interest | 400 | 379 | 520 |

| Net Debt | 44,345 | 42,803 | 41,362 |

| Other Liabilities | 25,029 | 26,573 | 21,083 |

| Total Assets (excluding cash and cash equivalents) | 94,796 | 98,409 | 94,227 |

| Net Debt/Total Assets | 0.47 | 0.43 | 0.44 |

| Net Debt /EBITDA | 40.93 | 35.50 | 20.65 |

Out of the above net debt, public sector banks such as State Bank of India, Punjab National Bank, IDBI Bank, Bank of Baroda, etc have the highest exposure to the default rated debt, which amounts to total of Rs 13,934 crore.

RCOM strategy for survival

- Though RCOM has come up with many attractive offers of voice calling and data services it is realistically not possible to increase the number of subscribers at this stage for them especially when Reliance Jio (RJio) is currently dominating the subscriber base. Hence there are doubts over the data led strategy. RCOM should reconsider this strategy.

- We see light in spectrum trading and sharing agreements with RJio, as this will enable RCOM to deliver access and connectivity to a world class, nationwide 4G LTE network to millions of valued customers, with minimal capex and considerably lower operating costs.

- Also, one of the option can to consider selling wireless business to the next best player possibly like Vodafone in which spectrum assets will be monetized and spectrum liabilities will be transferred. Or just wait for liquidation and let the wireless business die a slow death.

- Lastly, in the extreme case, if monetization of tower assets doesn’t provide a better value, then ADAG will have to sell other non-core businesses and use its proceeds to repay the debt.

Recent Developments

Comprehensive Debt Resolution Plan: R-Com’s debt resolution plan envisages no loan write-off by the lenders. R-Com will pay off up to Rs 17,000 crore of its debt, out of the proceeds of monetization of Spectrum, Towers and Fiber and MCN (Media Convergence Nodes) assets. R-Com will pay additional Rs 10,000 crore of its debt, out of the proceeds (Press Release dt. 30/10/17)

Conversion of Debt: Debt of Rs. 7,000 crore is proposed to be converted into 51% of the company’s equity, as per the SDR guidelines of the Reserve Bank of India. Shareholders of the company at the Annual General Meeting held on September 26, 2017, have already approved issuance of equity shares to lenders by conversion of loans. (Press Release dt. 30/10/17)

Scheme of arrangement: R-com informed stock exchanges about scheme of arrangement between R-com and SSTL made effective and effective date being 31/10/2017. R-com will issue Allotted fully paid up 27,65,53,305 equity shares of Rs 5 each to SSTL in terms of the Scheme which constitutes 10% of the fully diluted Equity Capital of the company. In addition, RCOM will assume the liability to pay the DoT, installments for SSTL’s spectrum, amounting to Rs 390 crore per annum for the next eight years. (Press Release dt. 31/10/17)

Conclusion

RCOM had started the second transaction with Aircel even though the first transaction with SSTL was not yet completed. And the terms of second transaction had included the transfer of assets acquired under first transaction to Aircel. Firstly, SSTL merger faced an opposition then Aircel merger faced an opposition from creditors. This resulted in delay due to legal hurdles coming in the way in completion of the said transactions.

Two zeros cannot add up to make one. RCOM and Aircel together were already dealing with substantial losses in the number of subscribers and debt repayment issues. This merger was destined to fail right from the start. What synergy benefits was RCOM getting by merging with a loss-making player? There was no value creation for shareholders, creditors and customers. Hence blaming vested interests for failure of merger is not a valid reason. Moreover, there will hardly be any buyers which will buy the wireless business and tower business of RCOM which is tainted.