The proposed merger of Indiabulls Real Estate Ltd.’s (IBREL) with two subsidiaries of Bengaluru-based Embassy Group will create one of India’s leading listed real estate development platforms with launched/planned area totalling to 80.8 Mn Sq. Ft, having 53% commercial and 47% residential assets, and 30 projects with key geographical focus in Mumbai (MMR), NCR, and Bengaluru. The Amalgamated Company will have a strong market leadership potential, post Amalgamation, with:

- Net surplus from Residential projects (including launched and planned projects) of ₹18,592 Cr

- Potential Annual rent on completion of planned commercial projects of ₹4,241 Cr

- Land Bank (with future development potential) of 3,353 acres

This transaction seems to be in line with group’s vision of consolidation of the real estate business with an earlier merger transaction announced by the group last year and covered in our September issue.

Indiabulls Real Estate Limited (IBREL) is a listed company and is engaged in the business of construction and development of residential and commercial properties across India.

NAM Estate Private Limited (NEPL) is engaged in the business of construction and development of real estate projects and provided allied services. It WoS of EPDPL pre internal restructuring and after internal restructuring promotors and groups, companies hold 78.4% and Institutional Investor holds 21.6%.

Embassy One Commercial Property Development Private Limited (EOCDPL) is engaged in the business of providing common area maintenance services to construction and development of real estate projects and other related services. It is WoS of EPDPL pre-swap exercise after swap exercise the entire shares holds by the shareholders of IPPL.

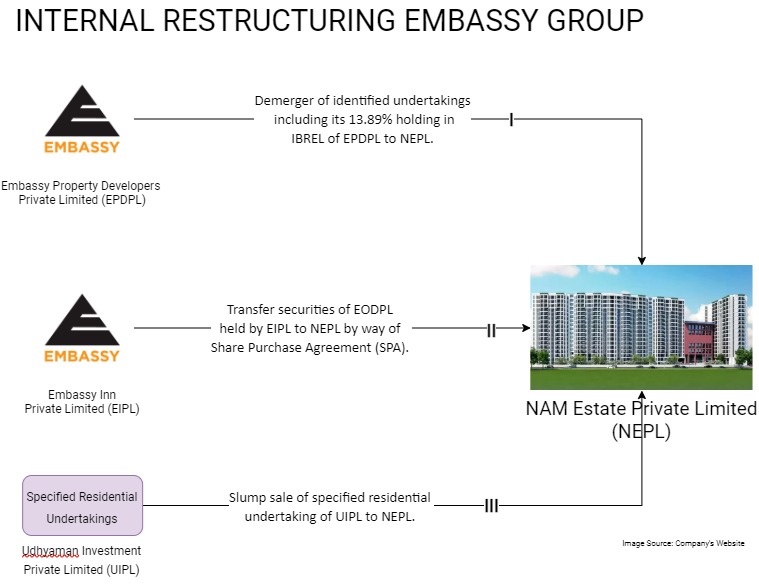

Pre-merger internal restructuring by Embassy Group

Other companies of Embassy Group involved as part of restructuring of Embassy group Embassy Property Developers Private Limited (EPDPL), Embassy One Developers Private Limited (EODPL), Embassy Inn Private Limited (EIPL), Udhyaman Investment Private Limited (UIPL), OMR Investment LLP (OMR), Embassy Infra Developers Private Limited (EIDPL). Before merger with Indiabulls embassy group went through massive internal restructuring to enhance value of NEPL before merger with IBREL as follow:-

- Demerger of identified undertakings including its 13.89% holding in IBREL of EPDPL to NEPL. As a consideration, NEPL issues 41 fully paid-up equity shares of Rs. 10 each for every 100 equity shares of Rs. 10 each.

- Transfer securities of EODPL held by EIPL to NEPL by way of Share Purchase Agreement (SPA).

- Slump sale of specified residential undertaking of UIPL to NEPL.

- Share swap with third party investors of securities held in identified SPV’s for equity shares of NEPL.

- Transfer of rights in residential units held by OMR to EIDPL by way of assignment agreement for sale followed by swap of consideration received for convertible securities of NEPL.

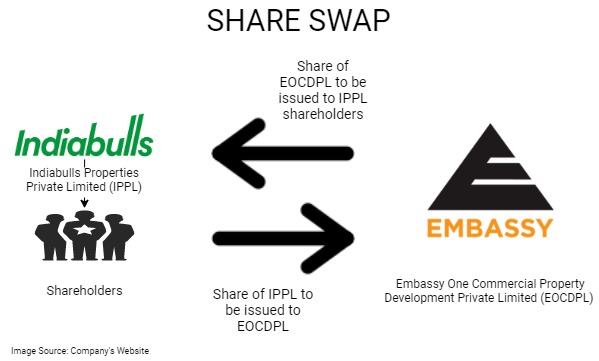

Pre-merger restructuring between private companies of both groups

Indiabulls Properties Private Limited (IPPL) comprises of the residential project ‘Sky.’ IPPL filed a demerger scheme with NCLT to demerge its commercial real estate and appointed /effective date of this part of the scheme will be post demerger effective date

Prior to the merger of EOCDPL with IBREL, the existing shareholders of IPPL would swap his share in exchange of EOCDPL shares.

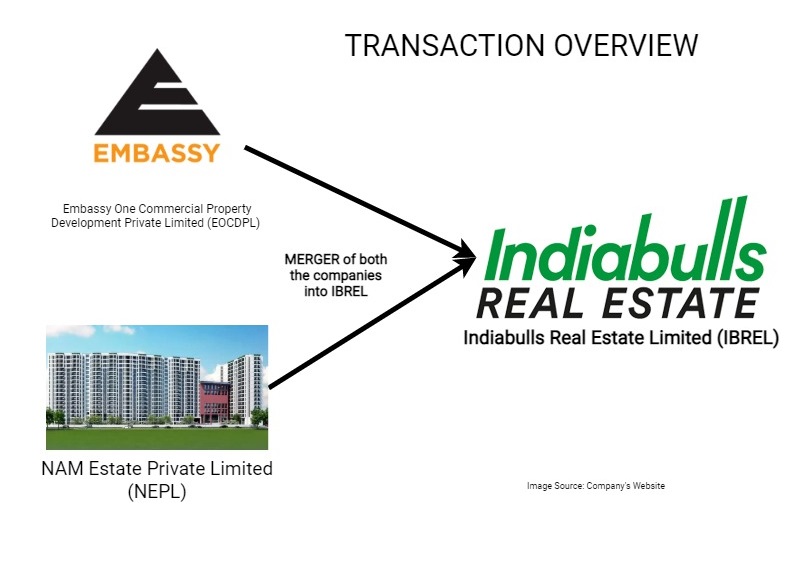

The Transaction:

Post internal restructuring as mentioned above, two Embassy group unlisted companies i.e., NEPL and EOCDPL are amalgamated with IBREL.

Appointed date:

The appointed date shall be –

- the effective date for the purpose of merger of NEPL with IBREL and

- for the purpose of merger of EODCPL with IBREL is later of

- thirtieth calendar day from the effectiveness of the IPPL demerger or

- approval from various authorities and other conditions. Thus, the Appointed Date and effective date is based on the approval of the other scheme filed by IPPL

Rational of the Scheme:

The Scheme:

Is for Consolidation of operation and business of amalgamating companies. no doubt, the scheme also achieves following objectives of parties to the scheme.

- The embassy group indirectly listing its businesses.

- To give exit or reclassify the existing promoters as public shareholders and Embassy group playing the role of promotors without going through takeover code and open offer procedures

- Existing promotors exit without selling their stake handover his listed co. to Embassy group.

The amalgamated company will cater not only to Bengaluru but will also have presence in other metro cities in India.

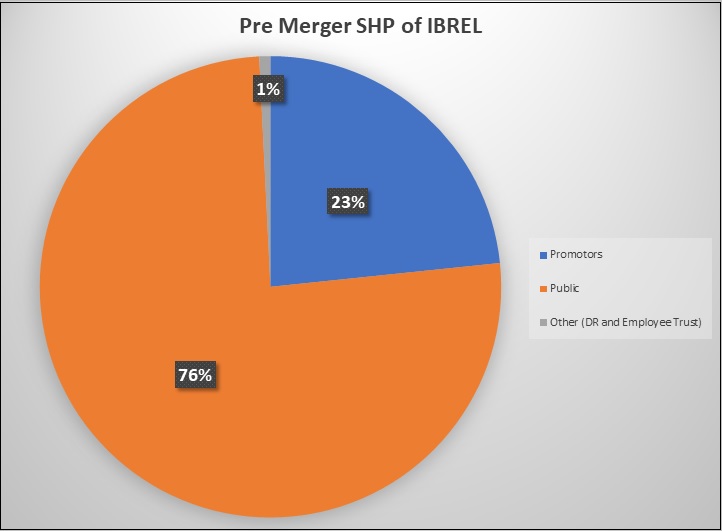

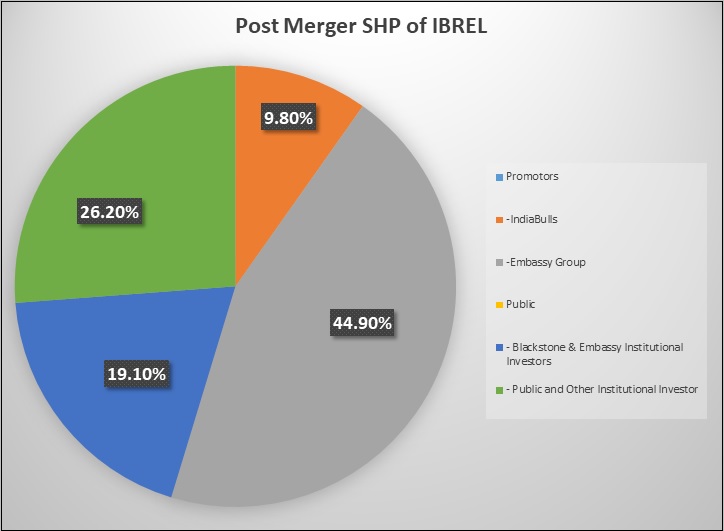

Shareholding pattern

In a scheme provided that if the shareholding of the IBREL promotors in the amalgamated company falls to or below 10%, the IBREL promotors shall reclassify as public shareholders.

Valuation:

Valuation for the purpose of a merger is done by arriving values through multiple methods and weights to be given to a method. For listed company 75% weight given to value arrive based on projected cash flows and 25% weights assigned to market rate value arrived based on the guidelines. However, for unlisted entity 100% weight given to projected cash flows. It is interesting to note that if 100% weights given to projected cash flow even in the case of listed company, valuation per share of IBREL will be circa 10% higher and IBREL promotors’ stake would have been more than 10%.

Consideration:

Consideration for:

- the merger of NEPL is 6619 equity shares of Rs.2 each for every 10000 equity shares of Rs. 10 each of IBREL.

- the merger of EOCDPL is 5406 equity shares of Rs. 2 each for every 10000 equity shares of Rs. 10 each IBREL.

Conclusion

This is the ideal scheme for both the parties in the present circumstances as it does not require the acquirer i.e., Embassy group to sell out any cash to increase its stake in the listed entity to pay off the present promotors but also no open offer is required to give exit to public shareholders as otherwise may be required under the takeover code. For present promotors, the scheme will provide better option to exit by selling in the open market whenever they feel valuation is right. It is also reducing risk for public shareholders as it will have better management and wider portfolio of projects in different metro cities. Jitendra Virvani (Embassy) in an interview said our immediate focus would be to generate liquidity of ₹10,700 crore by selling near completion/under construction inventory, which requires little additional capital of ₹200 crores. The liquidity generated will be redeployed for planned projects and new market opportunities.

Add comment