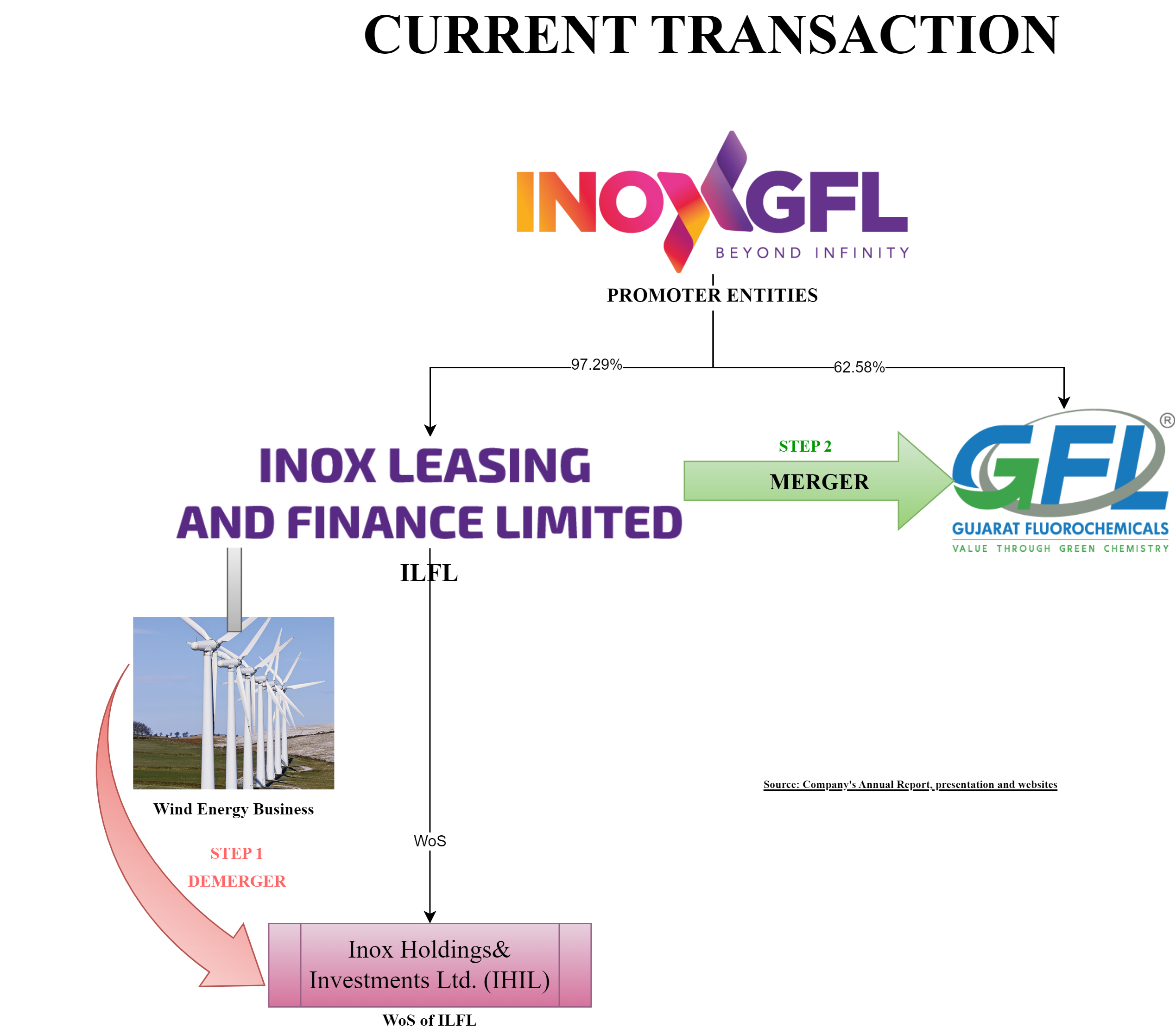

The Board of Directors of some of Inox Group entities have approved a Composite Scheme of Arrangement which provides for first demerger of the Wind Business of Inox Leasing and Finance Limited being a promoter group entity into Inox Holdings and Investments Limited and subsequently, the merger of remaining Inox Leasing and Finance Limited into Gujarat Fluorochemicals Limited to provide direct holding of the listed company to the promoters.

Gujarat Fluorochemicals Limited (‘GFCL’ or ‘Transferee Company) is engaged in the business of manufacturing and trading of Refrigerants, Fluorochemicals, Fluoropolymers and allied activities and other bulk chemicals. The equity shares of GFCL are listed on nationwide bourses. GFCL is in the process of changing its registered office from the state of Gujarat to Himachal Pradesh.

Inox Leasing and Finance Limited (‘ILFL’ or ‘Demerged/Transferor Company’) is engaged in the business of generation and sale of wind energy directly which is very small which it acquired in March 2023 by way of a slump sale for circa INR 17 crore from its subsidiary Inox Wind Energy Limited. It is also a holding company to group’s listed companies engaged in wind business. It also holds 52.61% of GFCL share capital. ILFL is registered with the Reserve Bank of India as non-banking financial company (NBFC). ILFL is in the process of changing its registered office from Delhi to Himachal Pradesh. Currently, circa 98% equity stake of ILFL is held by Inox group promoters and the remaining 2% are with other shareholders.

Inox Holdings and Investments Limited (‘IHIL’ or ‘Resulting Company’) is incorporated to facilitate the proposed transaction. IHIL is a wholly owned subsidiary of ILFL. The registered office of IHIL is in Himachal Pradesh.

The Inox GFL Group has been doing a lot of restructuring since quite a few years. The renewable energy business especially the Wind Energy business too has undergone lot of corporate restructuring. We covered the transaction of reverse merger of the holding company into its subsidiary in our article in September 2023 issue.

The Proposed Transaction

The proposed scheme of arrangement inter-alia provides for the following things which shall be given effect in chronological order:

- Demerger of Wind Business of Inox Leasing and Finance Limited into Inox Holdings and Investments Limited and

- Merger of remaining Inox Leasing and Finance Limited into Gujarat Fluorochemicals Limited.

The wind business preliminary consists of the wind energy business which ILFL acquired in 2023 along with strategic investment of ILFL in Inox Wind Limited, Inox Wind Energy Limited etc. From FY 2024 financials, the yearly income from wind energy was merely INR 3.69 crore. thus, substantial part of the undertaking shall consist of ILFL investment in its listed subsidiaries engaged in wind energy plus some surplus assets available.

As provided in the scheme, transferred assets & liabilities shall be compliant with provisions of section 2(19AA) of the Income Tax Act, 1961 including that of qualifying the litmus test of “being an undertaking”. Through demerger, ILFL shall transfer its entire assets & liabilities except for investment in equity shares of GFCL and other investments to IHIL.

The rationale for the proposed transaction:

- The segregation will result in huge value unlocking and will attract opportunity to attract different investors in its wind business

- The demerger will result in better price discovery for the business with clear capital allocation

- The merger will result in simplification of shareholding structure of GFCL along with reduction in legal entities for the group

Considering the size of the wind energy business, it will be interesting to see how above stated rationale holds in the coming future. It appears, the main reason for the entire transaction is third rationale which is collapsing the holding structure for GFCL and to achieve this, demerger was planned so as to transfer other assets of ILFL first.

The appointed date for both transactions will be 1st January 2025, or such other date as may be approved by the Hon’ble NCLT or board of directors. The key reasons for keeping the prospective appointed date could be completion of shifting of the registered office and the scope for reshuffling any assets & liability in ILFL which is not to be transferred to GFCL.

Share Capital & Swap Ratio

For the proposed demerger:

IHIL shall issue 1 equity share for every 1 equity share held in ILFL. Thus, the shareholding pattern of IHIL; post demerger will be mirror-imaged to the existing shareholding pattern of ILFL.

For the proposed merger:

As ILFL will have no other assets (and liabilities) except 5,77,91,906 equity shares of GFCL, GFCL will issue 5,77,91,906 equity shares to the shareholders of ILFL on a proportionate basis to their holding in ILFL. Thus, GFCL will not issue any incremental shares than the existing share capital.

Other Interesting Terms:

- All costs relating to the demerger shall be borne by the resulting company

- All costs for the merger will be borne by the transferor company. However, it is not clear whether promoters will keep the surplus amount to that extent with ILFL or it shall be transferred to the GFCL as a part of the merger.

- The scheme also provides for the classification of certain person from “promoter Group” to “promoter” and additional “promoter” and “promoter group” in GFCL pursuant to the merger. To avoid any further SEBI compliances/approval, the proposed reclassification is drafted with due care and provides that approval of the scheme shall be deemed to compliant with all required compliances.

- Further, the scheme provides that the merger of the remaining ILFL with GFCL shall be complied with Section 47 & Section 72A along with Section 2(1B) of the Income Tax Act, 1961. From the financials shared, ILFL does not have any carry forward losses and even if it has, it is difficult to get carry forward as the remaining ILFL will not likely to be an “Industrial undertaking”.

- The issue of shares clause for the proposed merger also provides that the swap ratio shall be adjusted if bonus, split, buyback, capital reduction or conversion of preference shares are being converted into equity shares. The scheme also provides power to companies involved to raise the fund as may be required. Though there won’t be any change in swap ratio if GFCL issues additional shares, enabling clauses must have provided if the management decided to raise capital in ILFL.

Conclusion:

The proposed transaction will pave the way for simplification of promoters holding in GFCL. At the same time, minority shareholders of ILFL shall get part liquidity with respect to their indirect holding in GFCL.

One may give a thought that instead of demerging the wind energy business into IHIL and continuing the holding-subsidiary structure for its wind energy business, ILFL could have demerge straight into Inox Wind Limited and collapsing the holding-subsidiary structure. One of the reasons for not doing so could be ongoing scheme of streamlining wind energy business by Inox Group (Inox Wind Energy Limited getting merged with Inox Wind Limited). In future we may see reverse merger of IHIL with Inox Wind Limited.

It will be interesting to see whether tax authority questions on undertaking fulfilment as major wind energy business is carried through subsidiary and NCLT approval as similar scheme was rejected by Mumbai NCLT years back however, many similar schemes are approved as well.