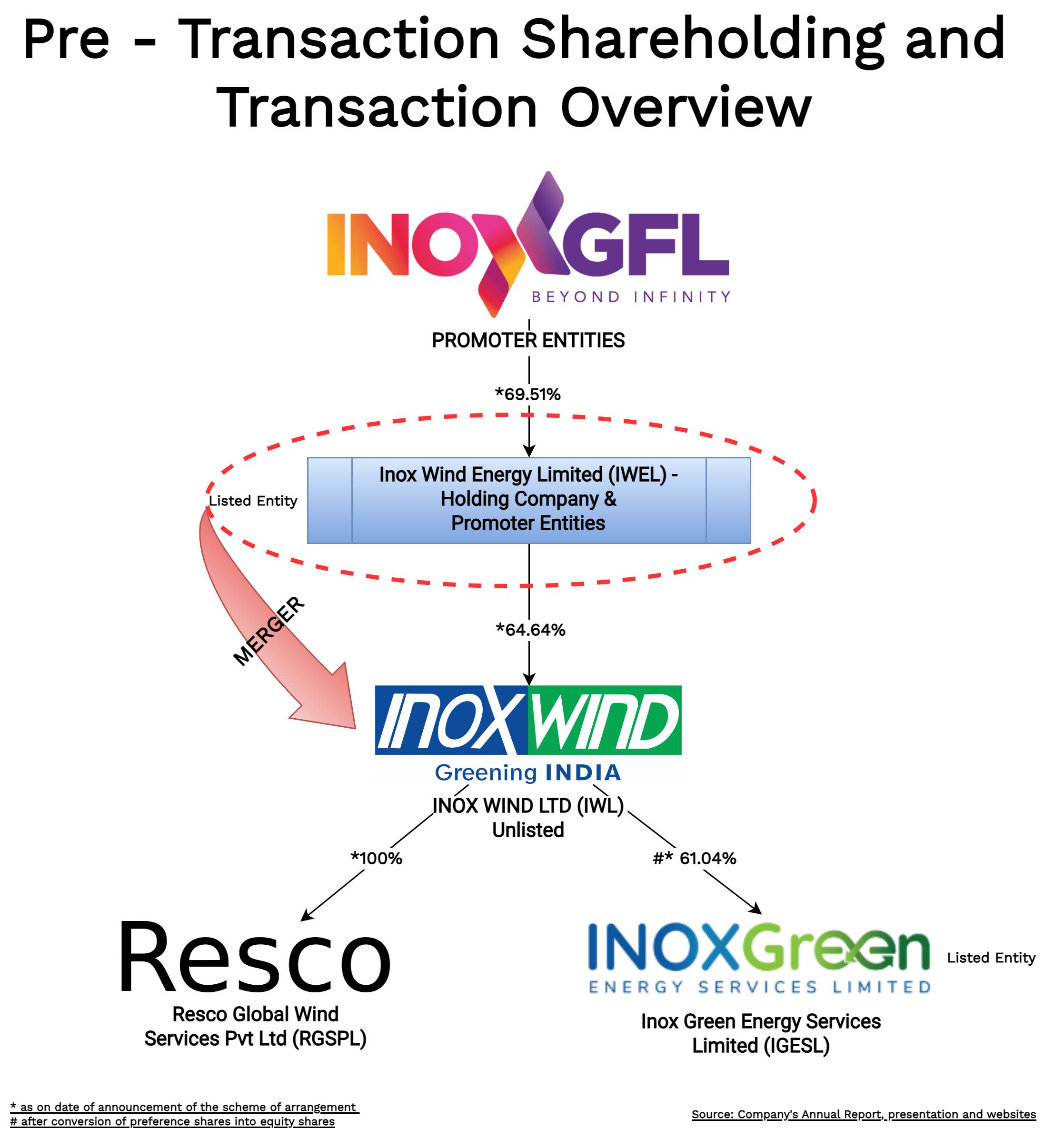

In 2020, Inox Wind Energy Limited was incorporated to facilitate the Composite Scheme of Arrangement between GFL Limited, Inox Renewables Limited and Inox Wind Energy Limited approved by the National Company Law Tribunal (NCLT) on 25th January 2021, Ahmedabad Bench with appointed date 01st July 2020 effective from 09th February 2021.

Inox Wind Energy Limited (“IWEL” or Transferor Company”) is engaged in the business of generation and sale of wind energy, providing services for Erection, Procurement and Commissioning (“EPC”) of wind farms and holding a strategic business interest in renewable energy. The equity shares of the company are listed on nationwide stock exchanges.

Recently, to streamline execution of the proposed scheme of amalgamation, IWEL changed its registered office from the state of Gujarat to Himachal Pradesh, the state where registered office of the transferee company is located.

On 28 March 2023, IWEL’s Board of Directors approved the transfer of its “Wind Energy Business” to its holding company, Inox Leasing and Finance Limited by way of slump sale through a Business Transfer Agreement for a consideration on circa INR 17 crore.

Based on the standalone financials statement for the year ended 31st March 2023, company becomes a Core Investment Company (CIC) in accordance with section 45-IA of the Reserve Bank of India Act, 1934. Interestingly, for the previous year (FY 2022) it was not CIC.

Inox Wind Limited (“IWL” or “Transferee Company”) is engaged in the business of manufacture and sale of Wind Turbine Generators (“WTGs”). It also provides EPC, Operations & Maintenance and Common Infrastructure Facilities services for WTGs and wind farm development services. The equity shares of the company are listed on nationwide stock exchanges. Recently, one of the company’s subsidiary, Inox Green Energy Services Limited went for an Initial Public Offer (“IPO”).

Currently, IWEL is holding circa 50.20% stake in IWL.

The Transaction:

Board of Directors of IWEL & IWL, has considered and approved the Scheme of Arrangement between Inox Wind Energy Limited and Inox Wind Limited and their respective shareholders which provides for holding company into its subsidiary.

The Appointed Date for the proposed merger is 1st July 2023 or such other date as maybe approved by the Hon’ble National Company Law Tribunal. This appointed date is exactly 3 years after the appointed date for its previous demerger of “Renewable Energy Business” which created two listed holding companies for the group.

Rationale for the scheme:

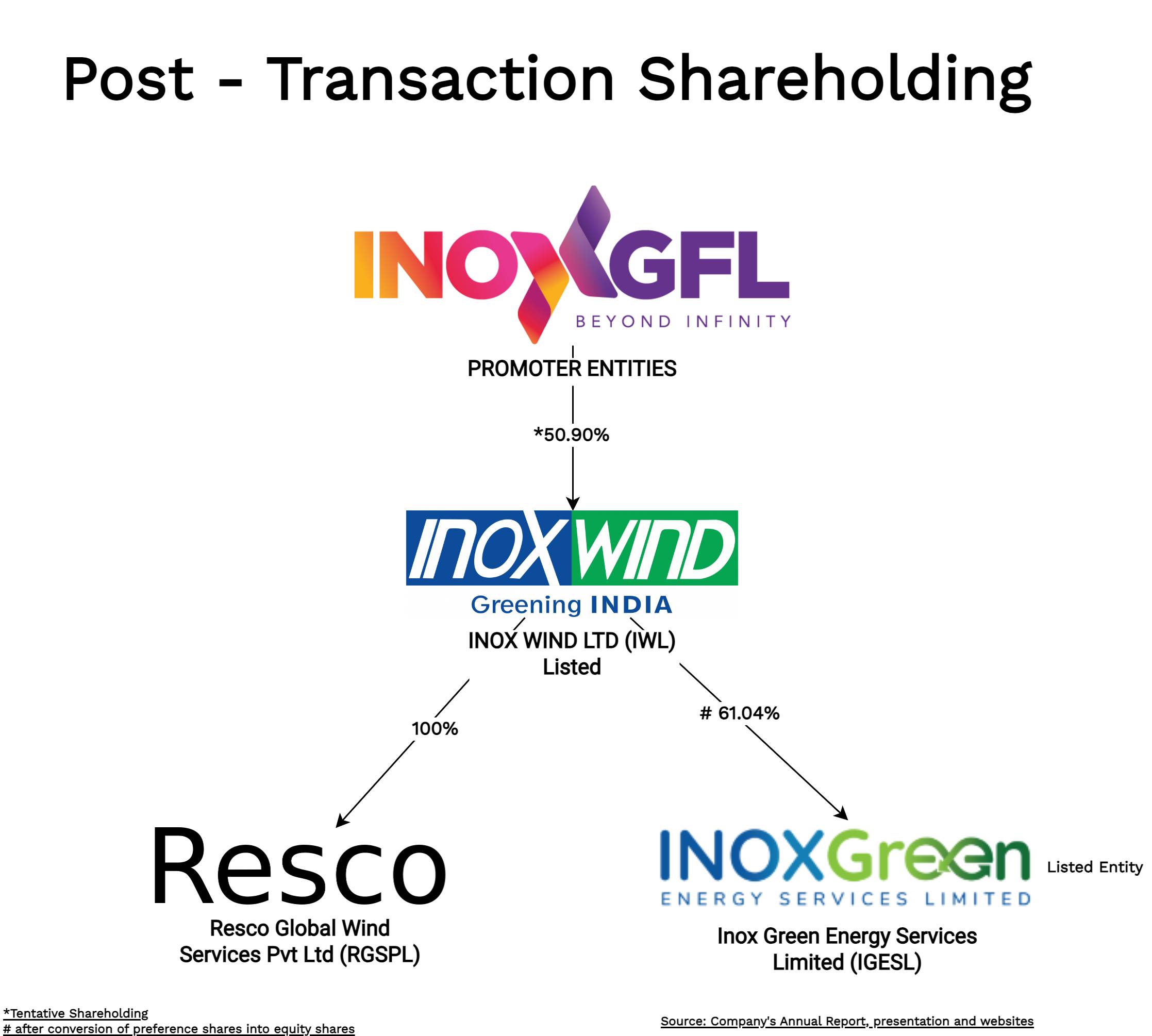

Streamlining group structure and operations – The Scheme ensures simplified and streamlined group structure by reducing the number of listed entities in the group. The Scheme ensures better synergy of operations by way of focused operational efforts, standardization & simplification of processes and productivity improvements which will entails the following advantages:

- Improve the overall operational efficiency and effectiveness of the combined businesses;

- Reduction in the overall operational, administrative and compliance cost.

Though the scheme also mentions about consolidation of wind energy business, IWEL has sold “Wind Energy Business” to its holding company and thus left with miniscule operating business now.

Consideration:

In consideration of the amalgamation of IWEL into IWL, IWL shall, without any further act or deed, issue and allot to every member holding equity shares in the Transferor Company and whose names appear in the Register of Members of the Transferor Company on the Specified Date in the following ratio:

158 equity shares of face value of Rs. 1o/- each of IWL to be issued for every 10 equity shares of face value of Rs. 1o/- each of IWEL

| Particulars | IWEL | IWL | IWL (Post Merger) |

| Paid-up Equity Share Capital | 1,20,47,573 | 32,59,45,496 | 35,26,66,778 |

| Face Value | 10 | 10 | 10 |

| Promoters Stake | 69.51% | 64.64% | 50.9% |

*: IWEL holds 50.2% stake in IWLIn pursuant to the merger, the promoters will hold circa 50.9% in the merged entity. The public shareholders of IWL will hold circa 32.7% and public shareholders of IWEL will hold circa 16.5% in the merged entity.

Fund Raising Initiatives:

Inox Group is continuously looking to deleverage the IWL’s balance sheet. One of the key initiatives was IPO of Inox Green Energy Services Limited last year. After announcing the merger deal, IWEL along with other promoter entities sold circa 7.36% stake in IWL which was re-invested into IWL in the form of non-convertible preference shares. IWEL sold circa 4.49% stake in IWL and realised INR 300 crore. Pursuant to the stake sale, IWEL’s holding in IWL decrease from 54.70% to 50.20%.

The promoter entities infused circa INR 500 crore in IWL including INR 350 crore by IWEL in IWL. Simultaneously, promoters’ entities of IWEL also converted the warrants issued to them in IWEL in 2022 into equity shares by paying the requisite amount.

Conclusion:

Historically, the wind energy business has always required huge capital for manufacturing as well for operations. Promoters of the Inox-GFL group seems to believe the conditions are now favourable for growing the renewable energy business. That is why promoters are envisaging to streamline the corporate structure & same time deleveraging the balance sheet of operating company. Interestingly, the holding company (IWEL) sold its equity shares in IWL, realised the amount and re-invested the amount into IWL in the form of non-convertible preference shares.

It looks like, the management is restructuring the company structure to make it more inviting for fundraising in the future even at the cost of reducing their beneficial stake.