In March 2020, the Board of Directors GFL Limited approved the Scheme of Arrangement between Inox Renewables Limited, GFL Limited and Inox Wind Energy Limited.

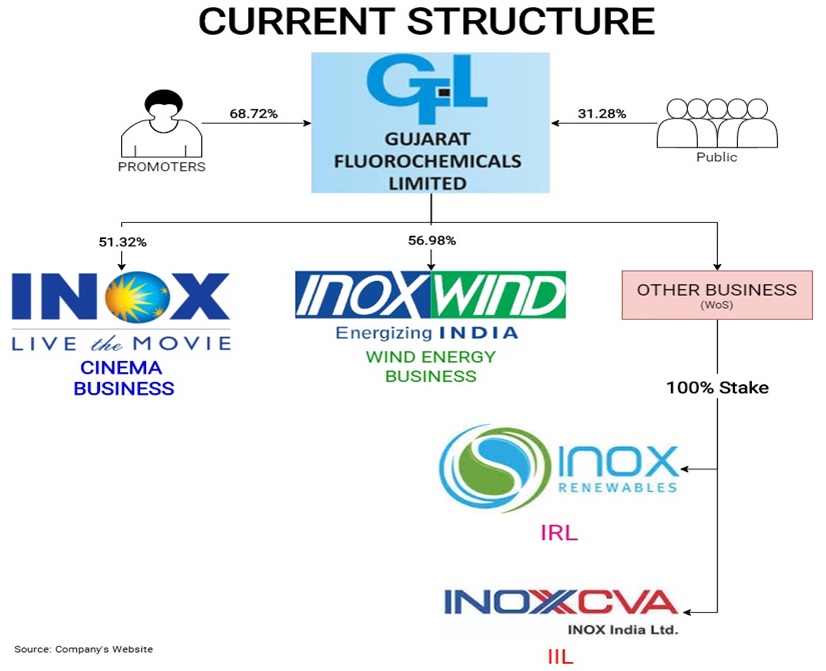

GFL Limited (GFL) earlier known as Gujarat Fluorochemicals Limited is a public limited company, listed on both the leading Stock Exchanges of India –BSE Limited and the National Stock Exchange of India Limited. GFL Limited holds strategic business interest in leisure, infrastructure and renewables.

- 51.3% stake in INOX Leisure Limited (ILL) – operates a national chain of multiplex cinema theatres

- 56.98% stake in INOX Wind Limited (IWL) – provides wind energy solutions to customers, who are primarily IPPs

Inox Renewables Limited (IRL) is currently engaged in the business of generation and sale of wind energy and providing services for the Erection, Procurement and Commissioning (EPC) of wind farms. The entire share capital of the IRL is held by GFL Limited.

Inox Wind Energy Limited (IWEL) is incorporated for this transaction. The entire share capital of IWEL is held by GFL (Gujarat Fluorochemicals Limited) Limited.

Inox Wind Limited (IWL) is another listed group company involved in manufacturing state-of-the-art wind turbine generators, rotor blades and tubular towers. However, IWL is not directly part of the Scheme.

Current Structure

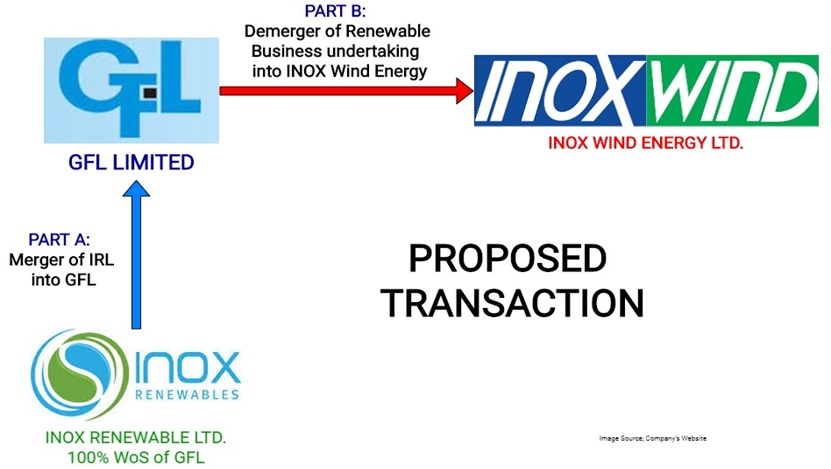

The Transaction

To consolidate the Renewable energy business of the group, GFL Limited has decided to do an internal restructuring in two parts:

Part A – Amalgamation of Inox Renewables Limited, wholly-owned subsidiary of GFL Limited, into GFL Limited and

Part B – Demerger of Demerged Undertaking (comprising of Renewable Energy Business) of GFL Limited into Inox Wind Energy Limited.

The Appointed date for the transaction:

- In relation to Part A of the Scheme, the Appointed date will be 1st April 2020

- In relation to Part B of the Scheme, the Appointed Date will be 1st July 2020

As consideration for Part B, all the shareholders of GFL Limited will be issued one fully paid-up equity share of INR 10 each in Inox Wind Energy Limited, for every ten fully paid-up equity share of INR 1 each held by them in GFL Limited. The shareholding of Inox Wind Energy Limited, therefore, will be identical to the shareholding of GFL Limited and Inox Wind Energy Limited will be separately listed.

Proposed Transaction

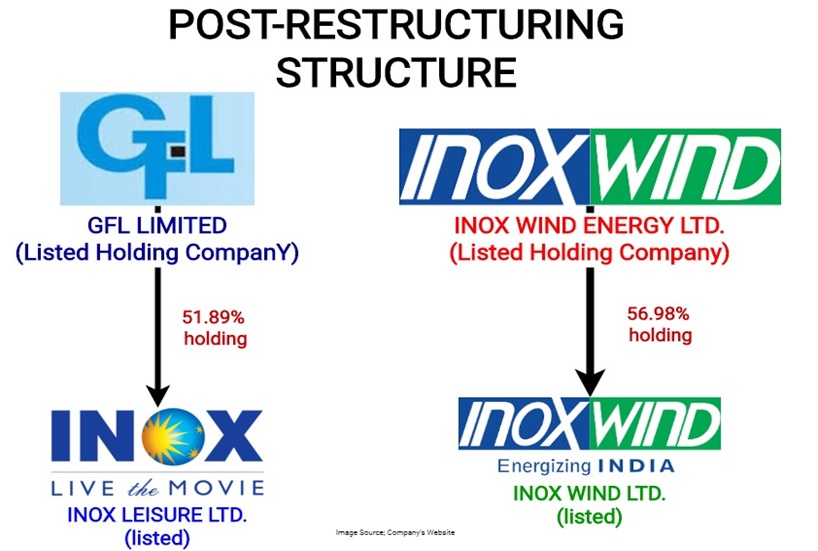

Post Restructuring Structure

As no significant business will be left in GFL after the proposed restructuring, the significant asset which will transfer as a part of the undertaking will be an investment in Inox Winds Limited. Further, as mentioned in the proposed Scheme, all the investments of GFL Limited relating to the Renewable business will be part of its demerged undertaking. Hence, the investment in Inox Winds Limited is likely to be a part of the demerged undertaking. After the proposed transaction, GFL Limited will continue to be a holding company for Inox Leisure Limited. Its investment in Inox Wind Limited will get transferred as a part of the undertaking and Inox Wind Energy Limited will become the holding company for Inox Wind Limited. After, the restructuring, the group will have two separate listed holding companies for its two different listed operating businesses.

Earlier Transactions

GFL Limited had floated two subsidiaries to pursue its wind energy business -Inox Wind Limited and Inox Renewables Limited. Inox Wind Limited manufactures ultramodern wind turbine generators, rotor blades and tubular towers and Inox Renewables Limited to operates wind farms. Pursuant to its decision to grow its wind energy business in its subsidiary, and to enable raising non-recourse capital for the same, in 2012, GFL Limited had transferred, by way of a slump sale, its entire wind energy business, comprising of 69 MW of operational capacity, and 70 MW of capacity being set up, to Inox Renewables Limited. That time GFL said that it is already in discussions with various equity and debt capital providers for funding the growth in this business.

In 2017

Inox Renewable Limited was operating 139 Wind turbine generators (WTG’s) for the generation and sale of power. During FY 2017, IRL (Inox Renewables Limited) decided to sell its 125 WTG’s and in pursuance thereof, entered into Business Transfer Agreement (BTA) with a party to transfer 125 WTG’s. However, BTA pertaining to 4 WTG’s lapsed and it transferred only 121 WTG’s.

As a result of this, IRL substantially exited wind farming business by selling 246 MW out of 269 MW of operations.

In 2018-19

All assets and liabilities pertaining to the Chemical Business Undertaking of GFL Limited (earlier Gujarat Fluorochemicals Limited) were transferred to a new resulting company on a going concern basis with effect from the Appointed Date i.e. April 01, 2019. Further, as per the said order, the name of Gujarat Fluorochemicals Limited is changed to GFL Limited.

Earlier this year

Earlier this year, GFL Proposed instead of merger of IRL, it announced demerger of Renewable Business of IRL into GFL and then again demerger of Renewable Business into IWEL. However, within a month, it decided instead of demerger, it will merge IRL with GFL Limited.

Financials

Table 1: Financials of IRL as on 31.03.2019 (All Figs in INR Crores)

| Particulars | Amount |

| Total Assets | 154 |

| CWIP | 431 |

| Total Assets | 651 |

| Networth | 127 |

| Revenue | 23 |

| PAT | 21 |

As per the disclosure made to the exchange, the total assets of IRL as on 31st December 2019 are INR 517.94 crores & total turnover is INR 8.98 crores.

GFL Limited has given significant intercompany deposits and advances for the purchase of assets to group companies including Inox Wind Limited and its subsidiaries.

Table 2: Financial Transactions of GFL Ltd. (All Figs in INR Crores)

| Particulars | Amount |

| Advances for purchase of assets | |

| Inox Wind Limited | 220.10 |

| Inox Wind Infrastructure Services Limited | 50.60 |

| Guarantees | |

| Inox Wind Infrastructure Services Limited | 269.87 |

| Inter Corporate Deposits | |

| Inox Renewable Limited | 242 |

| Inox Wind Infrastructure Services Limited | 100 |

| Inox Wind Limited | 94.85 |

Conclusion

The restructuring is announced with an aim of consolidating “renewable business” under one roof. However, it looks, even after the transaction, there will be a holding-subsidiary structure for the renewable business. After the transaction, IWEL will not have any significant operating assets and the major assets will continue to be investment in IWL. GFL in the process will continue to become a holding company for Inox Leisure Limited. The structuring in turn will create two separate listed holding companies for the group.

The reason for such structure instead of directly collapsing the holding-subsidiary structure could be implications under certain laws. Further, another reason for not collapsing the structure could be to comply with the covenant from lenders to maintain a minimum 51% stake in IWL. In the future, we may see another re-structuring to collapse the holding-subsidiary structure.

Add comment