The National Company Law Tribunal (NCLT) has cleared the Kalrock-Jalan plan (Resolution Applicant or RA) to revive Jet Airways Limited (Jet). The tribunal order comes exactly two years after the start of the insolvency proceedings. Jet is the first airline to see a resolution under the Insolvency and Bankruptcy Code (IBC). In this article, we have tried to understand the returns generated by the shareholders especially minority investors and what is next for them?

We had reviewed the JET Airways journey of admission under IBC in April 2019.

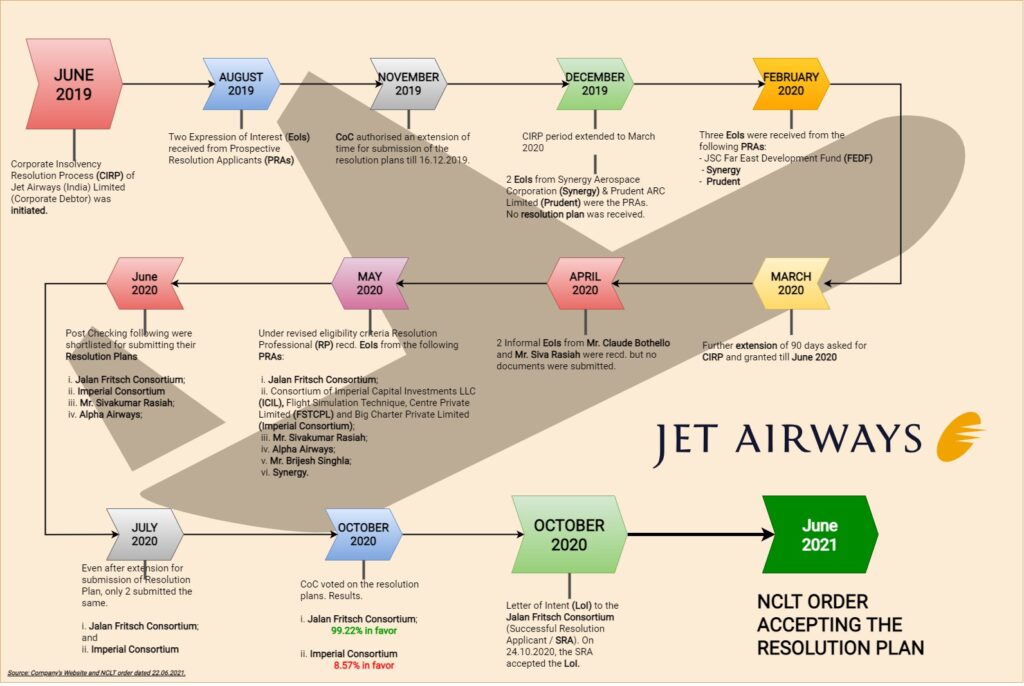

Below we present the Corporate Insolvency Resolution Process (CIRP) of Jet Airways from June 2019 to June 2021.

Salient Features of the Resolution Plan:

| Particulars | Comments |

| Assenting Financial Creditors | Assenting Financial Creditors (AFC) will get ₹ 185 crore within 180 days and ₹ 195 crore (in the form of Zero-Coupon Bond issued on the effective date) in year 2 plus guaranteed Net present value of ₹ 391 crore in year 3,4,5 through an issue of 0.001% Non-Convertible Debentures. RA will also pay an upside amount on aircraft sales and other things

In addition to it, AFC will receive 9.5% equity stake in Jet and 7.5% equity stake in Jet Privilege Private Limited (JPPL) and 100% stake in Jet Lite (India) Limited. |

| Workman and Employees | Workman and Employees will receive 52 crores within 180 days. In addition, RA also proposed to transfer an equity stake of 0.50% in Jet to the employees’ trust.

Further, as part of the resolution plan, RA has sought the demerger of third-party ground handling business of the Corporate Debtor to its wholly-owned subsidiary – Air-jet Ground Services Limited (AGSL). The RA will transfer 76% equity stake in, and management control of AGSL to the Trust after the Approval Date. In addition to it, there will be other things like Free Tickets, IT Equipment, etc. |

| Operating Creditors | ₹ 15,000 to each of the Operational Creditors, irrespective of their claim amount. |

| JJPL | RA will buy 50.01% shareholding in JPPL from Etihad and infuse ₹ 25 crore in the company. |

RA will give total cash of around ₹ 475 crore to various claimants and some equity stake in Jet as well as in JPPL to Financial Creditors. In addition, RA will also infuse ₹ 250 crore for working capital (including a portion to be used to buy a stake in JPPL) within a year and ₹ 600 crore in the form of ECB after year 2 onwards for working capital. In all, RA will infuse a total of ₹ 1375 crore at various stages through a combination of Equity and External Commercial borrowings.

Successful Resolution Applicant (SRA)

The Jalan Fritsch Consortium is a consortium of (a) Mr. Murari Lal Jalan, a Non-Resident Indian based in United Arab Emirates (UAE) and (b) Mr. Florian Fritsch, the former being the lead Partner. While Mr. Jalan has business interests spread across in the UAE, Brazil, India, Uzbekistan and Philippines, Mr. Florian Fritsch is the principal shareholder of Kalrock Group and an experienced professional in the restructuring business.

Treatment to the Shareholders

Following treatment is given to the Shareholders:

| Category of Shareholders | Treatment |

| Existing promoters, Etihad and financial institutions holding shares in Jet | Fixed sum of ₹ 10,000/- |

| Public Shareholders | For every 100 existing shares held by the public shareholders, they will be entitled to 1 (one) share in Jet. However, before this, there will be consolidation of shares as mentioned below. |

Reconstitution of Share Capital

Cancellation of Share:

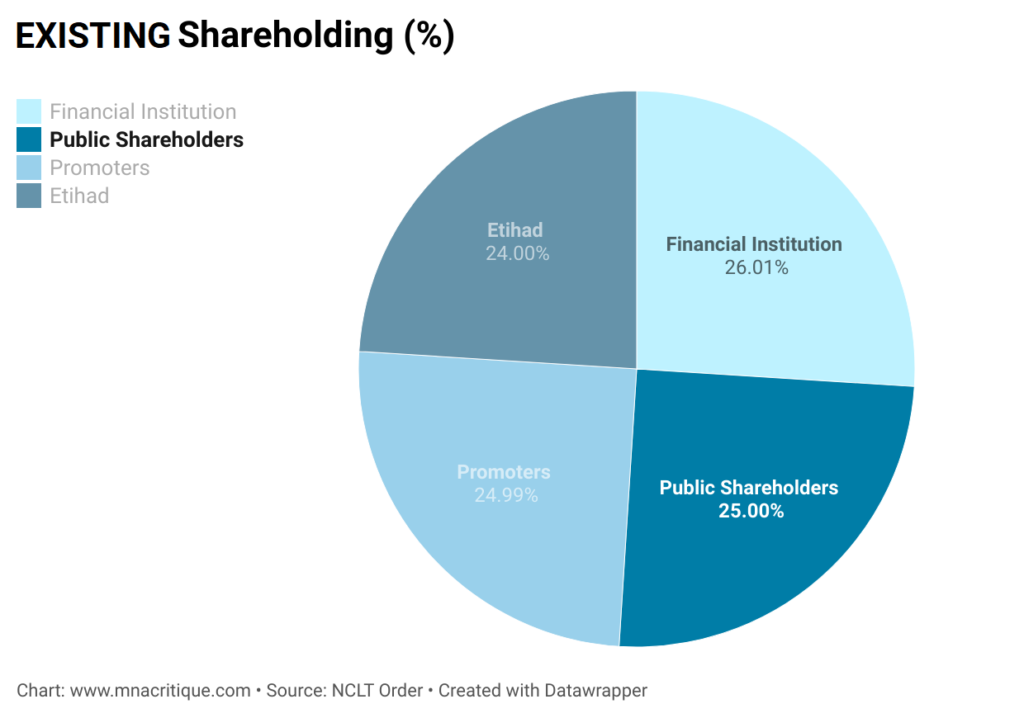

Equity shares held by the Promoters, Etihad, and Financial Institution equivalent to 8,51,98,037 shares of ₹ 10 each collectively representing 75% shareholding in Jet, and all the preference shares held by the Promoters and Etihad in Jet, shall stand fully extinguished as a part of this Resolution Plan.

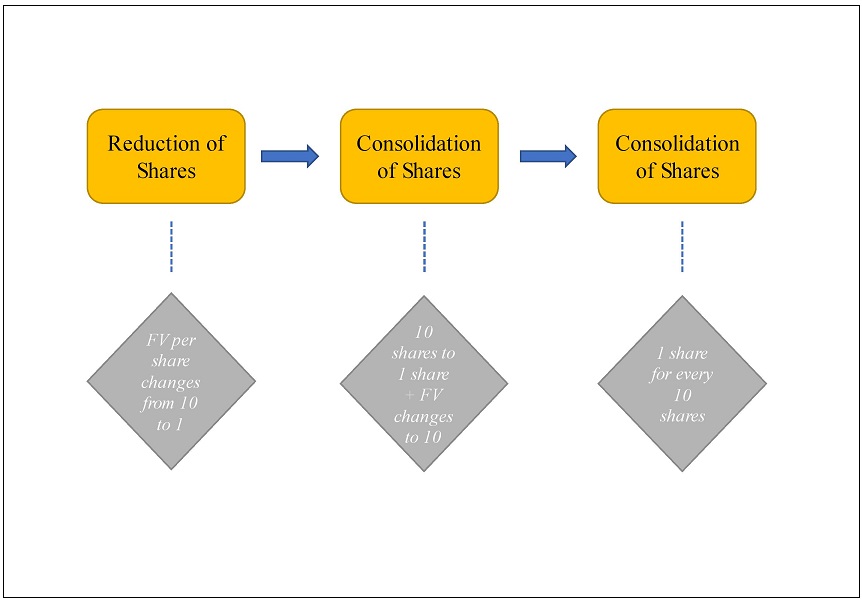

Reduction of Share Capital

The share capital of Jet shall be reconstituted in such a manner that the share capital of the existing Public Shareholders of Jet equivalent to ₹ 28,39,93,460/- divided into 2,83,99,346 equity shares shall stand reduced from face value (FV) of ₹. 10/-each to face value of ₹. 1/- each. Thus, effectively, the number of shares will remain the same but 90% of the value of equity share shall be reduced.

Consolidation of Share Capital

Immediately upon the Reduction in Share Capital, the shares shall be consolidated into equity shares with a face value of ₹. 10/- each. Any fractional entitlements of equity shares resulting from such consolidation shall be rounded off to the nearest whole integer. Effectively, Shareholders holding 10 shares will get 1 share of Jet.

Consolidation of Shares held by Public Shareholders

After above-mentioned consolidation, there will be further consolidation of equity shares held by public shareholders such that finally, shareholders holding 100 equity shares will be allotted 1 equity share.

Investment by RA

As mentioned above, RA will invest maximum ₹ 600 crore in the company in the form of Equity Shares.

Finally, the shareholding pattern of New Jet will look like:

| Shareholders | No. of Shares | Shareholding % |

| RA | 12,00,00,000 | 89.79% |

| Assenting Financial Creditors | 1,26,96,644 | 9.50% |

| Workmen & Employees | 6,68,244 | 0.50% |

| Existing Public Shareholders | 2,83,993 | 0.21% |

| Total | 13,36,48,882 | 100% |

Thus, effectively, public shareholders who are currently owing 25% stake in Jet will end up having a mere 0.21% stake in Jet (post-implementation). RA shall ensure that the public shareholding in the Jet is restored to at least 10% within a maximum period of 18 months and subsequently to 25% within a maximum period of 3 years, in each case from the date of first tranche issuance of equity shares to the RA. The RA proposes to restore the public shareholding in Jet through issuance of fresh shares of Jet to the public, at market price, by way of a Fellow Public Offer. Thus, effectively further reducing the stake of existing public shareholders much below 0.21%.

Number of Shares effectively owned by the public shareholder currently owing 1000 shares of Jet:

Thus, the shareholder currently owing 100 shares will end up with just 1 share post-implementation of the Resolution Plan.

In terms of Investment where it translates?

| Particulars | Figures |

| Current investment required in Jet to buy 1000 shares (Assuming rate of 126.45 per share) | 1,26,450 |

| Shares after implementation of Resolution plan | 10 |

| Minimum Number of Shares of Jet (Post Implementation) | 13,36,48,882 |

| Market Capitalisation of Jet (Post-Implementation) required to break-even investment | Circa 1,69,000 Crore |

To breakeven the investment for a minority shareholder who will receive 10 shares for every 1000 shares, the market capitalisation of Jet requires to be circa ₹ 1,69,000 crore. Currently, In India, only ~ 23 companies have market capitalisation more than that.

Now let’s look at the valuation of global aviation players:

| Particulars | Circa Market Capitalisation |

| Southwest Airlines Co. | $31.39 Billion |

| Delta Air Lines, Inc | $27.67 Billion |

| United Airlines Holdings Inc. | $16.19 Billion |

| Singapore Airlines Limited | $10.52 Billion |

| InterGlobe Aviation Limited (Indigo) | $ 8.99 Billion (₹ 67,000 Crore) |

The largest global airline (in terms of valuation) in the world has a valuation of circa ₹ 2,35,000 crores ($31.39 Billion) which is around just 40% higher of required break-even investment. As compared to India’s largest airline company, InterGlobe, required break-even investment valuation of Jet will be 2.5X.

As per the calculation given by RA in the resolution plan, Jet’s market capitalisation is likely to reach circa ₹ 37,000 crore in 5th year after implementation. Even as the order paves the way for the grounded airline’s revival, the resumption of operations hinges on negotiations with the government on the airport slots.

As per the order, the entire reconstitution of shares will take place at circa 170 days from the effective date (which is yet to take place), thus, Jet’s share likely to continue to trade as it for at least next 6 months.

Fading Shade for Jet

In 2004-05, Jet came up with an IPO (Initial Public Offer). Jet’s initial public offering (IPO) has been priced at ₹ 1,100 per share. The IPO, which was offering 17.27 million shares or around 20% of Jet’s equity, was interestingly oversubscribed to the extent of 18.7 times. Jet raised around ₹ 18.9 billion through IPO translating into an equity valuation of around ₹ 9500 crore.

To fulfil its ambitious plan of expansion and portray itself as a star brand, in 2013, Jet onboarded Etihad as a strategic partner. Etihad invested ₹ 2058 crores for 24% stake in the company translating to an equity valuation of ₹ 8575 crore which is almost similar (rather reduced) to what it fetched during IPO almost 8 years back. An additional amount of ₹ 859 crores was also invested by Etihad Airways towards a 50.1% equity investment in Jet’s Frequent Flyer Program- JetPrivilege which RA is ready to buy for ₹ 25 crores. In 2019, Etihad showed interest to further increase its share, but deal did not sail through as it put several conditions.

Conclusion

The intention behind introduction of the Insolvency and Bankruptcy Code was to revive loss making businesses instead of going for liquidation which results in total loss of assets and infrastructure of various companies. No doubt, all stakeholders must sacrifice, and it is obvious that equity shareholders are last in the list of waterfall mechanism on the distribution of funds infused by Resolution Applicant. However, provisions of Insolvency and Bankruptcy Code, Securities Exchange Board of India (SEBI) delisting regulations, SEBI Listing Obligation and Disclosure Requirements (LODR) does not capture loss to public shareholders in case of a listed company going for a resolution under IBC.

Amid of announcement of proposed bid/approval of a resolution plan, many of the small shareholders invest their hard-earned money by simply comparing the prices before insolvency proceeding or potential of a company without aware of the consequence of a final order passed by the NCLT reducing their holding to zero or insignificant. Further, there are no regulations that provide for the suspension of trading. One should be mindful of the fact that turnaround investment strategies are not low hanging fruits and should be perused after professional advice only. As a result, many public shareholders end up losing large money without understanding the financial implication of the order to them.

Add comment