JHS Svendgaard Laboratories Limited (JSLL) is a listed company and is engaged in the business of manufacturing and selling of Toothbrushes, Toothpastes, Mouthwash, Denture Tablets, and other allied oral care product. Apart from working on its own brands the company also offers contract manufacturing partnership to brands in the domestic and international market.

JHS Svendgaard Retail Ventures Private Limited (JSRVPL) is engaged in the retail business of selling the complete range of Patanjali branded products at major airports in India. 99.82% equity shares hold by JSLL and balance shares are held by the promoters of JSLL directly. Shares acquired in April 2018. The company is currently operating four retail outlets at IGIA, Delhi and Raipur, Chhattisgarh.

JHS Svendgaard Brands Limited (JSBL) is engaged in the business of selling toothbrushes, toothpaste, mouthwash, and other oral care products under “Aquawhite” brand name. 42.68% equity shares hold by JSLL (JHS Svendgaard Laboratories Limited), Promoters of JSLL (JHS Svendgaard Laboratories Limited) holds 9.23% and the remaining stake is held by others.

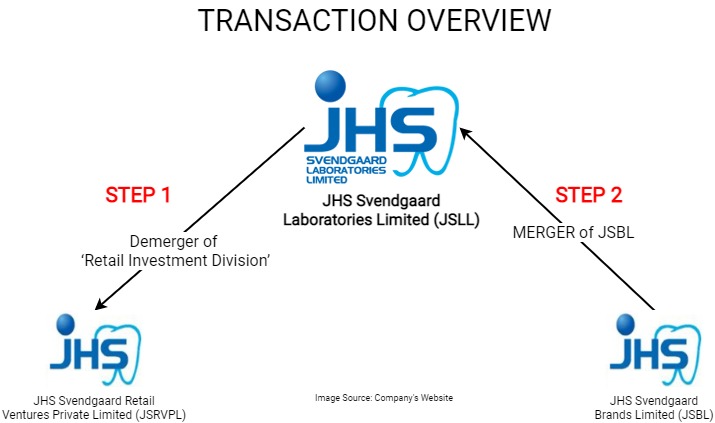

The Transaction

Steps:

- First Demerger of ‘Retail Investment Division’ of JSLL (JHS Svendgaard Laboratories Limited) into JSRVPL (JHS Svendgaard Retail Ventures Private Limited) followed by.

- Merger of JSBL with JSLL.

Appointed Date for the transaction is 1st April 2020

Retail Investment Division means investment by JSLL in the equity shares of JSRVPL (JHS Svendgaard Retail Ventures Private Limited).

Rational for the Scheme:

The Scheme is in two parts first demerger followed by merger for consolidation. Let us first discuss demerger.

Demerger:

The key reason for demerger is separation of retail business into listed entity.

As defined in the scheme, The Demerged Undertaking i.e. Retail Investment Division includes only shares in subsidiary company which is into retail trading business of only Patanjali products at various airports.

Swap ratio in the case of demerger is 1 share of JSRVPL (JHS Svendgaard Retail Ventures Private Limited) against 10 shares JSLL i.e., 1/10th capital of JSLL. So, capital of the proposed company to be listed will be 6.5 crores against sales of just 2.6 crores with negative EBIT of Rs 54 lacs. This match with the present paid-up capital of the JSRVPL. One may ponder whether it will be possible for any company to be listed on the main exchange with similar financials.

Primary question from the perspective of Income Tax could be whether Sole transfer of Shares of Subsidiary company constitutes “Undertaking” as per section 2(19AA) of Income Tax Act 1961and transfer of such undertaking on Going Concern Basis.

Definition of ‘Undertaking’ provided in section 2(19AA) of the Income Tax Act, 1961is “undertaking” shall include any part of an undertaking, or a unit or division of an undertaking or a business activity taken but does not include individual assets or liabilities or any combination thereof not constituting a business activity.

Definition of Undertaking as given in the perspective of Companies Act 2013 according to section 180:

(i) “undertaking” shall mean an undertaking in which the investment of the company exceeds twenty per cent of its net worth as per the audited balance sheet of the preceding financial year or an undertaking which generates twenty per cent of the total income of the company during the previous financial year.

(ii) the expression “substantially the whole of the undertaking” in any financial year shall mean twenty per cent. or more of the value of the undertaking as per the audited balance sheet of the preceding financial year.

As the investment in demerged undertaking is Rs. 6.5 crores which constitute circa 4% of net worth of JSLL, means transferred business does not likely to satisfy the definition of undertaking as per section 180 of Companies Act 2013.

Though the said definition is not relevant as far as Sec 230 of the companies act,2013 is concerned.

However, for transfer of such investments to other company would have been possible even without going through demerger scheme or even without approval of shareholders as the same is within the powers of the board.

Taxation:

If the proposed demerger is not considered as in compliant of Sec 2(19AA) of the income tax act, then the demerger is not exempted transaction under the provisions of the Income Tax Act, 1961. As a result, taxation in the hands of demerged company, resulting company and shareholders may arise which we discuss as follow.:

Taxation in the hands of Demerged co.

Section 47(vib) exempts transfer of assets in the course of demerger. The exemption is not available if the demerger is not a qualified demerger. so, one may examine to see that such a transfer is liable to tax under Sec 45 even though there is no consideration received by the Transferor Company. for the exemption from the definition of transfer of any capital asset in the course of demerger, hence, we need to examine whether the Assesses officer can levy tax under section 50CA on the ground of no /inadequate consideration. Though the demerged company’s defense that it never received any consideration and only its shareholders received consideration in the form of shares of the resultant company will save the company from the liability.

Taxation in the hands of Resulting co.

As a part of Undertaking resulting company not getting anything in fact those shares are cancelled, and shareholders of Transferor company get shares in the Transferee company in proportionate to their holding in Transferor company.

As per the scheme, shares were cancelled and issue new shares to the shareholders of JSLL. However, by applying rational of section 56(2)(x) of Income Tax act 1961 may get taxed this as income from other sources as the resulting company receiving shares without any consideration. Here also one may be able to argue that property/shares were never received by the company and directly issued to the shareholders of JSLL.

Taxation in the hands of shareholders:

One may assume that shares of resulting co. received by the shareholders of demerged co. is free of cost and by applying section 56(2)(x) is may get taxed in the hands of shares holders. However, shareholders have good defense that it received shares against it holding in JSLL and as result of the demerger value of its shares in JSLL will go down proportionately taxing individual shareholders by the tax department may not be very easy to implement.

Merger:

The second limb of the scheme is merger of JSBL with JSLL. we need to examine valuation method used for valuation of the shares of JSBL, unlisted group company. Let us examine valuation given to unlisted company.

According to valuation report the valuation of JSBL, in course of amalgamation is derived by giving 10% weighted to Book value and 90% to value derived by sales multiple. So, in the case of JSLL also one uses sales multiple as one of the methods, its value per share will be circa 3 times that of JSBL. Just academically, if one considers method as mentioned above, swap ratio will work out circa 30 shares of JSLL for every 100 shares of JSBL.

So in fact, it seems JSBL shareholders get 500% of value (i.e. 150 shares as against 30 shares) as compared to fair value of shares of JSLL on like-to-like basis Interestingly, despite having significantly greater revenue, the market capitalization of JSLL is much below its revenue for FY 2020 and on other hand, valuer has assigned 5.34 multiple to revenue to derive the valuation of JSBL. one needs to evaluate how it is fair to the public shareholders.

Now let us go to change in the shareholding structure of JSBL just before the announcement of merger.

Preferential and Right issue of shares:

| Date | Promotors/Non-Promotors | No. | Price | Amount |

| 08-10-2020 | Non- Promotors | 10,00,000 | 30 | 300,00,000 |

| 31-07-2020 | 13,51,113 | 10 | 135,11,130 | |

| 31-07-2020 | Promotors (Nikhil Nanda) | 1,48,890 | 10 | 14,88,900 |

| Calculation of Premium getting by JSBL shares holders | ||

| Particulars | JSBL | JSLL |

| No. of shares | 100 | 150 |

| Price | 10 | 20.96* |

| Total Value | 1000 | 3144 |

*Price taken as per valuation report.

From the above calculation, valuation has increased three times between 31st July 2020 and 8th October 2020.

Swap Ratio for merger of JSBL with JSLL is 150 equity shares of Rs. 10 each of JSLL for every 100 equity shares of Rs. 10 each of JSBL. Based on that shareholders of JSBL get value worth Rs 30 for its holding in JSBL in the form of shares of listed company JSLL.

Financials

Now we look at financials of JSBL, the unlisted entity.

- In FY 2019 JSBL having revenue from operation ₹6.45 Crore which turns into losses of ₹7.18 crores. On above turnover, the company incurred employees’ cost ₹ 4.24 crores and other expenses ₹ 5.26 crores. The company raised ₹ 14.26 crores out of which ₹ 4.86 crores used for investment. It purchased goods of ₹ 5.26 crores out of which ₹ 3.94 crores purchase from parent co. JSLL. The outstanding balance of trade payable in FY 2019 is ₹ 3.26 crores out of which ₹ 2.66 crores belongs to JSLL.

- In FY 2020, gross revenue is Rs 8.98 crores.

- So JSBL gets equity valuation of Rs 55 crores having NAV of 16 crores and incurring losses.

As against JSLL gets equity valuation of Rs. 142 crores having NAV of ₹ 197 crores. Its turnover for FY 2020 was ₹132 crores and PAT ₹1.77 crores. One must also consider that JSLL is listed company since 2006.

Other anomalies in compliances

As per valuation report the date of Valuer Appointment, Valuation date and Valuation Report Date single date i.e., 9/10/2020. Further Audit Committee meeting for approval of the Scheme happened between 12 pm to 2.30 pm on the same date. One may need to understand how entire process along with fairness report (which is required after valuation report but before audit committee meeting) arranged in such a brief time span.

Further also note that two non-executive directors resigned just before the announcement of the scheme, out of two one is an independent director.

Conclusion

The scheme rationale does not match with various facts, circumstance, compliances pre and post scheme. Both JSLL and JSBL raised funds by way of QIP (Qualified Institutional Placement) just before the scheme. The scheme proposes to create a listed entity with insignificant assets and revenue which otherwise become difficult to get listed. The merger ratio is skewed in favour of unlisted company. Independent directors resigned just before the approval of the scheme by the board. It will be challenging for the company to satisfy various regulatory authorities that it is fair to all the stakeholders.

Add comment