The acquisition by the consortium of JSW Steel Limited & AION Investments Private II Limited of JSW Ispat Special Products Limited (formerly known as Monnet Ispat & Energy Limited) marked foray as one of the first acquisitions through the Corporate Insolvency Resolution Process (CIRP) under the Insolvency & Bankruptcy Code, 2016 (IBC). Interestingly, the acquisition was through a Special Purpose Vehicle between a consortium of financial & the strategic investor (JSW Steel Limited). The merger of JSW Ispat Special Products Limited with the strategic investor was inevitable however, the journey from the acquisition to the merger was planned to facilitate promised returns to the financial investor as well as to have a minimum dilution of promoters holding post-merger. In this article, we have tried to study the various aspects from acquisition to announced merger.

JSW Steel Limited (“JSW Steel” or Transferee Company”) is the flagship company of the diversified conglomerate JSW Group. JSW Steel is a leading integrated steel manufacturer in India with a current consolidated domestic crude steel capacity of 27 million tonnes per annum (MTPA). The equity shares of the company are listed on nationwide bourses.

JSW Ispat Special Products Limited (“JSW Ispat” or “Transferor Company 2”) is engaged in manufacturing and marketing sponge iron, pellets, steel and ferro alloys. It has an integrated steel plant at Raigarh, which is currently operating at a capacity of ~0.95 MTPA which is in the process of expansion to 1.5 MTPA. It also has another unit for steel production at Raipur with 0.25 MTPA capacity. The equity shares of the company are listed on nationwide bourses.

Creixent Special Steels Limited (“Creixent” or “Transferor Company 1”) a special purpose joint venture formed by JSW Steel & AION Investments Private II Ltd. (AION) to acquire controlling stake in JSW Ispat. As on date, Creixent directly holds 48.12% equity stake (effective stake is 56.89%) in JSW Ispat. The non-convertible debentures of Creixent are listed on the wholesale debt market segment of BSE Limited.

The equity shares of the company are not listed. The shareholding pattern of Creixent is:

The History

Now we will look at the chronology of events that happened from acquisition of JSW Ispat by consortium of JSW Steel & AION.

Change of Management

In the financial year 2018-19, a consortium of AION and JSW Steel acquired a controlling stake in JSW Ispat through a special purpose vehicle namely Milloret Steel Limited (“MSL”). The Shareholders of MSL were Creixent, JTPM Atsali Limited (JTPM) and JSW Steel & other JSW group entities

Later, as part of the approved resolution plan, MSL merged with JSW Ispat and MSL shareholders become direct shareholders in JSW Ispat.

Funding of the Acquisition:

As a part of the approved resolution plan, the consortium infused an amount of ₹875 crore in MSL for capital expenditure & purchase of Compulsorily Convertible Preference Shares (CCPS) issued to financial creditors. In addition, JSW Steel also infused INR 125 crore as working capital in JSW Ispat directly.

As a result of MSL merger with JSW Ispat, JSW Ispat issued equity shares & CCPS respectively to the equity & CCPS shareholders of the MSL. Each CCPS is eligible to get it convert into one equity share.

Creixent & JTPM funded the MSL infusion through issue of Non-Convertible Debentures (NCD) & Preference Shares.

AION’s infusion in Creixent & JTPM was through NCD’s while JSW’s in Creixent was through Redeemable Preference Shares (RPS). JSW Group entity, JSW Techno Projects Management Limited also invested in optionally convertible preference shares of JTPM. The NCD’s & RPS had promised return of IRR 12%.

Tentative bifurcation of funds invested by JSW group & AION into equity & others to acquire JSW Ispat (directly and through SPV’s etc):

| Particulars | JSW Group | AION |

| Equity | 8 | 106 |

| Others (debt/preference shares/loan) | 358* | 408 |

*: Excluding working capital loan of INR 125 crore.

Effectively, JSW Steel acquired control over JSW Ispat with minimum equity infusion. Even to minimise dilution in JSW Steel post-consolidation, JSW group also acquired part stake through its group entity.

As a result, the shareholding pattern of the JSW Ispat immediately after the acquisition & MSL merger was:

*: Effective stake in after considering the conversion of CCPS

Thus, on fully diluted basis, Creixent stake was 56.9% & JTPM stake was circa 21% in JSW Ispat translates AION effective stake 60.57% & JSW group as 27.33%.

Partial Exit to AION

In June 2021, AION came up with offer-for sale (OFS) of up to 21.18% direct stake (9.99% effective stake) held in JSW Ispat. Interestingly the floor price was at INR 27 per equity share which was less than half of the prevailing market price of JSW Ispat at that time. There was no explanation provided by AION for doing OFS at lessor than half the prevailing market price however the move can be to swiftly absorb the OFS. Even at lower prices, AION got substantial returns. The OFS fetched AION circa INR 36 per share. Thereafter, JSW Ispat valuation remained rangebound and valuation assigned for working swap ratio for the merger is nearly the same rather lower.

AION being a financial investor, took the partial exit and realised handsome returns on their part investment while retaining the 50.58%* equity stake in JSW Ispat.

| Particulars | Amount |

| Circa Amount invested by AION to purchase direct stake in MSL in 2018 | ₹99 Crores |

| Circa money realised through OFS of effective 9.99% stake in JSW in 2021 | ₹360 Crores |

| Return | 3.6X |

| Effective stake after OFS of AION | 50.58%* |

*: Considering the stake held by JTPM Atsali.

Shareholding Pattern of JSW Ispat after OFS

Secondary sale of NCD’s by AION to JSW Steel

In FY 2022, JSW Steel also purchased NCD issued by Creixent to AION of worth circa ₹199 Crores in FY 2019 for a consideration of ₹269 crore.

Tentative amount realised by AION before the proposed merger:

INR in crore

| Particulars | Amount (₹ Crores) |

| Total amount invested by AION | 513 |

| Amount realised through OFS | 360 |

| Amount realised through sale of NCD’s | 269 |

| Total amount realised (before proposed merger) | 629 |

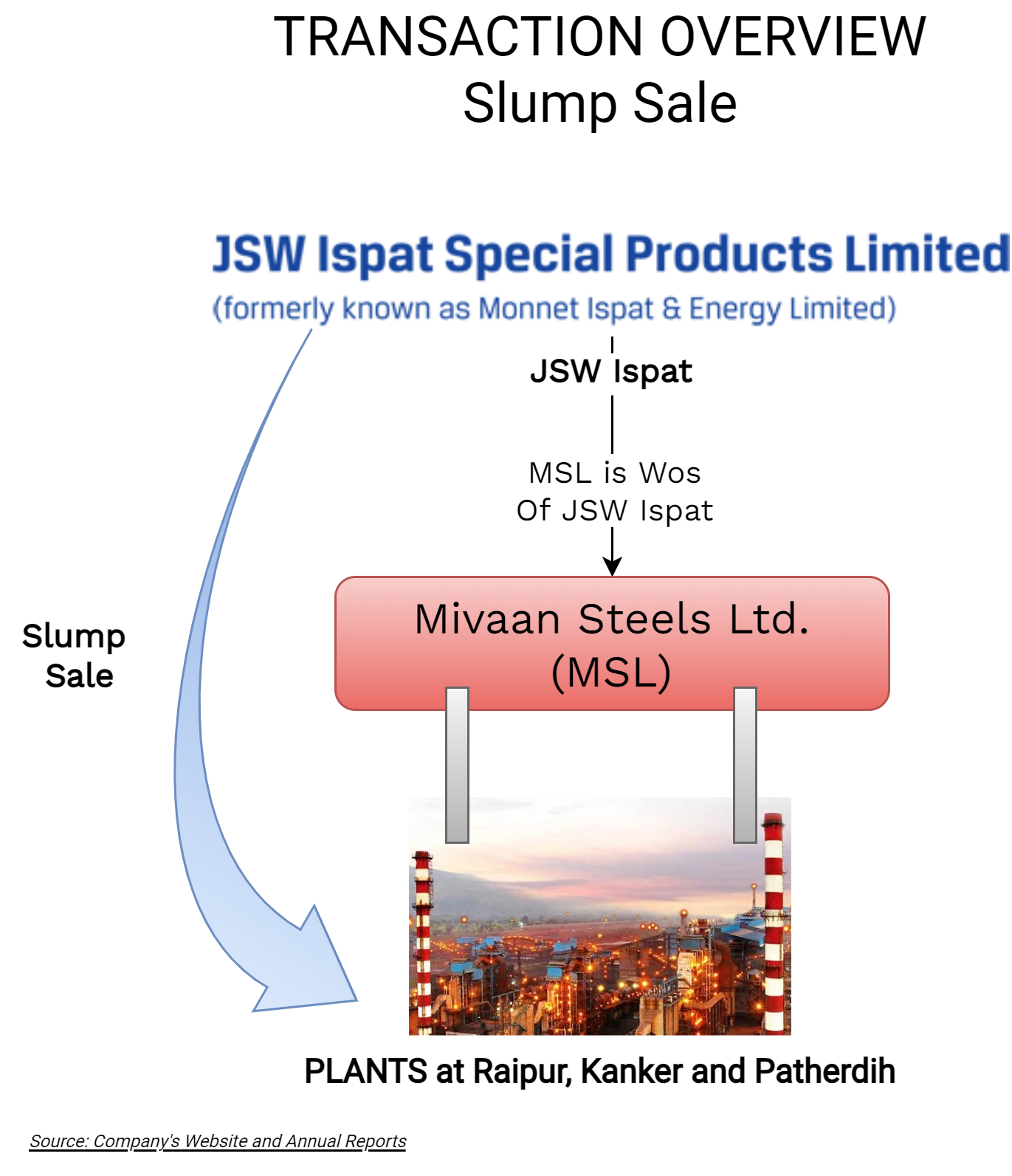

Slump Sale

In February 2022, the Board of Directors of JSW Ispat approved the Scheme of Arrangement between JSW Ispat and Mivaan Steels Limited, a wholly-owned subsidiary of JSW Ispat for the transfer of manufacturing facilities at Raipur and mining facilities at Kanker and associated coal washery operations at Patherdih from JSW Ispat to Mivaan Steels Limited on a going concern basis, by way of a slump sale.

The consideration for the slump sale shall be discharged through convertible debentures by Mivaan Steels Limited to JSW Ispat. Further, the Appointed Date for the transaction is the closing hours of 31st March 2022.

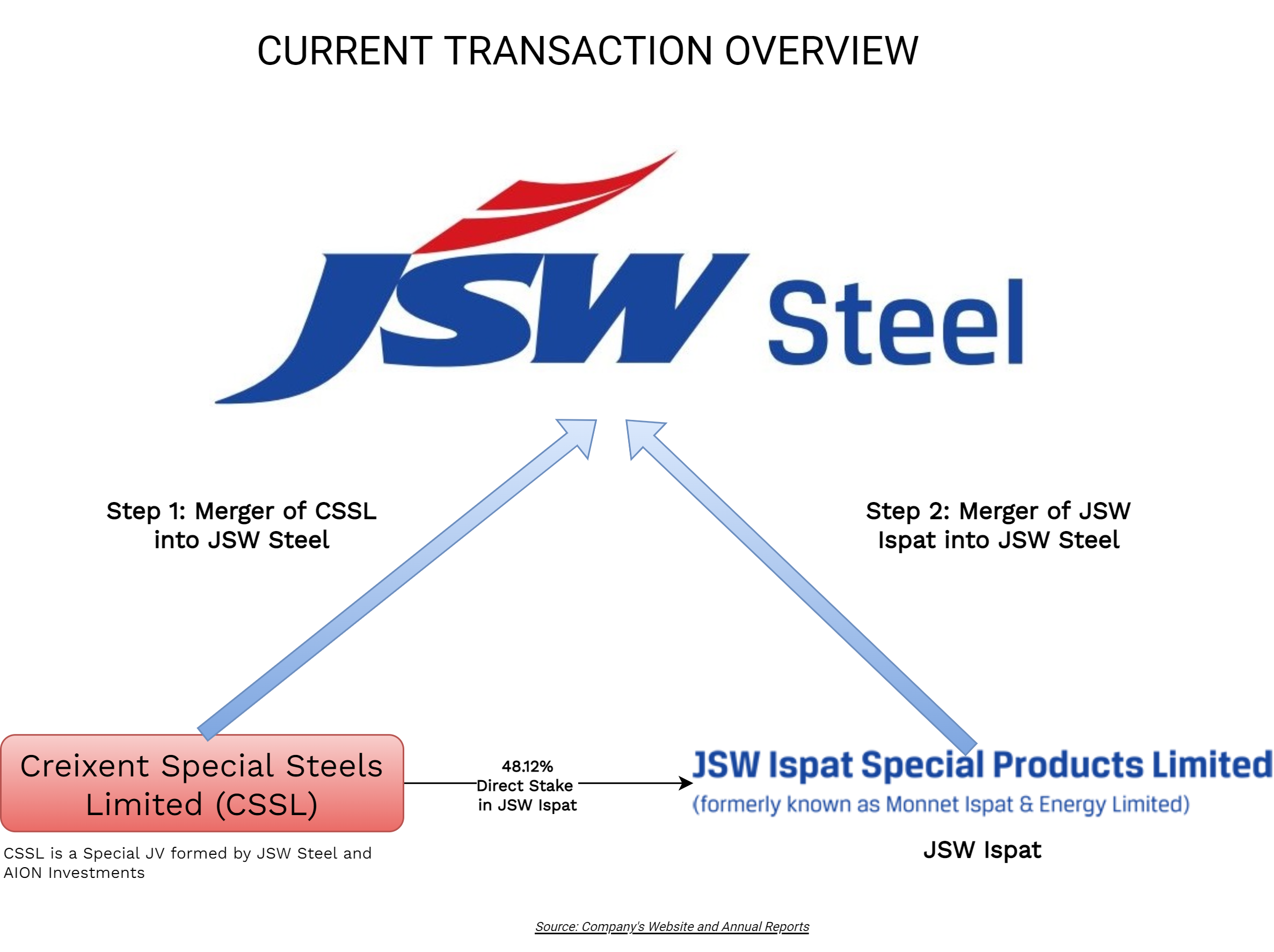

The Transaction: Final Step

In June 2022, the Board of Directors of JSW Steel, JSW Ispat & Creixent approved a composites scheme of arrangement (Scheme) which inter-alia provides for (chronologically):

Step 1: Amalgamation of Creixent into JSW Steel

Step 2: Amalgamation of JSW Ispat into JSW Steel

The Appointed Date for the transaction is 1st April 2022. The Scheme provides for different Effective Dates for each part of the transaction. Effective Date 1 (For step 1) means the date on which the last condition specified in clause 3.1 of Section III of this Scheme is complied with. Effective Date 2 means the date on which the last condition specified in Clause 3.2 of Section III of this Scheme is complied with or 7 (seven) days for the Effective Date 1, whichever is later.

Swap Ratio:

Step1: As a consideration, JSW Steel will issue 3 fully paid-up equity shares of Face Value INR 1 each for every 2 fully paid-up equity shares of Creixent of INR 10 each.

Step 2: As a consideration, JSW Steel will issue 1 fully paid-up equity shares of Face Value INR 1 each for every 21 fully paid-up equity shares of JSW Ispat of INR 10 each. For each holder of Compulsorily convertible preference shares, JSW Steel will allot 1 fully paid equity share of JSW Steel of INR 1 each.

It is clarified that, as a result of Step 1, JSW Steel will hold equity shares of JSW Ispat which shall get cancelled pursuant to step 2 and no equity shares will be issued.

Paid-Up Capital of the Companies involved:

| Particulars | JSW Steel | Creixent | JSW Ispat | JSW Steel (Post transaction) |

| No. of Equity Shares | 241,72,20,440 | 1,00,00,000 | 46,95,47,534 | 244,54,53,966 |

| Face Value | 1 | 10 | 10 | 1 |

| CCPS of INR 10 each | - | - | 52,59,80,000 | - |

Circa effective Stake in JSW Steel:

Post-arrangement, AION group will be classified as a public shareholder.

Value-Creation to stakeholders:

| Particulars | Amount |

| JSW Ispat value at the time of acquisition (Infusion of INR 875 for 87.9% stake) | ₹996 Crores |

| Value assigned to JSW Ispat in the proposed merger with JSW Steel | ₹3400 Crores |

| Value Creation in circa 4 years | 3.4X |

| Value of Public Shareholders (12.1% stake) of JSW Ispat at time of acquisition in 2018 | ₹121 Crores |

| Value of Public shareholders (12.1% stake) now | ₹415 Crores |

Vehicle to Re-align Shareholding

JTPM Atsali Limited which holds circa 21% effective stake in JSW Ispat is owned by AION, it has issued Optionally convertible Preference shares (OCPS) to JSW group entity, JSW Techno Projects Management Limited which if converted, will provide them complete ownership of JTPM which paves the way for both AION & JSW Group to re-align their holding in JSW Ispat as per the commercial agreed understanding. As the investment in JTPM is through JSW group entity and not through JSW Steel, this also provides promoters with minimum dilution in the merged entity.

In the purview of limited information available, interestingly, JTPM acquired 10.1% equity interest in Creixent from AION Investment Private II Limited before the proposed transaction. This acquisition was funded through an issue of non-convertible debentures.

Now considering this & assuming these OCPS converted into equity by JSW group, the revised shareholding pattern of JSW Steel (post-transaction):

| Particulars | Without JTPM | With JTPM |

| JSW Promoters | 44.49% | 44.96% |

| AION | 0.73% | 0.26% |

Conclusion

JSW Ispat is one of the first examples of a successful turnaround through CIRP process. To facilitate acquisition with minimum financial outgo, JSW Steel acquired JSW Ispat by forming a consortium with financial Investor, AION. The journey was well planned to provide exit with assured returns to AION and consolidate the JSW Ispat with steel without having a significant impact on the shareholders of JSW Steel.

The planned journey went through a couple of internal re-structuring which facilitated achieving the commercial understanding between AION & JSW group. After the successful turnaround of JSW Ispat and getting the desired valuation of JSW Steel & JSW Ispat, the companies decided to execute the final step in the journey. No doubt, the process created a lot for value of stakeholders of both companies.

Meanwhile, strategically, AION took a partial exit and realised more than what amount it has invested. After the transaction, AION will still remain with a minimum 0.26% (assuming JSW group converts OCPS in JTPM) which will be worth circa INR 450 crore plus NCD’s of JTPM with promised IRR of 12% which indeed makes a bonanza deal for AION too.

Tentative Value creation for different stakeholders:

| Particular | At time Acquisition Value/ Cost | Current Value1 |

| JSW Steel | 365 | 935 |

| AION | 514 | 19002 |

| JSW Ispat Public | 121 | 415 |

| IF JSW Techno Projects Managements Limited exercises its right to convert OCPS into Equity | ||

| AION | 514 | 14353 |

| JSW Techno Projects | 0.78 | 4884 |

1Based on value assigned by the valuer while arriving swap ratio.

2Prior exit through OFS+ Secondary debt sale+ Value of Shares received in JSW Steel

3Excluding JTPM stake in JSW Steel but adding circa INR 350 crore to be repaid to redeem NCD’s of JTPM held by AION.

4Value of JSW Steel equity shares received by JTPM less INR 350 crore required to redeem NCD’s held by AION in JTPM.

_______End_______

Due to the complex nature of the transaction & limited availability of recent data, there may be inaccuracy in above article/data/working.

Add comment