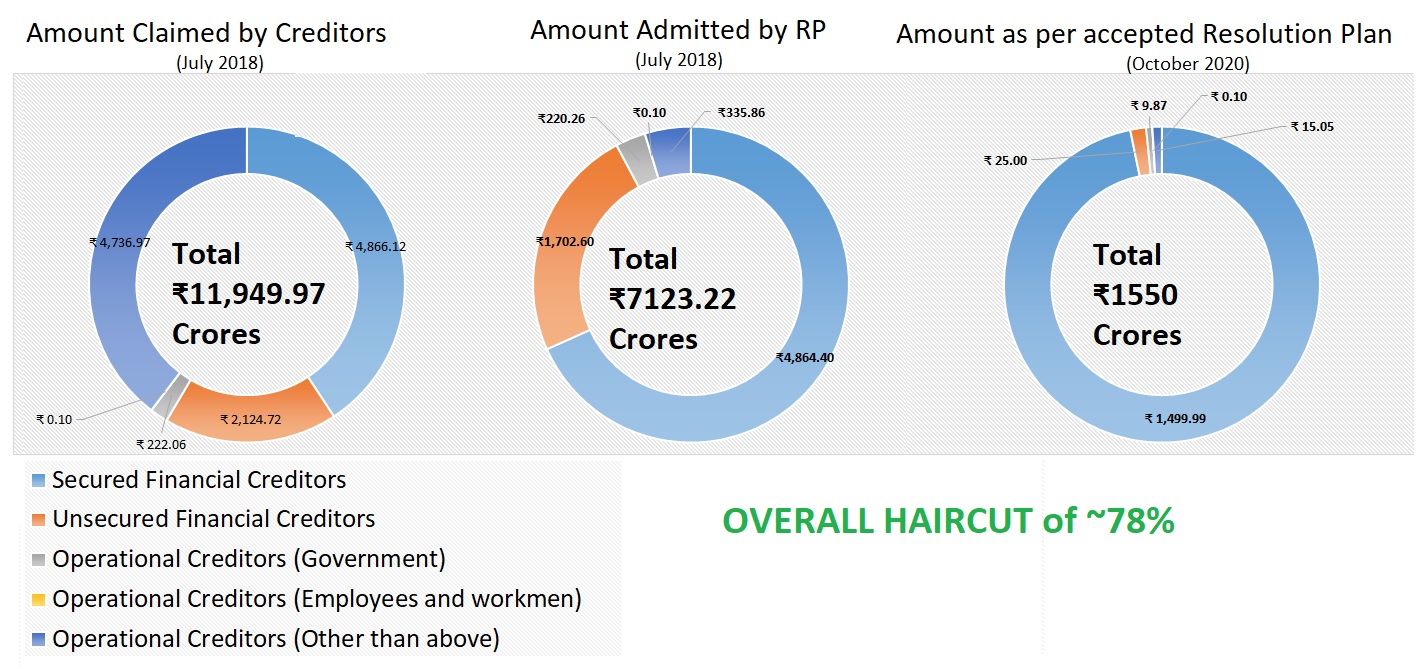

Asian Colour Coated Ispat Limited (ACCIL), a steel company, in the year 2018 was included in the Reserve Bank of India’s second list of defaulters on which banks were asked to take corrective action. State Bank of India, Punjab National Bank and JM Financial were among the lenders to ACCIL. Hon’ble National Company Law Tribunal (NCLT) on 20th July 2018 admitted the company petition for the commencement of Corporate Insolvency Resolution Process (CIRP) of ACCIL. Total claim received by the RP from all the creditors was Rs.11,949.97 Crores out of which amount of claim admitted by the Resolution Professional was Rs.7,123.22 Crores.

After inviting expression of interest (EOI) by the RP, 12 EOI were received by the RP. JSW Steel Limited became a Successful Resolution Applicant through its wholly-owned subsidiary JSW Steel Coated Products Limited (JSWSCPL) submitted unsigned resolution plan on 8th March 2019 amounting to Rs. 1200 Crore. The Resolution Applicant after considering the additional facts and feedback received from the committee of creditors (CoC), revised the plan value from Rs. 1200 Crores to Rs. 1550 Crores. The resolution plan was approved with 79.3% of voting shares of the CoC. The Delhi Bench of NCLT (National Company Law Tribunal) on 19th October 2020 approved the resolution plan submitted by JSW Steel to acquire bankrupt steel company ACCIL for Rs 1,550 crore.

Table 1: Original and Revised Resolution Plan Comparison

| Payment to creditors

(% of admitted claim) |

Original Plan –

Rs. 1200 Crores |

Revised Plan –

Rs.1550 Crores |

| Secured Creditors | 17.1% | 30.84% |

| Unsecured Financial Creditors | 17.1% | 1.47% |

| Operational Creditors | 14.57% | 4.86% |

Unsecured Financial Creditors comprising of Corporation Bank, Union Bank of India, IDBI Bank, Commercial Bank of Dubai, Indian Overseas Bank, Karur Vyasa Bank aggregating to 8.66% of voting share in the CoC who are the lenders of a related party of the ACCIL to whom ACCIL provided corporate guarantee filed an application and who dissented to the resolution plan, sought relief for change in the distribution of the payment to financial and operational creditors since they are getting settled at a much lower percentage as compared to the operational creditors.

Unsecured Financial Creditors have relied their saying on the point that since the operational creditors are getting paid more than the Financial Creditors there is a violation of section 53 of the IBC (Insolvency and Bankruptcy Code) which deals with the distribution of proceeds from the sale of the liquidation assets.

In reply to the saying of financial creditors w.r.t differential payment, Resolution Applicant has stated that it is the CoC that must assess and analyse the feasibility and viability of the plan and the manner of distribution. In section 30 (4) of the IBC, it has been clarified that CoC can decide the distribution inter-se creditors taking into consideration the nature of security. There are various judgments which gives paramount importance to the commercial wisdom of the CoC.

NCLT after hearing all the parties in the application concluded that there shall not be any differential treatment, inter-se creditors falling under section 30(2)(b) of the code, Explanation-1 of sec. 30(2)(b) says that distribution shall be fair and equitable to such creditors. Accordingly, NCLT disposed of the application and directed the resolution applicant to distribute the amount between unsecured financial creditors and operational creditors at an equal percentage by applying the same haircut.

Provision under IBC

Section 30 of the IBC deals with the submission of resolution plan by the Resolution Applicants. Resolution Professional is required to examine such resolution plan and ensure that it complies with provisions given under sub-section (2) of section 30.

Section 30 also contains the provision regarding payment to financial creditors who have not given their assent to the resolution plan. Pursuant to section 30(2)(b) in case of dissenting financial creditors amount being paid to such creditors under the resolution plan shall not be less than the amount being paid to such creditors as if company is in liquidation and the amount is getting distributed as per section 53(1) of the IBC. Explanation-1 given under section 30(2) of IBC has clarified that distribution between the dissenting financial creditors and operational creditors shall be fair and equitable

In the Resolution Plan submitted by the JSW Steel provision provided to operational creditors is 4.86 % in comparison with provision made to dissenting financial creditors i.e., 1.47 % which is contravening the explanation given under section 30(2)(b) of the Code. Though NCLT is not required to go in detail commercial wisdom of the resolution plan approved by CoC, under section 31 of the IBC before giving nod to the Resolution Plan, NCLT shall ensure that there is no violation of section 30 (2) of the IBC. Upon the application filed by the dissenting Financial Creditors, NCLT has correctly directed the Resolution Applicant to distribute the Resolution Amount at an equal percentage.

Structuring of a Transaction

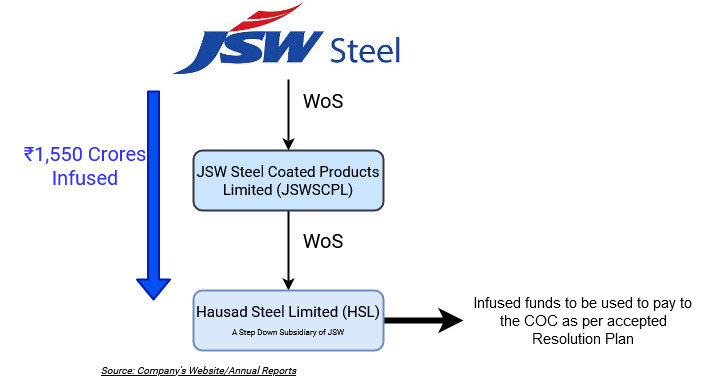

In order to implement the resolution plan submitted for the revival of ACCIL, JSW Steel has formed a wholly-owned subsidiary JSWSCPL and JSWSCPL has further formed a wholly-owned subsidiary named Hasaud Steel Limited (HSL) by infusing Rs.1,550 crores through a mix of equity/quasi-equity/debt instrument.

Implementation of Resolution Plan

HSL has paid ₹ 1476.94 crores to certain financial creditors of ACCIL, towards the assignment of their ACCIL loans, and has infused ₹ 73.06 crores into ACCIL in the form of a loan, for onward payments to operational creditors, workmen/employees, and other financial creditors of ACCIL, in full discharge of JSWSCPL’s obligations under the Resolution Plan. The existing issued equity share capital of ACCIL comprising of 88,07,76,270 equity shares of face value ₹.10 each held by the existing shareholders are cancelled and extinguished without any payment to the shareholders in accordance with the Resolution Plan.

Financials

ACCIL is a multi-location steel major with a vast array of close annealed coils and sheets (in plain, corrugated and profile forms) having a wide range of applications across Industries.

Its major products are Cold Rolled coils/sheets, Galvanised Corrugated Sheets, Colour Coated Coils/sheets.

Table 2: ACCIPL Plant Details

| Particulars (MTPA) | Khopoli | Bawal |

| Year of commencement of operations | 2014 | 2007 |

| Manpower strength including Contract workers | ~500 | ~475 |

| Land Area (Owned) | ~54 Acres | ~15 Acres |

| Picking | 8,00,000 | 1,80,000 |

| Cold Rolling | 6,00,000 | 1,80,000 |

| Galvanising | 2,20,000 | 4,50,000 |

| Colour Coating | 1,30,000 | 60,000 |

Table 3: Financials of ACCIPL (All Figs in ₹ Crores)

| Particulars | FY 2019 | FY 2018 |

| Property, Plant & Eq. | 2992 | 3166 |

| Net worth | -2026 | -1246 |

| Borrowings | 3357 | 3237 |

| Revenue | 2932 | 3348 |

| EBITDA | 75 | 92 |

| EBIT | -80 | -80 |

| Finance Cost | 492 | 506 |

| PAT | -788 | -1283 |

JSW Steel produces flat sheet products that include, hot-rolled coils, cold-rolled coils and coated products like galvanised, galvalume, tinplate and colour coated.

The FY 20, revenue share of Cold Rolling, Galvanised and colour coating was 16%, 8% and 5% respectively.

Table 4: Financials of JSW Ltd. (All Figs in ₹ Crores)

| Particulars | H1FY 21 | FY 20 |

| Revenue | 30,116 | 71,116 |

| EBITDA | 6039 | 12,419 |

| EBIT | 3843 | 8173 |

| PAT | 1862 | 3818 |

| Net worth | 37,032 | 36,024 |

| Borrowings (Estimated) | 54,000 | 59,373 |

Resolution plans submitted by JSW Steel in past

In the past, JSW Steel has completed the acquisition of two companies and is in the process to acquire Bhushan Power and Steel Limited (BSPL). The resolution plan submitted by JSW Steel amounting to Rs.19,350 Crores has been approved by the NCLT and National Company Law Appellate Tribunal (NCLAT).

| Sr No. | Name | Year of acquisition | Resolution Amount (₹ Crores) |

| 1. | Monnet Ispat and Energy Limited | September 2018 | 2,875 |

| 2. | Vardhman Industries Limited | December 2019 | 63.50 |

| 3. | Bhushan Power and Steel Limited | In Process | 19,350 |

With this acquisition, JSW Steel will have successfully acquired three stressed assets through bankruptcy court–one being Monnet Ispat and Energy Ltd, Vardhman Industries and now ACCIL. Considering management capabilities and deep understanding of the business, no doubt the JSW team will be able to use those assets to generate economic profit and create value for all the stakeholders.

Add comment