Deal Snapshot

The Board of Directors of ISMT Limited (“ISMT”), at its meeting held on November 25, 2021, approved the issuance and allotment of 15,40,00,000 Equity Shares of ISMT to Kirloskar Ferrous Industries Limited (“KFIL”), representing 51.25% of the emerging voting capital of ISMT on preferential issue and private allotment basis amounting to ₹ 476 crore. Subsequently, shareholders of ISMT in their meeting approved the transaction.

KFIL and the existing promoters of ISMT i.e., Taneja Group also entered into a shareholders’ agreement to record inter alia certain inter se rights and obligations. Further, KFIL will also provide an unsecured loan of Rs. 194 crores to ISMT as per the agreed terms.

Infusion of Funds by KFIL in ISMT

| Particulars | Amount (INR in crore) |

| Equity Share Subscription (51.25% stake) | 476 |

| Unsecured Loan | 194 |

| Total | 670 |

As required by SEBI regulations, KFIL has made an open offer to public shareholders up to 25.05% resultant voting capital of the company.

KFIL will fund the acquisition through internal accruals and through borrowing. The board of directors of KFIL approved raising of ₹750 crore through the issue of listed non-convertible debenture.

Some of the Salient Features of the deal:

- KFIL will be in sole control of ISMT and will be identified as and considered as the ‘promoter.’

- A one-time settlement agreement is proposed to be entered into between ISMT, the Taneja Group and the Lenders for full and final settlement of all the borrowings. As on completion date, KFIL will acquire sole control of ISMT.

- Taneja Group will continue to be identified as ‘promoters’ of ISMT with a call option available with KFIL for acquiring their stake.

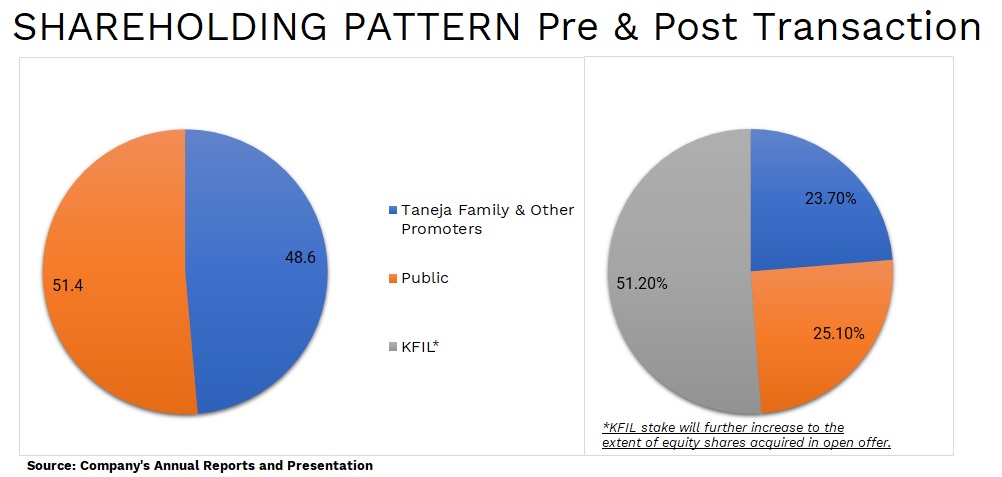

Shareholding Pattern:

*KFIL stake will further increase to the extent of equity shares acquired in open offer.

Retaining existing promoters as a promoter will not only provide a significant hand-holding for KFIL which ultimately result in smooth transition but also ensure the responsibility of the existing promoters to settle all the litigations, divestment of non-core assets or any complexity present in ISMT. More importantly, through a call option, KFIL in future will reach maximum permissible holding in ISMT by acquiring desired stake from the current promoters without triggering an open offer.

Making of ISMT Ltd

ISMT has been started by ambitious technocrats as one of the finest and first seamless tube manufacturers in India using Aseel mill technology. ISMT Limited soon became an integrated company.

- ISMT Ltd was incorporated on 29th July 1977 as ‘The Indian Seamless Metal Tubes Limited’ engaged in production of Seamless Tubes.

- ISMT acquired two small companies (Balaji tubes Pvt Ltd and United Fluid Power Pvt Ltd) to provide some extra finishing capacity.

- In 1992, the group promoted ‘Indian Seamless Steels and Alloys Ltd.’ to produce 1,50,000 MTPA alloy steel giving better control over product quality as well as deliveries.

- In a move to reposition ISMT as an integrated precision seamless tube manufacture, The Indian Seamless Metal Tubes Ltd.’ and ‘Indian Seamless Steels and Alloys Ltd.’ merged to form ‘ISMT Ltd’

- To expand its business, in 1999, ISMT merged into Kalyani Seamless Tubes Ltd., a competing Seamless Tube manufacturer with 90,000 MTPA capacity. The combined entity not only had a larger capacity but also a much wider size range (from 6 mm to 273 mm).

- To expand its wings overseas, ISMT acquired Structo Hydraulics AB (based in Storfors, Sweden), supplier of tubes and engineering products for the hydraulic cylinder industry.

- ISMT also added a PQF Mill.

- It also commissioned 40 MW Captive Power Plant located at Chandrapur district (Maharashtra) which later turned un-operational due to non-availability of coal & denial of energy banking facilities.

- Tridem Port and Power Company Private Limited the wholly owned subsidiary of ISMT, along with its subsidiaries had proposed to set up a thermal power project and captive port in Tamil Nadu. TPPCL had obtained the approvals for the projects including acquisition of land but failed to commercialise.

Meanwhile, the group incorporated Taneja Aerospace and Aviation Limited which engaged in aircraft manufacture and maintenance, Airfield services, Air charter and Engineering design services etc. The group also incorporated a Non-Banking Finance Company, Indian Seamless Financial Services Ltd. This has resulted in lack of focus in terms of the management time and group resources on its core company, ISMT.

Group’s engagement in multiple unrelated businesses coupled with ISMT’s investment into non-core business started a roller coaster ride for the group as well as ISMT. The finest seamless tube manufacturer soon attracted problems from everywhere. Its aspiration to expand its wing into multiple businesses and foray into foreign acquisition, power and port without having management bandwidth and talent to integrate led to the destruction of value even of its core business. Changing economy scenario, large scale imports from China and strong competitors destroyed its margin in its core business coupled with huge finance cost made it impossible to generate enough cash flow to meet its interest and debt repayment liabilities. On one hand, the debt has started piling up while on the other it faced multiple business problems.

As finance costs became higher than its operational profits, in 2015, ISMT approached the bankers for restructuring of its debt. Apart from this, ISMT also started to divest some of its non-core assets and infusing equity in the company. In 2019, Lead Bank Indian Overseas Bank and other major banks aggregating to about 71% assigned their debt to Asset Restructuring Company’s with ARCIL acquiring most of this debt. ARCIL initiated the process for restructuring the debt. However, nothing really fructifies for the company.

Finally, 2021, ISMT received an offer from Kirloskar Ferrous Industries Limited to acquire 51.25% of emerging share capital of the company followed by the open offer.

Kirloskar Ferrous Industries Limited (KFIL), a part of Pune based Kirloskar group, is engaged in the business of manufacturing pig iron and grey iron castings. The equity shares are listed on BSE & NSE. KFIL end product is used by ISMT to manufacture seamless tubes. In FY 21, KFIL had supplied total raw materials of ₹ 34.53 crores to ISMT.

KFIL is trying to expand its business. Last year, the company announced acquisition of pig iron plant from VSL Steel Limited. ISMT acquisition will open multiple doors for KFIL.

Apart from acquisition of one of the finest seamless pipe plants, KFIL will also get entry into a steel business. This will emerge as having presence in entire value chain for KFIL.

What next?

Despite being one of the finest seamless tube manufacturers in India, ISMT plant is operating partially. The immediate target for KFIL will be to achieve better capacity utilisation and focusing on cost reduction. The management on con-call confirmed that a significant reduction of power cost and other operating costs is feasible, and they will start working on the same immediately. With the post-one-time settlement, finance cost will reduce significantly.

As the net worth of ISMT will turn positive, ISMT may re-foray into government contracts which it was not able to bid due to its negative net worth. KFIL will also look to enter various value-added products and try to evaluate cross-selling opportunities.

Post-right sizing the balance sheet and operations, KFIL will evaluate the possibility of merging ISMT with itself. No doubt, KFIL must integrate operations of ISMT with KFIL to capture substantial synergies.

Our thoughts on Alternative Structure:

One alternative for Kirloskar Group may be to subscribe to the shares of ISMT Ltd through Kirloskar Industries Limited (KIL) or its special purpose vehicle. This alternate structure will lead to increased stake for promoter post-merger of ISMT with KFIL and may be more tax efficient. However, in the process, the paid-up capital of KFIL would have been higher. This would have also enabled to capture more value for the promoters of upside from acquisition price which in fact already twice of the acquisition price.

Apart from operational efficiency in acquiring through KFIL, the probable reason for not acquiring through KIL directly could be, KIL being a core-investment company, raising outside funds may be not allowed. However, this could have been mitigated through acquisition using a special purpose vehicle.

Acquisition through NCLT or without NCLT

With the introduction of Insolvency & Bankruptcy Code, a lot of good companies who were debt trapped got a chance to revive their fortunes. The systematic & time bound process expediated the recoveries for stakeholders and was able to turn around the companies within short span. However, the other alternative to the process emerging is takeover before going to National Company Law Tribunal (NCLT) through one-time settlement with lenders under the Reserve Bank of India circular.

KFIL acquisition of debt-laden ISMT before initiating the proceeding under Insolvency & Bankruptcy Code, provides multiple advantages. This way not only reduces the time but also simplify the process. More importantly, it provides flexibility for the existing promoters to continue or exit which in turn provides opportunity for promoters to gain through the share price increase.

Impact of Acquisition on KFIL Financials

Financials of KFIL for the year ended on 31st March 2021 and as on 30th September 2021 are as follow:

INR in crore

| Particulars | FY 2021 | H1 FY 2022 |

| Revenue | 2040 | 1781 |

| EBITDA | 464 | 398 |

| EBITDA % | 22.7% | 22.3% |

| PAT | 302 | 259 |

| PAT | 14.8% | 14.5% |

| Networth | 999 | 1218 |

| Borrowings | 290 | 210 |

With the acquisition of ISMT, the debt of KFIL will increase by circa INR 750 crore and it will have to bear the cost of such debt till merger of both operating companies are done. However, considering the H1FY 2022 EBITDA of KFIL, ISMT acquisition price will be lesser than one year EBITDA.

Tentative Balance Sheet of ISMT & KFIL

INR in crore

| Particulars | KFIL | ISMT | ||

| Pre (as on 30th Sep 2021) | Post-ISMT Acquisition | Pre (as on 30th Sep 2021) | Post-takeover by KFIL | |

| Share Capital | 69 | 69 | 73 | 150 |

| Reserves | 1149 | 1149 | -1637 | 1693iii |

| Networth | 1218 | 1218 | -1564 | 1843 |

| Circa Borrowings | 208 | 958i | 3600 | 394iv |

| Investment in ISMT (loan +Equity) | NIL | 671ii | - | - |

- KFI will raise INR 750 crore through issue of NCD.

- Excluding any acquisition of shares through open offer.

- Assuming borrowings of INR 3600 crore gets settled for INR 670 crore.

- INR 194 crore loan from KFIL & circa additional INR 200 crroe loan

Conclusion

KFIL moves to acquire ISMT otherwise than through the NCLT route seems to be win-win for all stakeholders and more so for shareholders including existing promotor shareholders of ISMT. Through this route, integration and settlement will be much faster as against in the NCLT route as it takes at least a year, provided there are no litigations and hurdles. The lenders get its settled amount almost immediately. other stakeholders like employees, customers and suppliers will also have certainty and better future. Costly assets and facilities created over last forty years will be utilised by the new competent management to generate substantial value for all concerned.

Add comment