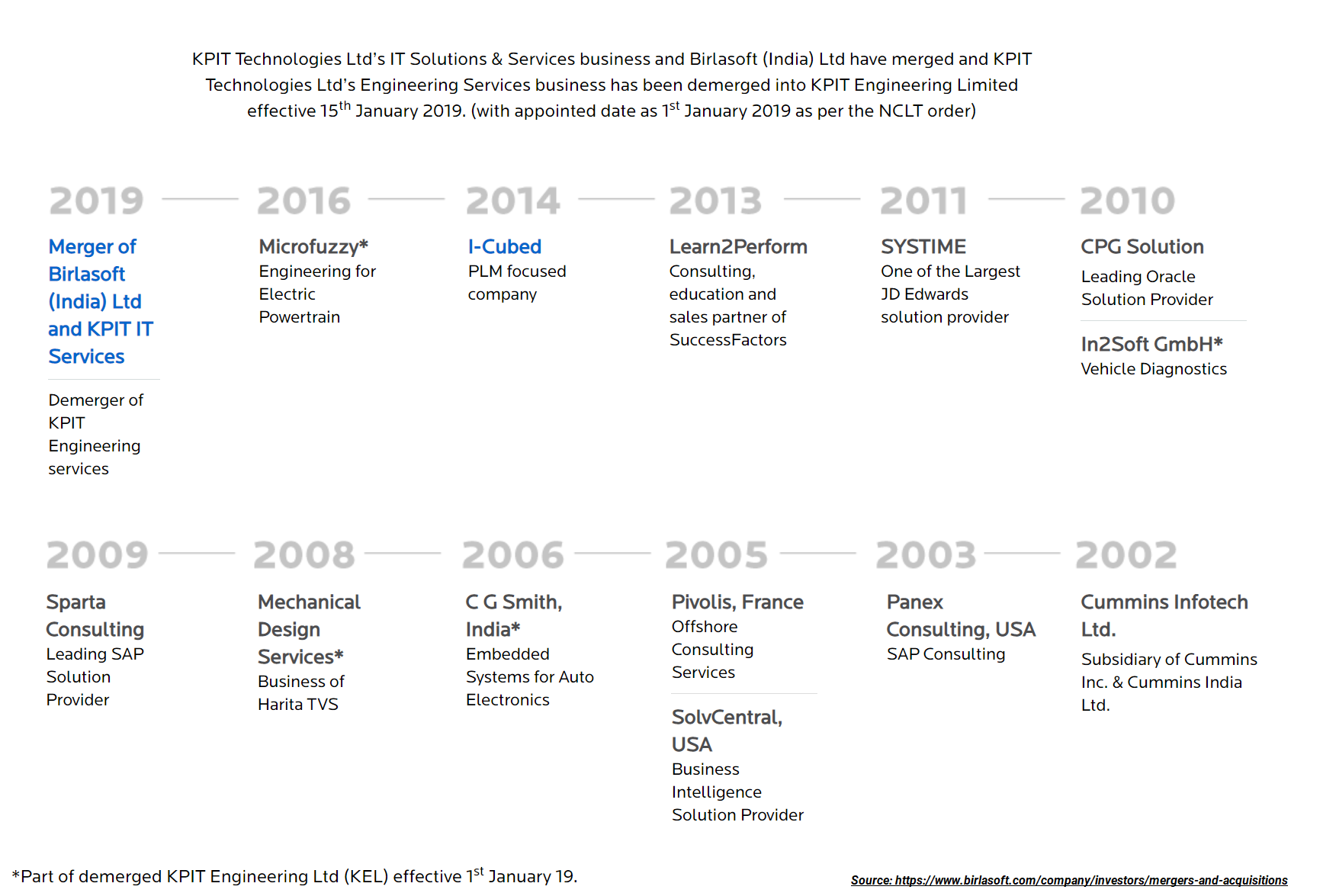

Before 2018, KPIT Technologies Limited had deep expertise in auto engineering and mobility solutions as well as a strong presence in business information technology. The equity shares of KPIT Technologies Limited were listed on nationwide bourses. Birlasoft (India) Limited was an unlisted company with having presence in business information technology solutions. These two companies were owned & run by different promoter groups.

In January 2018, KPIT Technologies Limited & Birlasoft (India) Limited joined hands and announced the amalgamation of Birlasoft (India) Limited with KPIT Technologies Limited immediately followed by the demerger of the engineering business of KPIT Technologies Limited into KPIT Engineering Limited which later got listed on nationwide bourses separately.

The intended purpose of the complex re-structuring was:

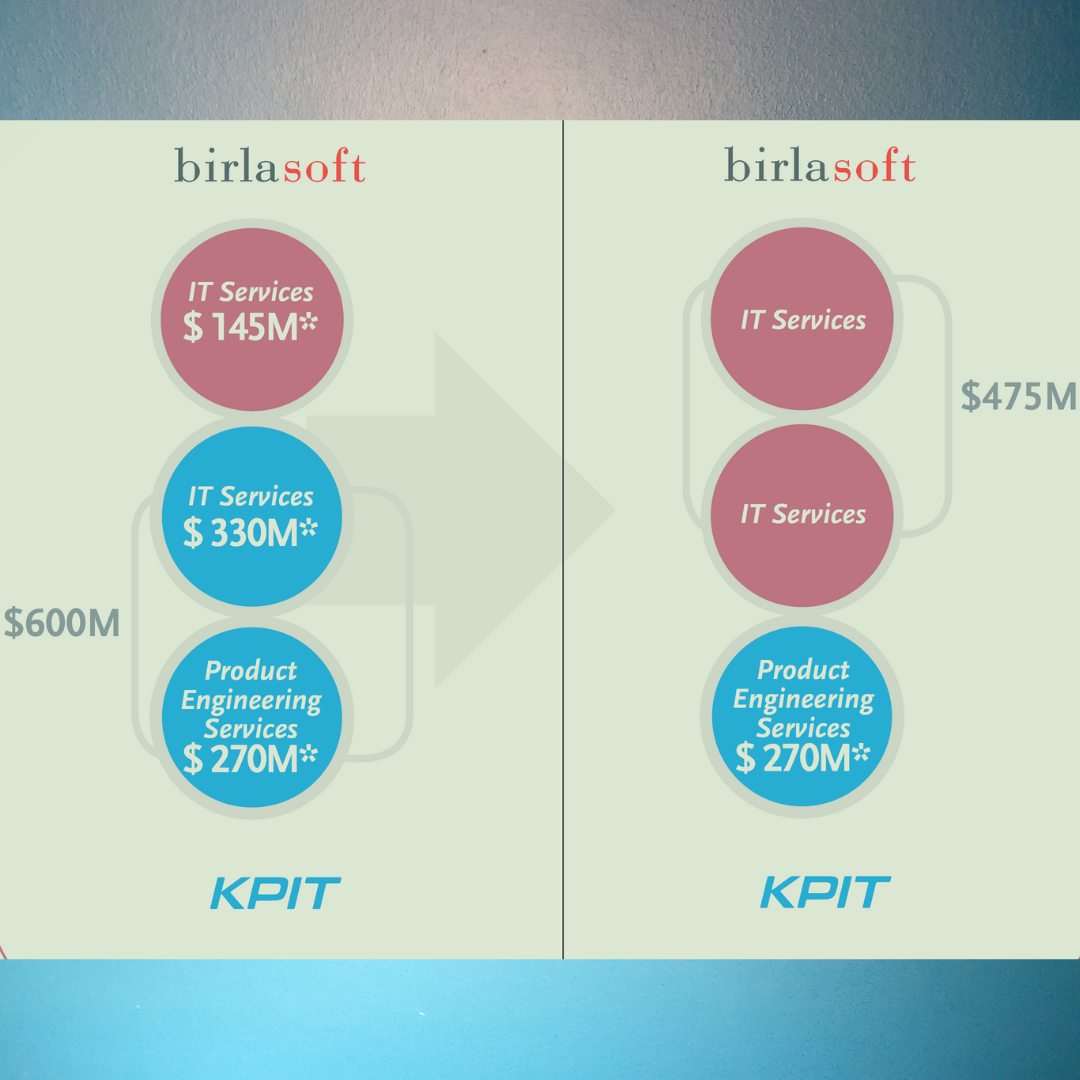

- Sale and Consolidation of information technology business (IT) of KPIT & Birlasoft under Birlasoft management followed by listing of Birlasoft (India) Limited. The IT business of KPIT was more than double that of Birlasoft at the time of the transaction.

- Separation of the engineering business under KPIT management

In fact, KPIT management sold their stake in business information technology to the promoters of Birlasoft and in the process it increased its stake in the engineering business.

The transaction was concluded in January 2019 whereby the KPIT promoter group continued to have full control of the engineering business of KPIT Technologies Limited & Birlasoft promoter group took control of the consolidated Business information technology solutions business of KPIT along with its own. The names of the companies were also changed. KPIT Technologies Limited’s name changed to Birlasoft Limited & KPIT Engineering Limited’s name changed to KPIT Technologies Limited. Post demerger, both KPIT & Birlasoft promoters did sell THEIR respective shares to another promoter group.

Revenue split for FY 2018:

A complex yet interesting transaction also included a joint open offer before the merger in Birlasoft Limited (that time KPIT Technologies Limited) from KPIT promoter group & Birlasoft promoter group and post demerger, by KPIT promoter group in KPIT Technologies Limited (that time KPIT Engineering Limited).

The price for the open offer:

| Particulars | Price per equity share | Open offer size |

| Birlasoft Limited (erstwhile KPIT Technologies Limited) | 182 | 26.00% |

| KPIT Technologies Limited (erstwhile KPIT Engineering Limited) | 66.20 | 26.00% |

Tentative Promoter stake:

Before the announcement of this deal, the KPIT promoters’ stake in that time KPIT Technologies Limited was circa 18.93% while Birlasoft was entirely owned by the Birlasoft promoter group. The swap ratio for the merger of Birlasoft with KPIT was 22 equity shares of KPIT for every 9 equity shares of Birlasoft. Pursuant to this, circa 7.66 crore equity shares translating into 27.96% of total post-merger paid-up capital have been issued to Birlasoft promoters.

Birlasoft Promoter group stake:

Birlasoft promoters along with KPIT group promoters made a joint open offer in KPIT Technologies Limited prior to the merger which did not fetch any response from public shareholders. Later but before the merger became effective, Birlosoft promoter group acquired circa 0.75% from the KPIT promoter group in that time KPIT Technologies Limited. Pursuant to the merger, the total promoter stake went to 41.20% with some circa 27.96% being allotted to the Birlasoft promoter group. Thereafter, the Birlasoft promoter group acquired the remaining equity shares of the merged Birlasoft Limited from the KPIT promoter group in tranches. Currently, they own circa 41. 31% stake in Birlasoft Limited.

KPIT Promoter group stake:

The swap ratio for the demerger for 1:1 and thus, the shareholding pattern was mirror imaged. Immediately after the demerger, KPIT promoter group’s share in KPIT Engineering Limited was circa 13.1%. They acquired 25.50% stake from the Birlasoft Promoter group while the remaining circa small stake of 3.11% was continued to be with the Birlosoft promoters. KPIT promoter group gave an open offer for acquiring an additional 26.00% stake. However, they were able to acquire only minuscule shares through an open offer and pursuant to which KPIT promoter group shareholding in KPIT Engineering Limited became 38.60%. Currently, the promoters’ stake is 40.10%.

Post-transaction progress:

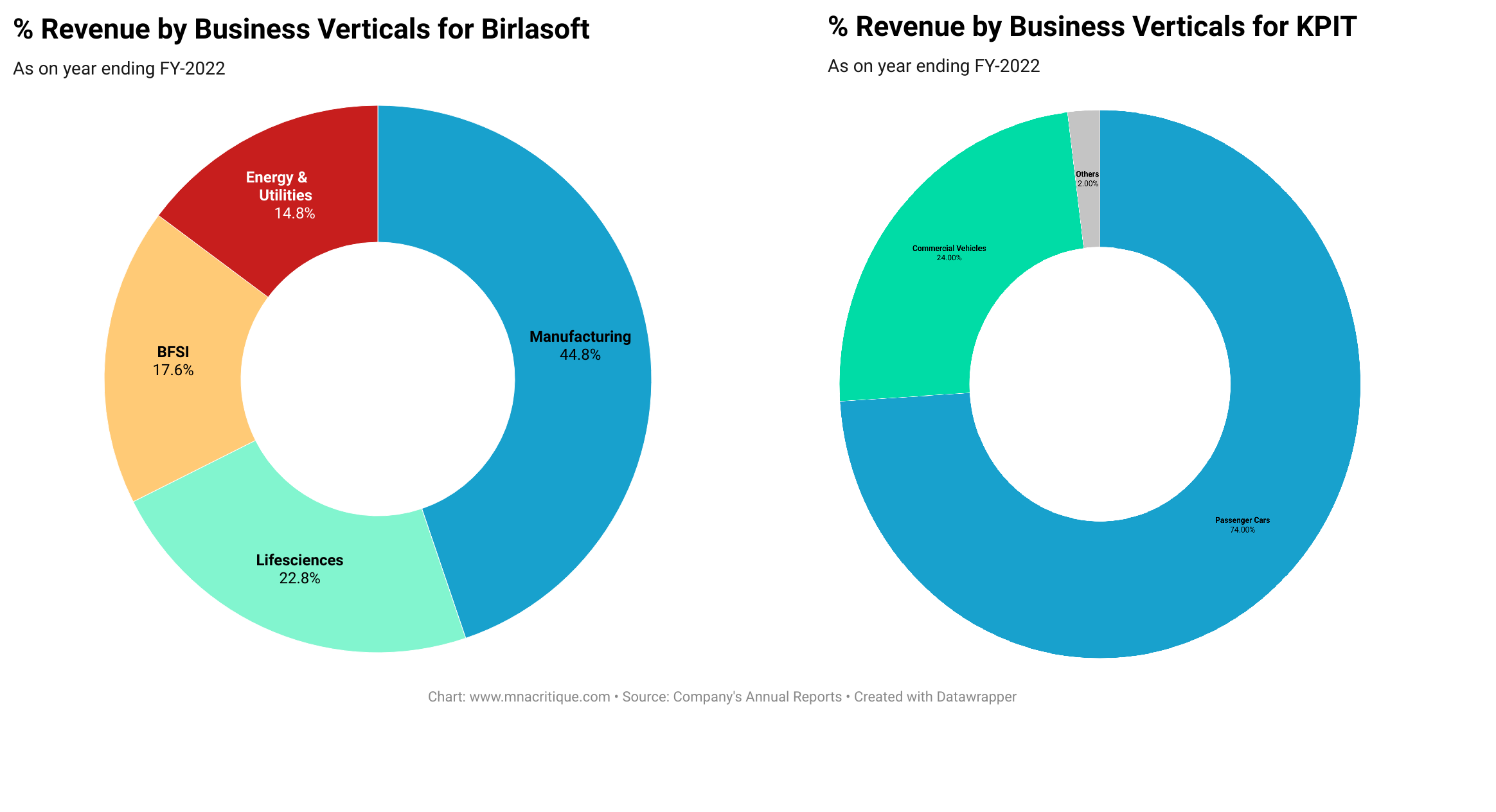

After the separation of respective promoter groups, Birlasoft focused on growing business information technology while KPIT focused on a niche area, engineering services for the automobile industry.

The employees count for Birlasoft has increased from 8078 employees as on 31st March 2019 to currently 12,000+ employees while for KPIT, 6600+ to 10000+. Both companies are focusing on increasing their margins & adding marquee clients to their portfolio. In past couple of years, KPIT has focused on expanding its business through acquisitions. It also opened its largest center for software development and integration in the area of electrification, autonomous driving, AUTOSAR, and vehicle diagnostics outside of India, in Munich, German.

Valuation

The record date for the merger & demerger was 24th January 2019. The closing price of combined KPIT Technologies Limited immediately before the record date (23rd January 2019) was circa INR 218 per equity share translating into a market capitalization of circa INR 4300 crore. As per the valuation report issued for the merger, standalone Birlasoft (before merger) was valued at circa INR 1542 crore. Based on that, the market capitalization on record date i.e., 24th January 2019 was as follows:

| Particulars | Market Capitalization post transaction | Market Capitalization as on 10.4.2023 |

| Birlasoft Limited (KPIT’s Business information technology + Standalone Birlasoft) | 3536 (On 24th January 2019) | 7,340 |

| KPIT Technologies Limited (Engineering Division) | 2878 (On listing date i.e., 22.04.2019) | 21,920 |

Thus, immediately after the transaction the market capitalization of both entities were circa INR 6414 crore against before transaction valuation of circa INR 5842 crore (INR 4300+1542 crore). Clearly, KPIT being present in niche business & overall increasing autonomous trends in automobiles, the transaction created enormous wealth for KPIT shareholders while for Birlasoft shareholders, the deal achieved listing on nationwide bourses.

Conclusion

KPIT promoter’s strategy of exiting Business information technology solutions & focusing on engineering division has worked extremely well for them. In the process, they have also increased their stake in the engineering business significantly from an earlier stake of circa 18.93% to 40.10% which has ushered in significant value creation for them. On other hand, for Birlasoft promoters, the transaction helped them not only in getting rid of the tedious IPO process for listing but also acquiring KPIT’s information technology solutions Business (which was doubled of its size). They paid some premium to KPIT shareholders to get themselves listed on nationwide bourses.

Over the last 5 years, KPIT being present in a niche domain, has not only got rerated but also able to position itself differently from other software companies. On other hand, Birlasoft is still waiting for shiny days. However, after five years, one may say the deal has ushered in a win-win situation for all stakeholders.