Madura Micro Finance Ltd. (MMFL), an unlisted NBFC – MFI (Micro Finance Institution), is going to get amalgamated into Credit Access Grameen Ltd. (CAGL) a listed NBFC-MFI. It is going to be part cash – part stock deal, divided into 2-steps. Earlier, in 2018, MMFL was in advanced talks with Federal bank, a listed commercial banking company. Those talks fell through and now CAGL is all set to acquire 100% of MMFL.

Credit Access Grameen Ltd. (CAGL) formerly known as Grameen Koota Financial Services Pvt. Ltd is listed on the NSE and BSE with MCap of approx. Rs. 12,300 Crores. CAGL, founded by Vinatha Reddy and Suresh Krishna in 1999, offers a variety of financial products like Group Lending, Retail Finance and Insurance. It provides micro-credit loans to support business enterprises, home improvement, family welfare and emergencies. As a strategy, they mainly target women borrowers from rural and low-income households. As of September 2019, CAGL has 887 branches, spread across 13 states mainly Karnataka (269), Maharashtra(221), Tamil Nadu(131), Madhya Pradesh(115), and some more including Chhattisgarh, UP, Odisha, Bihar, Jharkhand, Rajasthan, Kerala.

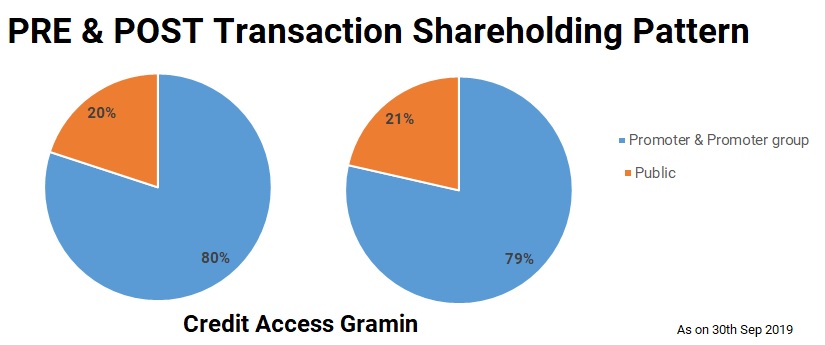

CAGL is promoted by Credit Access Asia N.V., a company incorporated in Netherlands. This company holds around 80% stake in CAGL.

Madura Micro Finance Ltd. (MMFL) is an unlisted NBFC-MFI, incorporated in 2005 by Dr. K.M. Thiagrajan, which provides unsecured microfinance loans to women self-help groups (SHGs) in rural and semi-urban areas as well as to retailers with small shops. It mainly gives 2 types of loans: Group Loans and Individual Loans of amounts ranging from Rs. 15,000 to Rs. 65,000. MMFL was started in Tamil Nadu, it established a strong base there and over years MMFL has around 430 branches in various states like Maharashtra, Karnataka, Kerala, Bihar, Orissa and West Bengal. MMFL also has a wholly-owned subsidiary called Madura Micro Education Ltd. (It is a very small company with total assets to the tune of Rs. 32 lacs).

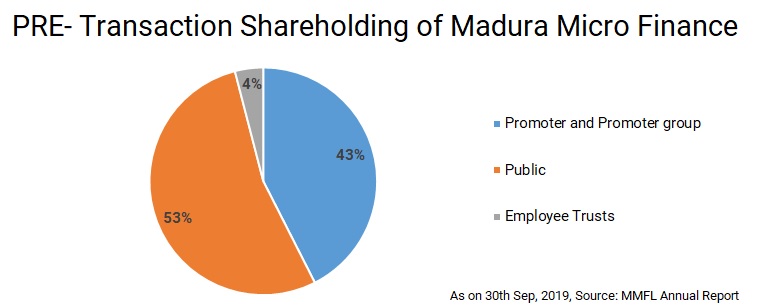

Promoters have a major stake in MMFL (43%) while the rest is with the public and employee trusts. Dr. Tara Thiagrajan, daughter of the founder, has 32% stake.

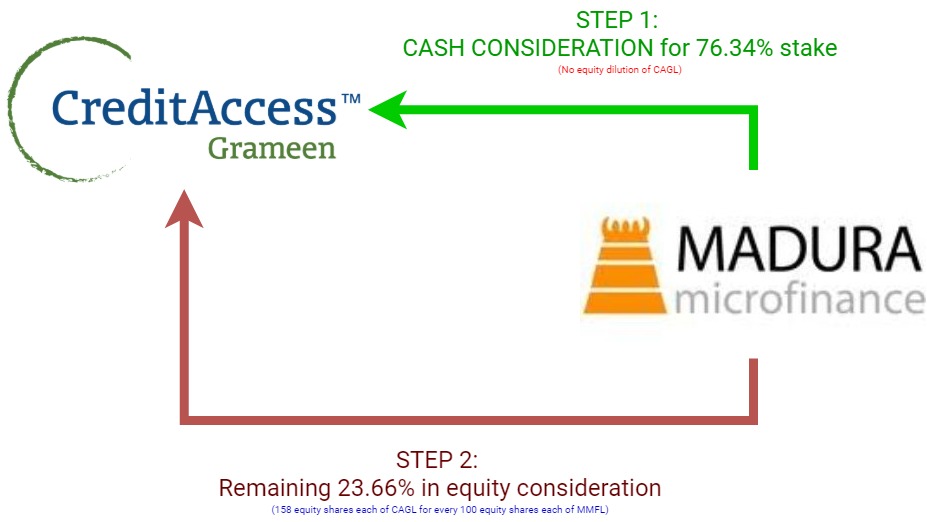

The Transaction:

It is a 2-step transaction. The sellers in MMFL mainly are Dr. Tara Thiagarajan (promoter), AVT Group, Elevar Equity Mauritius and other minority shareholders.

1st Step – Cash Consideration for 76% Stake

- CAGL proposes to acquire 76.34% of MMFL before filing the scheme. The scheme shall be filed and be effective only after this step.

- CAGL will acquire this stake by cash. It will be a payment of roughly Rs. 662 crores(figure arrived at using valuation report).

- Post this acquisition, MMFL will operate as an independent entity with existing management till the business processes are integrated and necessary approvals for the scheme is received.

Source: All figures from Reports and Results released by the Companies.

2nd Step – Equity Swap for Merger

- Once the scheme is effective, CAGL will issue new equity shares to the residual equity shareholders of MMFL (holding 23.66%).

- For issuing equity share swap ratio being 158 shares of CAGL to be issued for every 100 shares held in MMFL.

- The appointed date for the transaction is 2 March 2020.

Post the amalgamation whether the brand of MMFL will continue as it is or whether it will be merged with CAGL remains to be seen.

Shareholding Pattern

Post scheme the promoter holding will be diluted to 78.5%. As per SEBI rules, in all listed companies the public should hold a minimum of 25% in the company. So, we can expect the promoters to sell off more of their stake in the future.

Rationale of the Scheme:

- CAGL will get access to a large and unique client base of the Transferor Company, specifically in Tamil Nadu.

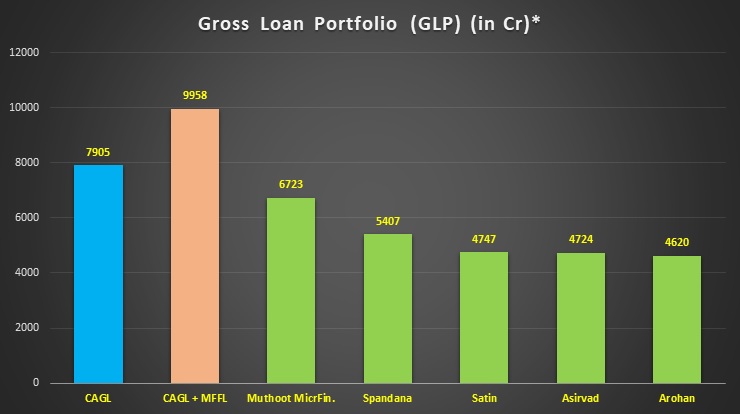

- Amalgamation would result in the geographical diversification of the portfolio of CAGL and strengthens its leadership position in the microfinance market. The combined loan portfolio would approximately be Rs. 10,000 crores, with approximately 37 lakh borrowers and more than 1,300 branches spread across 13 states and 1 union territory in India (as of September 30, 2019).

- CAGL can leverage the MFFL’S loan book, and its low cost of borrowing can potentially enable repricing of liabilities of the Transferor Company.

Valuation:

The valuation report has valued each share of MMFL to be Rs. 1208. Considering the no. of subscribed and paid-up shares, total valuation of MMFL comes to Rs. 870 Crores (approx.), which is just around 8% of CAGL’s market cap.

Accounting treatment:

- In Books of CAGL – After first step acquisition, all the assets and Liabilities will be consolidated at fair values in the Consolidated Financial Statements of CAGL, after following the “Acquisition Method” as per Ind AS 103: Business Combination.

- The Goodwill/capital reserve will have to have to be recognized accordingly.

- Post step 2 amalgamation, all the assets and liabilities will be transferred at their fair values only (as already recorded in books of CAGL) and Goodwill/Capital reserve will continue to show in books.

Analysis:

- The impending economic slowdown and the consequent stress on rural households may be a cause for worry for small NBFC-MFIs like MMFL and could be a factor pushing the promoters to exit the company.

- A cash deal helps avoid dilution of the shareholding of promoters of CAGL. The scheme is going to lead to a dilution of only 1.85 %* in the shareholding of promoters of CAGL. In the alternative of an all stock deal, the promoter holding would be diluted by around 8%.

- The 76% acquisition of share before amalgamation helps in easing up the vote of approval that is required for an amalgamation u/ 230 Companies Act, 2013.

Synergy benefits:

- The scheme Positions CAGL favourably w.r.t Competition:

*(Source: CAGL Investor Presentation. All figures are as of 30 Sept. 2019)

- Increase in no. of borrowers:

| Particulars | CAGL | MMFL | CAGL+MMFL |

| Borrowers (in lakhs) | 26.4 | 11.1 | 37* |

*Adjusted for overlap. CAGL claims there will be an overlap of only 0.5 Lakh borrowers

That is a 40.1% jump and accelerates CAGL’s growth.

- The deal positions CAGL as a market leader in TN with a combined portfolio of Rs 2,300 Cr. This is 2.6 times the current portfolio in TN.

- Helps CAGL in portfolio diversification at an overall level. It lowers Karnataka share from 51% to 41%

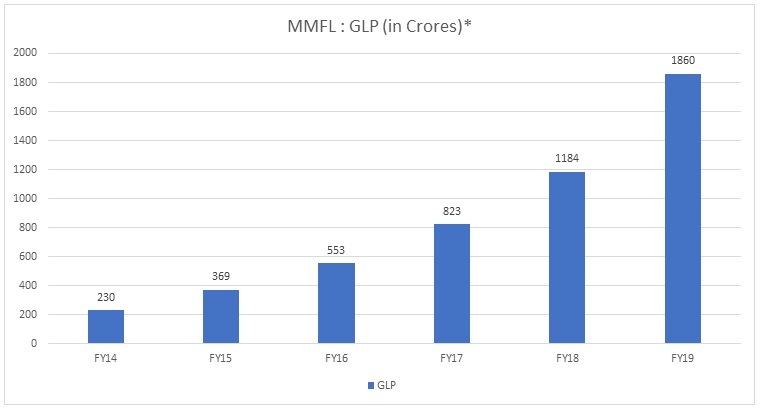

- MMFL has had an impressive growth in its Gross Loan Portfolio (GLP) over the years (refer graph below). This transaction should help accelerate CAGL’s growth.

- All the employees are going to continue post-merger, in their existing roles. CAGL has 9817 employees. MMFL has 3312. Post amalgamation the entity will have a total workforce of 12, 129 which is a jump of 33.7%.

Financials:

Table 1: Financials of CAGL & MMFL as on March’19

| Particulars | CAGL (A) | MMFL (B) | Multiples (A/B) |

| Revenue (Crores) | 1281.3 | 364.3 | 3.5 |

| Branches | 887 | 430 | 2 |

| Revenue per branch (Crore/ branch) | 1.4 | 0.8 | 1.75 |

| Loan Assets | 6602.8 | 1766.1 | 3.75 |

| No. of Employees | 9817 | 3312 | 2.96 |

| Revenue per employee (Lacs) | 13 | 11 | 1.18 |

| PAT (Crores) | 321.76 | 80.53 | NA |

| Deferred Tax Assets | 43.1 | 10.1 | NA |

| Gross NPAs (crores) | 38.4 | 15.8 | NA |

| Cash and Cash equivalents | 615.6 | 156.5 | NA |

*(Source Annual Reports of companies)

- CAGL is operating at a much larger scale than MMFL.

- Both the companies operate in one segment only and hence there is no segmental reporting as required by IndAS 108 “Operating Segments”.

- Both the companies have miniscule NPAs.

Table 2: Financial Ratios for CAGL & MMFL (All figs as on March 2019)

| Ratios | CAGL | MMFL |

| EBIT (Crores) | 914.49 | 261.2 |

| Interest (Crores) | 416.75 | 146.68 |

| Interest Coverage ratio | 2.19 | 1.78 |

| Debt (Crores) | 4866.57 | 761.05 |

| Equity (Crores) | 2365.06 | 319.39 |

| Debt Equity Ratio | 2.06 | 2.38 |

| Current Assets (Crores) | 5174.95 | 811.78 |

| Current Liabilities (Crores) | 2727.28 | 906.27 |

| Current Ratio | 1.9 | 0.9 |

Why may have talks between Federal Bank and MMFL collapsed?

By July 2018 there were news reports that Federal Bank was in advanced talks with MMFL to acquire them. Apparently, it had the winning bid but over the subsequent months, by September 2018, the IL&FS crises came to light. This crisis brought the whole NBFC sector into the spotlight. These defaults by such a large NBFC must have alerted the banks against dealing with NBFCs. Federal bank had an exposure of Rs. 210 crores in this scam.

In August 2018. Kerala was affected by devastating floods. Federal bank is headquartered in Kerala and has 47% branches there. While the floods didn’t affect the bank much in terms of revenue, they had a huge impact on the day-to-day operations of the bank.

Both these problems following one after the other, in such a short span, clearly would have de-railed the talks between Federal Bank and MMFL.

Besides, Federal Bank is a listed commercial bank which provides personal, NRI and business banking services. On the other hand, MMFL is an NBFC-MFI whose market base is mainly to rural women and low-income households and is functioning mainly in rural and semi-urban areas. Culturally and strategically the companies are poles apart. Amalgamation of MMFL into Federal bank could possibly rid MMFL of its identity and way of functioning. Also, synergy benefits would be greater if the merger is between 2 companies who are more in sync in their vision, mission and culture. These questions may have arisen in the minds of promoters and directors of MMFL.

Regulatory Hurdles:

RBI has discretionary powers to approve mergers that happen between Banks, NBFCs, etc. This scheme is going to have to pass through the complex web of scrutiny and regulatory mechanism of RBI. In the past RBI has either halted or rejected mergers between NBFCs whether it was Indiabulls Fin. and Laxmi Vilas bank or in the case of Shriram capital. And considering 80% stake in CAGL is held by a Foreign Company promoter, additional scrutiny and regulations are bound to apply.

Conclusion:

Mergers between NBFCs are not very common. This is a merger between 2 very similar NBFCs, functioning in 2 different geographical regions of India. The similarity in their goals will make the merger easier but whether this scheme will be approved by RBI remains to be seen. Another important question will be ease of integration about employees and systems and procedures for loan sanction, credit appraisal of its customers and recoveries systems And after approval, we believe if management spends enough time on these softer aspects merger than only it will likely to be proved to be beneficial to the stakeholders. Will this horizontal merger set a trend in the NBFC sector? Or will it be a one-off case? This will be interesting to observe.

Add comment