The journey of Mahindra and CIE Automotive that began in 2013 is a well thought out and superbly executed strategy to become a global leader in auto components space. There was no dilution in equity or any fresh fund infusion by either group. Mahindra group got added synergy by having dependable global supplier having manufacturing facilities in various countries for its passenger vehicles, commercial vehicle and off-market vehicles.

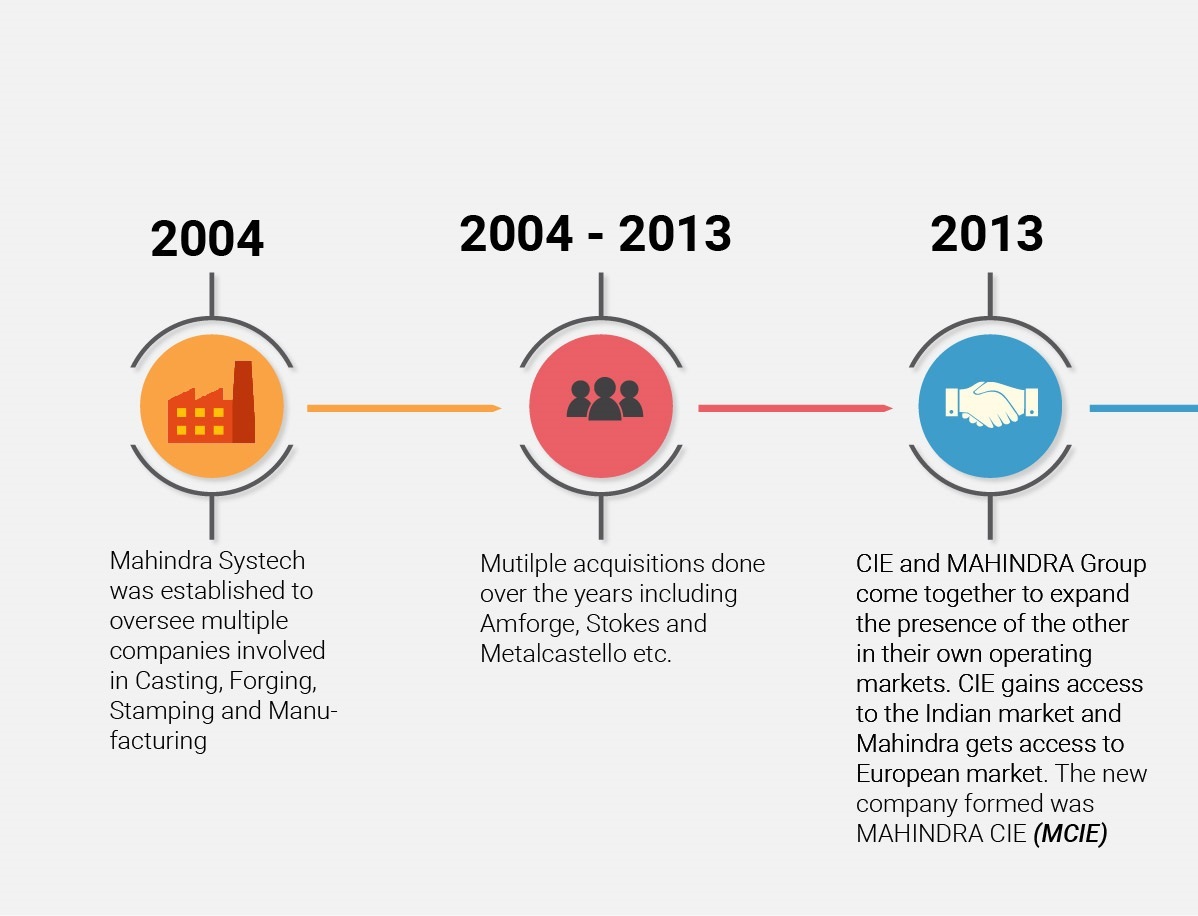

In 2013, the agreement between Mahindra’s automotive component businesses and CIE Automotive was signed through which CIE invested in Mahindra CIE Limited (MCIE or earlier Mahindra Forgings Limited) and Mahindra & Mahindra invested in CIE. The deal was nothing but the merger of ambitious plans of both the entities to spread its wings.

In this article, we have tried to analyse the where MCIE stands today? Whether the deal was truly accretive for all the stakeholder?

Background of the deal

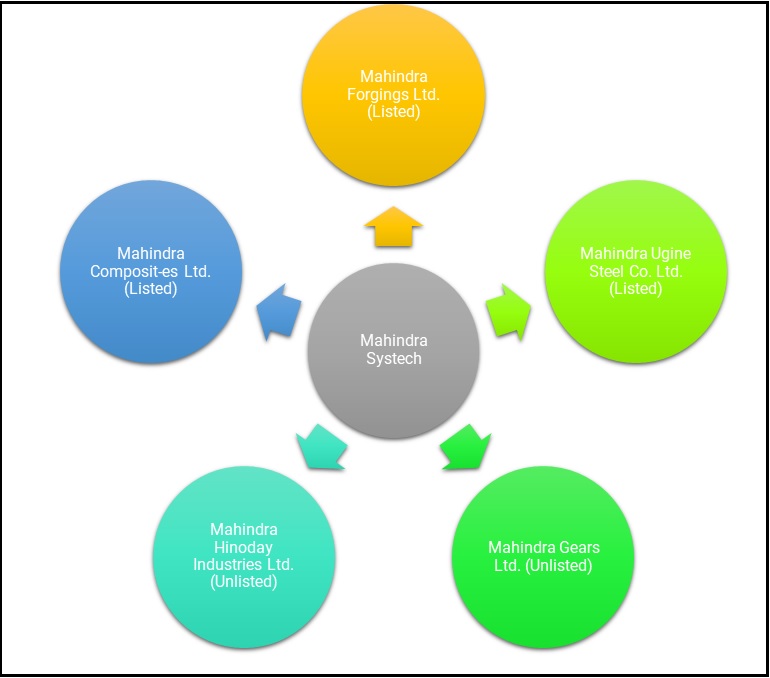

The Mahindra Systech (Systech) was established in 2004 by the Mahindra Group. Systech was a group of multiple companies of the Mahindra group which oversees the Castings, Forgings, Stampings, Gears, Rings, Magnetic products, Steel, Composites, Engineering and Contract Sourcing services. It was also offering a variety of components and services to the automotive and other ground-based mobility industries around the world. The group was having manufacturing units across India, Germany, Italy, and the UK.

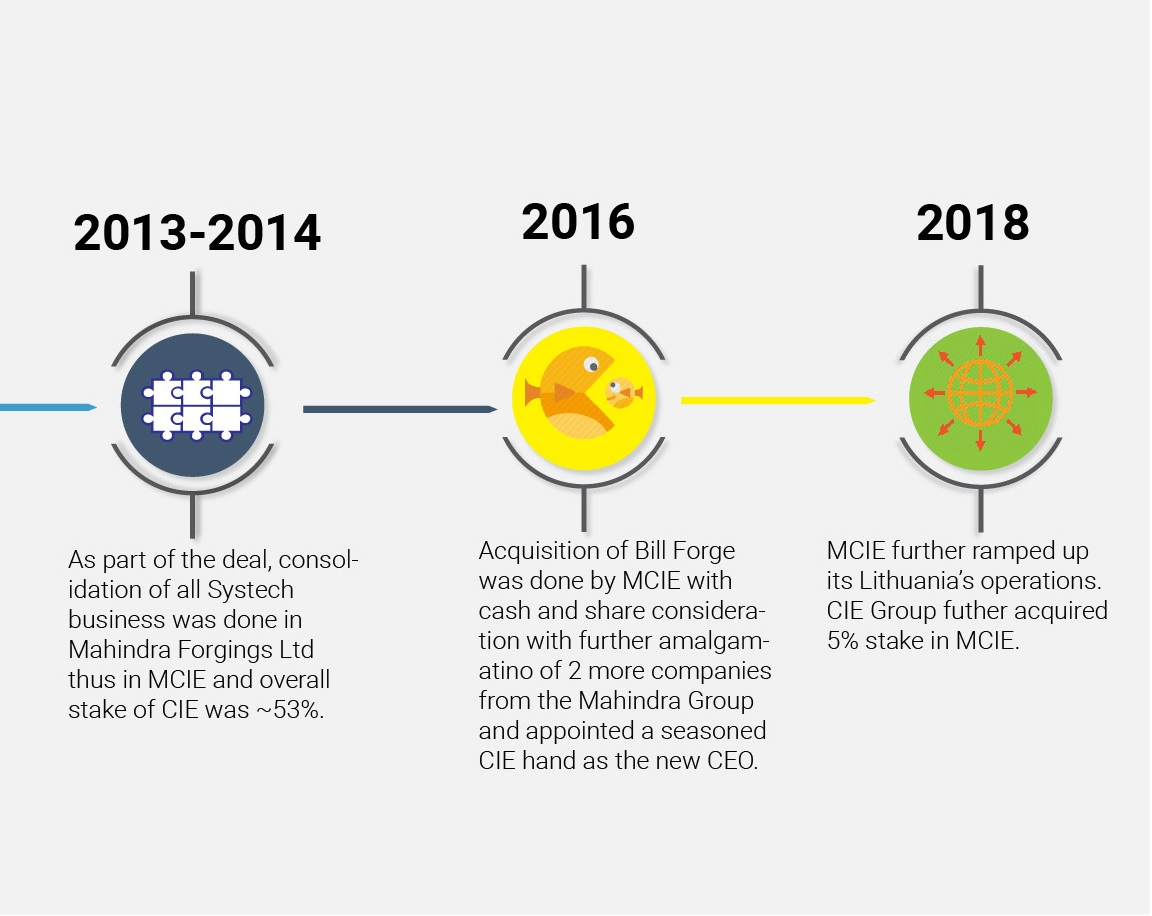

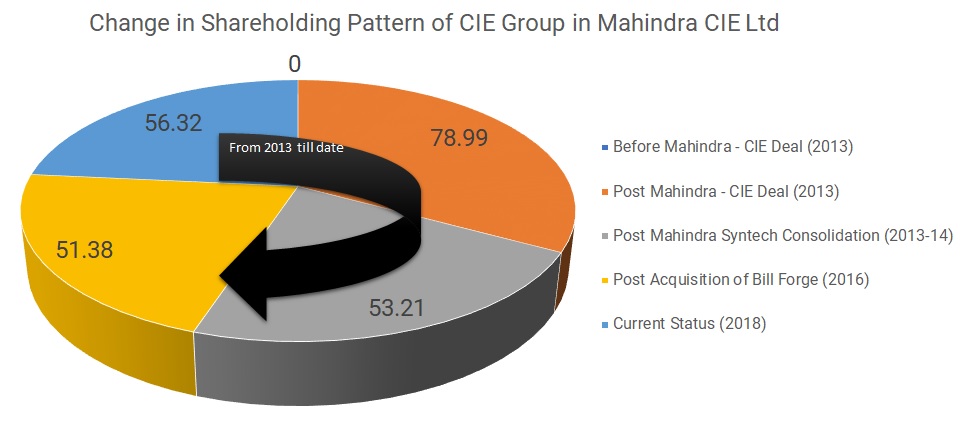

CIE Group, Spain was having a global presence in the fields of forgings, Machining, Stampings, Aluminium, Plastics, Bio-Fuel and Information & Communication Technology. In June 2013, the Mahindra group and CIE Automotive of Spain announced their global alliance whereby CIE Automotive would become the majority shareholder in the Systech Automotive Component Business while integrating CIE’s European forging business with Systech’s. Under the deal, CIE automotive acquired 53% in the new entity (Mahindra CIE) through its subsidiary and merged its European forgings business (Spain, Lithuania). M&M acquired 13.5% stake in CIE Automotive making the overall deal cash neutral to both parties. As a part of this deal, all the Systech’s were consolidated into Mahindra Forgings Limited (An entity part of Systech) and later the name changed to Mahindra CIE Limited.

Rationale for the deal

Mahindra Group

Through CIE, Mahindra Group got the opportunity to globalise and strengthen itself in India & Europe which they were striving for many years. CIE had a presence in five continents North & South America, Europe, Asia & Africa and was constantly increasing its footprint especially in emerging markets. Further, the group got the opportunity to become the second largest shareholder in CIE with minimal cash outflow. It also gave an opportunity for the group to capitalise CIE’s network for its other businesses.

CIE Group

Through the acquisition, CIE got entry to one of the most important emerging markets with the name & fame of Mahindra. The deal also resulted in CIE’s entry into the new line of business such as Gears’ Castings etc. It enabled the CIE’s auto component business to rise above the competition and extend its reach to new geographies with a comprehensive product portfolio.

Mahindra CIE Limited

Mahindra CIE has transformed from a small player into a global powerhouse after its alliance. The deal resulted in the consolidation of all the Systech’s business into MFL. Considering the nature of the business, the earlier business was highly dependent on the growth of Indian & European Economy. Prior to the alliance, the company was going through a downturn in European market coupled with high competition. The alliance helped the company to foray into different automobile categories. CIE also merged its forging business in Europe into MCIE. MCIE successfully leveraged CIE’s existing relationships with US and European clients (GM, Ford, Renault, VW) and made inroads vis‐à‐vis their requirements in India.

The minority shareholders

After CIE’s entry, the company grew through product & geographical diversification. The company got the opportunity to use CIE’s expertise to significantly improve their profitability. In terms of return, within a year, the markets have rewarded this bold step with more than doubling of the CIE share price and near quintupling of MCIE share prices since the deal had announced. However, since then, the prices remained in the same range.

Mahindra and Mahindra Group other Restructuring Deals.

- M&M Two Wheeler Expansion

- Amalgamation Of CIE & M&M Group

- CIE Automotive And Mahindra Group Tie Up

- Tech Mahindra Successfully Merges Satyam With Itself

- Mahindra & Mahindra Bets big on agri-equipment market

Unfolding the last 5 years

2013 – 14

- The Mahindra group consolidated all its Systech’s business. As a result of this, Mahindra Hinoday Industries Limited, Mahindra Ugine Steel Company Limited, Mahindra Gears International Limited, Mahindra Investments (India) Private Limited, Mahindra Composites Limited, Participaciones Internacionales Autometal Tres, S.L. amalgamated with Mahindra Forgings Limited.

- As a result of acquisition more than the threshold limits as mentioned under SEBI Takeover Code, CIE group made an open offer for equity shares representing 26% of the then Fully Diluted Equity Capital from the public shareholders of the Company at a price of INR 81 per share.

2015

- As a step toward increasing the overall efficiency of the company, the management decided to close Jeco-Jellinghaus GMBH’s operations in a phased manner by shifting machines & equipment to other manufacturing locations.

- Further, as part of a continuing restructuring exercise, the company outsourced the machining and finishing activities as well as some non-core activities to outside suppliers for some plant.

- The company also successfully turn around its Italian operations.

- In December, M&M transferred its entire shareholding in the company to Mahindra Vehicle Manufacturers Limited.

2016

- MCIE acquired 100% stake in Bill Forge for total consideration of INR 1313 crores, a market leading forging company with the same values and a complementary set of customers and technologies. The company was having six manufacturing units in India and one in Mexico. The acquisition widens MCIE’s portfolio in two-wheelers and three-wheelers. The acquisition was partly funded by cash & shares. Bill Forge’s management continued to remain invested in the company.

- To fund its Bill Forge acquisition, the company issued equity shares amounting to INR 450 crores to Participaciones Internacionales Autometal Tres, S.L on preferential basis.

- To align more tightly with CIE, the company also appointed Ander Arenaza, a seasoned CIE hand as a new CEO.

- The company amalgamated Mahindra Forgings International Limited and Mahindra Forgings Global Limited into the company. Further, it also announced the merger of Mahindra Gears Global Limited into Metalcastello S.P.A. All the three transferor entities were not having any significant business.

- It further closed Bill Forge Global DMCC.

2017

- With new CEO, the company also started to tighter integration of its employees with CIE’s expert. The company also stationed full-time CIE’s expert at its Pune plant.

- The company merged Mahindra Gears & Transmissions Private Limited and Crest Geartech Private Limited with the company.

2018

- Ramped up Lithuania’s operations.

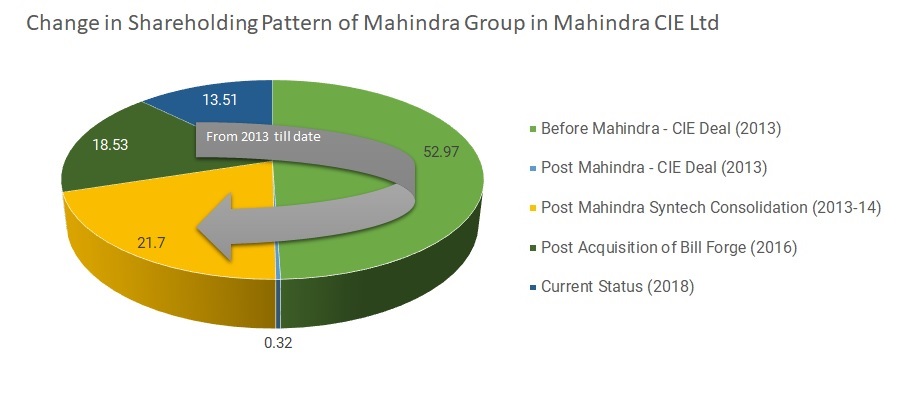

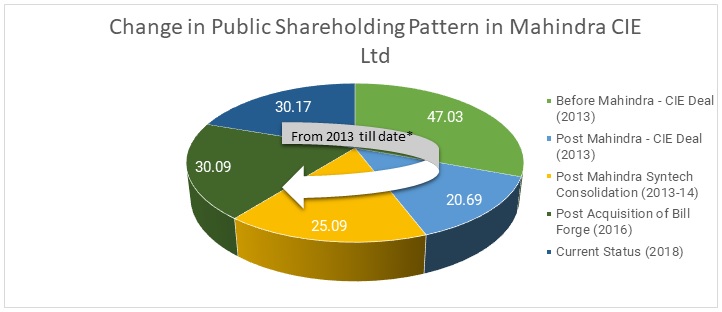

Shareholding Pattern

Consequent to the Open Offer the Acquirer acquired 24,502,193 equity shares representing 26% of the then Fully Diluted Equity paid up capital of the company. Immediately after open offer, CIE stake in MCIE got increased to ~79% and Mahindra groups became 0.32%. As a result of the consolidation of Systech’s business, M&M stake got increased to 21.7%.

Recently, CIE Automotive acquired an additional 5% in Mahindra CIE Automotive Ltd from Mahindra group, for an amount of approximately 60 million Euros. As a result of this, CIE’s stake in the company has increased to above 56%. On 27 July 2018, Prudential management & Services Pvt. Ltd (Part of Mahindra Group) sold its entire stake in MCIE. It is not yet clear to whom they sold.

*Approximate shareholding pattern. Further, the Shares held by Prudential Management and Services Pvt Ltd is considered under Mahindra Group.

The Number Game

Table 1: Value of the investment of CIE in MCIE

| Particulars | Amount (INR Crores) |

| CIE’s initial investment | 640 |

| Through Open Offer | 200 |

| Through QIP | 450 |

| Recent 5% stake increase | 480 |

| Total Investments | 1,770 |

| Current Value of Investment | 5,000 |

*Approximate Value. Actual amount may differ.

M&M, through its subsidiary, had invested ~13% in CIE Automotive. During last year, it’s holding came down to 7.43% stake as it sold 5% stake for INR 1160 Crore.

| Particulars | Amount |

| Stake in CIE Automotives | 13.50% |

| Amount invested | 750 |

| Sale of 5% stake last year | 1160 |

| Remaining stake | 7.43% |

Financial Improvement

Table 2: Mahindra CIE Financials

| Particulars | Dec-17 | Dec-16 | Dec-15 | Mar-15 | Mar-14 | Mar-13 | Mar-12 |

| Net Sales (INR Crores) | 6,520 | 5,320 | 3,865 | 5,570 | 2,591 | 2,216 | 2,440 |

| EBIT % | 8.7% | 6.2% | 5.9% | 4.4% | 0.1% | -2.9% | 4.1% |

| PAT % | 5.5% | 3.2% | 2.0% | -1.4% | -3.1% | -5.1% | 2.1% |

| Networth (INR Crores) | 3,716 | 3,266 | 2,007 | 1,887 | 656 | 754 | 872 |

| ROE | 9.6% | 5.2% | 3.8% | -4.1% | -12.4% | -15.1% | 5.9% |

| Total Borrowings (INR Crores) | 1,197 | 1,362 | 1,063 | 1,518 | 680 | 637 | 497 |

| Capital Employed (INR Crores) | 4,913 | 4,628 | 3,069 | 3,405 | 1,336 | 1,391 | 1,369 |

| RoCE | 11.6% | 7.1% | 7.5% | 7.3% | 0.1% | -4.6% | 7.3% |

| Total Assets (INR Crores) | 7,336 | 6,668 | 5,000 | 4,853 | 1,951 | 1,887 | 1,972 |

| Earnings Per Share (INR) | 9.5 | 4.5 | 2.4 | -2.4 | -8.8 | -12.4 | 5.6 |

Looking at numbers, it seems the strategy of first consolidation and then going for growth is has started giving returns to the company. Its margins are improving while slowly it is paying its debt through internal accruals.

Endnote

The deal was nothing but the merger of ambitious plans of both the entities to spread its wings. With an active involvement of the CIE group, MCIE intended to script a strong long-term growth story based on strong fundamentals. After the acquisition, CIE came out with a two-fold strategy. The first phase was focused on the consolidation of the businesses to improve the cost structure and then the second phase was to take the advantage of earning accretive inorganic opportunities for growth. Initial two years were spent on integrating its operations, simplification of its structure by merging/ closing its group companies and later they focused on its second phase.

With stake sale of CIE Automotive & MCIE by Mahindra group, the strategy by both the group seems to be very clear. In future CIE wants to grow this business on its own and Mahindra might remain in the business with a nominal stake or may exit completely.