Piramal Phytocare Ltd (erstwhile Piramal Life Sciences Ltd) was engaged in the two business activities NCE Research Activity and Herbal business activity. However, NCE research activity was demerged to Piramal Health Care (Now Piramal Enterprises Ltd) through a scheme of arrangement in December 2011 for approx. ₹196 crores. Post demerger Piramal Phytocare continued with its remaining business of Herbal products till date. Since Piramal Phytocare is running into losses since past 5 years, Piramal Enterprises post-merger will absorb the losses of herbal business.

Piramal Enterprises Ltd (PEL) is engaged in the business of pharmaceuticals, including research and development, financial services and information management through its subsidiaries. The product portfolio of the company is:

- Piramal Pharma

- Financial Services

- Healthcare Insights and Analytics

The Company offers its products under brands, including Saridon, Lacto Calamine, i-pill/i-know, Polycrol, Tetmosol, Untox, Stop AllerG and Throatsil. Piramal Enterprises Limited, the Group’s flagship company generates more than 51% of its revenues from international markets. Currently, PEL has a market cap on BSE of Rs 50,665 Crores.

Piramal Phytocare Ltd (PPL) offers medicinal products that are made from standardized herbal extracts. The Marketing of Herbal Products is done through country-specific marketing & distribution partners, manufacturing is outsourced on Loan License basis. In the year ended March 31, 2018, the Company has also entered into an arrangement with PEL whereby PPL has appointed PEL as a distributor to sell certain over the counter products bearing specific trademarks

Efficient Capital Deployment

Till date, Piramal Enterprises has a history of making over 50 acquisitions. The company is known for its efficient capital allocation.

| Capital Deployed | Financial performance |

| Loan Book Rs 46,995 Cr (on B/S) & Alternative AUM Rs. 7,620 Cr | ✔ 6-year loan book CAGR: 122%1 ✔ Q1 FY19 ROE: 19% ✔ Q1 FY19 GNPA ratio: 0.3% |

| Rs. 6,652 Crores invested in Pharma | ✔ 7 Year Revenue CAGR: 16%1 ✔ Q1FY19 Global Pharma EBITDA Margin: 20% ✔ 8 acquisitions in last 3 years |

| Rs. 4,583 Crores invested in Shriram Group | ✔ Around 16% annualized return on STFC and SCUF |

| Rs. 5,000 Crores invested in Healthcare Insight and Analytics | ✔ Around 20% appreciation in USD (relative to INR) since investment ✔ Peers trading at attractive valuations in US |

| Rs. 5,680 Cr of capital returned to shareholders since 2010 | ✔ Buyback of Rs. 2,508 Cr ✔ Annual dividends of Rs. 2,568 Crs & Special dividends of Rs. 604 Cr ✔ FY-2018 Dividend Pay-out –29 % |

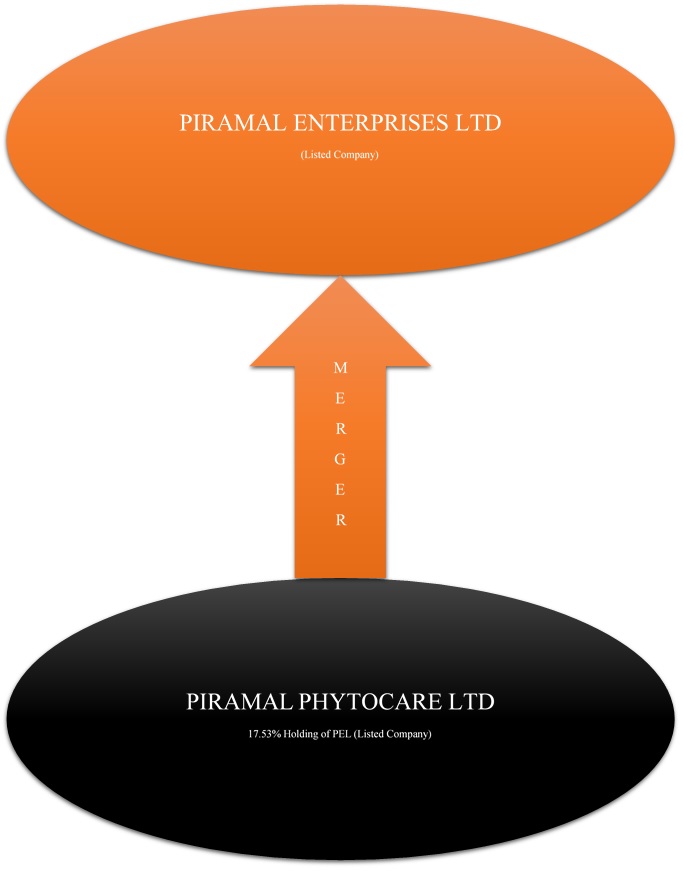

Transaction

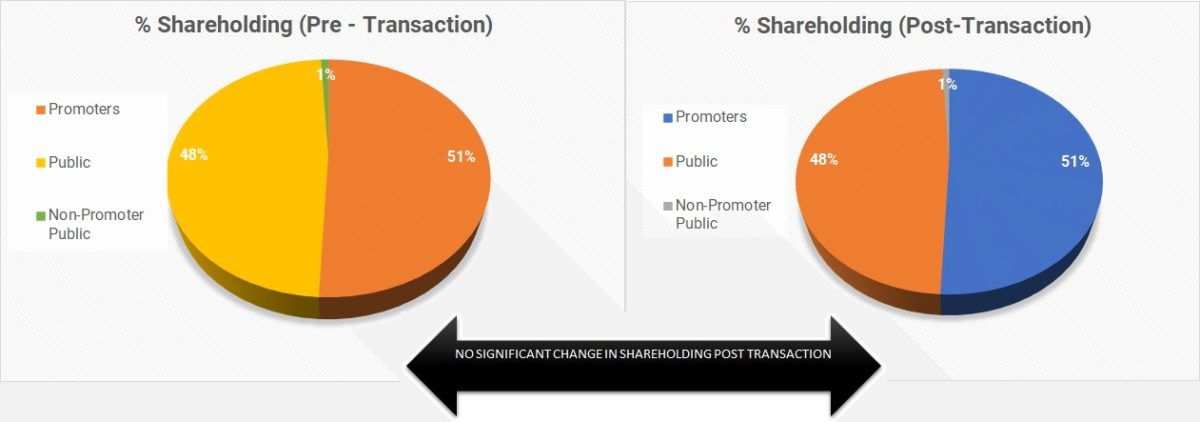

Shareholding Pattern

Both PEL and PPL have same the promoter group. Piramal Enterprises holds 17.53% stake in PPL which will get cancelled post-merger.

Consideration:

“1 (One) fully paid up equity share of Rs. 2/- each of the Transferee Company to be issued and allotted to the holders of equity shares of the Transferor Company for every 70 (Seventy) equity shares of Rs. 101- each held by them in the Transferor Company”

Financials

Table 1: Financials Standalone and Combined as on 31.3.2018 (All Figs in ₹Crores)

| Particulars | Piramal Enterprises Ltd | Piramal Phytocare Ltd | Combined |

| Carry Forward Losses | 0 | -46 | -46 |

| Networth | 21,337 | -17 | 21,293 |

| Secured Loans | 5,223 | 0 | 5,223 |

| Unsecured Loans | 9,378 | 0 | 9,378 |

| Fixed Assets | 1,919 | 0 | 1,919 |

| Revenue from operations | 3,297 | 24 | 3,321 |

| PBT | 753 | -22 | 731 |

| PAT | 518 | -22 | 496 |

| EPS | 29 | -8.65 | 28 |

Valuation

- Merger is from the Appointed Date as 1st April 2018.

- While arriving at the valuation weights are given to Earnings Approach (DCF Approach) and Market Price Approach, the relative value per share of PPL is Rs 35.78/-. Therefore, the transferor Company i.e. PPL is being taken over by PEL at 91.53 Crores.

- The Current Market Price of PPL is around Rs 40, but the relative share value is computed as Rs 35.78/- due to the weightage being given to DCF Method.

- Moreover, since in the proposed, transaction the Business value of the target company PPL is just 0.21 % of the Market capitalization of the acquirer company, namely PEL as on May 25, 2018. Since the size of the Target Company is insignificant compared to the acquirer, the mammoth task of carrying out a full-fledged valuation of PEL is not been undertaken by the valuers. Instead, they have considered the volume weighted average market price of PEL (for a period of three months ended the Valuation Date) for the purpose of determining the exchange ratio.

Accounting Treatment

PEL shall account for the amalgamation of PPL in the books of accounts in accordance with ‘Pooling of Interest Method’ of accounting as laid down in Appendix C of IND-AS 103 (Business Combinations of entities under common control):

| Elements | In the books of Transferee Company |

| Assets, Liabilities and Reserves | All the assets, liabilities and reserves in the books of the Transferor Company shall stand transferred to and vested in the Transferee Company pursuant to the scheme and shall be recorded by the Transferee Company at their carrying amounts as appearing in the books of Transferor Company, on the Appointed Date. |

| Investments | The carrying amount of investments in the equity shares of the Transferor Company to the extent held by Transferee Company, shall stand cancelled and there shall be no further obligation in that behalf. |

| Treatment of deficit or surplus of net value of assets, liabilities and reserves of the Transferor Company acquired and recorded by the Transferee Company over the sum of Face value of the new shares on merger issued and allotted and value of investments cancelled. | Adjusted against Capital Reserve Account in the Financial statements of the Transferee Company |

Conclusion

Both PEL and PPL are part of the same group. PPL is dealing with losses since past 5 years and considering negative Networth, it will not be possible for it to raise required fund as equity. It is just that the big brother PEL is bailing out small brother as it seems the business of PPL is not going anywhere. In that process government is also supporting by giving benefits of carry forward of losses, thereby creating a win-win situation.