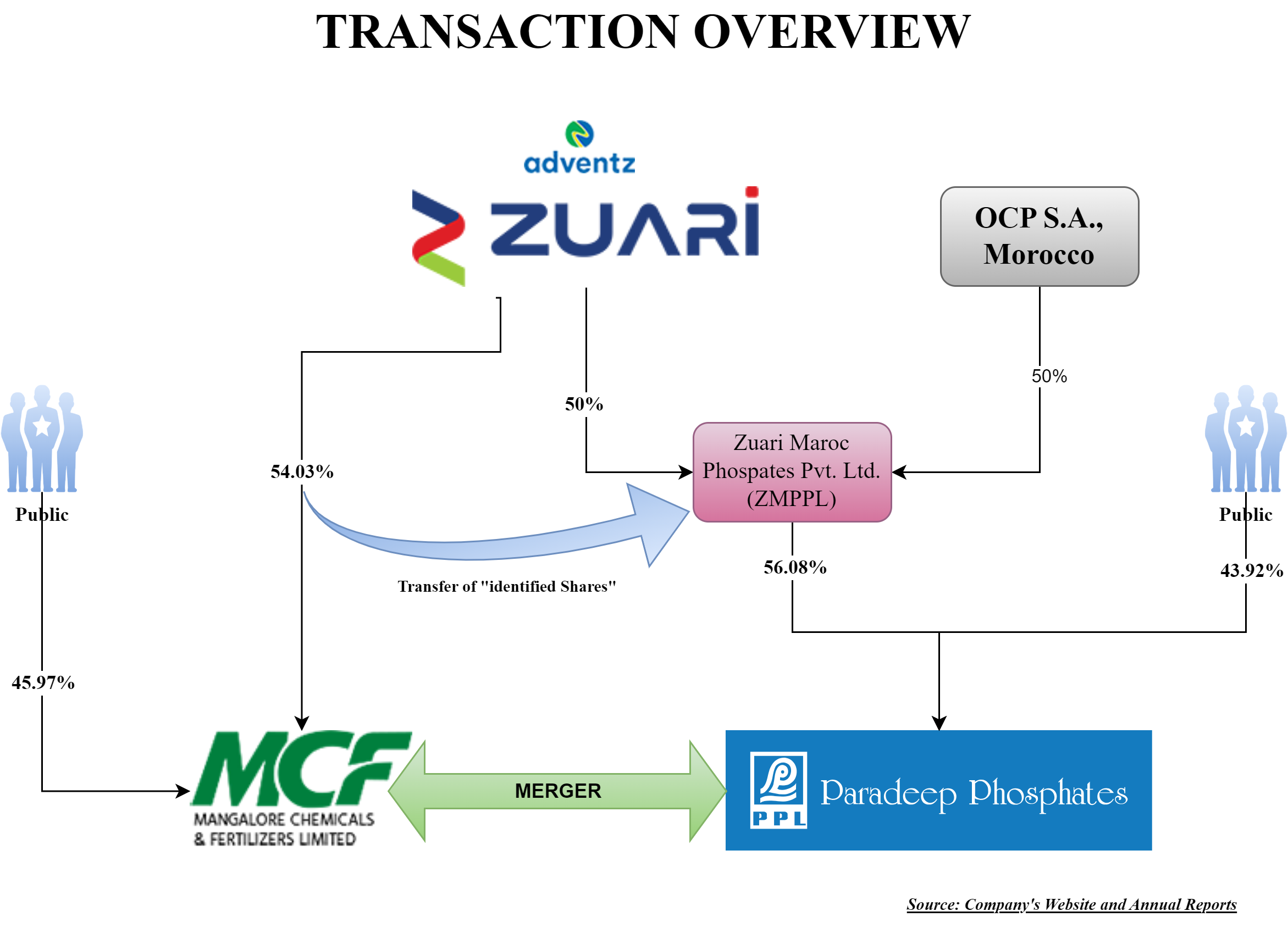

Recently Adventz (Zuari) Group announced the consolidation of its two group listed entities. One of its listed companies is entirely controlled by Adventz Group while the other being jointly controlled with OCP, Morocco (Morocco government entity).

MANGALORE CHEMICALS & FERTILIZERS LIMITED (hereinafter referred to as the “Transferor Company” or “MCFL”), is inter alia engaged in the business of manufacture, purchase, import and sale of fertilizers. The Equity Shares of MCFL are listed on the nationwide stock exchanges. MCFL is controlled by Zuari Agro Chemicals Limited which owns 54.03% equity shares of MCFL.

PARADEEP PHOSPHATES LIMITED (hereinafter referred to as the ”Transferee Company” or “PPL”) is inter alia engaged in the business of manufacture and sale of di-ammonium phosphate, complex fertilizers of NPK grades, urea, zypmite (gypsum-based product) and trading of fertilizers, ammonia, phospho-gypsum, and other similar materials ancillary or incidental thereto. The EquityShares of PPL are listed on the nationwide stock exchanges.

PPL is controlled by Zuari Maroc Phosphates Private Limited (ZMPPL) which owns 56.08% equity shares of PPL is a joint venture (50:50%) between Zuari Agro Chemicals Limited and Maroc Phosphore S.A., Morocco.

Till 2022, PPL earlier was a joint venture between the government of India & ZMPPL. In 2022, the equity shares of PPL got listed through an initial public offering and the Government of India took exit from the company. In the same year, it also completed acquisition of “Goa Fertiliser Plant” of Zuari Agro Chemicals Limited on a slump sale basis.

The Proposed Transaction

The Board of Directors of MCFL & PPL at their respective board meetings approved a composite scheme of arrangement (scheme) which inter alia provides for two key transactions:

- Merger of MCFL with and into PPL as a going concern

- Transfer of “identified Shares” from the MCFL’s promoter shareholder to the promoter shareholder of PPL i.e. ZMPPL.

Merger Transaction:

With the Appointed Date as 1st April 2024, MCFL will merge with PPL. Some of the rationale for the merger as envisaged in the scheme as follows:

- Merger will enable MCFL and PPL to combine their businesses and create a strong merged company, and become one of the leading private-sector fertiliser companies in India.

- MCFL and PPL are engaged in similar and/or complementary businesses and the proposed merger pursuant to this Scheme will create synergies between their businesses, including revenue synergies through the sharing of consumer understanding, market insights and channel models to ensure faster reach to the market and to achieve faster growth.

- To create enhanced value for the stakeholders of the MCFL and PPL.

The proposed combined entity will become one of the largest integrated private sector fertilizer companies in India, with a total manufacturing capacity of ~3.6 MMTPA. MCFL has a significant presence in the Southern regions of India while PPL has a strong presence in the Northern, Central and Eastern parts of India, thus making the proposed combined entity a pan-Indian fertilizer company.

Swap Ratio:

All shareholders of MCFL will be issued shares of PPL in the ratio of 187 equity shares of PPL for every 100 equity shares of MCFL. The new shares of PPL so issued to the shareholders of MCFL will be listed on both, the National Stock Exchange of India Limited and the BSE Limited.

Share Capital of the entities:

| Particulars | MCFL | PPL-Pre | PPL-Post |

| No. of Paid up equity shares | 11,85,15,150 | 81,47,39,453 | 103,63,62,779 |

| Face Value | 10 | 10 | 10 |

| Promoters Stake | 60.63% | 56.08% | 56.83%* |

| ZACL Stake (Direct & Indirect) | 54.03% | 28.04% | 30.06% |

*Promotors' of both the companiesOn account of the transfer of identified shares (as explained below) Zuari Maroc Phosphates Private Limited will continue to control the merged entity with 51.17% equity holding. The paid-up equity share capital of the company will exceed INR 1000 crore with a combined annual revenue of Circa INR 17,000 crore.

Further, in addition to the existing promoter of PPL, all the existing promoters of MCFL also will be classified as promoters of the transferee company.

Transfer of Identified Shares:

To ensure that the existing promoter of PPL continues to hold more than 50% of the share capital of the merged entity, the scheme provides for the transfer of identified shares from Zuari Agro Chemicals Limited to Zuari Maroc Phosphates Private Limited as its integral part. This is also the precondition for approval of the merger transaction.

The identified shares mean 3,92,06,000 equity shares of MCFL representing 33.08% of the total paid-up equity shares as held by Zuari Agro Chemicals Limited which shall be transferred to Zuari Maroc Phosphates Private Limited for a consideration of INR 144 each equity share (Cumulative consideration of INR 564.5 crore. The consideration will be arranged by ZMPPL through the raising of funds.

Basically, as part of the scheme, Zuari Agro Chemicals Limited will transfer 33.08% equity shareholding of MCFL to the promoters of PPL as a price decided now for a transaction that will be effective in future (after NCLT approval).

To give effect to the transfer of shares just prior to the effectiveness of the merger, the Scheme provides for two Appointed Dates & Effective Dates.

- Amalgamation: shall be effective on and from the Appointed Date 2 i.e. 1st April 2024 and shall be operative on and from the Effective Date 2 which is the date falling 3 days from the Effective Date 1. Appointed Date 1 is the same as Effective Date 1.

- Transfer of Shares: shall be effective on and from the Appointed Date 1 and shall be operative on and from Effective Date 1.

Effective Date 1 is being defined in the scheme which says the last date on which the conditions precedent for the effectiveness of the entire transaction shall be complied with.

The chronology must have been done as part of the commercial understanding between Adventz group & Maroc Phosphore S.A., Morocco which essentially provides that the merged entity continue to be controlled by ZMPPL. The commercial understanding has been well planned by including the same as an integral part of the scheme. Some of the key critical points to ponder for covering the share transfer arrangement as part of the scheme:

NCLT’s power/jurisdiction to approve share transfer:

As share transfer does not require any NCLT approval, whether providing share transfer arrangement as an integral part of the scheme will NCLT have any say on its approval/rejection? Will there be any regulatory objections on providing the same as a part of the scheme?

Open Offer Implication:

Currently, MCFL is controlled by Zuari Agro Chemicals Limited and PPL is controlled by ZMPPL being 50:50% Joint Venture between Zuari Agro Chemicals Limited and Maroc Phosphore S.A., Morocco. MCFL does not mention ZMPPL as a “promoter group entity”.

As a part of the scheme, shares representing 33.08% of the total paid-up capital of MCFL will be transferred to ZMPPL. General Exemptions to SEBI takeover code provide for an exemption for an applicability of the takeover code if change of control is through a scheme. The point to ponder is will this transaction be exempted from the requirements of an open offer.

One may argue that though the transaction is an integral part of the proposed scheme, it can be executed otherwise than the scheme and covering the same is only for avoidance of the open offer requirement.

Valuation:

The share transfer shall be effective upon the approval of the scheme however the pricing is being decided today. One may require analysing the income tax implications & foreign exchange management act implications, if any as PPL is jointly controlled by foreign shareholders if the price of MCFL exceeds the value envisaged as consideration.

Section 2(1B) of the Income Tax Act:

One of the requirements for any tax-neutral amalgamation is –

“shareholders holding at least 3/4th (three-fourths) in value of the shares in the Transferor Company (other than shares already held therein immediately before the amalgamation by, or by a nominee for, the Transferee Company or its subsidiary) will become shareholders of the Transferee Company by virtue of the amalgamation”

No doubt share transfer as per the scheme is before the effective date 2 of the scheme hence, literally the above clause is compiled with.

But can one argue that the shares representing 33.08% of the value is being discharged through payment of cash? Well, it is clearly envisaged under the scheme that share transfer will occur before the merger being effective and thus, ZMPPL will become the shareholder of MCFL prior to the merger and consideration will be issued to ZMPPL being one of the shareholders. Further, PPL is not paying any cash for the share transfer thus, there may not be any challenge.

Accounting Treatment:

PPL shall account for the merger of MCFL with PPL in its books of account as per the acquisition method in accordance with accounting principles as laid down in the Indian Accounting Standard 103 (Business Combinations), notified under Section 133 of the Act read with the Companies (Indian Accounting Standards) Rules; 2015, as amended and relevant clarifications issued by the Institute of Chartered Accountants of India.

Though the scheme provides for change of 33.08% of equity capital of MCFL to the promoter of PPL before giving effect to the proposed merger, the transaction will be recorded as per “Acquisition method”. It can be as Appointed Date for the merger is 1st April 2024 (prior to the date of the share transfer) and the merger implementation Agreement executed between two companies could provide for control to continue to remain with Zuari Agro Chemicals Limited for interim period (post share transfer to merger becoming effective).

Financials

Valuation

As both MCFL & PPL are listed on nationwide bourses and its equity shares have frequent trading, the relative valuation of both entities has been determined using weightage to various valuation methods such as discounted cash flow method, Market price and comparable company multiple method. MCFL share price has dropped from the levels as envisaged under the valuation report while PPL share price is in the same range.

Conclusion

This transaction is being proposed to become one of the largest integrated private sector fertilizer companies in India. One needs to consider whether it is a win-win proposition for all stakeholders. Historically, MCFL & PPL (since listing) has not given considerable returns to the shareholders. Hope the consolidation will change the fortunes.

Transfer of substantial shares as part of the scheme make the transaction one of its kind. Though the same has been envisaged by the promoters to remain in control of the merged entity with joint venture.