Max India sold its entire 51% stake in Max Bupa Health Insurance Co Ltd to private equity firm True North Fund for over Rs 510 crore. Earlier, it was in talks with HDFC Life to merger its life insurance business Max Life. But that failed as the insurance regulator objected to the proposed deal.

In fact, Max Bupa’s divestment follows Analjit Singh-owned company’s composite transaction involving demerger of Max India and the merger of Max Healthcare with Radiant-KKR. In the business community, savy Analjit Singh is known as a serial entrepreneur, who builds and sells his businesses. He has the ability to spot an opportunity in business like he did with telecom where he made Rs 561 crore in 1998 by selling his 41% stake in a joint venture with Hutchison Whampoa Ltd and insurance and healthcare early on, and more than that to quit when the business is on the top.

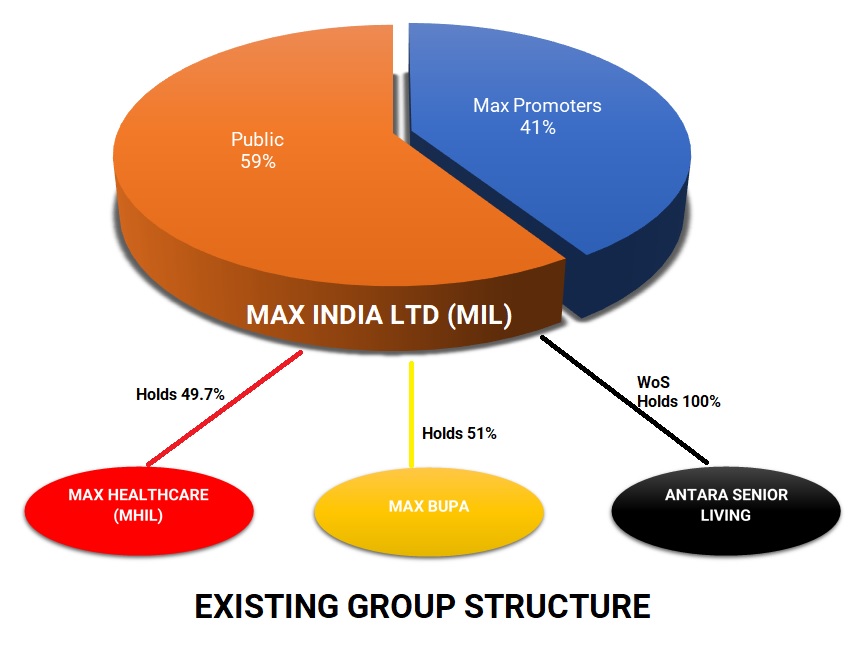

Max India Ltd. (MIL) is a listed company engaged in business of health and allied businesses. It holds stake in Max Healthcare, Max Bupa Health Insurance and Antara Senior Living. Max Healthcare and Max Bupa Health Insurance are joint ventures with global leaders Life Healthcare (South Africa) and Bupa Finance Plc. (UK), respectively. The Company owns 49.70% in Max Healthcare, a 51% in Max Bupa Health Insurance and a 100% in Antara Senior Living.

Max Healthcare Institute Ltd. (MHIL) is one of the leading comprehensive providers of standardized, seamless and international-class healthcare services. Max Healthcare has 14 facilities in North India, offering services in over 30 medical disciplines. Of this, 11 facilities are located in Delhi & NCR and the others in Mohali, Bathinda and Dehradun. Max Healthcare has a base of over 3,000 doctors, 10,000 employees and over 2.2 million patients from over 80 countries, across its network of 14 hospitals. MIL holds 49.7% stake in MHIL.

Radiant Life Care Pvt. Ltd. (Radiant) is promoted by Abhay Soi and is in the business of developing/redeveloping hospitals to provide high-end quaternary care. Presently, Radiant has two iconic facilities in its portfolio namely: BLK Super Specialty Hospital, Delhi and Nanavati Super Specialty Hospital, Mumbai.

Advaita Allied Health Services Ltd. (Advaita), Transferee Company, is Wholly Owned Subsidiary of MIL. The company has been formed especially for the current transaction.

Existing Group Structure:

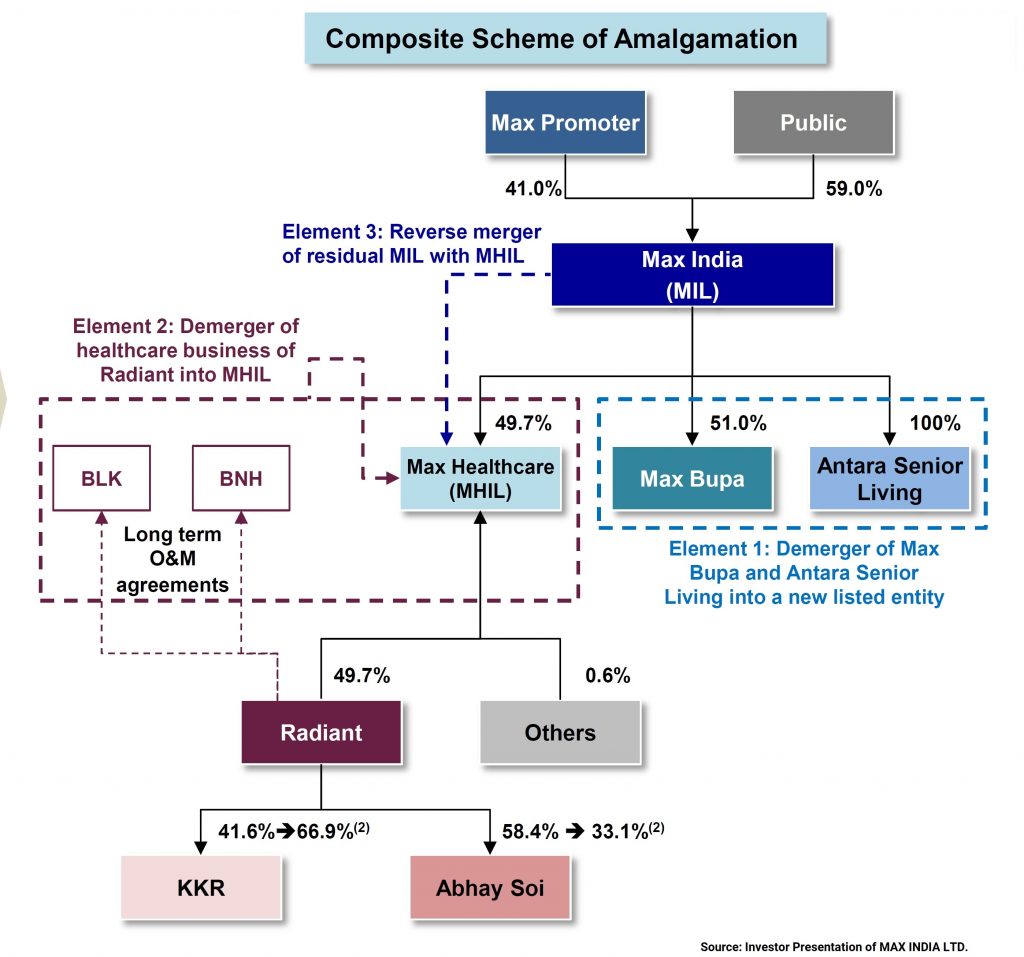

Proposed Transaction:

In a move to separate its Healthcare Business from other businesses, MIL will;

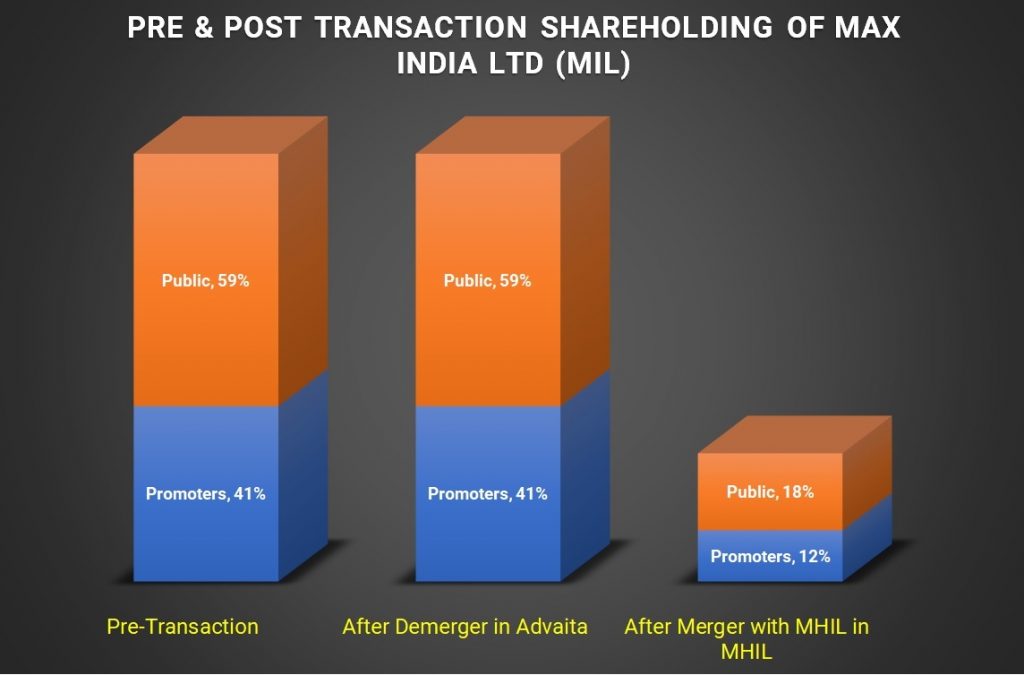

STEP I: Demerged its “Allied Health and Associated Activities” into Advaita appointed date is Feb. 1, 2019.

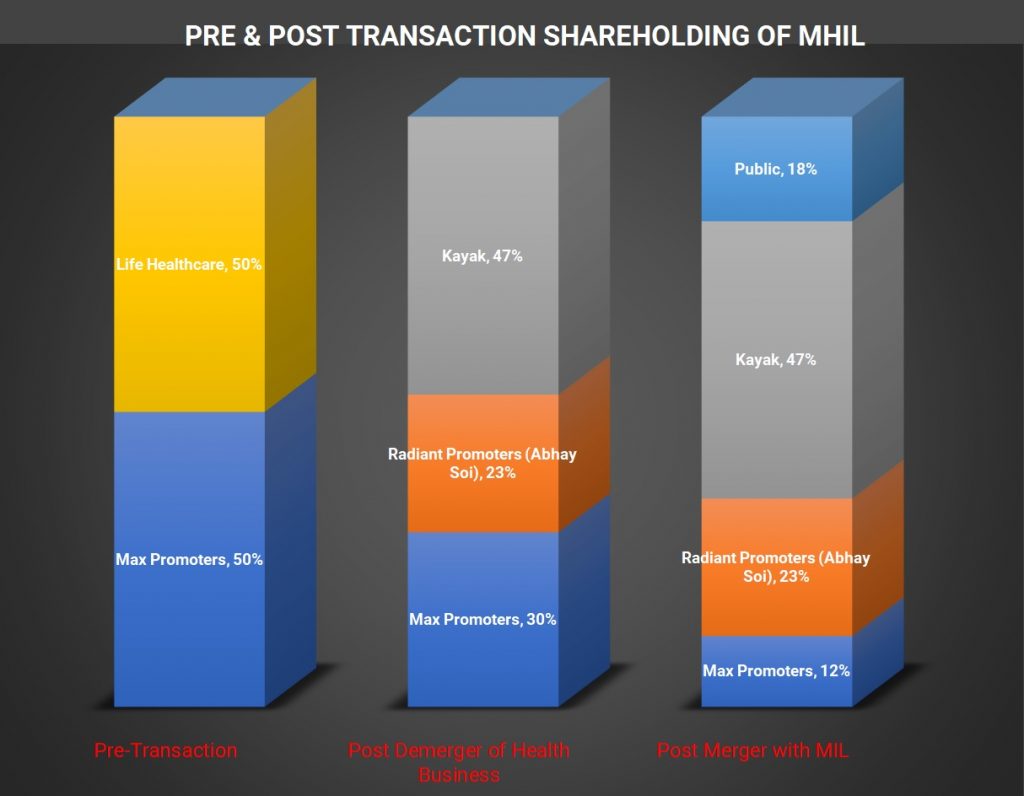

STEP II (A): Following the demerger, Radiant’s “Healthcare Undertaking” will be demerged into MHIL.

STEP II (B): “Remaining Business” of MIL will get merged with MHIL.

“Allied Health and Associated Activities” is an Insurance Business comprising of its stake in Max Bupa and Antara Senior Living.

“Healthcare Undertaking” of Radiant comprises the whole of the Healthcare Business i.e. health delivery services undertaken by Radiant by way of operating, managing and/or owning in relation to Dr. B.L. Kapur Memorial Hospital, Delhi and Nanavati Hospital including the shares of MHIL to be acquired by Radiant and the shares of Radiant Mumbai held by Radiant.

Appointed date:

Appointed date for STEP I, i.e. demerger of MIL and Advaita is 1st Feb, 2019. As part as STEP II is concerned, it is proposed that the appointed date for demerger of “Healthcare business” of Radiant into MHIL and Merger of MIL with MHIL is effective date i.e. after all the approvals are received and order is filed with ROC. The probable reason for choosing effective date as an appointed date could be, KKR will buy the stake in Radiant (which will buy stake in MHIL) in coming future & being PE investor.

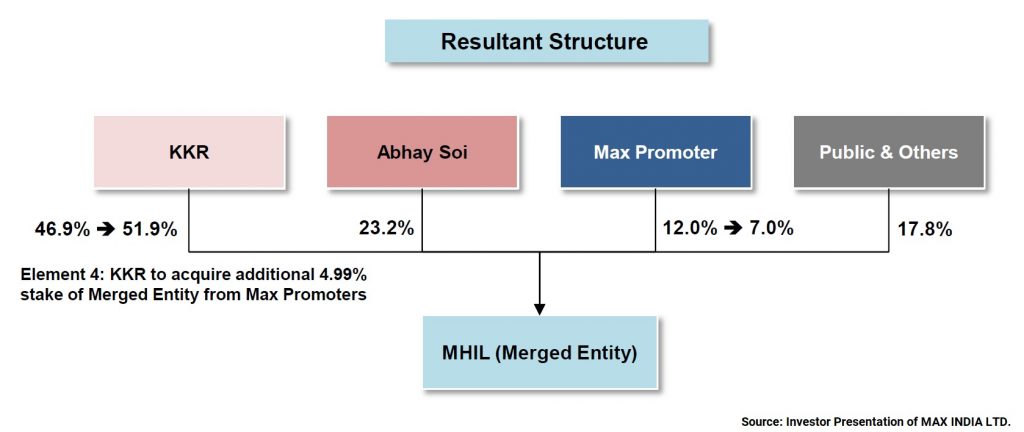

It is further agreed that the merged entity continues to use the current brand name of Max Healthcare. After this restructuring, equity shares of Advaita and MHIL to be listed on nationwide bourses.

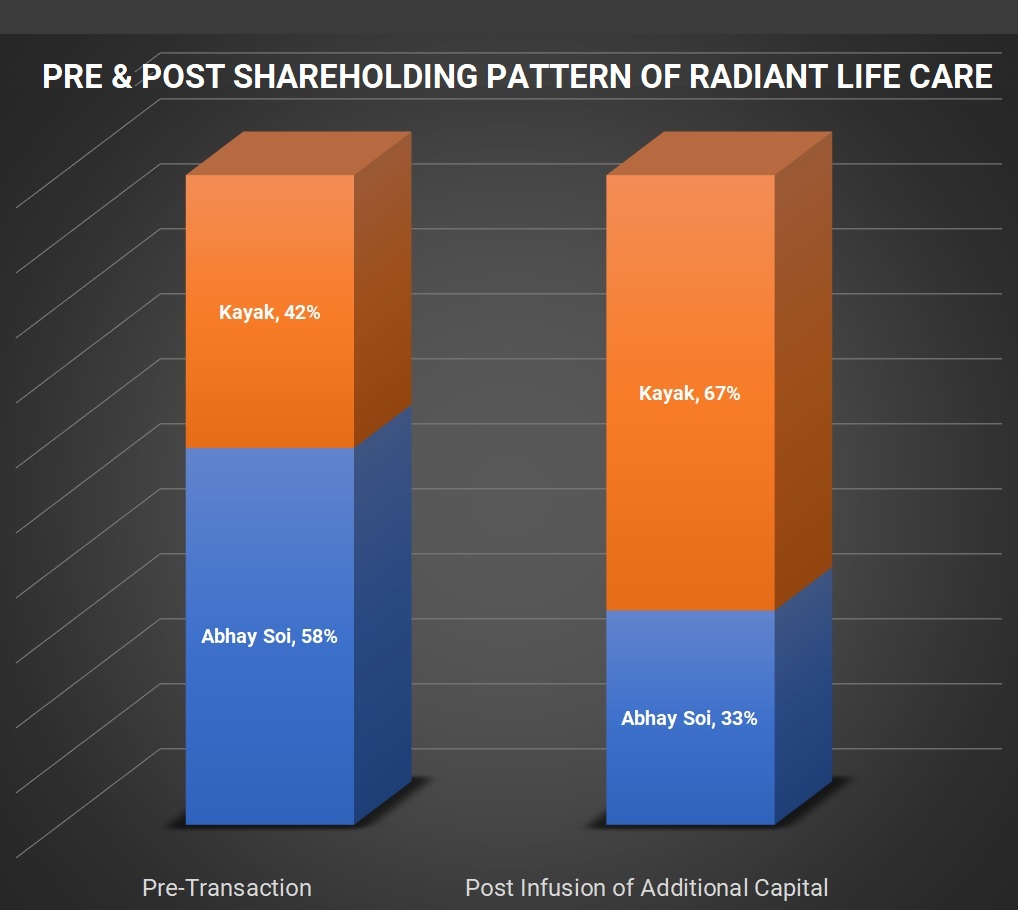

Shareholding Pattern: Pre and Post transaction structure

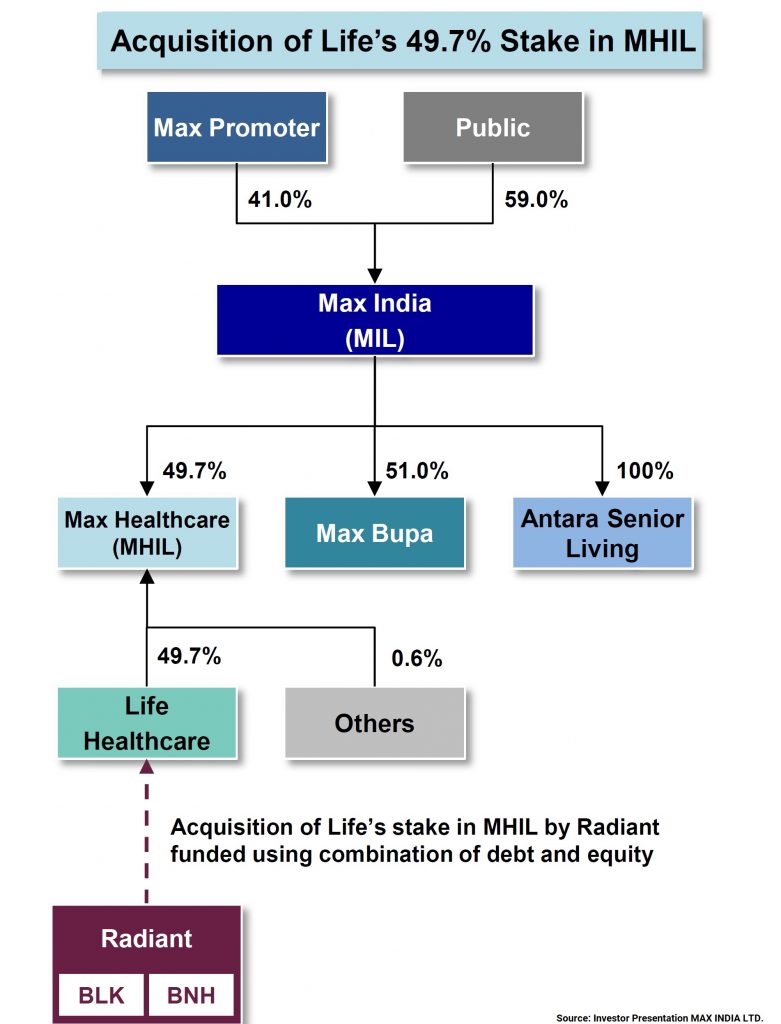

Before demerger of “Healthcare Business” of Radiant into MHIL, Radiant raise additional share capital of INR 2197 crores from existing shares holder I.e. Kayak. Post-infusion, Radiant will acquire 49.70% share of MHIL from Life Healthcare International Ltd. at INR 80 per shares amounting to INR 2135 crore. This will result in Radiant becoming the promoter of the MHIL.

Swap Ratio

Table 1: Swap Ratios for each transaction

| Transaction | Swap Ratio |

| For demerger of “Allied Health and Associated Activities” of MIL swap ratio is mirror image of shareholding of MIL. | Adavita will issue 1 equity share of ₹10 each for every 5 equity shares of ₹2 each of MIL. |

| Demerger of “Healthcare Business” of Radiant into MHIL | MHIL will issue 9074 equity shares for every 10 equity shares held in Radiant. |

| Merger of MIL with MHIL | MHIL will issue 99 equity shares for every 100 equity shares of MIL. |

Post-merger, MIL will cease to exist. Abhay Soi & Kayak (arm of KKR) will become promoters in MHIL. The Max promoters will hold 12% in MHIL. Subsequently, Max Promoters will get step down from MHIL & KKR will have the right to acquire this stake. Immediately, after the transaction, KKR will buy 4.99% stake from the Max promoters. This percentage has been kept below 5% so that the SEBI takeover code will not get applicable to KKR. In later years, KKR will likely to buy rest stake from the Max promoters. The public shareholding will get increased to 25% within a period of one year as required under LODR guidelines

Financials

Table 2: Financials- As on 31st March 2018 (Figs in ₹ Crores)

| Particulars | Max India-Consolidated | MHIL | Radiant | |

| Remaining | Non-Healthcare | |||

| Revenue | 647 | 769 | 2,619 | 824 |

| Net Worth | 719 | 710 | NA | NA |

| PAT | 22 | 18 | NA | NA |

| EBITDA | 7.3% | 8.5% | 7.6% | |

As Radiant is into health care business directly or through its subsidiaries, almost everything of Radiant will become a part of the” Healthcare Business”.

Valuation

The valuation of Max Healthcare & Radiant has been arrived using mix of the recent transactions happening/ happened in respective industry & Comparable Companies Multiple Method. The individual value derived by the two different independent valuer is different however, the relative value for deriving swap ration is similar for both the valuer.

Conclusion

Recently, MIL announced selling of its stake in Max Bupa for INR 510 crores to other PE firms. The company will utilise this cash inflow to further invest in existing business or new business opportunities.

The transaction is a result of Max promoter’s selling its different businesses to different PE firm. Further, the structure is design in way that Max promoters can get exit from the Healthcare business & KKR will purchase it without triggering SEBI Takeover code. Similarly, change in the composition of the board by giving board seats to new shareholders and no seat to Max promotors is also achieved through scheme. In meantime, KKR should also consolidate its Hospital business with MHIL.

The scheme covers crucial terms of SPA executed between Max Promoters, KKR & Abhay Soi in the form of annexures. But approval of the scheme does not amount to approval of terms contained in the said SPA. Further, it is possible for the honourable NCLT to approve the scheme when there are multiple conditions precedent and major financial transactions between shareholders of companies to the transaction is also considered as condition precedent to the scheme. The scheme also covers incentives and upside for the new promotor, Abhay Soi if he achieves various performance parameters and reach milestones.

Add comment