In a contradictory move to separate two unrelated business & merging other unrelated business, Indiabulls Integrated S

Indiabulls Integrated Services (IISL) is directly and through its subsidiaries, primarily engaged in the businesses of real estate development, providing management and maintenance services, construction advisory and other related services, charter business of aircraft, trade in all kinds of sculptures, paintings and art graphics, etc. The shares of the company are listed on BSE & NSE.

IISL has recently acquired non-operational Indiabulls Life Insurance Limited (ILIL) from its group company and has incorporated Indiabulls General Insurance Limited (Together referred as “Insurance Business”). ILIL has received preliminary acceptance from IRDAI.

SORIL Infra Resources (SORIL) is engaged in the business of equipment renting, LED lighting, management and maintenance services, construction advisory and other related and ancillary activities. Recently it acquired Littleman Fiscal Services Prive Limited to foray into the financial services business. Listed on BSE & NSE, it is a subsidiary of IISL in which IISL holds 64.7%.

Indiabulls Pharmaceuticals (IPL), established in 2016 is a promoter company engaged in pharma business and health advisory business.

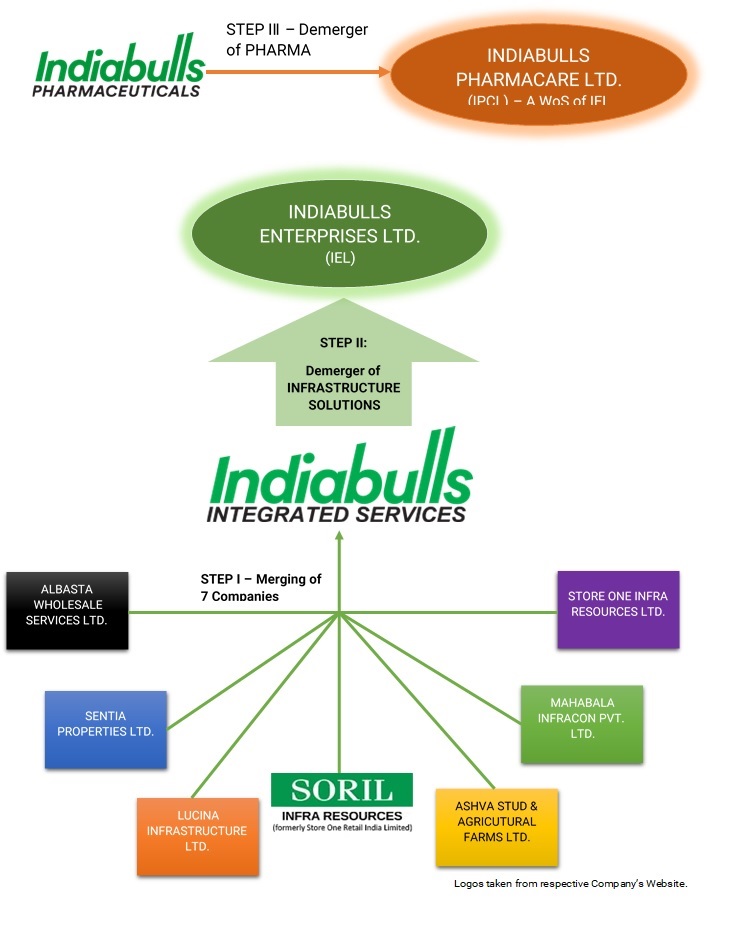

Indiabulls Enterprises Limited (IEL) & Indiabulls Pharmacare Limited (IPCL) are the companies formed for the purpose of this scheme. IPCL is a wholly owned subsidiary of IEL.

Other companies involved in the restructuring are Albasta Wholesale Services Limited (AWSL), Sentia Properties Limited (SPL), Lucina Infrastructure Ltd. (LIL), Ashva Stud and Agricultural Farms Limited (ASAFL), Mahabala Infracon Pvt. Ltd. (MIPL) are wholly owned subsidiaries of the IISL while Store One Infra Resources Ltd. (Store Infra) is WoS of SORIL having negligible business.

Transaction structure

The restructuring exercise shall be carried out in 3 different steps.

Step I: All the wholly-owned subsidiaries including SORIL will get merged into IISL.

Step II: Post-Merger, “Infrastructure Solution Business” will be demerged into IEL.

Step III: The “Pharma Business” of IPL, the promoter entity will get demerged into IPCL.

The “Infrastructure Solution Business” includes Equipment Renting Business, Facility Management Business, LED Lightning Business, Construction Advisory Business, trading in all kinds of sculptures, paintings and art graphics investment in engaged in infrastructure financing.

The “Pharma Business” includes the business of marketing, sales and distribution of prescription and over the counter pharmaceutical products.

The Appointed date for the purposed restructuring is 1st April 2019.

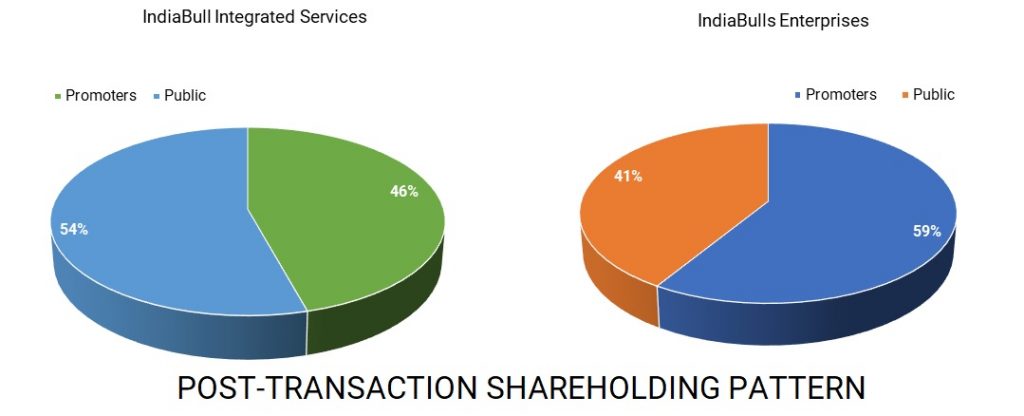

Shareholding pattern of listed companies

100% of the 9% non-convertible non-cumulative redeemable preference shares of IISL are held by the Indiabulls Real Estate Limited. These preference shares are not part of the demerged undertaking. Apart from that, IISL also has some employee stock options and compulsorily convertible warrants. 100% of the 9% non-convertible non-cumulative redeemable preference shares of SORIL are held by IISL & its wholly owned subsidiary, which will get cancelled during the merger.

IN 2017-18, the promoters have agreed to infuse INR 462 crore in the company through the warrants. Further, certain foreign investors have also invested around INR 658 crores in the company. In last two and half years, the promoters have raised their holding in IISL from 30.45% to 43.25%.

IN 2018-19, SORIL has allotted 39,00,000 fully paid-up equity shares to some foreign investors for the consideration of INR 210 crores.

Swap Ratio

| Amalgamation of SORIL into IISL | 1 Equity Share of IISL for every 1 Equity Share of SORIL. |

| Demerger of Infrastructure Solution Business | |

| Demerger of Pharma Business to IPCL | 156 equity share of IEL for every 100 equity shares of IPL. |

*There could be a regulatory reason for issuance of one preference share for all the preference shares of IISL.

Post-Transaction

Above stake is assuming the outstanding warrants will get converted to the equity. If the same has not get converted into equity shares, the promoter holding in IISL will become 38.46% & in IEL will be 56.04%.

As a result of the demerger of Pharma Business into IPCL, IEL will issue shares to the shareholders of IPL. This will result in indirect listing to the pharma business of IPL. Post-Transaction, shareholders of IPL will hold ~46% in IEL.

Financials

The major revenue comes from Equipment Renting Business & LED Lightning Business. Together they account for 72% of the total revenue. The insurance business of IISL has not yet started. It has got preliminary acceptance from IRDA for its life insurance business a few months back. Hence all the business which are generating revenue will get demerged into IEL and IISL will house the newly launched businesses.

Brief financials of the subsidiary companies

Table 1: Financials of Company as on 30th Sep 2018 (All Figs in ₹ Crores)

| Particulars | Networth | Unsecured Loans | Revenue | PAT |

| AWSL | 74.72 | 62.13 | 1.82 | 0.34 |

| SPL | -34.04 | 334.27 | 0.82 | 0.13 |

| LIL | 0.82 | 0 | 0 | 0 |

| ASAFL | 0.04 | 0 | 0 | 0 |

| MIPL | 0.28 | 14.86 | 0 | 0 |

| SORIL | 220.83 | 52.26 | 67.39 | 7.71 |

| Store Infra | 0.63 | 0 | 1.8 | 0.02 |

Except for the SORIL, all other subsidiaries don’t have any significant revenue. These are the special purpose vehicle used by IISL for funding some other group entities. As a result of the consolidation of group entities, all the inter-corporate deposits will get cancelled.

Table 2: Financials of Indiabulls Pharmaceuticals Ltd (All figs in ₹ Crores)

| Particular | 30-Sep-18 | FY 2018 | FY 2017 |

| Networth | 114.19 | 166.29 | -1.99 |

| Revenue | 16.57 | 67.34 | 0.33 |

| PAT | -52 | -136 | -20 |

| Book Value | 18.19 | 26.49 | -0.45 |

IPL has continuously reported losses. The financials of “Pharma Business” of IPL is not separately given, however, a significant part of the revenue likely to be pertain to the “Pharma Business”. As a result of the demerger, the losses of IEL (Infrastructure Solution Business) are likely to be widened.

The reason for not merging all other business into other company instead of SORIL could be it wouldn’t have had resulted in a cancellation of preference shares subscribe by the IISL & its subsidiary and the promoters stake in the “Infrastructure Business Solution” would have been different.

Valuation

For the merger of all WoS & SORIL, IISL & SORIL has been valued using the market price method. All the significant business except for the newly launched insurance business will be transferred to the IEL as a result of the demerger of “Infrastructure Solution Business”. However, IEL has been valued using the mix of Asset approach & Market Approach.

Table 3: Valuation for Merger (All Figs in ₹ Crores)

| Particulars | Amount |

| IISL | 4,763 |

| SORIL | 1,572 |

| IISL + SORIL* | 5,318 |

| IEL- Before Pharma Business | 1,784 |

| Value assigned to Insurance Business | 3,534 |

*Assuming no holding company discount.

The valuation of IPL has been arrived using the valuation at which the PE investor infused the funds in IPL in 2017 & DCF method. One needs to consider why hefty valuation assigned to IPL despite a relatively new player in pharmaceutical space (the same is mentioned in the Valuation Report).

Table 4: Valuation of other entities

| Particulars | Per Share (₹) | Amount (₹ Crores) |

| IISL | 439.8 | 4,763 |

| SORIL | 436.8 | 1,572 |

| IPL | 245.1 | 1,619 |

| IEL | 156.7 | 1,784 |

Conclusion

The move to separate insurance business from other businesses could be a regulatory purpose or institutional pressure. One must understand the reason for not consolidating other business activity in SORIL, an existing listed entity. Further, merging loss-making pharma business into diversified business company is unlikely to create any value for the stakeholder except for the existing shareholders of the pharma business who will get the shares of the listed entity. Owing to the merger of pharma business with Infrastructure Solution Business, promoters shareholding in the Infra Solution Business will increase significantly.

Add comment