In ordinary parlance, a hostile takeover shall imply the acquisition of Target Company by the Acquirer which is accomplished by going directly to the company’s shareholders or fighting to replace management to get the purchase approved. A hostile takeover can be achieved through either an open offer or a proxy fight.

There have been very few instances of hostile takeover in our country. Of late, the biggest tussle in the power of control is being witnessed in the Information Technology sector wherein Mindtree Ltd deploying all resources and tactics to fight tooth and nail to fend off L&T takeover attempt. It will be the first-ever hostile takeover move in India’s technology industry for a publicly traded company.

One could say that life has come full circle for Mr A.M. Naik, Current Group Chairman of the L&T who had battled with both Reliance and Birla Groups to thwart a hostile takeover bid for L&T in the early 2000s. The tables have turned around by L&T with a similar coup attempted against Mindtree, and thus, history is repeating itself.

Instances of Hostile Takeover in India

The inception of hostile takeover in India initiated with London-based industrialist Swaraj Paul who sought to control the management of two Indian companies, i.e. Escorts Limited and Delhi Cloth Mills Limited by picking up their shares from the stock market. The bids were retracted but leaving behinds scars and shock-waves to comparatively complacent and naïve Indian business environment.

In 1998, India Cements Limited (“ICL”) made a hostile bid for RaasiCements Limited (“RCL”) with an open offer for RCL shares at ₹300 apiece at a time when the share price was trading on the BSE around ₹100. The investors felt betrayed by the management as they were left high and dry without providing an opportunity to sell their stake to the acquirer during the open offer. However, ICL to avoid any resentment increased their holding in RCL to 85% by purchasing the shares of investors.

Another hostile takeover was triggered in 2008 when Emami acquired a 24 % stake in Zandu from Vaidyas (co-founders) at ₹6,900 per share. After four months of tedious struggle by the promoters withan endeavour to protect the company, Parikh’s finally gave away 18% stake. The Emami group paid Rs 750 Crores as consideration for a 72% stake in the company.

In October 2000, Abhishek Dalmia made an open offer to acquire 45 per cent of share capital in Gesco Corporation at₹23 per share. This transaction became a drama of hostile takeover until the promoters of Gesco and the Dalmia group announced that they had reached an amicable settlement in the battle for Gesco, with the former buying out Dalmias’ 10.5 per cent stake at ₹54 per share for a total consideration of ₹16 crores.

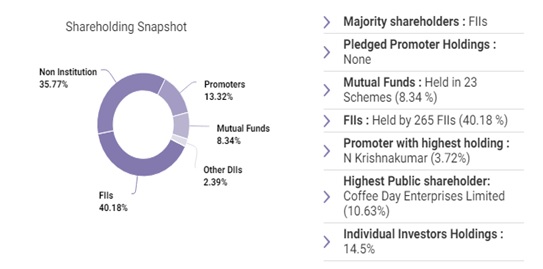

Shareholding Pattern of Mindtree Ltd

The promoter group has been significantly diluted and constitutes merely 13% of the total shareholding. The largest shareholder in the company was VG Siddhartha who exercised significant influence through investment in individual capacity and other entities. The breakup of the VG Siddhartha in Mindtree Limited as follows:-

Table 1: Shareholding of VG Siddhartha (Individual & Via Group Entities)

| Category & Name of the Shareholders | Shareholding % |

| V G Siddhartha | 3.33 |

| Coffee Day Enterprises Limited | 10.63 |

| Coffee Day Trading Limited | 6.45 |

| Total | 20.41% |

Transaction

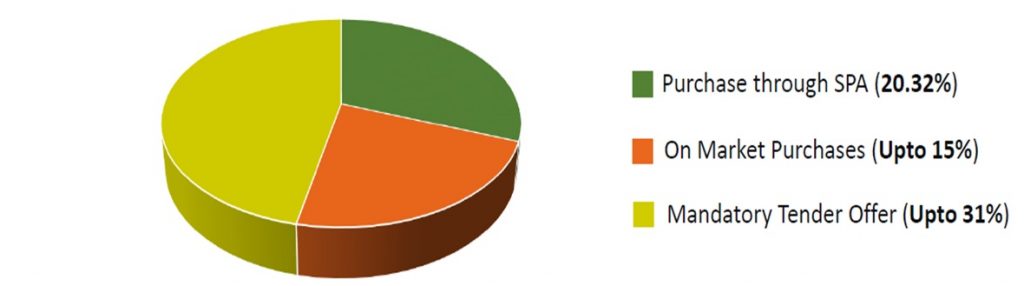

The clearance from the Income-tax Department, vide its letter dated February 13, 2019 for withdrawal of the provisional attachment issued on January 25, 2019 under section 281 B of the Income Tax 1961 for the transfer of charge of 22,20,000 and 52,70,000 equity shares of Mindtree Limited by Coffee Café Enterprise Limited and VG Siddhartha held by them respectively herald the beginning of the transaction. L&T has entered into a share purchase agreement dated March 18, 2019, with Mr. V. G. Siddhartha, Coffee Day Trading Limited and Coffee Day Enterprises Limited for the acquisition of 3,33,60,229 equity shares of the Target Company aggregating to 20.32% of the paid-up equity share capital of the Target Company at a price of Rs. 980 per share.

Additionally, the L&T has placed a purchase order with its stockbroker for acquiring up to 2,48,34,858 equity shares at per equity share price of not more than Rs. 980 per share and for an overall consideration amount not exceeding Rs. 2434 crore, on any recognised stock exchange in India in tranches/lots, from time to time.

With an intention to acquire control of the Mindtree Ltd,the public announcement was issued by Axis Capital Limited and Citigroup Global Markets India Private Limited on 18th March 2019 pursuant to Regulation 3(1)and 4 read with 13(1) and Regulation 15(1) of the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011.The Acquirer Company made an open offer for Rs. 980 per share to acquire5,13,25,371 equity shares of the Target Company aggregating to 31% of the voting share capital of the Target Company

Rationale for the Transaction

V. G. Siddhartha (Seller: 20.36% Stake)

V.G. Siddhartha was compelled to sell his stake due to liquidity crunch which triggered by defaults in payments by Infrastructure Leasing and Financial Services Ltd (IL&FS) in August. It led to his lenders calling in their loans against which his almost entire holding in Mindtree had been pledged. Another reason is to finance the expansion of his coffee venture Coffee Day Enterprises that runs the Café Coffee Day chain. The expansion plans have been stalled by the enterprises owing to rising debt and stiff competition arising out of booming café business. The proceeds from the sale would be used to pare down Coffee Day Group’s debt. Hence, L&T’s offer of Rs 981 per share for Siddhartha and Coffee Day would, in turn, reduce the amount and necessary cash infusion of Rs3,000-3,200 crore through stake sale.

L&T [Acquirer Company]

L&T has been motivated to execute such hostile takeover on account of following reasons as mentioned:-

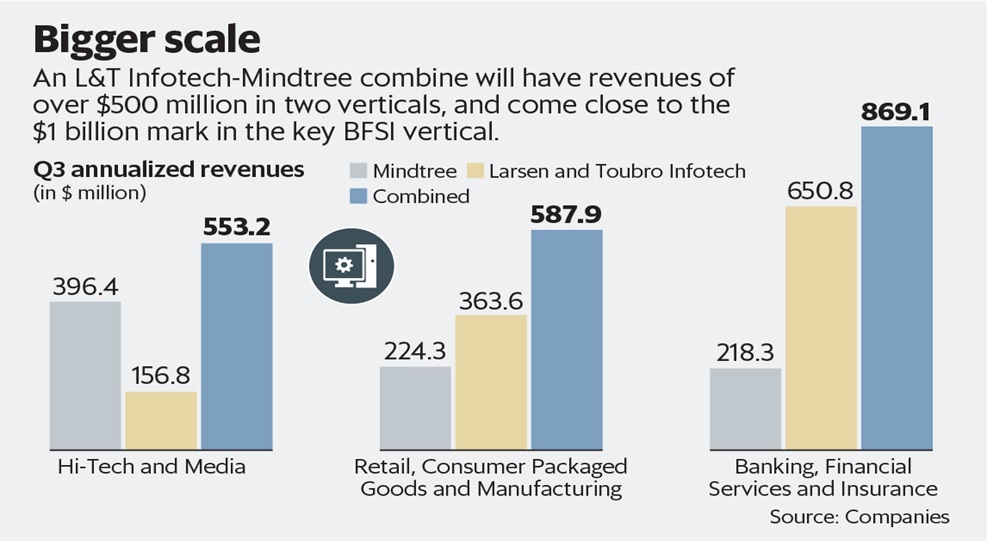

- Acquisition for Scale

L&T has an appetite for the acquisition and deep pocket to finance such expansion. Mindtree would serve as shining armour to its IT business and elevate its stature in the industry. The presence of L&T Infotech is limited to Banking, Financial Services and Insurance and such an arrangement shall provide synergy benefits in and thereby expanding the diversified customer base.

The acquisition of Mindtree Ltd will add significant scale to the group’s hi-tech, Consumer Packaged Goods, retail and travel verticals. The addition will enhance the contribution of services to the overall business portfolio providing a full suite of digital capabilities, top-tier clients and large digital talent pool. The combined entity would have to trail 12-month (TTM) revenue of $837 million in BFSI, $520 million in hi-tech and media and $554 million in manufacturing, retail and CPG. This implies a scale larger than Tech Mahindra in Banking Financial Service and Insurance, hi-tech and media verticals.

- Increasing Shareholder Wealth

The cash and cash equivalents of L&T stands at Rs 8,000 crores. Further, the management endeavours to diversify the business to an asset-light model, which means low capital expenditure in its traditional infrastructure business. It was exploring alternative options to generate value for shareholders after the Securities & Exchange Board of India rejected its plan for Rs 9,000-crore buyback. Mindtree Ltd is financially vibrant which could boost the vision of L&T for expansion in the domain of Information Technology.

S.No. Particulars L&T Infotech (in Crores) Mindtree (in Crores) 1 Sales 7,306 5,463 2 Operating Profit Margin % 16% 14% 3 Profit before tax 1,442 742 4 Net Profit 1,112 570 5 EPS 61.74 33.32 6 Compounded Sales Growth 5 Years: 13.66% 18.26% 3 Years: 13.65% 15.32% TTM: 28.34% 25.00% 7 Compounded Profit Growth 5 Years: 13.50% 11.64% 3 Years: 11.18% 3.49% TTM: 32.45% 52.11% 8 Return on Equity 5 Years: 40.13% 23.36% 3 Years: 34.73% 20.88% Last Year: 30.19% 21.44% - Repenting the missed opportunity

Back in 2009, L&T had made an aggressive move to acquire the scam-hit Satyam Computer Services. However, it missed the bus by the whisker. Rather than repenting on the loss, they lashed upon to acquire Mindtree Ltd as in when the opportunity presented and provided adequate stimulus to L&T Infotech for further scaling the business.

Legal Analysis

Strategies for the prevention of hostile takeover

Promoters with thin shareholding can also consider strategies as a defence to foil takeover attempt. The viable option that the management of Mindtree ltd can take to counter hostile takeover bids are mentioned below:-

- Crown Jewel:In a move to make the acquisition less interesting for the acquiring company, the target company may sell the whole company or the most critical assets of the company. Thereby, making the sale less attractive for the acquiring company.

Mindtree Limited can dispose off Crown Jewel in the form of Intangible assets, Intellectual Property and other assets to make the business less attractive for the L&T. Since the Mindtree ltd is in the service business, the resignation of key personnel including promoter and senior management before the takeover attempt can impact the valuation at such exorbitant price. It shall result in loss of wealth to the shareholders of the L&T which may, in turn, resist the temptation to acquire the enterprise. - Shark Repellents: To deter hostile takeovers Acquirer Company may make special amendments to its legal charter which becomes active only when a takeover is attempted. It is commonly known as a porcupine provision. These are put in place primarily to reinforce the ability of a firm’s board of directors to remain in control. Techniques such as staggered or classified board structures may be implemented through which only specified directors are re-elected to the board while others have a fixed tenure, there by forcing a hostile bidder to wait until the completion of tenure.

The amendment needs to be incorporated in the articles of Mindtree Ltd to deter hostile attempt. However, any change in the articles requires approval from 75%of the shareholders. Considering the present structure, it seems to be a utopian dream. - Pac-Man Defence: Pac-man defense is a bold move in which the Target Company prevents a takeover by buying stocks in the Acquirer Company and ultimately gaining control of the acquirer. In this case,the strategy is purely fictional and academic exercise as Mindtree Ltd do not have deep pockets like L&T.

- White Knight: Where a hostile takeover seems imminent, the target may seek out other investors which are friendly to the target company, and sell the company or substantial stocks of the company to the friendly investor. Such a friendly investor is called a white knight. Few instances of White Knight strategies adopted in corporate India are provided below:-

- In 2010, Reliance Industries turned white knight for Prithvi Raj Singh Oberoi’s EIH Ltd as Mukesh Ambani helped the company fight off a potential takeover bid by consumer goods company ITC. Ambani had picked up a 14.12 percent stake in the hotel business. ITC had amassed close to 14.98 percent stake in the company over the years. However, it had said it would never make a hostile bid to take control of EIH. The transaction with RIL gave Oberoi enough funds to shore up a defence.

- In2001, Radhakishan Damani made a hostile bid for British American Tobacco (BAT)’s VST Industries. Damani had acquired below 15 percent stake in the company. Henow wanted another 20 percent stake in the company at Rs 112 per share, which was a 26 percent premium to the market price. However, cigarette company ITC stepped in as the white knight and gave a counter-offer of Rs 115 per share that went up to Rs 126 per share later.

- In 2000, Kolkata-based Arun Bajoria bought a 15 percent stake in Wadia Group’s Bombay Dyeing. He threatened to make an open offer to the shareholders of the company. The Wadias turned to Ratan Tata and Keshub Mahindra to help prevent a takeover. Bajoria finally sold his shares to the Wadias for a considerable profit.

- This can be a feasible strategy, but the rich valuation of Rs 980 per shares provided by L& T can desert away from the fresh investors. Mindtree Ltd is struggling to find any takers at the given price point, but the promoters can make outreach exercise with private equity investors, family offices, institutional and HNI (high net worth individual) shareholders in the company to prop up a friendly white knight as a counter.

- Buyback of shares: Another defence available to the Target Company is to purchase their shares own shares from the open market. The promoters of the Mindtree ltd can buy back up to 10% of the total paid up capital and free reserves subject to the passing of the ordinary resolution. The general reserves and retained earnings for the financial year 2017-18 stood at Rs 26,321 million. There are enough cash reserves to fund their buyback expenses.

Mindtree intimated stock exchange, pursuant to Regulation 29(1) (b) and 29(2) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, for considering Shares Buyback in the upcoming board meeting on 26th March 2019. However, it was decided by the board not proceed with a plan to buy back its shares.

- Golden Parachutes: Golden parachutes are additional compensations to the top management of Mindtree in the case of termination of its employees following a successful hostile acquisition by L&T. Since these compensations decrease the Mindtree assets, this defence reduces the amount the acquirer is willing to pay for the Mindtree shares. Since the company is dealing in the IT service industry making a great ploy to deter hostile takeovers.

Compliance Bottlenecks [CCI]

There is no specific list of compliances for the purpose of the hostile takeover owing to limited transaction of this nature in the country. However, the acquisition shall be subject to the approval from following authorities:-

- a) Competition Commission of India;

- b) Section 39 (1) of the Act against Restraints of Competition fromBundeskartellamt in Germany;

- c) Approval under, or expiry of the Hart-Scott-Rodino waiting period as required pursuant to rules for Certain Mergers and Acquisitions as applicable in the United States of America;

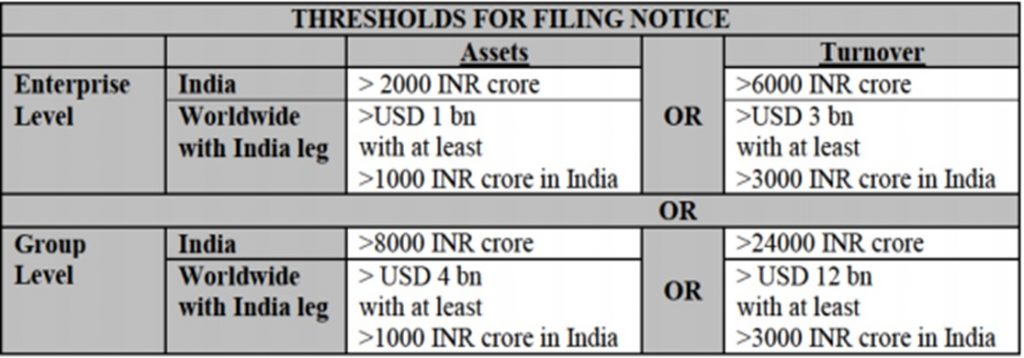

Section 5 of Competition Act 2002 provides for the threshold limit for attracting the provision of Combinations. In the present case, the Hostile Takeover of Mindtree Ltd shall exceed the mandatory criteria asper Assets as well as turnover. The limits of the combination were revised as provided in Notification No. S.O. 675(E) dated March 4, 2016.

Competition Commission of India (CCI) views on the takeover will set the precedent for corporate India in the light of Hostile takeover. Thus, CCI will have to scrutinise the transaction and certify that the transaction is not anti-competitive having appreciable adverse impact on the competition.

Game over for Mindtree

It is too late in the date for the Mindtree to weather the impending storm of takeover. The strategy mentioned above is not

- Alienate any material assets whether by way of sale, lease, encumbrance or otherwise or enter into any agreement therefor outside the ordinary course of business;

- Effect any material borrowings outside the ordinary course of business;

- Issue or allot any authorised but unissued securities entitling the holder to voting rights;

- Implement any buy-back of shares or effect any other change to the capital structure of the target company;

- Enter into, amend or terminate any material contracts to which the target company or any of its subsidiaries is a party, outside the ordinary course of business, whether such contract is with a related party, within the meaning of the term under applicable accounting principles, or with any other person; and

- accelerate any contingent vesting of a right of any person to whom the target company or any of its subsidiaries may have an obligation, whether such obligation is to acquire shares of the target company by way of employee stock options or otherwise.

Post the disposal of the equity holding of 20.32% holding of VG Siddhartha in favour of L&T, it becomes a nearly improbable task to pass a resolution in support of the Mindtree Ltd. It is just a matter of time before the formalities of the Hostile takeover completes, and the ownership changes the guard.

Battle Ready for the Corporate India

Shareholder Right Plan or Poison Pill:

The shareholder rights plan is a type of defensive tactic used by a board of directors against a takeover. Typically, such a plan involves shareholders the right to buy more shares at a discount if one shareholder acquires a certain percentage or more of the company’s shares. The plan could be triggered. If every other shareholder can buy more shares at a discount, such purchases

Section 53 of the Companies Act 2013 lays down the restriction on issue of shares at a discount except in the case of issuance of sweat equity of shares. The amendment needs to be made to allow the issue to shares at a discounted price during an abnormal situation.

Restructuring while raising capital

It is essential to structure the capital and investor who is pouring the money into the business. For instance, Ola [ANI Technologies Private Limited] refused the infusion of $1 billion from the Softbank investor to prevent the control of the company. The deficient capital requirement was met by raising the amount from Sachin Bansal, Steadview Capital and Temasek.

The entry of Temasek result in holding in 7-8% stake in Ola. But the Investors have explicitly mentioned that its voting rights are aligned with Ola’s founders, and Bansal. Similarly, DST Global had given its voting rights to Ola founders at the time of the investment in 2015 which has holding of close to 6%. The start-up’s co-founders, meanwhile, collectively own 10-11%, which means that Aggarwal stands to control about 25% voting rights.

The promoter group are having over 25-26% stake would allow Aggarwal to block special resolutions proposed by shareholders, including corporate actions like mergers & acquisitions. The move will keep Softbank in check to avoid the merger of the entity of Uber and Ola. Similarly, a lot of enterprises and Startups need to plan to avoid such a precarious position at a later date.

Conclusion

Hostile Takeover in IT service business is an unprecedented event, and such a transaction may send a shockwave to the corporate governance and takeover norms in our country. Only time will justify whether service business will be integrated successfully in the industry or not. This hostile takeover may compel to protect the promoter group from the likes of sharks/ corporate raider/ opportunistic company in the future.

Add comment