In the last eight years, auto parts house Uno Minda has expanded its business 5.24 times from Rs 954 crore to 5,000 crore and a major part of the expansion has come from mergers and acquisition of many entities. To continue on its expansion plans, the flagship company of Uno Minda group, Minda Industries Limited has announced the merger of listed Harita Seating Systems Limited (HSSL), part of the TVS Group, with itself in a share swap deal. This is the largest M&A transaction that Uno Minda has ever undertaken.

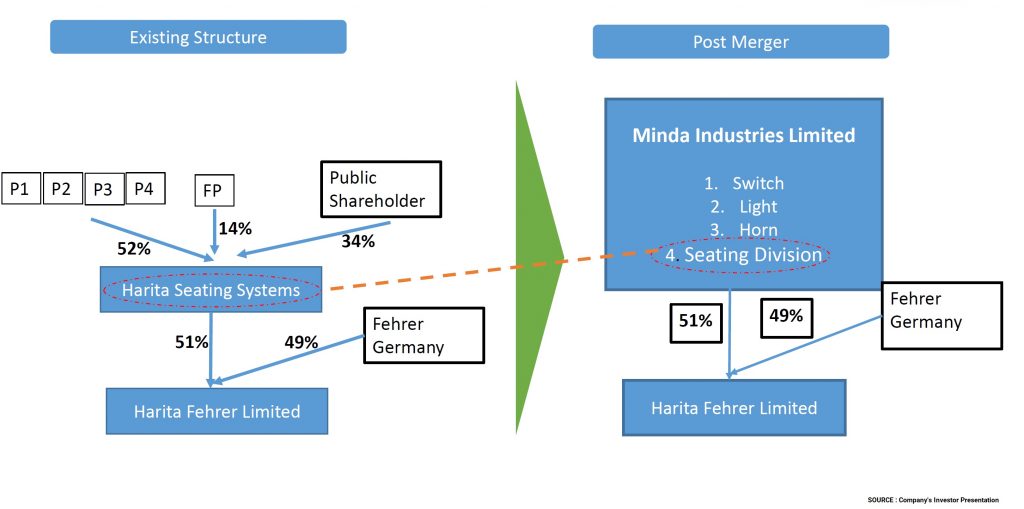

HSSL with the market capitalisation of circa 350 crores operates 12 manufacturing plants across India and offers solutions for driver and cabin seating for commercial vehicles, tractors and buses. The merger of HSSL with MIL was done through a composite scheme of arrangement and the transaction also encompasses Minda getting a 51% stake in Harita Fehrer Ltd, a joint venture of Harita with Fehrer Automotive GmbH, an automotive seating player in Europe.

For Minda, the deal will enable synergies across products, technology, customers, sales channels and value accretive. As HSSL is a quality, focused, system driven organisation, the deal is likely to take the company to the next level and create value for all stakeholders.

Minda Industries Limited (MIL) is a flagship Company of UNO MINDA Group. Along with its subsidiaries/Joint Ventures/ and Associates, it has business divisions include Lighting Systems Division, Switch & Handle Bar Systems Division. Acoustics Systems Division, and Sensors Actuators and Controllers Division. Further, the company has business divisions, which are engaged in production of batteries for two wheelers, fuel cap, compressed natural gas (CNG)/liquid petroleum gas (LPG) kits, blow moulding components and aluminium die casting. It has 58 manufacturing plants globally and has IVs/Technical Agreements with world renowned manufacturers from Japan, Italy, Taiwan and India. Its endeavour is to deliver high technology and quality products to its valued customers globally. The equity shares of MIL are listed on both the Indian Bourses.

Harita Seating Systems Limited (HSSL) is engaged in the manufacture of seating system, accessories and other parts for automotive and non-automotive applications. The company’s products include driver seats products, such as commercial vehicles seats, tractor seats and off-road vehicles seats, and bus passenger seats, which include intercity bus seats, intrastate bus seats, urban/city bus seats and standard bus seats. It has plant locations in Tamil Nadu, Maharashtra, Karnataka and Uttarakhand, among others. Their key customers include TVS, Royal Enfield, TAFE, Daimler, John Deere and TATA’s among others. The Company has 51:49 joint venture with Fehrer. viz., Harita Fehrer (HFRL), which is a complete foaming solution provider for automotive seats and manufactures and sells two and three-wheeler seats to OEMs. HSSL along with its subsidiary has 12 manufacturing plants at strategic locations across India. The equity shares of HSSL are listed on NSE.

The other companies included in the transaction Harita Limited (HL), Harita Financial Services Limited (HFSL), Harita Venu Private Limited (HVPL), Harita Cheema Private Limited (HCPL) are the investment companies which hold direct or indirect stake in HSSL.

The Transaction

The merger has potential to create significant shareholder value backed by superior business profile and performance. The transaction encompasses merger of HSSL into MIL; and its 51% holding in Harita Fehrer Limited (HFRL) which is a joint venture with Fehrer Automotive GmbH, one of the leaders in automotive seating business.

- Step I: Amalgamation of all the Investment Companies with MIL

- Step II: Amalgamation of HSSL with MIL

The appointed date for the transaction is 1st April 2019. The record date for the merger of other companies excluding HSSL is the effective date & Record date for the merger of HSSL with MIL will be not later than 10 days from the effective date i.e. Record date for the merger of other companies.

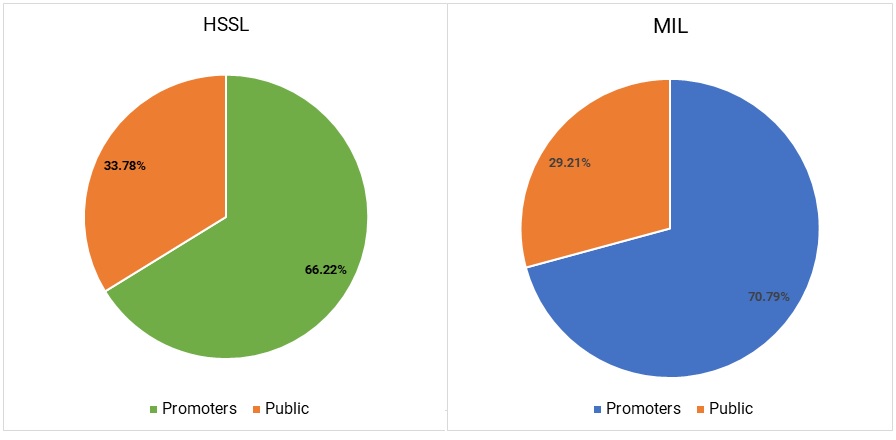

Pre-Shareholding Pattern

*: Currently, out of 66% promoter holding, TVS group holds 52% and Martin Grammer holds the remaining 14%.

Swap Ratio

As a consideration for the Proposed Amalgamation, the shareholder of the Transferor Companies (i.e. HFSL, HL, HVPL, HCPL, and HSSL) shall have an option to opt for equity shares or nonconvertible redeemable preference shares of MIL.

Table 1: Shares Consideration Options

| Merger of HL with MIL | 180 equity shares of INR 2 each of the MIL for every 121 fully paid up equity shares of INR 10 or 58 0.01% fully paid-up Non-Convertible Redeemable Preference Shares of MIL for every 14 fully paid up equity shares of INR 10. |

| Merger of HVPL with MIL | 1996 equity shares of INR 2 each of the MIL for every 30 fully paid up equity shares of INR 10 or 2409 0.01% fully paid-up Non-Convertible Redeemable Preference Shares of MIL for every 13 fully paid up equity shares of INR 10. |

| Merger of HCPL | 767 equity shares of INR 2 each of the MIL for every 14 fully paid up equity shares of INR 10 or 3357 0.01% fully paid-up Non-Convertible Redeemable Preference Shares of MIL for every 22 fully paid up equity shares of INR 10. |

MIL proposes to issue 0.01 % Non-Convertible Redeemable Preference Shares (‘NCRPS’) of Face and paid up value of INR 100 each at an issue price of INR 121.25 per share with a yield of 7.5% per annum on the issue price. These NCRPS will have a tenor of 36 months and it will be redeemable at any time after 18 months from the date of issue at the option of MIL.

For the merger of HSSL with MIL

152 fully paid equity share of INR 2/- each of MIL for every 100 fully paid up equity share of INR 10/- each held in HSSL; OR 4 fully paid up Non-Convertible Redeemable Preference Share of INR 100 each at a premium of INR 21.25 per Non-Convertible Redeemable Preference Share of MIL for every fully paid equity Share(s) of INR 10/- held in HSSL.

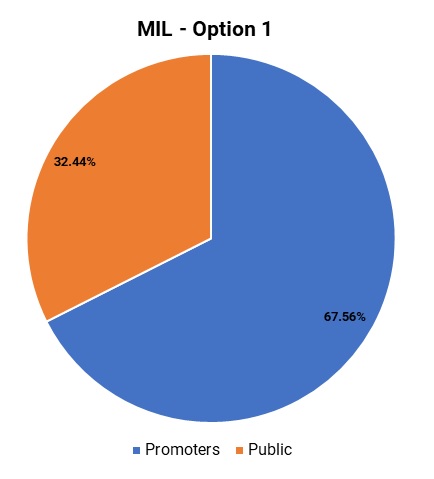

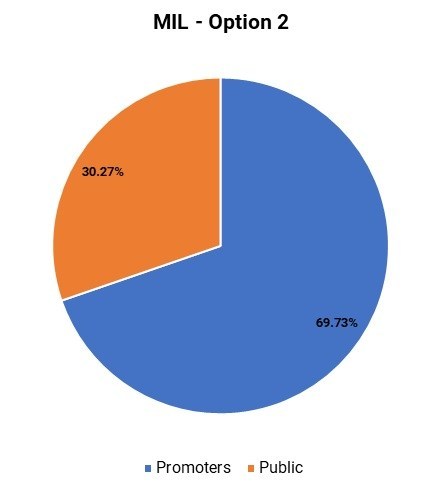

Post-Shareholding Pattern

1: This shareholding pattern is assuming all the shareholders of HSSL will opt for the equity shareholders.

2: This shareholding pattern is assuming all the shareholders except promoters of the HSSL will opt for the equity shares.

Post-Merger, the existing promoters of HSSL will be classified as public shareholders of MIL. It is likely that the promoters of HSSL will opt for the non-convertible preference shares during the merger.

Financials

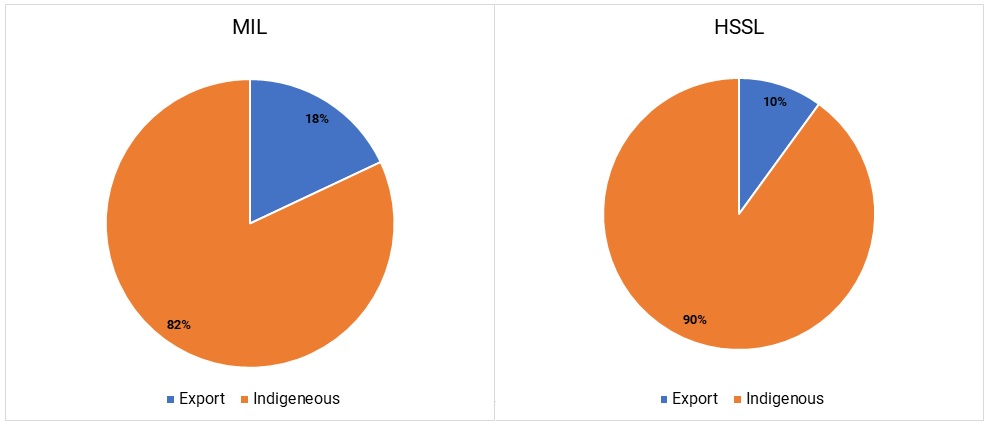

Export vs Indigenous Turnover break up

Table 2: Last 3 Years Financials for HSSL and MIL (All Figs in ₹ Crores)

| HSSL | MIL | |||||

| Particulars | 2016 | 2017 | 2018 | 2016 | 2017 | 2018 |

| Revenue | 691 | 790 | 905 | 2,527 | 3,665 | 4,548 |

| EBIT % | 5.8% | 6.7% | 7.8% | 6.3% | 6.8% | 8.8% |

| PAT % | 4.6% | 4.7% | 5.4% | 4.4% | 5.0% | 7.3% |

| Networth | 96 | 119 | 154 | 482 | 1059 | 1391 |

| RoE | 33.3% | 31.1% | 31.8% | 23.0% | 17.5% | 23.8% |

| Capital Employed | 97 | 126 | 176 | 853 | 1,497 | 1,933 |

| RoCE | 41.2% | 42.1% | 40.3% | 18.5% | 16.8% | 20.8% |

| Fixed Asset Turnover | 6.01 | 5.68 | 6.03 | 4.38 | 4.33 | 3.79 |

As on 31st March 2018, HL & its wholly owned subsidiary HFSL were having investments in various quoted & unquoted companies. Last year HL also merged its 2 wholly owned subsidiary with itself. As on 31st December 2018, HCPL & HVPL has a loan liability of INR 11 crores & INR 19.75 crores respectively. Further, HCPL has land & building having a book value of INR 5.88 crores & HVPL has a land having a book value of INR 10.87 crores. Both companies also receive farm income from these lands. Further, as on 31st March 2018, both companies had an investment in some other group entities, listed companies & paintings. All surplus assets get converted into tradable listed equity or preference shares for the shareholders of Harita group giving tax benefits ad cash flow directly in the hands of individual shareholders.

Table 3: Financials for 9 months ended 31st Dec 18 for MIL & HSSL (All Figs in ₹ Crores)

| Particulars | MIL | HSSL* |

| Revenue | 4,421 | 400 |

| EBIT | 387 | 16 |

| PAT | 254 | 12 |

*Standalone

As all surplus assets are not likely to be core to its business for MIL, in effect it has made a preferential allotment to shareholders of Harita group at INR 320 per share. Once MIL encashes those surplus assets, it can use the same for its business.

Table 4: Financials for 9 months ended 31st Dec 18 of other companies (All Figs in ₹Crores)

| Particulars | HL | HVPL | HCPL |

| Networth | 17.09 | 11.35 | 2.77 |

| Secured Loan taken | 0 | 19.75 | 11 |

| Fixed Assets | 10.89 | 5.88 | |

| Total Income | 1.04 | 1.92 | 0.57 |

Valuation

| Particulars | MIL | HSSL |

| Value Assigned | 8,391 | 377 |

| Current M-CAP | 9,995 | 386 |

The value arrived for HSSL & MIL is through Market Approach. The value for Investment Companies mainly comprise of the value assigned to its stake directly and/or indirectly in HSSL. The other surplus assets of HL including HFPL, HVPL and HCPL has been valued circa INR 60 crore and loan payable of circa INR 30 crore.

Gain to the Minority shareholders of HSSL

| Particulars | Amount |

| Current Value of 100 Equity Shares held in HSSL | 49,400 |

| Current Value of 152 Equity Shares of MIL | 58,140 |

| Value of 400 Pref. shares of MIL | 48,500 |

| Amount to be received after Three years (including Interest) | 60,251 |

If minority shareholders opt for equity shares of MIL, they have benefits to the extent of about 18%. This is because while arriving at the swap ratio, value per equity share of MIL is captured at INR 320 as against the present market price of INR 382.

Conclusion

Harita has strong hold in a margin accretive Commercial Vehicle & Off-Highway Vehicle segment while MIL is completely into 2-Wheeler & Passenger Car Segment. This merger will pave the way for MIL to enter high margin space and add its product portfolio. Further, With the addition to its existing offering, MIL can fetch better pricing for all the products. In future, there can be large cross-selling of products for MIL.

The option to opt for listed equity shares or unlisted preference shares for the merger could be to provide an exit to the existing promoters of HSSL. Further, the transaction has been structured in such a way that all the proceedings that the promoters of HSSL will receive from the redemption of preference shares or selling equity shares will be tax efficient for them. The promoters of Harita group will likely to receive gross INR 230 crores which they can use in other business.

Add comment