Automobile parts manufacturer, Motherson Sumi Systems Ltd, through one of its European subsidiary Samvardhana Motherson Automotive Systems Group BV (SMRPBV) has announced the acquisition of a majority stake in Plast Met Kalip (Istanbul) and Plast Met Plastik, Bursa together known as Plast Met Group (Turkey).

In fact, SMR will acquire 75% stake all for cash consideration and will enter a partnership with the founder of Plast Met, which reported combined revenues of 33.4 million Euro in 2019 and estimated 28 million Euro last year. Erol Senol, the founder of Plast Met will retain 25% stake in the companies and will continue to drive further business growth as a partner with SMR. Motherson Sumi expects these acquisitions to close within three months subject to receipt of necessary approvals. Consideration will be based on enterprise value of Euro 21.78 million subject to certain agreed adjustment.

The acquisitions come at a time when the automobile industry across the world and even in India has slowed down because of the Covid-19 pandemic. As Motherson Sumi has a good track record of buying companies and turning it, lots of good companies with scale are up for sale globally because of the pandemic. So, acquiring the right company is key to growth once the pandemic subsides.

Turkey is a strategic growth market

This acquisition will mark Motherson Group’s entry into Turkey through SMR. Turkey is a strategic growth market for the Motherson Group, with annual passenger vehicle production of 1.4 million units and long-term growth potential. For Motherson, entry into Turkey is consistent with the geographic expansion opportunities highlighted in the company’s Vision 2025 strategy. The buyouts are a part of the company’s vision of tripling revenues by FY25 to $36 billion from $12 billion under the Vision 2025 strategy. If that is achieved, then Motherson will be among the world’s top five auto component suppliers in terms of revenue. Moreover, around 80% of Motherson’s targeted consolidated revenue over the next five years will come through acquisitions and as part of Vision 2025, Motherson Sumi Systems will be expanding into new divisions like medical, aerospace, logistics and IT (Information Technology).

Turkey is likely to play a key role as a competitive sourcing hub and as a platform to serve the Group’s customers in European region. The acquisition will provide Motherson with diversification opportunities aligned with its core competencies and give competitive capacity expansion in Europe. The transaction will also enhance Motherson Group’s tooling capabilities and complement its existing manufacturing footprint as Plas Met is engaged in the manufacturing injection moulded parts, sub-assemblies for mirrors, trim modules, and lighting systems. The acquisition will help in addition of capacities for in-house tooling in Europe and increased ability for prototyping and securing short lead time programmes. It will reduce dependence on specialized tool makers and enhance competitiveness.

Past acquisitions

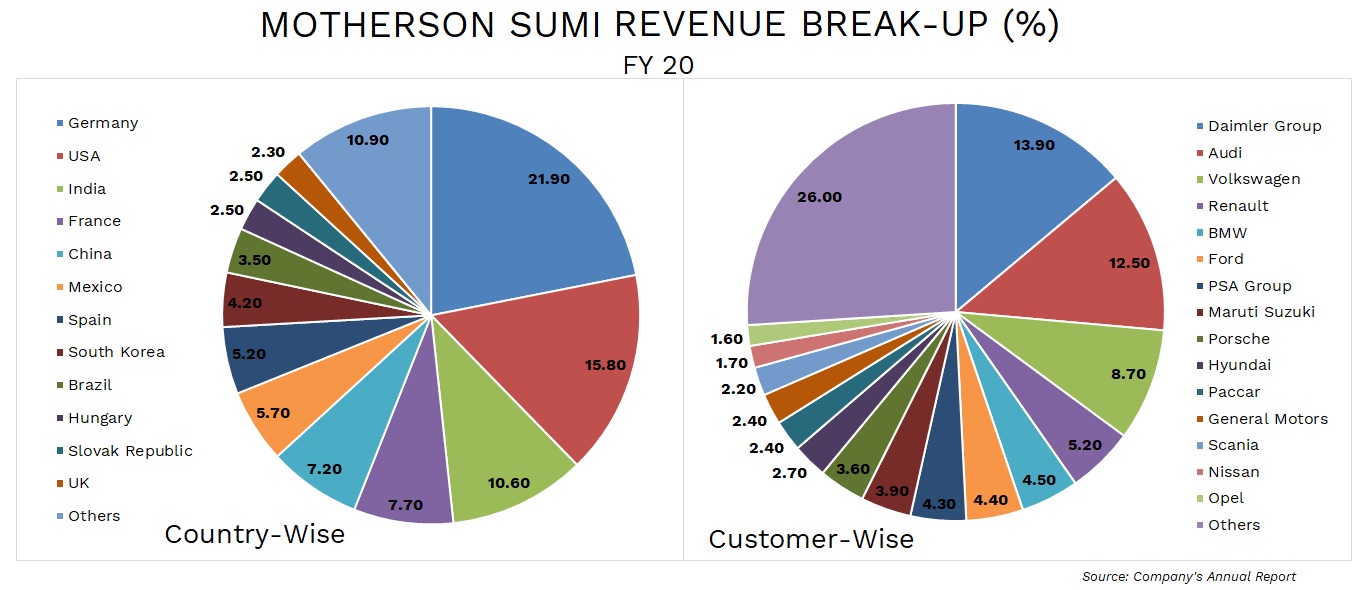

Motherson continues to be on the lookout for other potential companies for acquisitions, which have been a major reason behind the company’s growth. The acquisition in Turkey is the 25th one and comes three months after Motherson Sumi signed a strategic agreement to acquire the electrical wiring interconnection systems business of Bombardier Transportation, the rail equipment division of Bombardier Inc. In the last six years, Motherson Sumi has been aggressive in acquiring companies to scale up its operations. At present, Motherson Sumi is operating in 41 countries with 230 facilities and around 90% of the company’s revenues come from outside India.

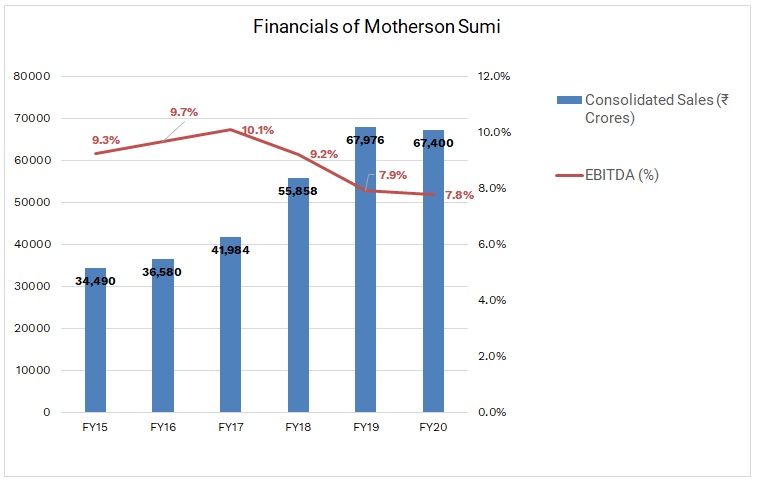

In the midst of the global financial crises, Motherson Sumi acquired UK-based Visiocorp in 2009. The takeover target was twice the size of Motherson Sumi. As Visiocorp was in financial trouble, Motherson Sumi acquired the company for just 26.5 million Euros, to become the world’s largest maker of rearview mirrors overnight. In 2011, Motherson Sumi acquired 80 per cent stake in German auto component maker Peguform. It was Germany’s second-largest supplier of door panels and a market leader in bumpers. The deal gave Motherson Sumi a strong presence in the polymer modules business like making bumpers, dashboards, and vehicle cockpits. The global acquisitions expanded the company’s growth from Rs 6,702 crore in 2010 to Rs 67,400 crore as on March 31, 2020.

The company has a strategy of 3CX10, which means no country, customer or component should contribute more than 10% to its revenues. It has also envisioned that 75% of revenues would be from the automotive industry and 25% from new divisions by 2025.

About Plast Met

Plast Met was founded in 1987 by Erol Senol, who is a first-generation entrepreneur. The group is based out of Turkey and is an important supplier of plastic moulded parts, related sub-assemblies, and injection moulding tools. Two facilities of Plast Met are located in Istanbul and Bursa in Turkey and employ 400 personnel.

About Motherson Group

Motherson – the name comes from mother and son as it was set up by the current chairman, Vivek Chaand Sehgal and his late mother, Shrimati Swaran Lata Sehgal in 1975. Initially, it did trade in silver and made electrical wiring for homes. Motherson Sumi Systems Limited was established in 1986 and is the flagship company of the Motherson Group. It is one of the world’s largest manufacturers of components for the automotive and transport industries. It has been listed at the Indian stock exchange since 1993. Motherson Sumi Systems Ltd. is a joint venture between Samvardhana Motherson International Ltd of India and Sumitomo Wiring Systems Ltd. of Japan.

The company is a specialised full-system solutions provider and caters to a diverse range of customers in the automotive and other industries across Asia, Europe, North America, South America, Australia, and Africa. It has a growing presence in wiring harnesses, rearview mirrors, cockpits, bumpers, interior trim as well as a broad range of other polymer, elastomer and metal-based parts and systems. It also offers proximity to its customers, supporting them in their product requirements across the globe.

Samvardhana Motherson Automotive Systems Group BV is a Motherson Group company. It is a joint venture between Motherson Sumi Systems Limited and Samvardhana Motherson International Limited. It is present in all major global automotive production regions, with 70 production facilities spread across 24 countries. SMRPBV operations include supplies to the global automotive industry through its subsidiaries Samvardhana Motherson Reflectec, Samvardhana Motherson Peguform, Samvardhana Motherson Reydel Companies and Samvardhana Motherson Innovative Auto systems.

Conclusion

Motherson group grew inorganically and to fulfill its vision 2025, it needs to acquire businesses as organically it is not possible to have such growth. The Covid-19 pandemic has affected the global automobile industry and India is no exception. However, buying good companies for cheap is a good proposition to grow and scale up operations. Motherson Sumi must integrate the acquisition of Plast Met and tap the markets where it has not been present. Keeping the Vision 2025 strategy in mind, Motherson Sumi should target a much wider mobility space from passenger vehicles to other auto segments including off-highway vehicles. However, critical concern is huge debt on the consolidated Balance sheet. Net debt is lowest in the last fourteen quarters but needs to have business plan which balance funding for new acquisitions for growth and clear plan to deleverage to create substantial value for its stakeholders.

Add comment