Motilal Oswal Financial Services Limited (MOFSL) is a listed company on BSE (Bombay Stock Exchange) Limited and National Stock Exchange of India Limited. It is a SEBI (Securities and Exchange Board of India) registered Trading Member registered with BSE Limited, National Stock Exchange of India Limited, Multi Commodity Exchange of India Limited, and National Commodity & Derivatives Exchange Limited. It is also a SEBI registered Depository Participant registered with Central Depository Services Ltd, (CDSL) and National Securities Depository Limited (NSDL) and execute transactions in capital markets/equity derivatives/commodity derivatives/ currency derivatives segments on behalf of its clients which include retail customers (including high net worth individuals), mutual funds, foreign institutional investors, financial institutions, and corporate clients. Besides stockbroking, it also offers a bouquet of financial products and services to its client base. It is registered with the SEBI as Research Analyst; Portfolio Manager and with various other bodies I agencies like IRDA, AMFI, CERSAI, KRA agencies (CVL, Dotex, NDML, CAMS (Computer Age Management Services) and Karvy) etc.

Passionate Investment Management Private Limited (PIMPL) is a private limited company and registered as a Stockbroker with BSE Limited. It is also the holding company of MOFSL. It holds 57.95% shares of MOFSL as on 31st December 2020.

MOPE Investment Advisors Private Limited (MOPE) is a subsidiary of MOFSL (MOFSL holding 87.16% equity shares). It is engaged as an investment manager/ advisor to alternative investment funds, venture capital funds and Mauritius based funds. It is also engaged, inter alia, in the business of portfolio management services, providing financial, investment advisory services, management, referral & facilitation services and identifying investment opportunities.

Motilal Oswal Real Estate Investment Advisors Private Limited (MORE) is a wholly-owned subsidiary of MOPE. It is a Managing Partner in India Realty Excellence Fund II LLP.

Motilal Oswal Real Estate Investment Advisors II Private Limited (MORE II) is a subsidiary of MORE and it is an investment manager/advisor to alternative investment funds. It is also engaged, inter alia, in the business of providing financial, investment advisory, management, referral & facilitation services and identifying investment opportunities etc.

MO Alternate Investment Advisors Private Limited (MO ALTERNATE) It is a wholly-owned subsidiary (WoS) of MOFSL. The main object of Company interalia includes providing investment advisory services, management/advisory/referral services, advising and/or managing real estate funds, alternative investment funds, venture capital funds, offshore funds etc.

The Transaction:

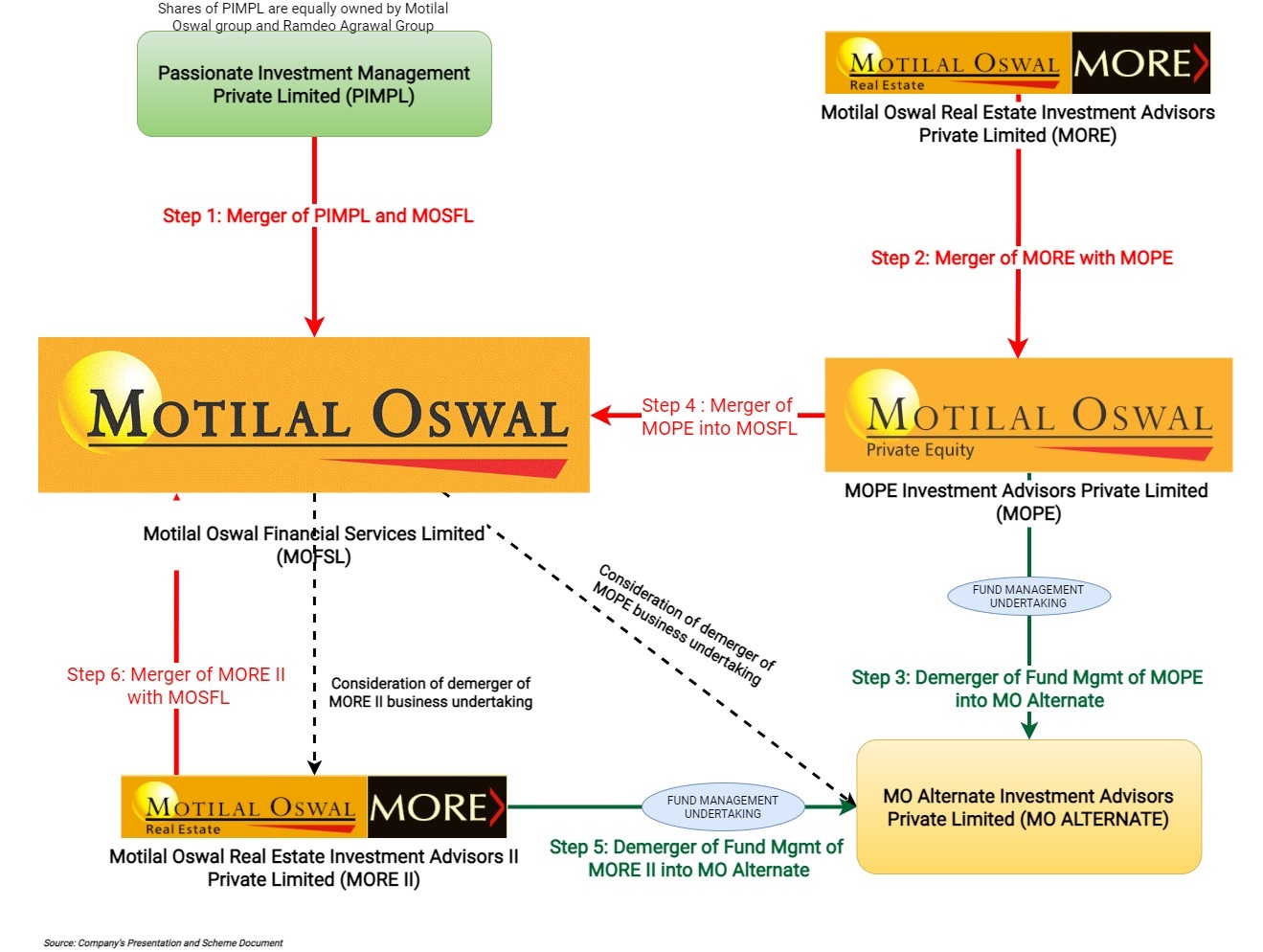

MOFSL file a composite scheme of merger and demerger between group companies. First part of the scheme i.e., Part B is simple merger of promotor holding company into listed operating company as follows:

Step 1: Merger of PIMPL with MOFSL and because of merger shareholders of PIMPL will have direct holding in the listed company.

Second part of the scheme is consolidation of operations involving merger and demerger between subsidiaries followed by merger and demerger into flagship listed operating company of various subsidiaries as listed below.

Step 2: Merger of MORE (Motilal Oswal Real Estate) with MOPE and

Step 3: Demerger of ‘Fund Management Undertaking’ of MOPE into MO ALTERNATE (consideration for demerger is discharged by issuing shares of MOFSL) and

Step 4: Merger of MOPE with MOFSL and

Step 5: Demerger of ‘Fund Management Undertaking’ of MORE II into MO ALTERNATE (consideration for demerger is discharged by issuing shares of MOFSL) and

Step 6: Merger of MORE II with MOFSL.

Appointed date for the transaction is 1st April 2020 but second part of the scheme between operating subsidiaries involving 3 mergers and 2 demergers is dependent on earlier part of the scheme and if any part of the scheme is not approved next part cannot be executed.

Rational of the Scheme:

Amalgamation of the PIMPL with the MOFSL:

- This will lead to clear cut and straight forward shareholding structure and eliminating needless layers of shareholding tiers and at the same time demonstrate the Promoter Group’s direct commitment and engagement with the MOFSL and improve the confidence of all shareholders.

Consolidation of fund management business of the Group:

- It is considered necessary to consolidate the fund management business and investment advisory services across sectors in a single entity.

- Further, such consolidation can also help the Group achieve following benefits:

- Concentrated management focus on the business in a more professional manner.

- Develop combined long-term corporate strategies and financial policies; and

- Operational rationalization, organizational efficiency, and optimal utilization of resources.

- Alignment of Key Managerial Personnel (‘KMP’) and employees of the Demerged companies with overall strategy of the group.

- Layered Structure:

- The Fund Management and investment advisory services are carried on by three-layered companies.

- From a governance perspective and keeping in mind amendments as per Section 2(87) and Section 186 of the Companies Act, 2013, reduced layer of entities shall enhance flexibility to the MOFSL to incorporate subsidiaries and/or acquire companies or any other body corporates with controlling stake as per their business strategies. Therefore, the Group intends to reduce the three-layers and simplify the corporate structure.

- The other businesses of the Group are largely carried on by single-layered wholly-owned subsidiaries. Therefore, the Group desires that fund management should also be carried on by a single wholly-owned subsidiary.

- Segregation of Remaining Business i.e., Investment Division of the Demerged Companies: it is advisable that the investments lying in the Demerged Companies are consolidated at the MOFSL level.

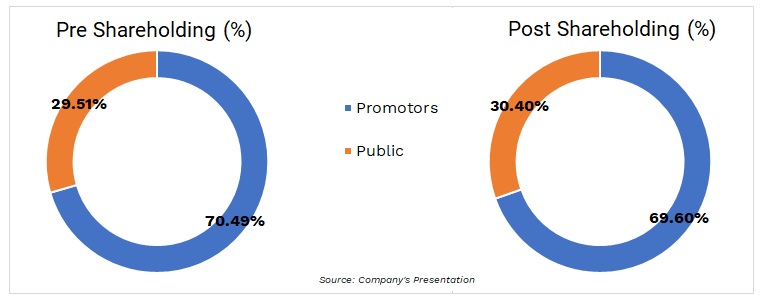

Shareholding pattern:

Shareholding pattern of MOFSL Pre and Post scheme

After the scheme, the promoters shareholding declines by 0.89% but numbers of shares remain same.

The interesting part in this is consideration on demerger of ‘Fund Management Undertaking’ of MORE II and MOPE will be issued by the holding company MOFSL while the demerger of undertakings is happening into MO ALTERNATE.

The consideration is as follows:

For first part of the scheme

As consideration the same number of shares (i.e., 8,49,21,363) of MOFSL being issued to the shareholders of PIMPL in lieu of shares held by PIMPL in MOFSL. Please note that number of shares to be issued will be exactly same as number of shares held by PIMPL on the Effective Date. However, the scheme is clear that there will no reduction in holding of shares of MOFSL. if any shares acquired by PIMPL after the approval of the scheme by the board, additional shares for same numbers will also issue to the shareholders of PIMPL. Old shares held by PIMPL get cancelled and new shares issued to the shareholders of PIMPL and expenditure for same is bears by PIMPL and shareholders of PIMPL.

For the second part of the scheme

| S. No. | Particulars | Swap Ratio |

| 1 | Demerger of ‘Fund management Undertaking’ of MOPE | 120 equity shares of the face value of ₹ 1 each fully paid-up of MOFSL for every 1 equity share of face value ₹ 10 each fully paid up held by equity shareholders of MOPE. |

| 2. | Demerger of ‘Fund management Undertaking’ of MORE II | 372 equity shares of the face value of ₹ 1 each fully paid-up of MOFSL for every 1 equity share of face value ₹ 10 each fully paid up held by equity shareholders of MORE II. |

Valuation:

Valuation of Fund Management Undertaking of MORE II and MOPE is derived by DCF (Discounted Cash Flow) method. While on the other hand the valuation of MOFSL is derived based on market value. However, the merger of MOPE and MORE II with MOFSL is derived based on adjusted net assets method:

| S. No. | Particulars | Method |

| 1. | MOFSL | Based on Weighted Average Market Price as required by SEBI regulations |

| 2. | PIMPL | Assets based approach |

| 3. | For Demerger of Fund Management Undertaking of MOPE and MORE II | DCF |

| 4. | For Remaining MORE II and MOPE | Adjusted Net Assets Value Method. |

Total valuation of ₹ 727.75 crores and ₹ 252.45 crores to MOPE and MORE II given respectively which is divided into two undertaking as follows:

| S. No. | Particulars | Valuation of MOPE | Valuation of MORE II | ||||

| ₹ in Crores | ₹ in Crores | ||||||

| Demerged Undertaking | Remaining | Total | Demerged Undertaking | Remaining | Total | ||

| 1 | Equity value | 447.29 | 280.46 | 727.75 | 236.93 | 15.52 | 252.45 |

| 2 | No. of equity shares | 58825 | 58825 | 58825 | 10000 | 10000 | 10000 |

| 3 | Value per equity shares (₹) | 76,037 | 47,677 | 1,23,714 | 2,36,930 | 15,520 | 2,52,450 |

Taxation:

All parts of the scheme are compliant with all tax provisions. including in accordance with section 2(1B) and 2(19AA) of Income Tax 1961, hence there is no tax liability either at company level or at shareholders’ level. However, one interesting things in this scheme is the consideration for demerger is issued by the holding company of resulting company as permitted under section 2(41A) of Income Tax Act 1961.

Whether shareholders of PIMPL will be able to claim grandfathering benefits as per section 55(2) (ac) on shares held by PIMPL in MOFSL as on 1st January 2018.

Conclusion

The scheme’s primarily to consolidate all fund base businesses, make key employees’ part of the whole business by giving employees’ shareholders of unlisted companies allotting shares of listed company. It also achieves promotors getting shares in their individual name as the scheme also envisages to collapse the holding company. The scheme will lead to more transparent, simple, and compliant structure for long term growth of MOFSL’s business.

Add comment