Five and a half years after acquiring India’s largest cash logistics company CMS Info Systems, Baring Private Equity Asia is exploring an exit after currency in circulation surged 22% last year from a year before, a record high that belies the popular belief that cash usage is coming down.

The Hong Kong-based buyout group that owns 100% of CMS is in discussions with JP Morgan and other investment banks to formally launch a sale process shortly, tapping PE and strategic firms, said at least three people aware of the plan. The company received regulatory approval for an IPO in 2017 but didn’t proceed because of the demonetisation impact.

Under Baring, sources said, CMS has grown 25% CAGR, clocking an FY21 EBITDA of Rs 280-Rs 300 crore on a top line of Rs 1,500 crore.

Baring Asia expects a Rs 5,500-Rs 6,000 crore ($750-$800 million) valuation for CMS, although some insist such a premium may be a challenge.

“Globally, peers are trading at 8-10 times EBITDA but they are growing at 2-3% and not at the pace at which CMS has,” said an official on condition of anonymity as the discussions are still in private domain.

Baring Asia, CMS Infosystems and JP Morgan spokespersons declined to comment.

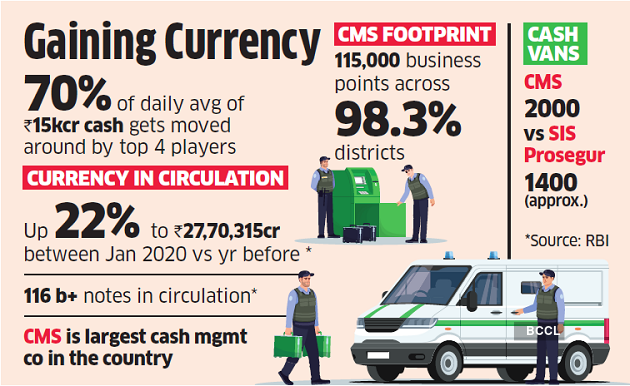

CMS handles cash processing from cards to ATM networks and services 115,000 business points across the country daily. The company controls over 50% of the cash management segment in the country. A lion’s share of its profit comes from ATM and retail cash management.

Barings acquired 53% of the company from Blackstone, 37% from the founding Grover family and 10% from the management team for about Rs 2,000 crore ($250 million) in 2015. Private equity peers Carlyle, Temasek and SIS India had also taken a shot at CMS then.

In 2009, the Blackstone Group, the world’s largest PE fund, teamed up with Rajiv Kaul, former chief executive of Microsoft India, to buy a majority in the company, investing Rs 280 crore in two tranches. Kaul is currently CEO of CMS.

Recently, State Bank of India, the country’s largest lender, moved its entire 40,000 ATM network to a software solution implemented by CMS. This is a 7-year contract worth over Rs 500 crore for CMS.

The software solution “makes the ATM a central component to the bank’s digital strategy where it starts playing the role of an intelligent branch manager and sells personalised products and services,” Kaul had said then. “Financial institutions could leverage ATMs better by linking it to mobile banking and CRM systems to offer seamless banking experience to their customers.”

The company expects a Rs 75 crore EBITDA bump due to the SBI contract and hopes to end FY22 with an operating profit of Rs 400 crore, said people aware of the matter.

The business is ripe for consolidation. CMS acquired the ATM business of smaller rival Logicash Solutions last November, bumping up the number of ATMs it covered by 10,000 to 72,000.

Between the big four – CMS, SIS-Prosegur, Secure Value (a group firm of AGS) and Brinks Arya – almost 70% of the daily average of Rs 15,000 crore in cash gets moved around.

Despite the boom in digital payments, Reserve Bank of India data suggests that currency in circulation grew by Rs 5 lakh crore to Rs 27,70,315 crore between January 1, 2019, and January 1, 2020.

According to the banking regulator, currency growth has exceeded 17% for three to four consecutive years only four times during the past 50 years. Even in US, 35% of all the dollars in circulation were printed in the past 10 months, largely on account of central bank easing, according to global reports.

“There has been an 18-20% dip in cash usage in large metros but beyond that cash usage has actually seen a 10% jump,” said an analyst. “Digital usage is seeing a near 40% jump but that is also a base effect.”

However, some experts said strong headwinds might make this a difficult sale as opposed to an IPO, especially since minimum wages are going up, as per new labour rules. Additionally, some banks have entrusted rural shopkeepers with rotating and managing cash.

“The reason why lossmaking fintech startups are getting valued at such rich multiples is because in the long term, people believe volumes will only benefit digital players as opposed to the legacy ones,” said a Mumbai-based investment banker who covers financial sector transactions.