The Blackstone Group has concluded its $1.5 billion acquisition of realty developer Prestige Group’s commercial portfolio, including offices, retail malls and hotel assets, said three people with direct knowledge of the matter.

The acquisition has strengthened Blackstone’s position as India’s largest owner of office and retail space.

The US-based private equity firm will enter into a joint venture with the realty developer for under-development office and retail projects under what is now one of the largest real estate portfolio transactions in India.

“The deal will see Blackstone acquiring over 16.8 million sq ft of completed and under-construction office projects and retail malls including hospitality assets. Blackstone will also acquire solar power plants, which will generate energy for these assets, once they are completed,” said one of the people.

A majority of the office assets in this portfolio is located in Bengaluru, India’s technology hub and its top-performing office market. It counts global corporations including Amazon, Cisco, Juniper and Walmart among its key tenants.

The retail assets in the portfolio being acquired are expansive shopping malls with shops, entertainment and leisure facilities, and food and beverage outlets.

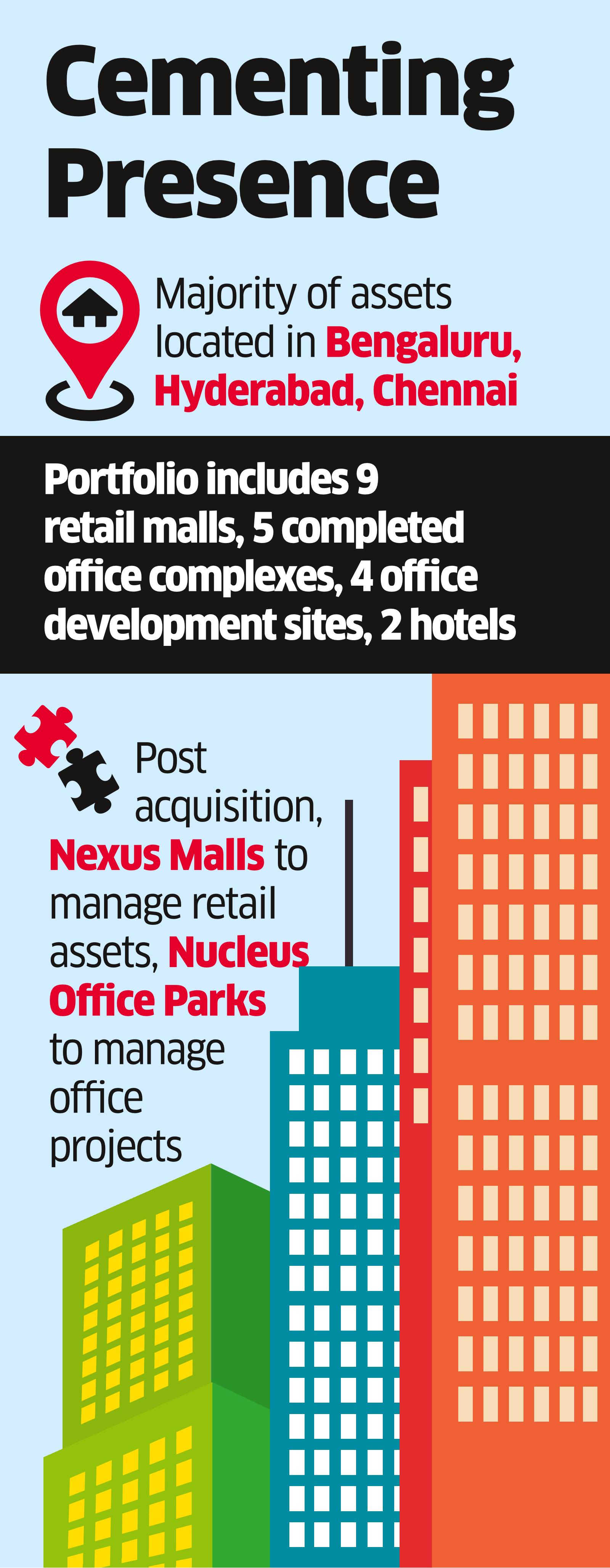

Most of these assets are located in the urban centres of Bengaluru, Hyderabad and Chennai.

“Following this acquisition, Blackstone-owned Nexus Malls will manage the day-to-day operations of the retail portfolio, while the firm’s real estate platform Nucleus Office Parks will manage the operations of the office projects,” said another person.

As part of the deal, Blackstone will be acquiring five completed office complexes in Bengaluru, Chennai and Ahmedabad, and four office development sites of which three are located in Bengaluru.

The portfolio also includes nine retail malls in Bengaluru, Hyderabad and Chennai. Office and retail assets also include two hotels and solar power plants that supply energy to office tenants.

ET’s email queries to Blackstone and the

Group remained unanswered at the time of going to press on Monday.

In October, Prestige had signed a non-binding letter of intent with certain entities, acting on behalf of the funds controlled and managed by the Blackstone Group, for the sale of these assets.

Blackstone will acquire 100% control of the portfolio that has been carved out of the Prestige Group’s ready and under-construction projects.

In the office segment, before the sale, Prestige had 36 million sq ft of completed projects, 15 million sq ft of ongoing work and 22 million sq ft of projects under planning. In retail, it had 10 operational projects of 7.5 million sq ft space.

Blackstone has emerged as the most aggressive institutional investor in India with assets estimated to be $50 billion at market value across various sectors, making it one of the top 10 business groups in the country. Real estate accounts for nearly $20 billion of this market value across its 40 investments. It is the largest office and retail assets owner in India with an office portfolio of 130 million sq ft and 10 million sq ft of retail space.